At Davies Wealth Management, we often encounter clients grappling with the decision between estate planning and financial planning. These two strategies, while distinct, play crucial roles in securing your financial future and legacy.

Estate planning vs financial planning is a common dilemma, but understanding their unique purposes and how they complement each other is key to comprehensive wealth management. In this post, we’ll explore both approaches, their differences, and how they work together to protect your assets and achieve your long-term financial goals.

What Is Estate Planning?

Estate planning is a critical process that extends beyond drafting a will. It involves a comprehensive strategy to protect and distribute your assets according to your wishes, both during your lifetime and after your death.

The Foundation of Estate Planning

A well-crafted will forms the cornerstone of any estate plan. This legal document outlines how you want your assets distributed after your death. However, estate planning encompasses much more. It includes the creation of trusts to minimize taxes and avoid probate, the designation of beneficiaries for retirement accounts and life insurance policies, and the establishment of powers of attorney for financial and healthcare decisions.

Essential Components of a Robust Estate Plan

A thorough estate plan typically includes several key documents. These may include:

- A living trust, which can help your heirs avoid the time-consuming and costly probate process. Transferring assets to a revocable trust will remove those assets from your estate for state probate law purposes but not for federal (or state) estate tax purposes.

- An advance healthcare directive (also known as a living will). This document outlines your wishes for medical treatment if you become incapacitated. Without this, your family may face difficult decisions without knowing your preferences.

The Far-Reaching Advantages of Estate Planning

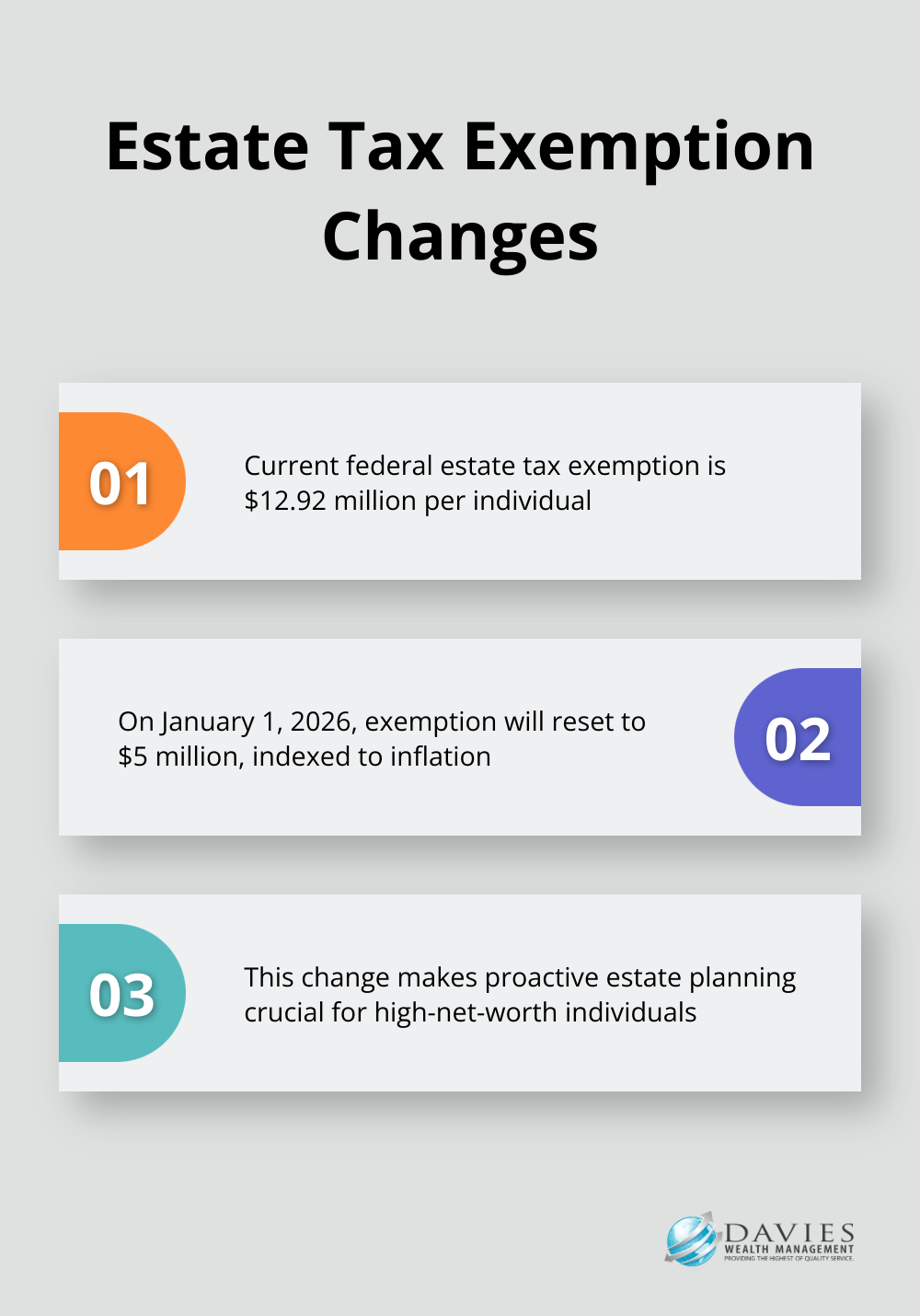

The benefits of a well-structured estate plan extend far beyond asset distribution. For instance, it can significantly reduce estate taxes. As of 2025, the federal estate tax exemption will decrease from its current level of $12.92 million per individual to approximately $6 million. This change makes proactive estate planning even more important for high-net-worth individuals.

Estate planning also provides protection for your beneficiaries. You can set up trusts that provide for your children while protecting the assets from creditors or spendthrift tendencies.

The Ongoing Nature of Estate Planning

Estate planning is not a one-time event but an ongoing process. It requires regular reviews and updates to reflect changes in your life circumstances and financial situation. This approach ensures that your hard-earned assets remain protected and distributed according to your wishes, minimizing family conflicts and legal challenges.

As we transition to our next topic, it’s important to note that while estate planning focuses on asset protection and distribution, financial planning takes a broader view of your overall financial health and goals. Let’s explore how these two strategies work together to create a comprehensive wealth management approach.

What Is Financial Planning?

Financial planning serves as a comprehensive process that helps individuals and families achieve their short-term and long-term financial goals. It acts as a roadmap for achieving your goals, encompassing everything from budgeting and saving to investing and retirement planning.

The Building Blocks of a Financial Plan

A solid financial plan begins with a thorough assessment of your current financial situation. This includes an analysis of your income, expenses, assets, and liabilities. From this foundation, clear and achievable financial goals are set. These might include saving for a down payment on a house, funding your children’s education, or planning for a comfortable retirement.

One of the core elements of any financial plan is a robust investment strategy. Recent projections suggest more modest returns, with Fidelity’s 2023 report projecting 3.9% real returns through 2042, and Vanguard’s 2024 report projecting 4.9-6.9% returns through 2054.

Risk Management and Insurance

Risk management forms another essential aspect of financial planning. This involves the identification of potential financial risks and the implementation of strategies to mitigate them. For example, a study found that 55% of Americans would experience financial insecurity in a year or less after losing a primary wage earner. Appropriate life insurance coverage addresses this risk and provides peace of mind for families.

The Power of Tax-Efficient Strategies

Tax planning often gets overlooked in financial planning, but it can significantly impact wealth accumulation. The Tax Policy Center reports that the average American household pays about $15,000 in federal taxes each year. The implementation of tax-efficient investment strategies and the use of tax-advantaged accounts can help reduce this burden (and keep more money in your pocket).

Measuring Progress and Adapting

Financial planning requires regular review and adjustment. An annual review of your financial plan is recommended, or whenever significant life changes occur such as marriage, the birth of a child, or a career change. This ongoing process ensures that your financial strategy remains aligned with your evolving goals and circumstances.

Each client’s financial situation is unique, which necessitates tailored financial planning services. Professional athletes managing a sudden influx of wealth or business owners planning for succession require specialized expertise to guide them towards financial success. As we move forward, let’s explore how financial planning intersects with estate planning to create a comprehensive wealth management approach.

Estate Planning vs Financial Planning: Key Differences and Priorities

Distinct Focuses in Wealth Management

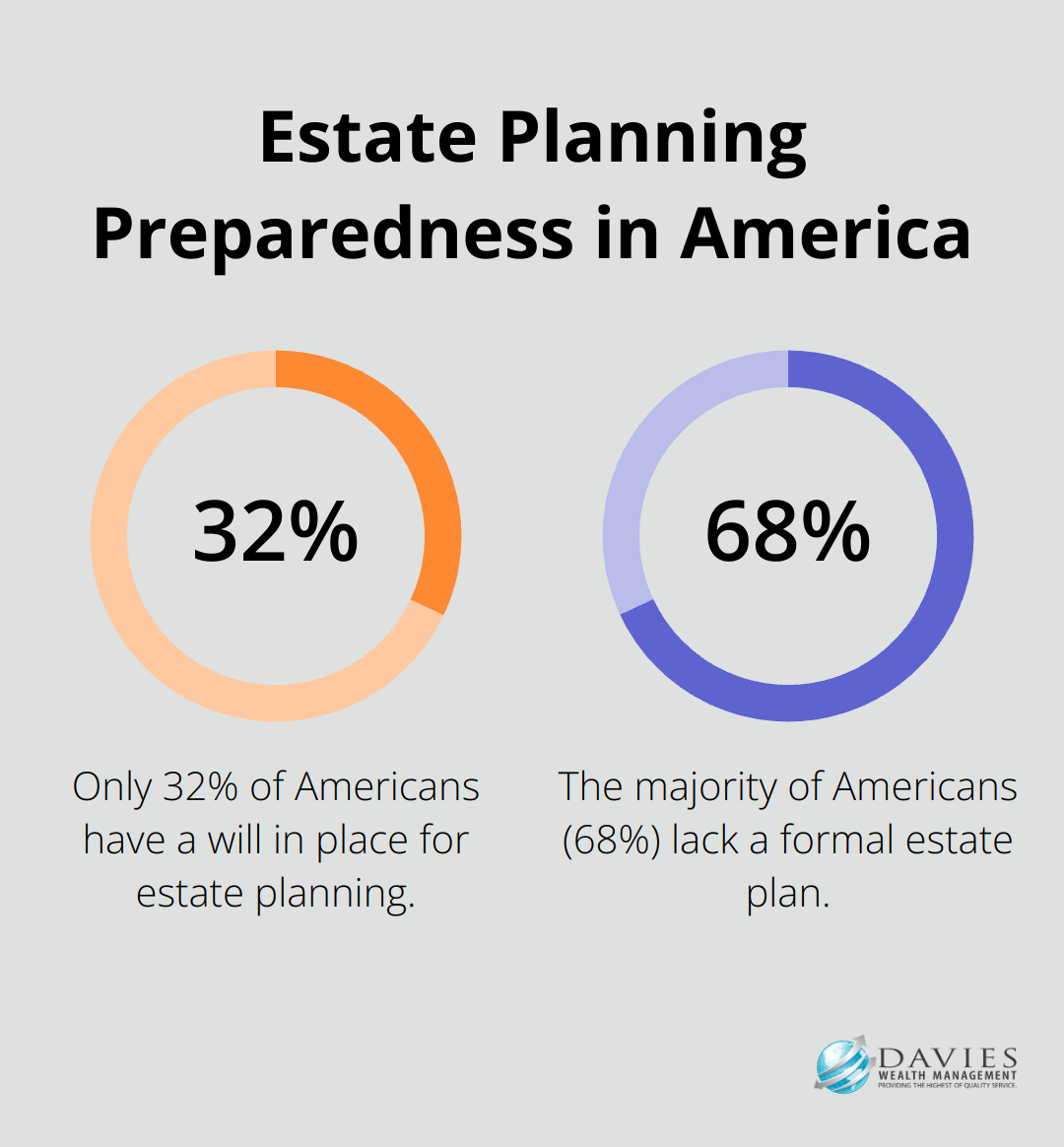

Estate planning and financial planning represent two essential aspects of wealth management. Each plays a vital role, but their focuses differ significantly. Estate planning primarily addresses the distribution of assets after death. It ensures wealth transfers to chosen beneficiaries efficiently and with minimal tax implications. A recent survey by Caring.com revealed that only 32% of Americans have a will in place, indicating a substantial gap in estate planning preparedness.

Financial planning takes a broader view of one’s financial life. It manages money effectively throughout one’s lifetime to achieve various goals. This includes budgeting, saving, investing, and planning for major life events (such as home purchases, education funding, or retirement).

Scope and Components

Estate planning encompasses more than just asset distribution. It includes important decisions about healthcare and financial management in case of incapacitation.

Financial planning covers a wide range of financial aspects. A key component is retirement planning.

Prioritizing Estate Planning

While both planning types hold importance, certain situations call for prioritizing estate planning. For those with minor children, establishing guardianship through a will becomes paramount. Business owners should prioritize succession planning to ensure business continuity after their death.

High-net-worth individuals should focus on estate planning due to potential estate tax implications. On January 1, 2026, the exemption is scheduled to automatically reset to $5,000,000, indexed to inflation, making proactive planning critical for wealth preservation.

The Power of Integration

Estate and financial planning work best when integrated. A financial plan informs the estate plan by determining available assets for distribution. Conversely, estate planning goals shape financial strategies, such as investment choices or insurance policy purchases.

For example, if an estate plan includes charitable giving, the financial plan might incorporate strategies to maximize tax benefits from these donations during one’s lifetime. If the estate plan involves leaving a significant inheritance, the financial plan might focus on wealth accumulation and preservation strategies.

Tailored Approaches for Unique Situations

Professional athletes with complex financial situations should start estate planning early. The unpredictable nature of athletic careers necessitates a solid plan for asset protection and distribution. Specialized wealth management firms (such as Davies Wealth Management) offer expertise in navigating these unique financial landscapes, ensuring athletes can secure their long-term financial future beyond their playing years.

Final Thoughts

Estate planning and financial planning form two essential pillars of comprehensive wealth management. Estate planning protects and distributes assets according to your wishes, while financial planning manages money effectively to achieve various goals. The debate of estate planning vs financial planning overlooks their synergistic relationship, as these strategies work best in tandem.

At Davies Wealth Management, we understand the importance of integrating both approaches for holistic wealth management. Our team creates tailored solutions that address the unique needs of each client (whether you’re a professional athlete, business owner, or individual seeking financial security). We offer comprehensive wealth management services that encompass both estate and financial planning.

Our expertise ensures your hard-earned assets are protected, grown, and distributed according to your wishes. Davies Wealth Management helps you navigate the complexities of wealth management with confidence. Your financial strategy will support your goals now and in the future.

Leave a Reply