Real asset investment strategies have become increasingly popular among investors seeking to diversify their portfolios and hedge against inflation. At Davies Wealth Management, we’ve seen a growing interest in tangible assets like real estate, infrastructure, and commodities.

These investments offer unique benefits, including potential steady income streams and long-term value appreciation. In this comprehensive guide, we’ll explore various real asset investment approaches and their role in a well-balanced financial strategy.

What Are Real Assets?

Real assets form a unique category of investments that have gained significant attention in recent years. At Davies Wealth Management, we’ve noticed an increasing interest in these tangible assets as investors look for alternatives to traditional stocks and bonds.

Types of Real Assets

Real assets encompass a diverse range of investments. Real estate stands out as the most recognizable, including residential properties, commercial buildings, and land. Infrastructure investments, such as toll roads, airports, and utilities, also fall under this category. Natural resources like timber, oil, and gas are considered real assets, as are precious metals like gold and silver.

Key Characteristics of Real Asset Investments

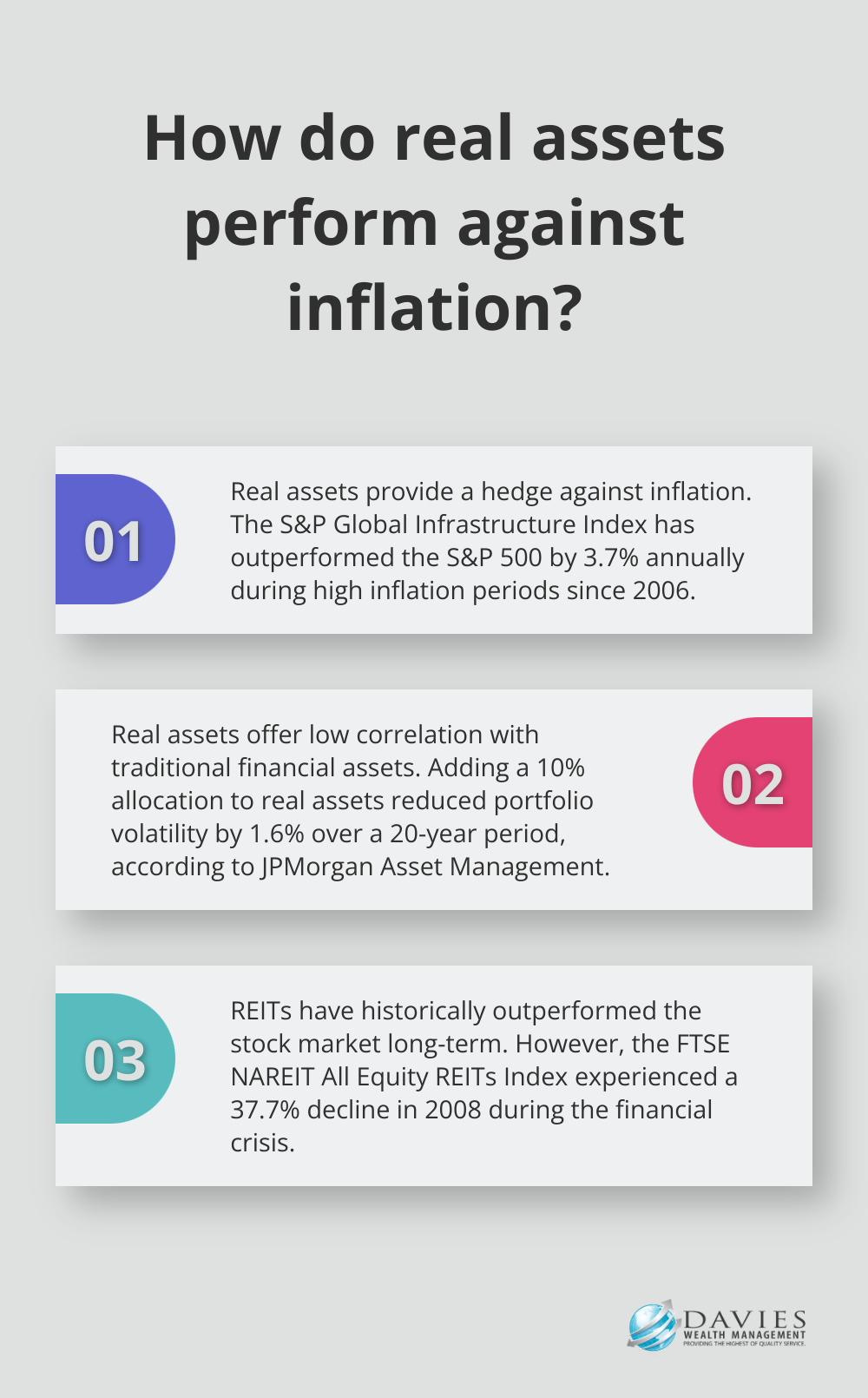

Real assets typically share several important characteristics. They often provide a hedge against inflation, as their value tends to rise with overall price levels. For example, the S&P Global Infrastructure Index has outperformed the S&P 500 by 3.7% annually during periods of high inflation since 2006.

These investments also generally offer low correlation with traditional financial assets, enhancing portfolio diversification. A study by JPMorgan Asset Management found that adding a 10% allocation to real assets reduced portfolio volatility by 1.6% over a 20-year period.

Historical Performance and Risk-Return Profiles

The performance of real assets has historically been strong, particularly during inflationary periods. Historical data shows that REITs have outperformed the stock market over the long-term.

However, it’s important to note that real assets can be more volatile than traditional investments. The FTSE NAREIT All Equity REITs Index experienced a 37.7% decline in 2008 during the financial crisis. This underscores the importance of professional guidance when investing in real assets.

Liquidity Considerations

One key aspect to consider with real assets is liquidity. Unlike stocks or bonds, which investors can easily buy and sell, physical assets like real estate or infrastructure projects may take months or even years to liquidate. This lack of liquidity can act as a double-edged sword, potentially leading to higher returns but also increased risk.

As we move forward, it’s essential to understand the various strategies investors can employ to incorporate real assets into their portfolios. Let’s explore these approaches in the next section.

How to Invest in Real Assets

Real asset investment strategies offer diverse opportunities for investors who want to expand their portfolios beyond traditional stocks and bonds. Several effective approaches to real asset investing can potentially yield significant returns while providing a hedge against inflation.

Direct Investment in Physical Assets

One of the most straightforward strategies involves purchasing tangible assets like real estate properties or land. Investing in a rental property can provide a steady income stream through rent payments while potentially appreciating in value over time. The National Association of Realtors reports that the median existing-home price in the United States increased by 14.8% from 2020 to 2021, demonstrating the potential for substantial returns.

Direct investment requires significant capital and hands-on management. Investors must prepare for ongoing expenses such as property taxes, maintenance, and potential vacancies. It’s important to conduct thorough due diligence on the local real estate market and property condition before making a purchase.

Investing Through REITs

Real Estate Investment Trusts (REITs) offer an attractive alternative for those who seek a more liquid and hands-off approach. REITs are companies that own and operate income-producing real estate properties. They provide investors with the opportunity to gain exposure to real estate without the need for direct property management.

REITs have historically delivered strong returns. Over the past 20, 25, and 50 years, REITs have outperformed the S&P 500, as evidenced by historical data. Additionally, REITs must distribute at least 90% of their taxable income to shareholders as dividends, making them an excellent option for income-seeking investors.

Exploring Infrastructure and Natural Resource Funds

Infrastructure and natural resource funds present another avenue for real asset investment. These funds typically invest in assets such as toll roads, airports, utilities, timber, and energy resources. The Global Listed Infrastructure Organisation (GLIO) represents the asset class through the FT Wilshire GLIO Index, education, promotion, and outreach.

