Table of Contents

- The PGA Boulevard Executive Landscape

- How RSU Vesting Actually Works

- Florida's Tax Advantage (And the Gotcha You Need to Know)

- Deferred Compensation: The Double-Edged Sword

- 2026 Tax Planning: What's Changed

- The Sell-to-Cover Strategy Explained

- When Divorce Enters the Picture

- Working With a Fiduciary Advisor

The PGA Boulevard Executive Landscape

If you work in one of the glass-fronted buildings lining PGA Boulevard between Palm Beach Gardens and Jupiter, chances are you're sitting on a significant equity compensation package. The corridor has become Florida's quiet wealth engine: biotech firms, fintech startups that went public, private equity shops, and Fortune 500 satellite offices all clustered within a few miles of each other.

The common thread? Restricted Stock Units (RSUs) and deferred compensation packages that can eclipse your base salary by multiples. I've worked with executives pulling down $250K in salary who are vesting into another $800K in equity annually. That's life-changing money: if you handle it correctly.

The problem is that most national brokerage firms treat RSU planning like an afterthought. You get a generic "diversify immediately" recommendation and maybe a tax projection spreadsheet. What you actually need is a comprehensive strategy that accounts for Florida's unique tax environment, the 2026 federal tax changes, and your personal liquidity timeline.

How RSU Vesting Actually Works

Let's start with the basics, because RSU terminology gets thrown around loosely. Restricted Stock Units are equity-based compensation where your employer grants you company shares that become available upon meeting certain conditions: typically continued employment over a set period.

