EQUITIES END THE WEEK MIXED AGAIN AS DRAMA UNFOLDS IN WASHINGTON AND AS OIL DROPS A WHOPPING 9% ON THE WEEKWeekly Market Update — October 7, 2023 |

||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

Weekly Market Performance

*Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD. This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results. |

||||||||||||||||||||||||||||||||

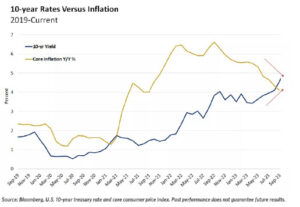

Stocks, Equities Mixed as Oil Prices TumbleWall Street closed out the first week of September mixed, as small-caps (Russell 2000) and mega-caps (DJIA) declined while the tech names (NASDAQ) and large-caps (S&P 500) advanced. Thankfully, the S&P 500 snapped its four week losing streak this week too. Not surprisingly, the Growth stocks outpaced the Value Stocks and the larger-caps trounced the smaller-caps. And unfortunately, this weeks big 2.2% decline in the smaller-cap Russell 2000 pushed the index into negative territory for the year. The 10-year Treasury yield moved above 4.80% this week, a rate last seen in 2007. Some attribute the increase in Treasuries to the Feds “higher-for-longer” mantra, but others are suggesting that we might be at an inflection point, as the 10-year and the core Consumer Price Index have recently crossed paths. There was a lot of economic data this week, including that:

|

||||||||||||||||||||||||||||||||

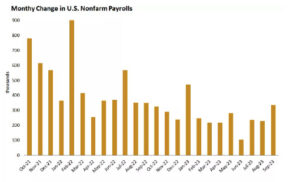

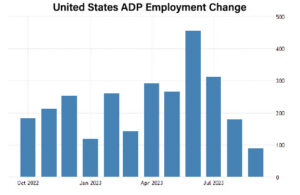

Private Sector Employment and Pay Growth Both Slow in SeptemberOn Tuesday, it was announced that private sector employment increased by 89,000 jobs in September and annual pay was up 5.9% year-over-year, according to the September ADP National Employment Report. “We are seeing a steepening decline in jobs this month. Additionally, we are seeing a steady decline in wages in the past 12 months.” Jobs ReportPrivate employers added 89,000 jobs in September and September showed the slowest pace of growth since January 2021, when private employers shed jobs. Further, large establishments drove the slowdown, losing 83,000 jobs and wiping out gains they made in August. Pay Growth Slowed

|

||||||||||||||||||||||||||||||||

| Sources

adpemployment.com ;ismworld.org ;census.gov ;msci.com;fidelity.com;nasdaq.com;wsj.com; morningstar.com; |

✅ BOOK AN APPOINTMENT TODAY: https://calendly.com/tdwealth

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ LET’S GET SOCIAL

Facebook: https://www.facebook.com/DaviesWealthManagement

Twitter: https://twitter.com/TDWealthNet

Linkedin: https://www.linkedin.com/in/daviesrthomas

Youtube Channel: https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

DISCLAIMER

**Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply