Stuart, Florida attracts thousands of retirees each year with its pristine beaches and year-round sunshine. This coastal gem offers a compelling mix of small-town charm and modern amenities.

However, retirement relocation to Stuart comes with both significant advantages and notable challenges. We at Davies Wealth Management break down the key factors you need to consider before making this major life decision.

Stuart’s Lifestyle and Climate Advantages

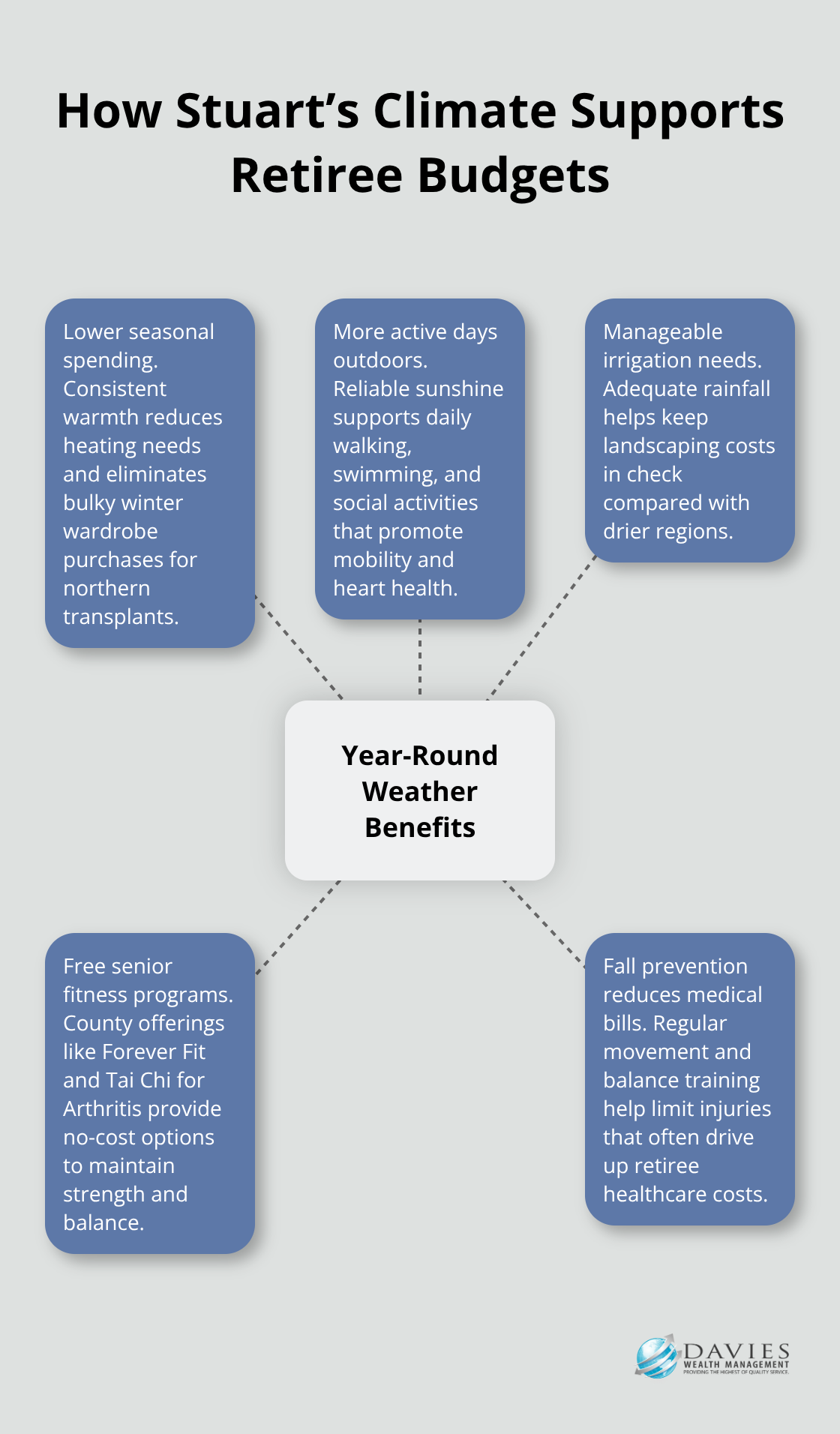

Year-Round Weather That Cuts Retirement Costs

Stuart delivers abundant sunshine with temperatures that average 82°F in summer and 67°F in winter. This consistent climate creates ideal conditions for year-round outdoor activities that reduce healthcare costs and boost quality of life. The stable weather eliminates seasonal clothing expenses and heating bills that burden northern retirees, while the 64-inch annual rainfall provides enough moisture to keep landscaping costs manageable without excessive irrigation needs. Martin County Parks and Recreation offers free fitness programs specifically for adults over 50, including Forever Fit classes and Tai Chi for Arthritis sessions at the Log Cabin Senior Center. These programs can reduce medical expenses by maintaining mobility and preventing falls (a major concern for retirees nationwide).

