Table of Contents

- Understanding QDROs in Florida

- The Florida Retirement System (FRS) Complication

- Why 2026 Changes Everything

- The Four Most Expensive QDRO Mistakes

- 401(k) vs. Pension Division: Different Rules, Different Risks

- Tax-Smart QDRO Execution for Stuart and Jupiter Residents

- Building Your Divorce Financial Plan

Understanding QDROs in Florida

If you're going through a divorce in Martin County or Palm Beach County, and you or your spouse has accumulated retirement assets during the marriage, you're about to enter the world of Qualified Domestic Relations Orders: or QDROs for short.

A QDRO is a legal order that tells your retirement plan administrator to split your 401(k), pension, or other qualified retirement plan between you and your former spouse. It sounds straightforward until you realize that one drafting error can trigger immediate taxation, penalties, and a permanent loss of retirement security.

Here's what makes QDROs particularly tricky in 2026: we're sitting at the edge of the largest tax code shift since 2017. The Tax Cuts and Jobs Act provisions are set to sunset on December 31, 2025, which means tax brackets, deductions, and retirement account treatment could change dramatically starting January 1, 2026. If your divorce settlement doesn't account for these changes, you could be handing over significantly more to the IRS than necessary.

For high-net-worth families along PGA Boulevard or in Stuart's waterfront communities, we're talking about retirement accounts that often exceed $1 million. A poorly timed or incorrectly structured QDRO could cost you six figures in unnecessary taxes.

The Florida Retirement System (FRS) Complication

Florida public employees: teachers, law enforcement, state workers, and municipal employees: participate in the Florida Retirement System, which operates under different rules than private-sector 401(k)s. If you or your spouse has an FRS pension, the QDRO process becomes more complex.

The FRS offers both a pension plan and an investment plan, and each has unique division rules. The pension plan requires specific language in your QDRO that addresses:

- Whether the alternate payee (your ex-spouse) receives a percentage of the monthly benefit or a fixed dollar amount

- When payments begin (at your retirement or when you become eligible)

- How cost-of-living adjustments are handled

- Survivor benefit elections

Many divorce attorneys aren't intimately familiar with FRS-specific QDRO requirements. We've seen cases where couples agreed to split retirement assets 50/50, but because the QDRO wasn't properly drafted for FRS compliance, the division didn't execute as intended: or at all.

Why 2026 Changes Everything

You've probably heard about the estate tax sunset, but the 2026 tax changes impact far more than just estate planning. When the Tax Cuts and Jobs Act expires, we're looking at:

- Higher marginal tax rates: The top bracket returns from 37% to 39.6%

- Lower standard deductions: Potentially cut nearly in half

- Bracket compression: More of your income taxed at higher rates

- Changes to capital gains treatment: Possible adjustments to long-term rates

For divorcing couples splitting retirement accounts, timing becomes critical. If you take a distribution in 2026 versus 2025, you could face a significantly higher tax bill: even if the distribution amount is identical.

Consider this scenario: You're a corporate executive in Jupiter with a $2 million 401(k). Your divorce settlement calls for a 50/50 split. If your ex-spouse takes an immediate cash distribution rather than rolling it into their own retirement account, they'll pay ordinary income tax on that $1 million. Under 2025 rates, that's approximately $370,000 in federal taxes. Under 2026 rates? Potentially $396,000 or more: a $26,000 difference just from timing.

This is exactly the kind of planning issue we discuss regularly on the Davies Wealth Management podcast, where we break down complex financial situations into actionable strategies for Martin and Palm Beach County residents.

The Four Most Expensive QDRO Mistakes

Over nearly two decades working with divorcing couples in Stuart and Jupiter, we've identified four mistakes that consistently trigger the biggest financial losses:

1. The 10% Penalty Trap

QDROs allow penalty-free withdrawals from retirement accounts: but only if executed correctly. If your QDRO isn't approved before you take a distribution, or if the distribution doesn't meet specific IRS requirements, you'll face the standard 10% early withdrawal penalty. On a $500,000 distribution, that's an unnecessary $50,000 loss.

2. The "I'll Deal With It Later" Mistake

Some couples finalize their divorce without addressing the QDRO, planning to "get to it eventually." This is dangerous for two reasons: First, the account owner could die before the QDRO is executed, potentially cutting the ex-spouse out entirely. Second, market fluctuations can dramatically change account values, creating disputes about what constitutes the agreed-upon split.