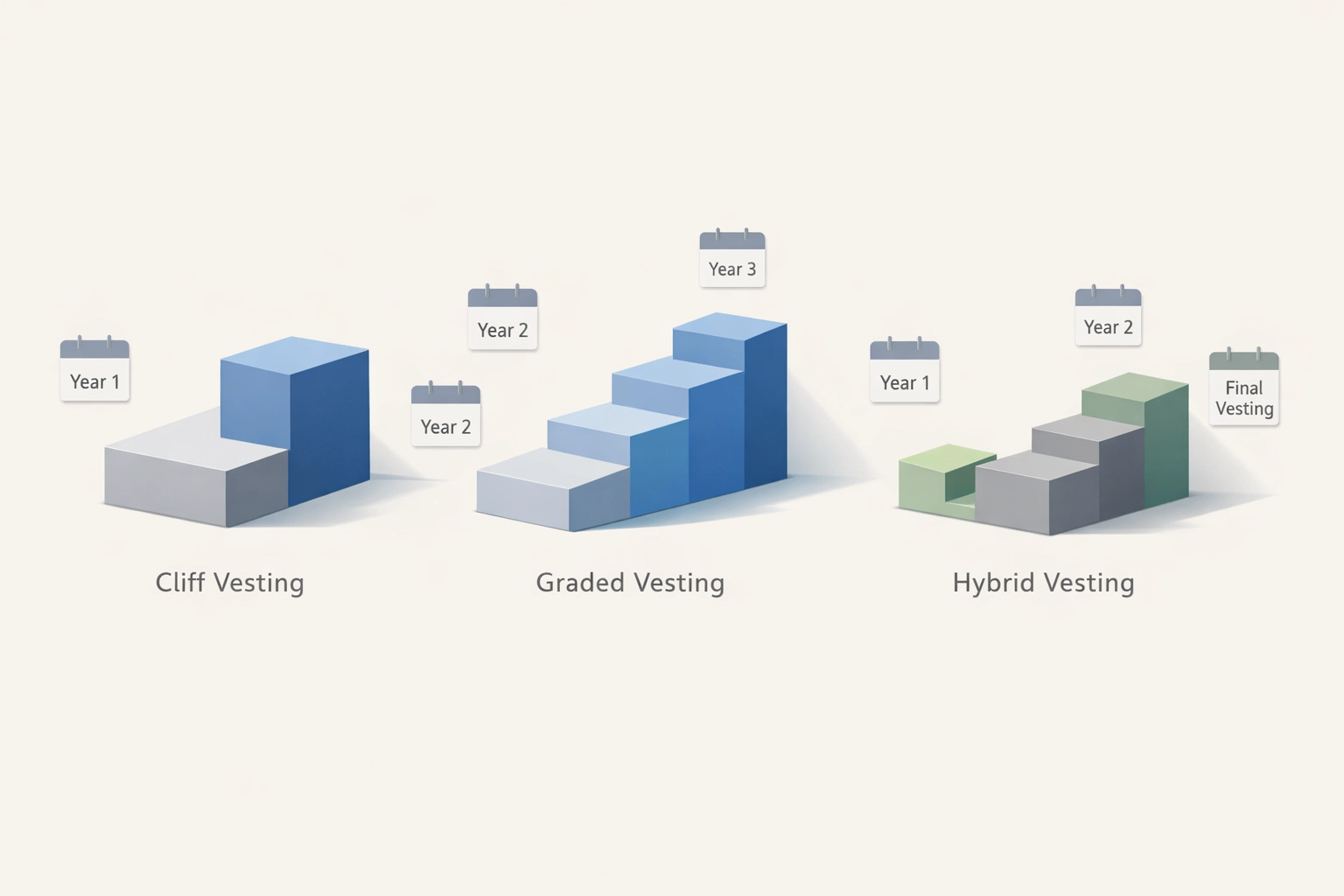

The three most common vesting structures I see with PGA Boulevard clients are:

Cliff vesting: All shares vest at once. Example: 10,000 RSUs granted on your start date, all vesting on your two-year anniversary. This is common with startup equity packages or sign-on grants.

Graded vesting: Shares vest in portions over regular intervals. Example: 4,000 RSUs vesting 25% annually over four years. Most public companies use this structure for annual equity refreshes.

Hybrid vesting: A combination approach. Example: 25% of your grant vests after one year (the cliff), then the remaining 75% vests monthly over the next three years. This is the gold standard at tech companies: it creates immediate retention value while maintaining ongoing incentive.

Here's what matters: You don't own these shares until they vest. Until that vesting date hits, you have zero control, zero voting rights, and zero ability to monetize them. Your employer controls everything, and if you leave before the vesting date, you typically forfeit unvested shares.

Florida's Tax Advantage (And the Gotcha You Need to Know)

This is where Florida residency becomes a strategic wealth multiplier. When your RSUs vest, the fair market value is treated as ordinary income subject to federal and payroll taxes. Your employer typically withholds federal taxes at 22%, plus Social Security (6.2%) and Medicare (1.45%).

But here's Florida's edge: We have no state income tax. If you were doing this same job in California, you'd be paying an additional 9.3% to 13.3% state tax on that vesting income. On an $800K RSU vest, that's between $74,400 and $106,400 you're keeping simply because you live in Palm Beach County instead of San Francisco.

However: and this is critical: if you were granted those RSUs while working in another state, that state may still claim taxation rights on a portion of the income. States like California and New York are notoriously aggressive about this. They'll calculate the percentage of time between grant date and vest date that you worked in their state, then claim tax on that proportional amount.

Example: You received a 4-year RSU grant while working in New York, then relocated to Jupiter after two years. When those RSUs vest in years three and four, New York may claim they're entitled to tax 50% of the vesting income (the portion earned while you were a NY resident). You'll need documentation proving your Florida domicile and potentially legal representation to fight it.

We covered this exact scenario in Episode 47 of our podcast at www.1715tcf.com: it's worth a listen if you're a recent Florida transplant.

Deferred Compensation: The Double-Edged Sword

Many PGA Boulevard executives also have access to non-qualified deferred compensation (NQDC) plans. These allow you to defer a portion of your salary or bonus into a future year, theoretically when you'll be in a lower tax bracket.

The appeal is obvious: Instead of paying 37% federal tax on a $500K bonus this year, you defer it until retirement when you might be in the 24% bracket. Plus, the deferred amount continues to grow tax-deferred inside the plan.

The risk that nobody talks about: You're now an unsecured creditor of your employer. If the company files for bankruptcy, your deferred comp sits in the general asset pool with all the other creditors. It's not protected like your 401(k). I've seen executives lose seven figures when their employer went under unexpectedly.

My general rule: Only defer compensation if you're extraordinarily confident in your company's financial stability (think top-tier credit rating) and you have a specific tax arbitrage strategy. Don't defer just because someone at HR suggested it during open enrollment.

2026 Tax Planning: What's Changed

We're now operating in a different tax environment than when most of you received your RSU grants. The 2017 Tax Cuts and Jobs Act provisions are set to sunset at the end of 2025, which means:

- The top federal ordinary income rate likely returns to 39.6% (from the current 37%)

- Standard deductions get cut roughly in half

- The $10,000 cap on state and local tax (SALT) deductions may disappear (though this helps you less in Florida)

Translation for RSU planning: Every dollar of RSU income that vests in 2026 and beyond faces potentially higher federal taxation. If you have control over your vesting schedule: for instance, if you're negotiating a new executive package or considering exercising performance-based acceleration clauses: front-loading vests into 2025 could save you 2.6% in federal taxes alone.

On a $1 million vest, that's $26,000 in tax savings. Worth modeling out with someone who understands the equity compensation planning landscape.

The Sell-to-Cover Strategy Explained

When your RSUs vest, you face an immediate decision: What do you do with the shares? The most common default option is "sell-to-cover," where your employer automatically sells enough shares to cover your estimated tax withholding.

Here's how it works: Let's say 1,000 shares vest at $50 per share, creating $50,000 in taxable income. Your employer withholds approximately 22% federal + 7.65% payroll taxes = 29.65%, or about $14,825. They sell 297 shares at $50 to cover that withholding, and you receive the remaining 703 shares.

The problem with sell-to-cover: It typically underwitholds. That 22% federal rate is fine if you're in the 22% bracket, but most executives with significant RSU packages are solidly in the 35% or 37% bracket. You'll owe additional taxes at filing.

A better approach for high earners: Sell more shares at vesting to cover your true marginal tax rate, or make estimated quarterly payments to avoid underpayment penalties. The worst outcome is getting hit with a $40K tax bill the following April when you've already spent or invested your RSU proceeds.

When Divorce Enters the Picture

This gets messy fast, so pay attention if your marriage is struggling. In Florida, RSUs granted during your marriage are generally considered marital assets subject to equitable distribution. It doesn't matter if they haven't vested yet: they're still on the table for division.

Florida courts use what's called a "coverture formula" to determine how much of your RSU grant is marital versus separate property. The calculation: (Number of months from grant date to divorce filing) ÷ (Total months from grant date to full vesting) × (Total value of RSUs).

Example: You received a 10,000 RSU grant with 4-year vesting on January 1, 2023. You file for divorce on January 1, 2025 (24 months later). The marital portion is 24/48 = 50%. If those shares are worth $100 each at the time of distribution, your spouse may be entitled to 5,000 shares × $100 = $500,000.

The strategic implication: Document everything. Keep records of when grants were made, what percentage vested before versus during marriage, and whether any grants were explicitly for pre-marital performance. A qualified family law attorney and a forensic financial advisor can make a six-figure difference in your settlement.

Working With a Fiduciary Advisor

Here's the reality check: Your company's equity compensation department isn't looking out for your best interest. They're processing paperwork. The brokerage firm that holds your vested shares? They make money when you trade, which creates a structural conflict of interest.

What you need is a fiduciary advisor who's required by law to act in your best interest and who has specific experience with executive compensation planning. Someone who can model out scenarios like:

- Should you exercise and hold or exercise and sell?

- What's the optimal vesting schedule given the 2026 tax changes?

- How do you integrate RSU vests with your broader financial plan without over-concentrating in your employer's stock?

- What's the tax-efficient way to diversify while managing capital gains exposure?

We work with PGA Boulevard executives on these exact questions every week at Davies Wealth Management. The conversation starts with understanding your complete equity picture: not just RSUs but also stock options, ESPP shares, deferred comp, and any other forms of equity-linked wealth.

The goal isn't to maximize every single tax deduction or time every market movement perfectly. The goal is to build a systematic approach that converts your equity compensation into durable, diversified wealth while keeping Uncle Sam's take to the legal minimum.

If you're sitting on a significant equity package and you're not sure whether your current advisor really understands the nuances, let's talk. The first conversation costs you nothing but an hour of your time: and it might be the most valuable hour you spend this year.

Leave a Reply