EQUITIES ADVANCE THIS WEEK AS THE FED RAISES RATES BY 25 BASIS POINTS AND AS EARNINGS COME IN BETTER THAN EXPECTEDWeekly Market Update — July 29, 2023 |

||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

Weekly Market Performance

*Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD. This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results. |

||||||||||||||||||||||||||||||||

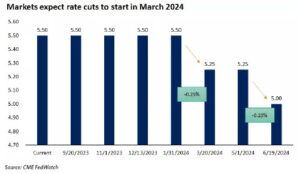

Stocks And Equities Advance This Week as Fed Raises RatesStocks had a good week, as all four of the major U.S. equity indexes advanced on hopes that a soft landing engineered by the Federal Reserve was becoming real. Most encouraging for investors was the fact that the DJIA saw its 13th consecutive daily gain through Wednesday, marking its longest winning streak since 1987. Growth stocks far outpaced Value stocks, driven by NASDAQ’s 2% gain, which padded its 36%+ YTD gain. The week’s biggest news was widely anticipated, as the Federal Reserve voted unanimously on Wednesday to raise the fed funds rate by 25 basis points, after pausing last month. Fed Chair Jerome Powell was non-committal about whether rates would be raised further, but he did acknowledge that inflation is far from its most-recent peak. The fed futures market is predicting that there will be about a 30% chance of another rate hike later this year. There was a lot of economic data received this week and here are a few highlights:

|

||||||||||||||||||||||||||||||||

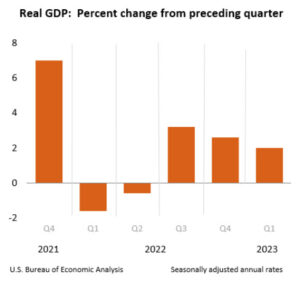

GDP Revised Up SignificantlyThe third estimate for Q1 GDP saw a very large, upward revision to 2.0% from 1.3%, as consumer spending proved to be much more robust than anticipated. Highlights

|

||||||||||||||||||||||||||||||||

New Home Sales Jump in May But Sales Prices DeclineNew home sales surged 12.2% month-over-month in May to a seasonally adjusted annual rate of 763,000 units. On a year-over-year basis, new home sales were up 20.0%, but the median sales price declined 7.6% year-over-year to $416,300 while the average sales price declined 6.6% to $487,300. In addition:

|

||||||||||||||||||||||||||||||||

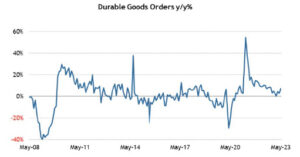

Durable Goods Orders Are UPTotal durable goods orders were up 1.7% month-over-month following an upwardly revised 1.2% increase (from 1.1%) in April. Excluding transportation, durable goods orders increased 0.6% month-over-month following a downwardly revised 0.6% decline (from -0.2%) in April. Highlights

|

||||||||||||||||||||||||||||||||

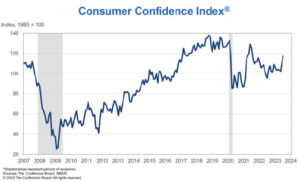

Consumer Confidence Up Again To Best Level Since July 2021On Tuesday, it was announced that the Conference Board Consumer Confidence Index rose again in July to 117.0 (1985=100), up from 110.1 in June. Further:

Consumer confidence rose in July 2023 to its highest level since July 2021, reflecting pops in both current conditions and expectations. Headline confidence appears to have broken out of the sideways trend that prevailed for much of the last year. Greater confidence was evident across all age groups, and among both consumers earning incomes less than $50,000 and those making more than $100,000.” |

||||||||||||||||||||||||||||||||

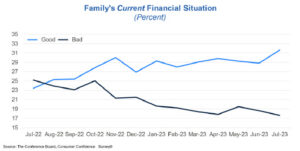

Family’s Current Financial SituationConsumers’ assessment of their Family’s Current Financial Situation signals still-healthy family finances in July.

|

||||||||||||||||||||||||||||||||

| Sources

federalreserve.gov ; conference-board.org; census.gov ; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com; census.gov ; |

✅ BOOK AN APPOINTMENT TODAY: https://calendly.com/tdwealth

===========================================================

🔴 SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!💥

🎯🎯🎯Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

🔥🔥🔥 ====== ===Get Our FREE GUIDES ========== 🔥🔥🔥

🎯Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

🎯Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ LET’S GET SOCIAL

Facebook: https://www.facebook.com/DaviesWealthManagement

Twitter: https://twitter.com/TDWealthNet

Linkedin: https://www.linkedin.com/in/daviesrthomas

Youtube Channel: https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

DISCLAIMER

**Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply