Table of Contents

- The Quiet Exodus Happening in Stuart

- What’s Really Driving the Change

- The Fiduciary Difference That Actually Matters

- The Real Cost of “Free” Advice

- Why Local Expertise Beats National Scale

- Making the Switch: What Stuart Executives Need to Know

The Quiet Exodus Happening in Stuart

Something shifted in Stuart’s wealth management landscape over the past 18 months. Walk down Colorado Avenue or grab coffee on Osceola Street, and you’ll hear the same story from executives at Seacoast Bank, RSI, and the growing tech corridor along PGA Boulevard: they’re firing their big-box brokers.

Not because of one dramatic failure. Not because of a scandal. But because they finally did the math.

A CFO at a local manufacturing firm recently told me his Morgan Stanley advisor called him exactly twice in 2025: both times to pitch a new product. Meanwhile, his portfolio’s asset allocation hadn’t changed since 2022, despite his company going public and his equity compensation skyrocketing from $200K to $1.8M annually. When he asked about tax-loss harvesting strategies for his RSUs, the response was “we’ll look into that” followed by radio silence.

He’s now working with an independent RIA in Stuart. He’s not alone.

What’s Really Driving the Change

The narrative from Wall Street is that clients are “going independent” for lower fees. That’s partially true, but it misses the bigger picture. Stuart executives aren’t leaving Wells Fargo or Merrill Lynch just to save 50 basis points. They’re leaving because the incentive structures at national wirehouses are fundamentally misaligned with client outcomes.

Here’s what’s actually happening in 2026:

Product Quotas Still Exist – Despite regulatory pressure, most big-box firms still have soft quotas for proprietary products. Your advisor might not admit it, but their bonus structure rewards selling the firm’s mutual funds over third-party alternatives. A recent industry analysis found that 67% of wirehouses still tie a portion of advisor compensation to proprietary product sales.

Relationship Creep – You started with one advisor. Now you’re being handed off to a “team” where a junior associate handles most inquiries. The person who actually knows your business just got promoted to managing bigger accounts.

Technology Theater – Those flashy apps and AI-powered dashboards look impressive, but they often can’t handle the nuances of concentrated stock positions, multi-state tax planning, or the deferred comp plans common among Stuart’s executive class. You end up with tools built for mass affluent investors, not the specific challenges you’re facing.

The Florida Factor – National firms often lack deep expertise in Florida-specific estate planning, domicile rules, and the unique tax landscape executives navigate when moving here from high-tax states. We’ve covered this extensively on the Davies Wealth Management podcast, particularly regarding Jupiter Island domicile planning.

The Fiduciary Difference That Actually Matters

You’ve probably heard the terms “fiduciary” and “suitability standard” thrown around. Here’s why it matters for your portfolio, not just in theory, but in actual dollars.

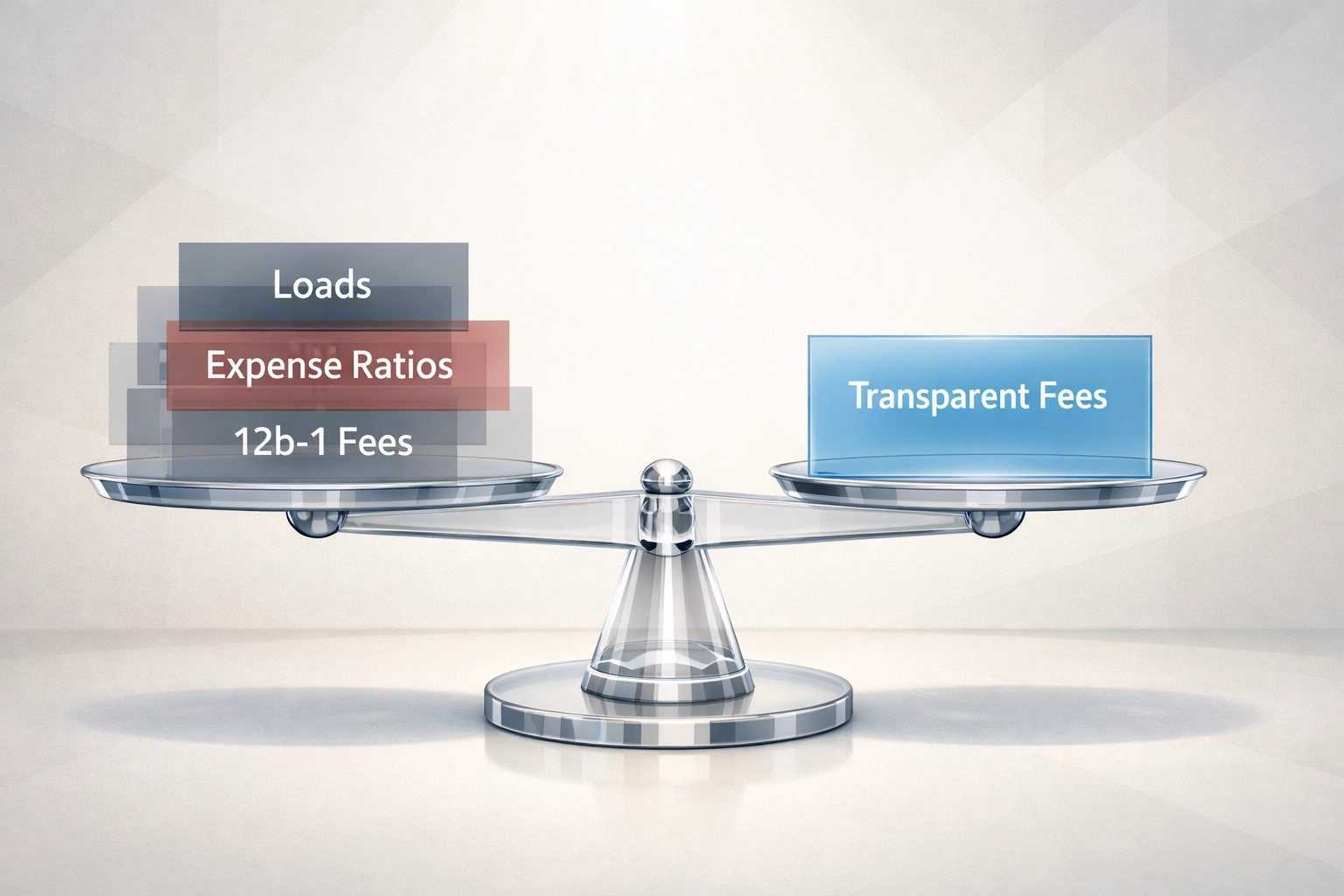

Under the suitability standard (which most big-box brokers operate under), your advisor must recommend products that are “suitable” for your situation. That’s a low bar. It means they can legally recommend a mutual fund with a 1.2% expense ratio and a 5.75% front-end load, even if an identical index fund exists at 0.04% with no load: as long as the expensive fund isn’t completely inappropriate for your risk profile.

Independent RIAs operate under a fiduciary standard. They must act in your best interest, not just recommend something that’s “suitable.” In practice, this means:

- Fee transparency – You see exactly what you’re paying. No hidden 12b-1 fees buried in fund prospectuses.

- Best execution – If there’s a lower-cost way to get the same exposure, that’s what you get.

- Conflict disclosure – Any potential conflicts of interest must be disclosed in writing, not buried in 47 pages of fine print.

For a Stuart executive with a $3 million portfolio, this difference typically translates to $15,000-$30,000 annually in reduced expenses. Compounded over 20 years, that’s real money: often the difference between retiring at 60 versus 65.

The Real Cost of “Free” Advice

The big-box pitch often sounds attractive: “We don’t charge advisory fees. We make money when you do.” It’s compelling until you examine how transaction-based compensation actually works.

Let me walk through a real scenario we saw last year:

A Martin County executive came to us after spending five years at a national brokerage. His “fee-free” advisor had him in 18 different mutual funds, most with front-end loads between 3.5% and 5.75%. Every time the advisor rebalanced (which happened annually), the executive paid new sales charges.

His actual cost? About 2.1% annually when you factored in:

- Front-end loads amortized over holding periods

- Expense ratios averaging 1.14%

- 12b-1 marketing fees (0.25% on most funds)

- Trading costs embedded in fund operations

Compare that to comprehensive wealth management services at an independent RIA, where fees typically range from 0.75% to 1.0% for portfolios over $1 million, with no transaction charges, no front-end loads, and institutional-class funds averaging 0.15% in expenses.

The math isn’t close.

Why Local Expertise Beats National Scale

Stuart isn’t Greenwich, Connecticut. It’s not Silicon Valley. The wealth here comes from different sources: business sales, professional practices, executive compensation at regional companies, and increasingly, remote tech executives who discovered they can work from the Treasure Coast instead of Atlanta or Charlotte.

National firms train advisors on standardized strategies that work reasonably well for the average American investor. But “reasonably well” isn’t good enough when you’re dealing with:

Complex equity compensation – If you’re receiving RSUs, ISOs, or performance shares from employers like BioReference Laboratories, Seacoast Bank, or any of the growing tech firms along PGA Boulevard, you need an advisor who understands equity compensation planning at a granular level. Most big-box advisors have a boilerplate approach: “We’ll sell some shares each quarter.” That’s not a strategy.

Florida domicile rules – Moving to Florida for tax purposes seems simple until you’re hit with an audit from your former state claiming you’re still a resident. Independent RIAs working in Stuart understand the documentation requirements, the 183-day rules, and the specific steps to establish clear domicile.

Local business ecosystem – When your advisor knows the local M&A attorneys, CPAs, and business brokers, coordination actually happens. National firms talk about “comprehensive planning,” but their infrastructure isn’t built for the kind of deep collaboration that happens in smaller markets like ours.

Real estate complexity – Stuart executives often own property in multiple states. Your advisor should understand how different state laws affect estate planning, not just regurgitate generic advice about living trusts.

Making the Switch: What Stuart Executives Need to Know

If you’re considering the move from a big-box firm to an independent RIA, here’s what the transition actually looks like:

Account transfers take 2-4 weeks – Most assets move via ACATS (Automated Customer Account Transfer Service). Your new advisor handles the paperwork. You might see a delay if you’re transferring out of proprietary products that need to be liquidated first.

Tax implications are usually minimal – Transferring securities “in kind” doesn’t trigger capital gains. You’re just moving the same holdings to a different custodian. The exception is if you’re in funds with surrender charges or have annuities with early withdrawal penalties.

You’ll actually meet your advisor – This sounds obvious, but at independent RIAs, you typically work directly with a principal or senior advisor, not a revolving door of junior associates. When you call, you’re not navigating a phone tree.

Expect real tax planning – One of the biggest differences you’ll notice is proactive tax-loss harvesting and year-round tax coordination. Most independent RIAs view tax efficiency as central to wealth management, not an afterthought.

Technology improves, not deteriorates – Contrary to what big-box firms suggest, independent RIAs typically offer superior technology. Why? Because they’re not locked into legacy systems built in the 1990s. Modern RIAs use best-in-class software for everything from financial planning to document management.

The Stuart executives making this switch in 2026 aren’t chasing the latest trend. They’re recognizing what should have been obvious all along: when your advisor’s incentives align with yours, you get better outcomes. When expertise is local and accessible, planning actually happens. And when you’re paying for advice directly rather than through hidden product commissions, you can see exactly what you’re getting.

That clarity alone is worth the switch.

Leave a Reply