Table of Contents

- Key Premium Increases Hit Florida Seniors

- Medicare Advantage Plan Shake-Up in the Sunshine State

- Out-of-Pocket Costs: What’s Changing

- Part D Prescription Drug Updates

- New Coverage Benefits Worth Knowing About

- Your Enrollment Options Moving Forward

- Action Steps for Florida Retirees

If you’re a Florida retiree, you’ve probably heard whispers about Medicare changes coming in 2026. Well, those whispers just got a lot louder. As we head into the new year, significant shifts in Medicare are about to affect everything from your monthly premiums to which doctors you can see. Let’s break down exactly what’s happening and what it means for your healthcare and financial planning.

Key Premium Increases Hit Florida Seniors

The biggest sticker shock comes right out of the gate with Medicare Part B premiums. Starting January 1, 2026, you’ll be paying $202.90 per month for Part B coverage: that’s an increase of $17.90 from 2025. For many Florida retirees living on fixed incomes, this represents a nearly 10% jump in one of their most essential healthcare costs.

But here’s where it gets trickier. If you’re among Florida’s higher-earning retirees, you’re facing even steeper increases. Income-related premium surcharges now kick in at $109,000 for single filers and $218,000 for joint filers: slightly higher thresholds than 2025, but the surcharges themselves have increased. This means if your retirement income puts you above these levels (remember, they look at your 2024 tax return), you could be paying significantly more than the standard premium.

For those who need to purchase Part A coverage, the costs are jumping even more dramatically. The reduced premium rate increases to $311 per month, while the full premium rises to $565 monthly. That’s a substantial hit to any retirement investment strategy you’ve carefully crafted over the years.

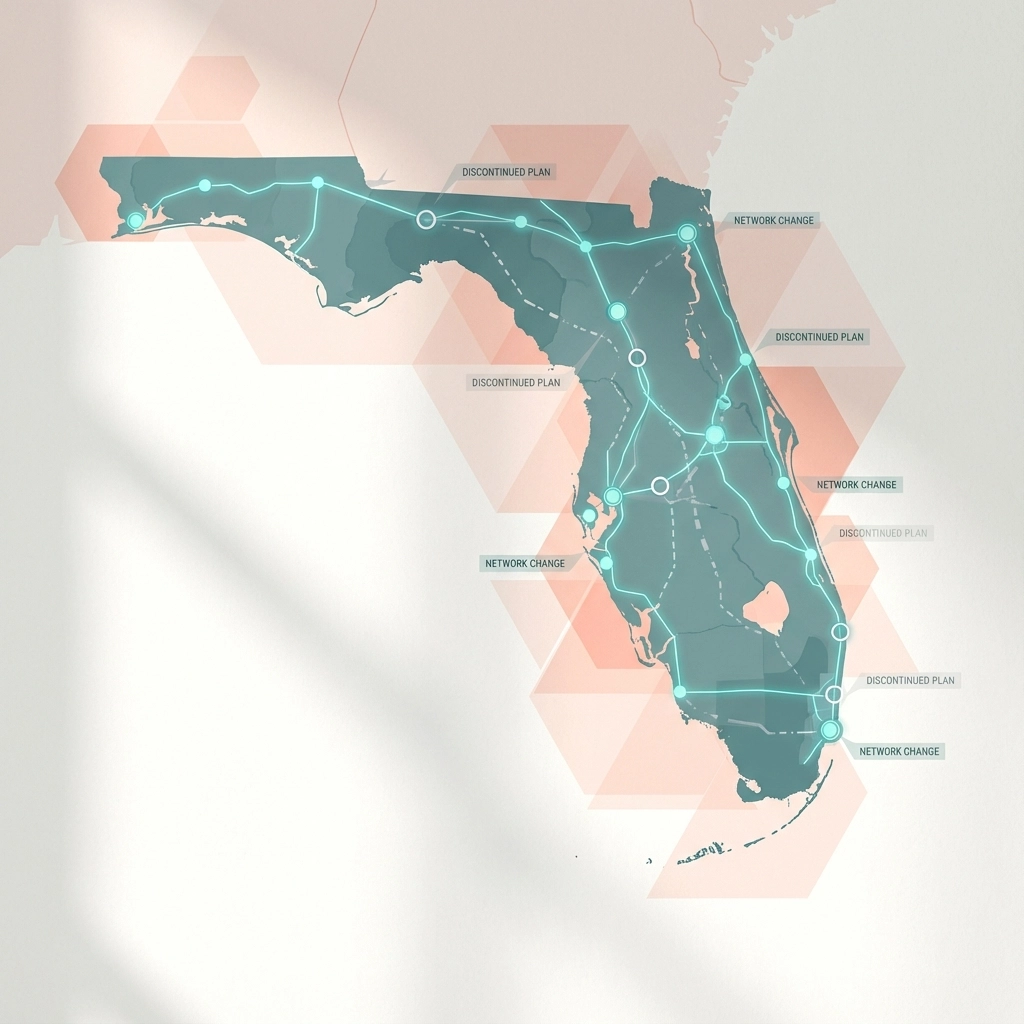

Medicare Advantage Plan Shake-Up in the Sunshine State

Florida’s Medicare Advantage landscape is experiencing some serious turbulence in 2026. If you’re enrolled in a Medicare Advantage plan, you need to know that some plans are disappearing entirely, while others are hiking premiums or slashing benefits. This isn’t happening in a vacuum: federal reimbursement formulas are changing, and insurance companies are responding by making tough choices about which plans to continue offering.

The Star Ratings system plays a huge role here. Plans with four or five stars typically receive additional federal funding, making them more likely to survive and thrive. Lower-rated plans? They’re often the first to get the ax. This means you might lose access to a plan you’ve been happy with simply because it didn’t score high enough on federal quality measures.

