Market volatility has reached levels not seen since 2020, with the S&P 500 experiencing daily swings exceeding 2% on 15 occasions this quarter alone.

Smart asset allocation becomes your primary defense against these unpredictable conditions. We at Davies Wealth Management have identified three key strategies that help investors maintain portfolio stability while positioning for future growth.

The right rebalancing approach can mean the difference between preserving wealth and watching it erode during turbulent periods.

What Economic Forces Are Reshaping Investment Returns?

Federal Reserve Policy Creates New Investment Landscape

The Federal Reserve’s aggressive rate adjustments have fundamentally altered investment dynamics. After the Fed cut rates by 25 basis points in September, markets anticipate policy rates near 2.9% by year-end 2026. This shift ends the era where money market funds generated 5%+ returns with zero risk.

Over $7.3 trillion currently sits in cash and money market accounts, representing massive capital that must find new homes as yields compress. The inverted yield curve that made short-term investments attractive is now normalizing, forcing investors to extend duration for meaningful returns. Money market investors face a stark reality: their safe haven will soon offer diminished rewards.

Inflation Persistence Demands Strategic Asset Selection

Core inflation has cooled to 2.4% year-over-year as of September, with the Consumer Price Index rising 0.2% month-over-month. This persistent price pressure creates a challenging environment where traditional 60/40 portfolios struggle to generate real returns. Consumer spending patterns show resilience despite inflation, with retail sales growing 2.1% year-over-year.

The number 0% seems to be not appropriate for this chart. Please use a different chart type.

Discretionary spending faces pressure from higher housing and energy costs. Fixed income investors must now choose between accepting lower real returns or extending maturities to capture the additional yield that steep yield curves offer. Investment-grade corporate bonds currently offer 200-300 basis points above Treasuries, providing inflation protection that cash cannot match.

Market Concentration Risk Reaches Extreme Levels

The S&P 500’s forward price-to-earnings ratio sits at 22.5x, driven primarily by seven mega-cap technology stocks that represent 32% of index weight. This concentration creates vulnerability to sector-specific shocks that can devastate broadly diversified portfolios.

Small-cap stocks trade at 14.2x forward earnings, offering value opportunities for patient investors. International developed markets trade at 13.8x earnings with stronger dividend yields (averaging 3.4% versus 1.3% for US equities). Geographic diversification becomes essential as US markets command premium valuations while offering limited yield potential.

These market distortions create both challenges and opportunities that require tactical portfolio adjustments to navigate successfully. Wealth management firms face sluggish economic growth and low return potential from many assets, making strategic allocation decisions more critical than ever.

How Should You Reposition Your Portfolio Now?

Target 70-30 Stock-Bond Allocation for Maximum Flexibility

Current market conditions demand aggressive portfolio restructuring away from cash positions. With money market funds losing their 5%+ advantage, investors should immediately shift toward a 70% equity, 30% fixed income allocation for portfolios under age 50. This allocation captures growth potential while providing stability through high-quality bonds.

Investment-grade corporate bonds now offer 4.5-5.2% yields, representing genuine income opportunities that cash cannot match. Municipal bonds provide tax-advantaged yields of 3.8-4.3% for high earners (particularly attractive given current tax rates). The steep yield curve rewards investors who extend duration beyond short-term cash positions.

International Markets Offer Superior Value Propositions

European and Asian markets trade at significant discounts to US equities, with the MSCI EAFE index offering attractive valuations versus the S&P 500. International developed markets provide higher dividend yields compared to US stocks.

Allocate 20-25% of equity positions to international markets, focusing on quality companies in Germany, Japan, and the UK where valuations reflect economic reality rather than speculation. Emerging markets offer additional diversification opportunities, though limit exposure to 5-10% due to volatility concerns.

Extension Swaps Generate Superior Risk-Adjusted Returns

Replace short-duration Treasury bills with 7-10 year investment-grade corporate bonds to capture the steep yield curve premium. Extension swaps currently provide additional yield while reducing reinvestment risk in a declining rate environment.

Focus on high-quality issuers with strong balance sheets and avoid reaching for yield in lower-rated securities. Treasury Inflation-Protected Securities should comprise 10-15% of fixed income allocations to hedge against persistent inflation pressures that continue affecting consumer prices.

These strategic shifts position portfolios to capitalize on current market dislocations while maintaining appropriate risk levels. The next step involves implementing these changes through systematic rebalancing techniques that minimize tax consequences and transaction costs.

How Do You Execute Portfolio Changes Without Losing Money to Taxes?

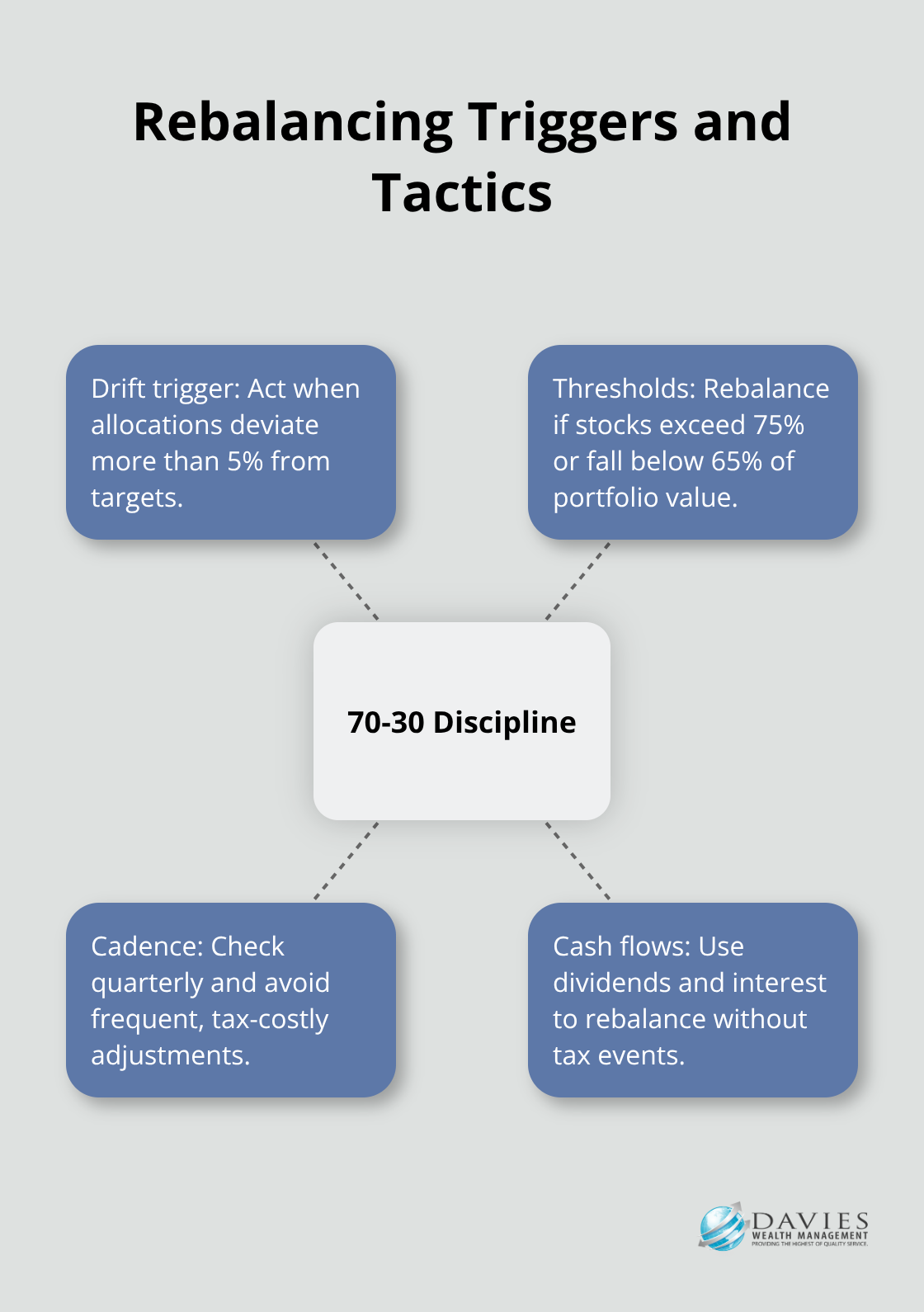

Rebalance When Allocations Drift Beyond 5% Thresholds

Your portfolio demands immediate attention when asset allocation deviates more than 5% from target percentages. Research shows that monthly rebalancing balances transaction costs with desired risk exposure. For the recommended 70-30 stock-bond allocation, you must rebalance when stocks exceed 75% or fall below 65% of total portfolio value.

Check your portfolio quarterly but avoid frequent adjustments that create unnecessary tax consequences. Historical S&P 500 data reveals double-digit pullbacks occur in over half of all years, which makes threshold-based rebalancing more effective than calendar-based approaches during volatile periods. Portfolio cash flows like dividends and interest payments allow you to rebalance without tax events.

Harvest Tax Losses While You Maintain Strategic Positions

Tax-loss harvesting requires you to sell positions with unrealized losses while you immediately purchase similar (not identical) securities to maintain market exposure. This strategy works particularly well with international index funds where you can swap between different regional allocations without wash-sale violations.

You should prioritize shares with higher cost basis to minimize tax liabilities during rebalancing activities. Investors over age 73 must coordinate rebalancing with required minimum distributions to avoid penalties while they optimize tax efficiency. Tax-advantaged accounts work best for high-turnover strategies, and you should hold tax-efficient index funds in taxable accounts.

Partner with Fee-Only Advisors for Complex Strategies

Professional guidance becomes essential when you manage portfolios exceeding $500,000 or deal with concentrated stock positions from employer benefits. Fee-based advisors charge set fees for their services, either hourly, by project, or as a percentage of assets under management. You can expect to pay 0.75-1.25% annually for comprehensive wealth management services that include tax planning and estate coordination.

Annual portfolio reviews should include stress tests against various market scenarios and allocation adjustments based on your changing life circumstances. Professional advisors provide access to institutional-quality investments and tax strategies that individual investors cannot access (particularly valuable during market transitions like the current environment).

Final Thoughts

Market volatility and economic shifts demand immediate portfolio action rather than passive approaches. Data demonstrates that investors who maintain disciplined asset allocation strategies during uncertain periods consistently outperform those who chase performance or panic during downturns. Your portfolio success depends on strategic allocation, systematic rebalancing, and professional guidance.

The current environment rewards investors who extend duration beyond cash positions while they maintain geographic diversification across undervalued international markets. Asset allocation decisions made today will determine portfolio resilience as Fed policy normalizes and market concentration risks persist. Professional management becomes essential when complex strategies require coordination across multiple account types and tax considerations.

We at Davies Wealth Management help individuals, families, and businesses navigate challenging market conditions through comprehensive wealth management solutions. Our team provides investment management, retirement planning, and tax-efficient strategies that align with your specific financial goals (particularly valuable for those with fluctuating income patterns). Davies Wealth Management offers the personalized guidance needed to optimize your investment approach and build long-term wealth despite current market uncertainties.

Leave a Reply