3. The Roth Confusion

Roth 401(k)s and Roth IRAs have different rules than traditional retirement accounts. Many QDROs fail to address Roth accounts properly, leading to unintended tax consequences. If you're splitting Roth accounts, the receiving spouse needs to roll those funds into their own Roth account to preserve the tax-free status. One wrong move, and you've converted tax-free money into taxable income.

4. The FRS "Separate Interest" Miscalculation

For Florida Retirement System pensions, couples can choose between a "separate interest" approach (alternate payee receives their own benefit) or a "shared payment" approach (alternate payee receives a portion of the member's benefit only when paid). The separate interest approach offers more flexibility but requires precise calculations to determine the alternate payee's benefit amount. Get this wrong, and one party ends up with significantly less than intended.

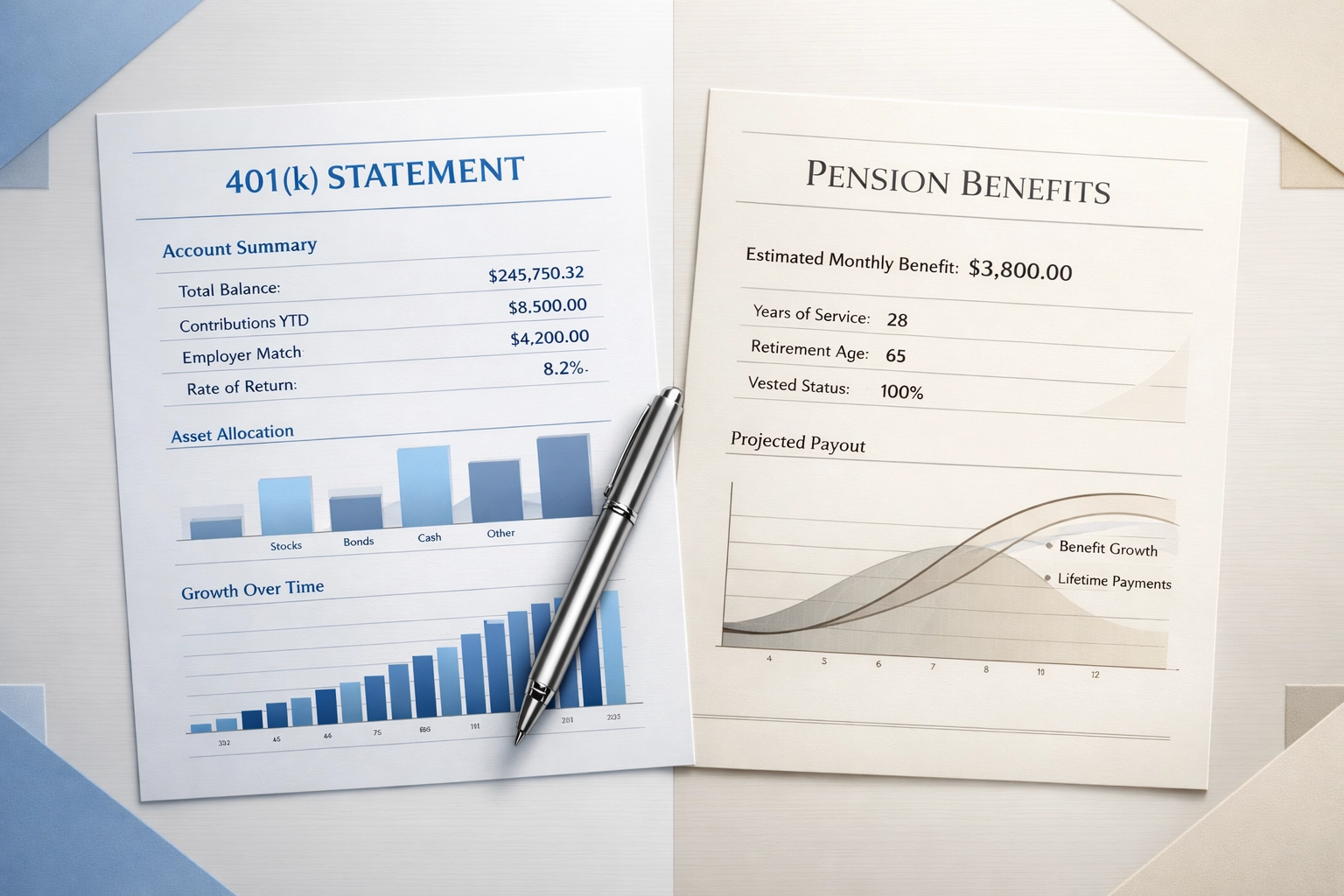

401(k) vs. Pension Division: Different Rules, Different Risks

Dividing a 401(k) is fundamentally different from dividing a pension, and the 2026 tax environment makes these differences even more pronounced.

401(k) Division:

With a 401(k), you're splitting a defined account balance. Your QDRO specifies either a dollar amount or a percentage, and once the plan administrator receives the approved QDRO, they'll transfer that amount to the alternate payee's account. The alternate payee then has three options:

- Roll it into their own IRA or 401(k) (no taxes due)

- Take a cash distribution (taxes due, no penalty if QDRO-qualified)

- Keep it in the original plan temporarily (if allowed)

The key planning opportunity: If you're splitting a 401(k) in late 2025 or early 2026, consider the timing of any cash distributions. Taking the distribution in 2025 could save thousands in taxes if rates increase in 2026.

Pension Division:

Pensions pay monthly income rather than lump sums, which creates different planning considerations. Your QDRO must address:

- When the alternate payee's payments begin

- Whether payments continue if the plan participant dies first

- How benefits are calculated if the participant hasn't retired yet

- Whether the alternate payee can take a lump sum (if the plan allows)

For FRS pensions specifically, the alternate payee cannot receive benefits until the member either retires or reaches retirement eligibility. This means if you're the non-employee spouse, you might wait years before seeing any pension income from your QDRO.

Tax-Smart QDRO Execution for Stuart and Jupiter Residents

If you're navigating a divorce with significant retirement assets, here's your strategic framework for minimizing the 2026 tax impact:

Start Early: Begin the QDRO drafting process as soon as your settlement agreement is reached. Plan administrators can take 90 days or more to review and approve QDROs. If you're trying to execute before year-end 2025, you need to start now.

Model Different Scenarios: Before finalizing your settlement, model the tax impact of different division strategies. Should you take retirement assets in lieu of other property? Would it make sense to give your spouse a larger share of taxable retirement accounts in exchange for a larger share of Roth accounts?

Consider the Three-Year Rule: If your spouse plans to take a cash distribution rather than rolling over their QDRO proceeds, they can spread the tax liability over three years under certain circumstances. This can be particularly valuable if we're looking at rate increases in 2026.

Coordinate With Your Estate Plan: A divorce changes your entire financial picture. Your QDRO execution should coordinate with updates to your beneficiary designations, trust documents, and overall wealth transfer strategy. We cover comprehensive approaches to this coordination at Davies Wealth Management.

Use Professional QDRO Drafters: Don't rely solely on your divorce attorney to draft the QDRO. Many attorneys outsource this to QDRO specialists who know the specific requirements of different plan types. For FRS pensions, this is absolutely essential.

Building Your Divorce Financial Plan

A QDRO is just one piece of your divorce financial puzzle. When you're splitting decades of accumulated wealth, you need a comprehensive strategy that addresses:

- Retirement income planning: How will your retirement look with half the assets you expected?

- Tax-efficient withdrawal strategies: Which accounts should you tap first in retirement?

- Investment reallocation: Should your asset allocation change post-divorce?

- Estate planning updates: Who inherits your retirement accounts now?

- Insurance considerations: Do you need to maintain life insurance for alimony obligations?

For Stuart and Jupiter residents with substantial assets: think executives with deferred compensation plans, business owners with qualified retirement plans, or dual-income couples with combined 401(k) balances exceeding seven figures: the financial planning complexity multiplies.

The 2026 tax sunset creates urgency. If your divorce will be finalized in 2026 or later, you're planning in an environment where the tax rules have shifted. What worked for someone who divorced in 2023 may not be the optimal strategy for you.

This isn't about gaming the system or finding loopholes. It's about understanding the rules and structuring your divorce settlement in a way that preserves as much wealth as possible for both parties. After all, legal fees and divorce stress are expensive enough without adding unnecessary tax bills to the mix.

Moving Forward With Confidence

The QDRO trap isn't that these orders are inherently problematic: it's that they're deceptively complex, and the consequences of errors are severe. When you're already dealing with the emotional and logistical challenges of divorce, it's easy to sign off on a settlement agreement without fully understanding how the retirement division will actually play out.

If you're in the early stages of divorce discussions, make retirement account division a priority conversation with your attorney and financial advisor. If your divorce is already finalized but your QDRO hasn't been executed, don't delay any further: especially with the 2026 deadline approaching.

For personalized guidance on QDROs, retirement account division, and comprehensive divorce financial planning in Martin and Palm Beach Counties, schedule a consultation with our team. We work with divorcing individuals and couples to model different settlement scenarios, minimize tax impact, and build post-divorce financial plans that support your long-term goals.

The decisions you make today about your QDRO will impact your financial security for decades. Make them count.

Leave a Reply