Network Changes That Could Affect Your Care

One of the biggest concerns for Florida seniors is potential changes to doctor networks. Your primary care physician or favorite specialist might no longer be included in your plan’s network come 2026. Given Florida’s large senior population and ongoing physician shortages in some areas, these network changes can create real access problems.

If your doctor gets dropped from your plan’s network, you’re facing a tough choice: find a new doctor within the network or pay significantly higher out-of-network costs to keep seeing your preferred provider. Neither option is ideal, especially when you’ve built a relationship with healthcare providers who understand your medical history.

Benefit Cuts on the Horizon

Those extra benefits that made Medicare Advantage plans so attractive: dental coverage, vision care, hearing aids, gym memberships, transportation services: are often the first things to get cut when insurers face cost pressures. While Florida Blue Medicare continues to offer comprehensive benefits across all 67 counties, other insurers are trimming these extras to keep their plans financially viable.

Your prescription drug formulary is also getting an update. Each plan maintains its own list of covered medications, and there’s a good chance your current prescriptions might move to a higher cost tier or disappear from coverage entirely. This could mean paying hundreds more annually for the same medications you’ve been taking.

Out-of-Pocket Costs: What’s Changing

The out-of-pocket maximum for Medicare Advantage plans has been climbing steadily, and 2026 continues this trend. While some reports suggest a slight decrease in maximum limits, the reality is that most Florida seniors should prepare for higher out-of-pocket costs overall.

Copayments for office visits, specialist appointments, and prescriptions are expected to rise across many plans. What used to be a $20 copay for a doctor’s visit might become $30 or $40. These increases might seem small individually, but they add up quickly when you’re managing multiple chronic conditions or need frequent medical care.

This is where comprehensive estate planning becomes crucial. Healthcare costs are one of the biggest wildcards in retirement planning, and these Medicare changes 2026 developments highlight why you need to build healthcare cost inflation into your long-term financial strategy.

Part D Prescription Drug Updates

There’s some good news mixed in with all these changes. Medicare’s prescription drug coverage is getting some important updates that could save you money. Ten high-cost medications will be available at lower prices through Medicare’s new drug price negotiation program. If you’re taking any of these medications, you could see significant savings.

The Part D out-of-pocket cost cap continues to be indexed for inflation, but the overall structure is becoming more consumer-friendly. The annual deductible is adjusting, and the catastrophic coverage threshold is designed to provide better protection against extremely high drug costs.

However, individual Part D plans are still making changes to their formularies. Your specific medications might move between tiers, affecting your monthly costs even if the overall program structure improves.

New Coverage Benefits Worth Knowing About

It’s not all bad news. Medicare is expanding coverage in some important areas for 2026. Colorectal cancer screenings are now covered, which is particularly relevant given Florida’s aging population. Early detection of colorectal cancer can be literally life-saving, and removing cost barriers to screening is a positive development.

Advanced Primary Care Management services are also being added to covered benefits. This type of coordinated care can help manage chronic conditions more effectively and potentially prevent costly complications down the road.

Your Enrollment Options Moving Forward

If you’re unhappy with your current plan’s changes or your plan is being discontinued, you still have options. The Annual Enrollment Period ended on December 7, 2025, but that doesn’t mean you’re stuck with unwanted changes.

The Medicare Advantage Open Enrollment period runs from January 1 through March 31, 2026. During this window, you can make one plan change if needed. This is particularly valuable if you discover that your 2026 plan changes are worse than you expected once you start using your coverage.

If your plan is ending entirely or you’re moving to a new area in Florida, you qualify for a Special Enrollment Period, which provides additional flexibility beyond the standard enrollment windows.

You also have the option to return to Original Medicare and purchase a Medigap plan. While this typically involves higher monthly premiums than Medicare Advantage, it can provide more predictable costs and broader provider access. You might also want to add a standalone Part D prescription drug plan to complement your Original Medicare coverage.

For more detailed guidance on navigating these choices, check out our discussions on retirement planning strategies on the Davies Wealth Management podcast, where we regularly cover Medicare and healthcare planning topics.

Action Steps for Florida Retirees

Here’s what you need to do right now to prepare for these Medicare changes 2026:

Review Your Current Plan Changes: Look carefully at the materials your current Medicare Advantage plan has sent you about 2026 changes. Pay special attention to your doctor network status, medication formulary changes, and any reductions in supplemental benefits.

Contact Your Healthcare Providers: Confirm that your primary care doctor and specialists will still be in your plan’s network for 2026. If not, find out what other plans they accept or start researching new providers within your network.

Evaluate Your Prescription Costs: Check whether your medications are still covered at the same cost level. If your drugs are moving to higher tiers or being dropped entirely, compare costs across different Part D plans.

Consider Your Options: If your current plan is making changes you can’t accept, use the January 1–March 31, 2026 open enrollment period to select a new plan. Don’t wait until you have a health crisis to realize your plan doesn’t meet your needs.

Update Your Budget: Factor these premium increases and potential out-of-pocket cost changes into your 2026 budget. Healthcare inflation is outpacing general inflation, and these changes reflect that reality.

The Medicare changes 2026 brings significant shifts that will affect every Florida retiree’s healthcare costs and access. While some of these changes create challenges, staying informed and taking proactive steps can help you navigate them successfully. Your healthcare is too important to leave to chance: take action now to ensure your 2026 Medicare coverage meets your needs and fits your budget.

For personalized guidance on how these Medicare changes might affect your overall retirement and financial planning strategy, consider scheduling a consultation to discuss how healthcare costs fit into your long-term wealth management plan. Visit our services page to learn more about our comprehensive approach to retirement planning.

Leave a Reply