Stuart, FL families face unique challenges when protecting their financial future. Florida’s tax laws and estate regulations create both opportunities and pitfalls for wealth preservation.

We at Davies Wealth Management see how proper planning can shield your assets from unnecessary taxes and legal complications. The right strategies implemented today will protect what matters most to your family for generations.

What Unique Risks Face Your Stuart Legacy?

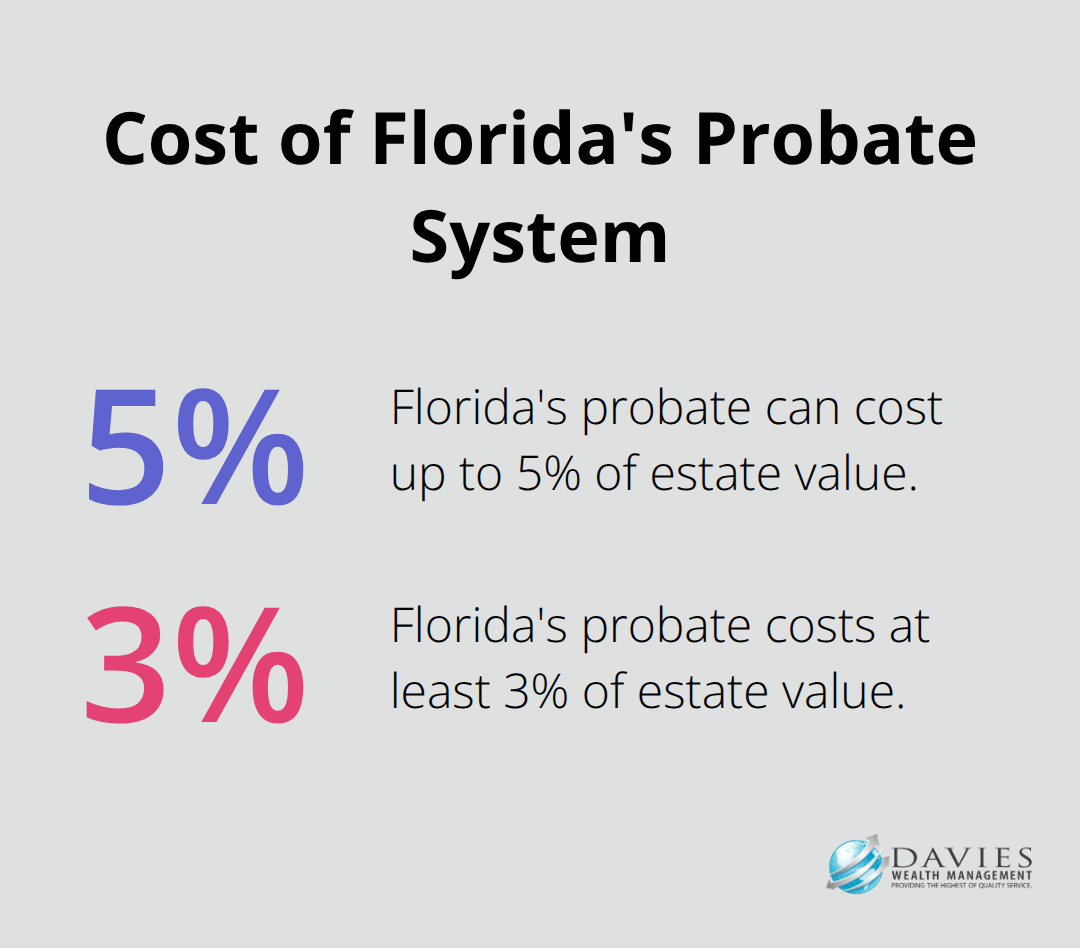

Florida’s no-state-income-tax advantage creates a false sense of security for many Stuart families. While you avoid state income taxes during your lifetime, federal estate taxes still apply to estates that exceed $13.61 million in 2024. More concerning is Florida’s complex probate system, which ties up assets for 6-12 months and costs your family 3-5% of your estate value. The Sunshine State’s homestead exemption protects your primary residence from creditors but creates complications when you want to downsize or relocate.

The Hidden Costs of Poor Planning

Stuart’s proximity to high-litigation areas makes asset protection planning non-negotiable. Professional liability claims and auto accidents can wipe out decades of wealth in a single lawsuit. Florida’s joint tenancy laws seem protective but actually increase tax burdens for your heirs. When one spouse dies, the survivor loses the stepped-up basis on half the property (potentially creating massive capital gains taxes later). Additionally, Florida’s forced heirship rules for homestead property can override your will and give your children rights you never intended them to have.

State-Specific Traps That Destroy Wealth

Florida Statute 732.4017 requires specific language in wills to override the state’s elective share provisions. Without proper drafting, your spouse can claim 30% of your estate regardless of your will’s instructions. The state’s complex trust laws also create opportunities and pitfalls. Florida allows self-settled spendthrift trusts, which give you creditor protection while you maintain some control over assets. However, the two-year lookback period means timing matters (threats that appear after you establish these trusts make the strategies worthless).

Professional Liability Exposure

Stuart professionals face unique risks that standard insurance policies don’t cover. Medical malpractice claims average $348,000 in Florida, while legal malpractice settlements reach $165,000 on average. Real estate professionals encounter additional exposure through errors and omissions claims. These professional risks require specialized asset protection strategies that go beyond basic estate planning documents and standard liability coverage.

The right protection strategies can shield your wealth from these threats while you build your legacy for future generations.

How Do You Preserve Wealth for Future Generations?