Waterfront Access at Affordable Prices

Stuart’s median home price of $435,000 provides waterfront access at prices significantly below nearby Jupiter ($681,174) and Palm Beach Gardens ($653,983). This price difference makes coastal retirement financially viable for middle-income retirees. The Intracoastal Waterway and St. Lucie River offer boating opportunities directly from many neighborhoods, while beaches like Jensen Beach and Bathtub Beach provide free recreation just minutes from downtown. Property owners gain access to fishing, sailing, and water sports without paying resort fees or membership costs that can drain retirement budgets by thousands annually.

Small Town Comfort with Metropolitan Access

Stuart’s population of 19,236 residents maintains a manageable community size where medical appointments average 20-minute commutes. The town provides highway access to West Palm Beach’s extensive medical facilities and cultural venues within an hour’s drive. Stuart hosts year-round festivals and cultural events that foster social connections without the crime rates and traffic congestion of larger metropolitan areas. Known as the “Sailfish Capital of the World,” Stuart provides residents with retirement income planning opportunities while enjoying proximity to major airports for family visits or travel during retirement years (essential for maintaining connections with distant relatives).

These lifestyle advantages form just one part of the retirement equation. The financial planning implications of choosing Stuart require equally careful consideration.

Cost of Living and Financial Considerations

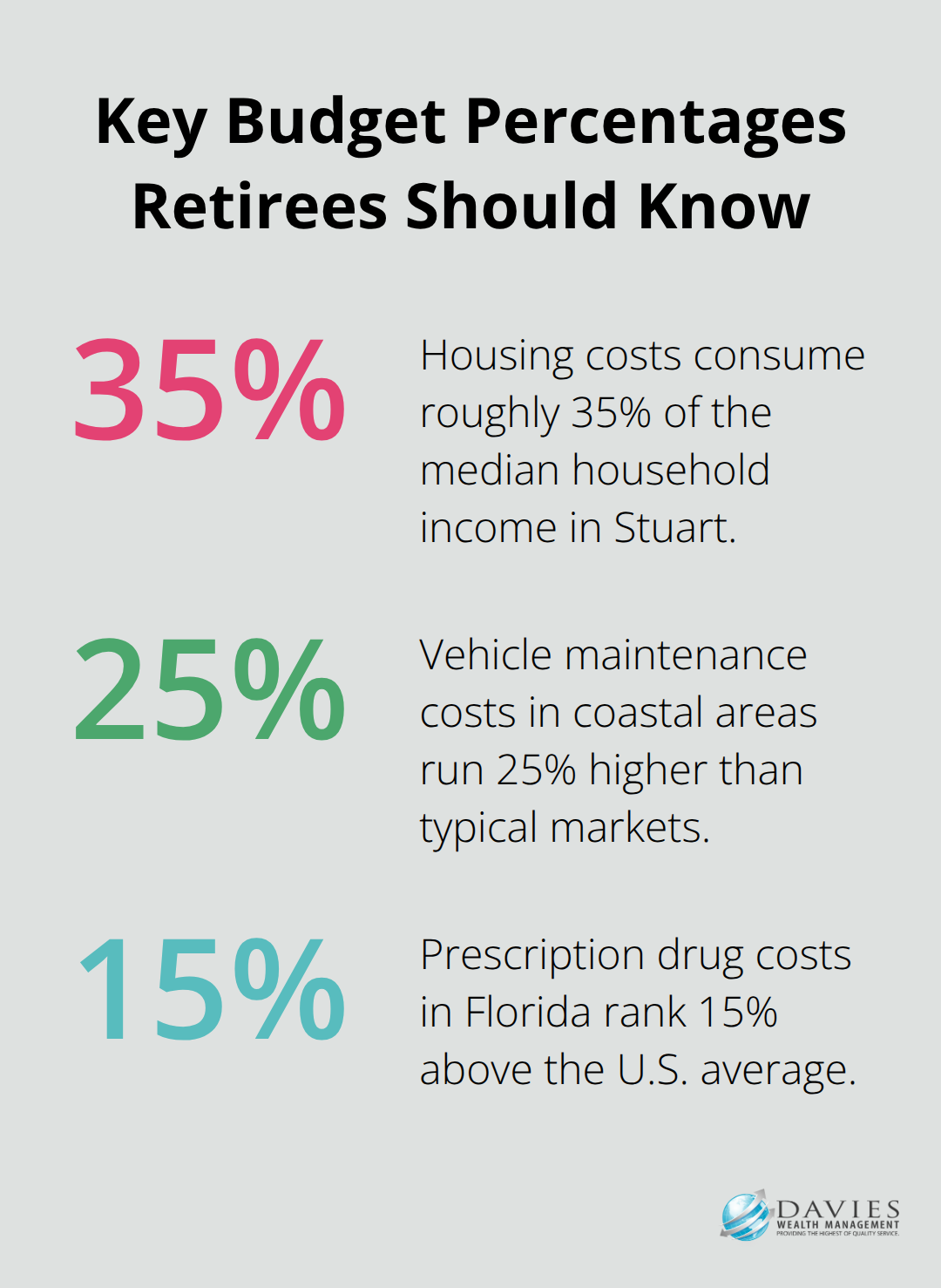

Stuart’s median home price of $570,000 places it in the premium coastal market range, making waterfront retirement a significant investment. Property taxes in Martin County average 1.1% of assessed value, which translates to approximately $6,270 annually on the median home. Florida’s homestead exemption reduces property taxes by up to $50,000 in assessed value for permanent residents, which cuts annual tax bills by $550. Housing costs consume roughly 35% of the median household income in Stuart, reflecting the premium coastal location. Rental properties average $1,227 monthly and provide affordable options for retirees who sell larger homes.

Healthcare Expenses Strain Retirement Budgets

Medicare beneficiaries in Martin County have access to various supplemental insurance options through the school district’s retiree plans. Hospital stays at Martin Health System facilities average $2,100 per day before insurance coverage kicks in. Prescription drug costs in Florida rank 15% above the national average due to limited generic competition in coastal markets. Long-term care facilities in Stuart charge $4,200 monthly for assisted care and $8,500 for skilled care. Medicare Advantage plans popular with retirees average $45 monthly premiums but restrict provider networks and potentially limit access to specialists in nearby West Palm Beach.

Florida Tax Benefits Offset Higher Expenses

Florida eliminates state income tax on retirement distributions, Social Security benefits, and pension payments. This saves retirees an average of $3,200 annually compared to high-tax states like New York or California. The state imposes no inheritance tax and protects wealth transfers to heirs. Sales tax reaches 7.5% in Martin County but excludes groceries, prescription medications, and medical services that represent major retirement expenses. Intangible personal property taxes were eliminated in 2007 and protect investment portfolios from additional taxation. These tax savings effectively reduce Stuart’s cost of living by 8-12% for most retirees and make the higher costs manageable for those who relocate from tax-heavy northern states.

While these financial factors paint an attractive picture, Stuart presents several challenges that could impact your retirement experience and budget in unexpected ways. Consider consulting with a financial advisor to develop a comprehensive plan that accounts for hidden costs specific to your situation.