These investments often benefit from long-term contracts and steady cash flows, providing stability to a portfolio. However, they can be subject to regulatory risks and environmental concerns, requiring careful consideration and expert guidance.

Commodities and Precious Metals

Investing in commodities (such as oil, natural gas, or agricultural products) and precious metals (like gold and silver) represents another strategy for real asset exposure. These investments can serve as effective inflation hedges and portfolio diversifiers. For example, gold has historically shown a low correlation with stocks and bonds, potentially offering protection during market downturns.

Investors can gain exposure to commodities and precious metals through various means, including futures contracts, exchange-traded funds (ETFs), or physical ownership. Each method carries its own set of risks and benefits, warranting careful consideration and potentially professional advice.

As we move forward, it’s essential to weigh the benefits and risks associated with these real asset investment strategies. The next section will explore these factors in detail, providing a comprehensive view of real asset investing.

Navigating the Real Asset Landscape: Benefits and Challenges

Real asset investments offer a unique set of advantages and challenges that investors must carefully consider. Understanding these factors is essential for making informed decisions and maximizing the potential benefits of real asset investments.

Diversification and Inflation Protection

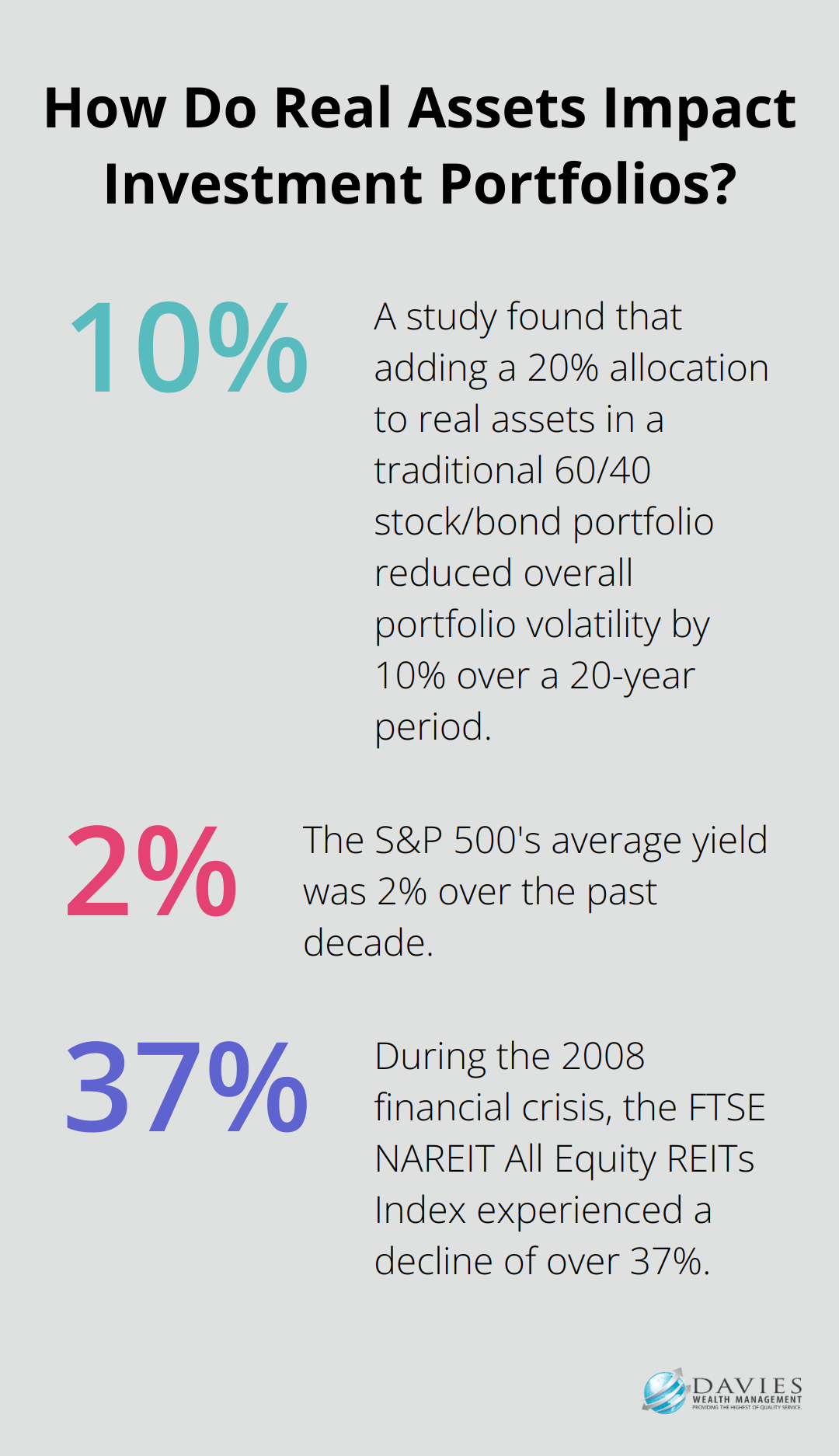

One of the primary attractions of real assets is their ability to diversify investment portfolios. A study by BlackRock found that adding a 20% allocation to real assets in a traditional 60/40 stock/bond portfolio reduced overall portfolio volatility by 10% over a 20-year period. This diversification benefit stems from the low correlation between real assets and traditional financial assets.

Real assets also serve as an effective hedge against inflation. At the end of 1978, for example, real GNP was 13.8 percent. This inflation-hedging capability is particularly valuable in today’s economic environment, where inflationary pressures are a growing concern.

Income Generation and Capital Appreciation

Many real assets, particularly real estate and infrastructure investments, offer the potential for steady income streams. The FTSE NAREIT All Equity REITs Index reported an average dividend yield of 3.7% over the past decade (significantly higher than the S&P 500’s average yield of 2%).

Beyond income, real assets can also provide substantial capital appreciation over time. The Case-Shiller U.S. National Home Price Index has shown an average annual increase of 3.5% over the past 30 years, demonstrating the long-term appreciation potential of real estate investments.

Liquidity Constraints and Market Volatility

While real assets offer numerous benefits, they also come with certain risks and challenges. Illiquidity is a significant consideration, particularly for direct investments in physical assets. Selling a property or infrastructure project can take months or even years, potentially locking up capital for extended periods.

Market volatility is another factor to consider. Although real assets can provide stability during certain economic conditions, they are not immune to market fluctuations. During the 2008 financial crisis, the FTSE NAREIT All Equity REITs Index experienced a decline of over 37%, highlighting the potential for significant short-term volatility.

Regulatory and Environmental Considerations

Investors in real assets must also navigate a complex regulatory landscape. Zoning laws, environmental regulations, and tax policies can significantly impact the performance of real asset investments. Changes in renewable energy policies can affect the profitability of infrastructure investments in wind or solar power projects.

Environmental factors are increasingly important in real asset investing. Climate change is one of the most significant risks faced by the real estate industry, impacting rising global temperatures, erratic weather patterns, and other factors. Conversely, investments in sustainable infrastructure or green buildings may benefit from growing environmental consciousness and supportive government policies.

Final Thoughts

Real asset investment strategies offer powerful portfolio diversification and potential inflation hedges. Investors can choose from direct investments in physical assets, REITs, infrastructure funds, and commodities. Each approach presents unique benefits and challenges, which investors must align with their financial goals and risk tolerance.

Real assets attract investors with steady income streams and long-term appreciation potential. However, these investments carry risks such as illiquidity and market volatility. Regulatory and environmental factors add complexity to real asset investing, necessitating careful consideration and monitoring.

Professional guidance proves invaluable when navigating the intricacies of real asset investments. Davies Wealth Management provides personalized wealth management services tailored to individual client goals (including investment management and tax minimization strategies). Our team’s extensive experience can help you make informed decisions that support your long-term financial well-being.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply