License from FINRA

We hold our series 66 FINRA license

The vast majority of financial providers in the United States who insinuate they are independent — are not. Use of the term "independent" is restricted by the Corporations Act and means that an adviser doesn't have their own products to sell and doesn't receive any commissions or volume-based payments.

In order to give financial advice in the United States, you need to have a license from the Financial Industry Regulatory Authority (FINRA). Most advisers lack the skills or knowledge to obtain a license themselves and so they align themselves with a bank or other financial institution that already has a license. Unfortunately, in doing so, they have taken the easy option but sacrificed their independence. They give over control to the bank to decide which investments they are allowed to recommend.

In the US, there are around 318,000 financial advisers. Yet some statistics in recent years are that:

Instead, we got licensed and certified because being independent is very important to us.

We hold our series 66 FINRA license

We are a practicing member of the Financial Planning AssociationTM.

Our financial planners are members of the Institute of Business & Finance

The CFS designation 1988—it’s the fourth-oldest designation in the U.S.—to fill a serious gap in the professional practice of certified financial planners.

Mastering the sophisticated investment strategies that top financial advisors use on a daily basis for risk management, taxes, and estate planning.

*mutual funds, ETF, and REITs

*closed-end funds and similar investments

*advanced fund analysis and selection

*asset allocation and portfolio construction

Click here to review the Gold Standard of Independence criteria that we meet.

to choose Davies Wealth Management as your financial advisor and personal financial coach

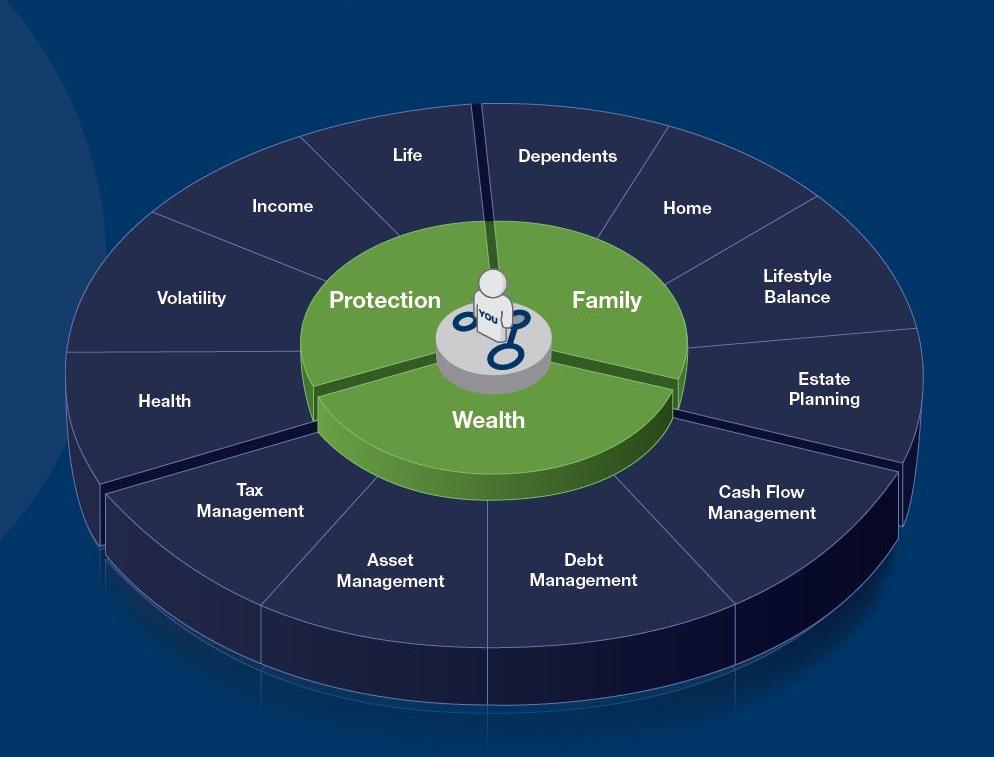

Our collaborative team offers the depth and breadth you need to navigate life's decisions. For many of our clients, we operate as their personal CFO, simplifying their lives by providing clarity and answers to the myriad of financial decisions they face every day.

Efficient financial planning requires a close look at more than just account values and years to retirement. Our team assesses your insurance coverage, cash flow, investment strategy, real estate portfolio, and more. We review each area within the context of your current situation and long-term goals.

As an independent firm, we do not have a vested interest in specific products or services that can bias our judgment or recommendations. And since our compensation is completely independent of insurance or investment decisions you may make, we can be completely neutral in our analysis of your situation.

We are a boutique firm and we thrive on building long-term relationships with our clients. Our process is an opportunity for us to get to know our clients exceptionally well. Davies Wealth Management prides itself in working as a team — both internally and with you — offering as much or as little hand holding as you need.

Most financial advisors offer clients tools to help manage their future. But few offer both proprietary tools AND personal coaching to help you use them. We help you understand how to use the tools effectively and efficiently to meet your specific needs.

Davies Wealth Management took the time to understand our situation & tailor their advice & solutions to our specific needs which, being a business owner, can be quite complex. Their strategies & advice have been clearly articulated & have placed my wife & I at ease.

They listened to what I want to achieve for a secure retirement & have guided me towards an investment plan which is balanced for growth & security.

Davies Wealth Management advisors have a formidable background in financial planning. They complement each other in providing first-class financial advice. Their honesty, integrity & sincere interest in securing a financial future for their clients makes them a standout group.

I have been highly impressed with their recent retirement plan & start to enjoy some of the fruits of our working life. Thomas was able to provide me with the right plan to take the next step which could have been delayed without quality financial advice.