Potential Drawbacks of Retiring in Stuart

Hurricane Season Threatens Financial Security

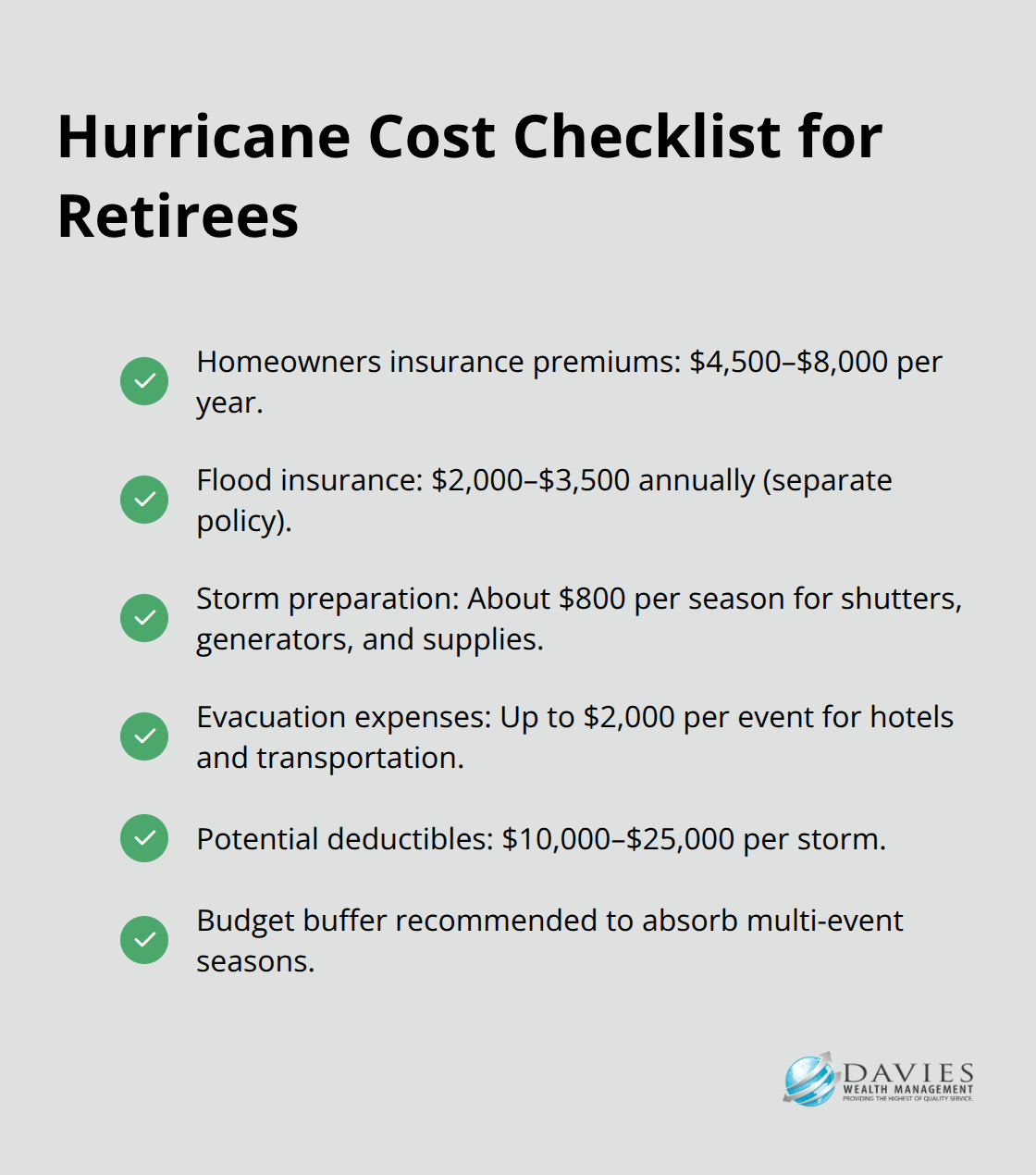

Stuart’s hurricane season from June through November exposes retirees to significant financial risks that many underestimate. Hurricane Ian in 2022 caused $112 billion in damages across Florida, with Martin County experiencing substantial flooding and wind damage. Homeowners insurance premiums in coastal Florida have seen significant fluctuations, with many Stuart residents paying $4,500-$8,000 annually for adequate coverage. Flood insurance adds another $2,000-$3,500 yearly and remains separate from standard policies. Storm preparation costs average $800 per hurricane season for shutters, generators, and emergency supplies, while evacuation expenses can reach $2,000 per event for hotel stays and transportation. Many retirees discover their fixed incomes cannot absorb these costs plus potential deductibles of $10,000-$25,000 per storm.

Transportation Dependency Creates Hidden Expenses

Stuart lacks comprehensive public transportation and forces retirees to maintain vehicles longer than planned. The county’s limited bus service operates only on major routes with infrequent schedules, which makes medical appointments and grocery shopping difficult without personal transportation. Vehicle maintenance costs in coastal areas run 25% higher due to salt air corrosion, with air conditioning repairs averaging $1,200 annually in Florida’s climate. Rideshare services charge premium rates due to limited driver availability, with typical trips to medical facilities costing $25-$45 each way. Many retirees spend $8,500 annually on transportation compared to $4,200 in cities with robust public transit systems.

Premium Coastal Prices Strain Budgets

Stuart’s cost of living presents challenges for retirees, driven by premium coastal location prices. Grocery costs run above state averages, with basic items like milk and bread commanding resort-area prices year-round. Restaurant meals average $28 per person compared to $19 in inland Florida cities (making dining out a luxury expense). Home maintenance requires specialized contractors familiar with coastal conditions, with routine services like HVAC cleaning costing $300 versus $150 inland. These cumulative expenses add $4,800-$6,200 annually to retirement planning budgets compared to similar-sized inland communities and potentially force lifestyle adjustments that many retirees find unacceptable after relocating.

Final Thoughts

Retirement relocation to Stuart demands careful evaluation of $570,000 median home prices and $6,270 annual property taxes against Florida’s tax-free retirement income and year-round outdoor activities. The $4,800-$6,200 premium for coastal life competes with hurricane risks that average $10,000-$25,000 in potential deductibles and $4,500-$8,000 insurance premiums. Your retirement goals determine whether Stuart’s waterfront lifestyle justifies these costs.

Retirees who prioritize outdoor activities and warm weather often find the premium worthwhile, while budget-conscious individuals may prefer inland alternatives. Successful relocation starts with comprehensive financial planning that accounts for hurricane preparation, transportation dependency, and premium coastal prices. We at Davies Wealth Management help retirees navigate these location-specific challenges through personalized wealth management solutions.

Test your budget with a six-month rental before you purchase property. This approach reveals actual costs and helps avoid expensive mistakes that force unwanted relocations after retirement begins (a costly error that affects 23% of retirees who move without proper planning). Smart preparation protects your retirement savings and helps you make informed decisions about coastal retirement.

Leave a Reply