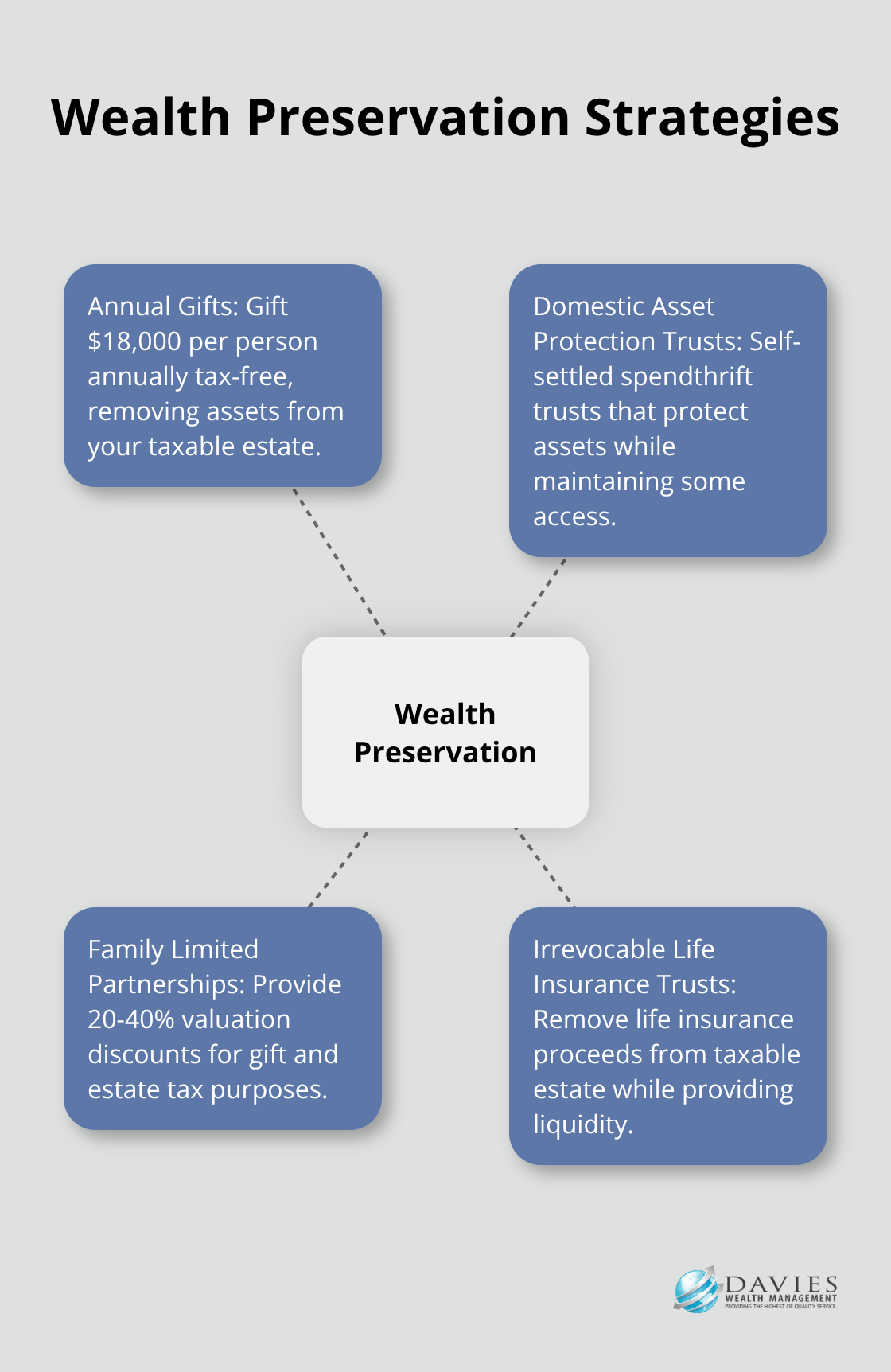

Annual Gifts Maximize Tax Benefits

The IRS allows you to gift $18,000 per person per year without gift tax consequences in 2024. Stuart families with three children can transfer $108,000 annually tax-free when both spouses participate. This strategy removes assets from your taxable estate while you maintain control during your lifetime. Medical and educational expenses paid directly to providers qualify for unlimited gifts without counting against your annual exclusion. Private school tuition for grandchildren becomes a powerful wealth transfer tool that reduces your estate value while supporting family education goals.

Domestic Asset Protection Trusts Shield Assets

Florida permits self-settled spendthrift trusts that protect your assets while you maintain some access. Nevada and Delaware offer stronger protection with shorter statute of limitations periods for creditor claims. These trusts require a two-year period before creditor protection activates, which makes early implementation vital. Nevada trusts work well for Stuart professionals who face litigation risks because they provide complete protection after just two years. The trustee must be located in the trust state, but you can serve as investment advisor and retain significant control over distributions.

Family Limited Partnerships Create Multiple Protection Layers

Family limited partnerships combined with protective trusts create multiple barriers that make your wealth virtually judgment-proof. You transfer assets to the partnership and gift limited partnership interests to family members at discounted values (typically 20-40% below fair market value). The general partner maintains control while limited partners receive economic benefits. This structure provides valuation discounts for gift and estate tax purposes while protecting assets from creditors of individual family members.

Irrevocable Life Insurance Trusts Multiply Estate Value

An ILIT removes life insurance proceeds from your taxable estate while providing liquidity for estate taxes. A $2 million policy purchased at age 50 costs approximately $15,000 annually but delivers tax-free benefits worth potentially $600,000 more than the same assets left in your estate. The trust must follow strict rules, including Crummey notices to beneficiaries within 30 days of contributions. Generation-skipping trusts can extend these benefits for up to 1,000 years in Florida, which creates dynastic wealth that compounds tax-free across multiple generations.

Professional advisors play a vital role in implementing these sophisticated strategies correctly and coordinating all moving parts of your wealth preservation plan.

Who Should Handle Your Legacy Protection?

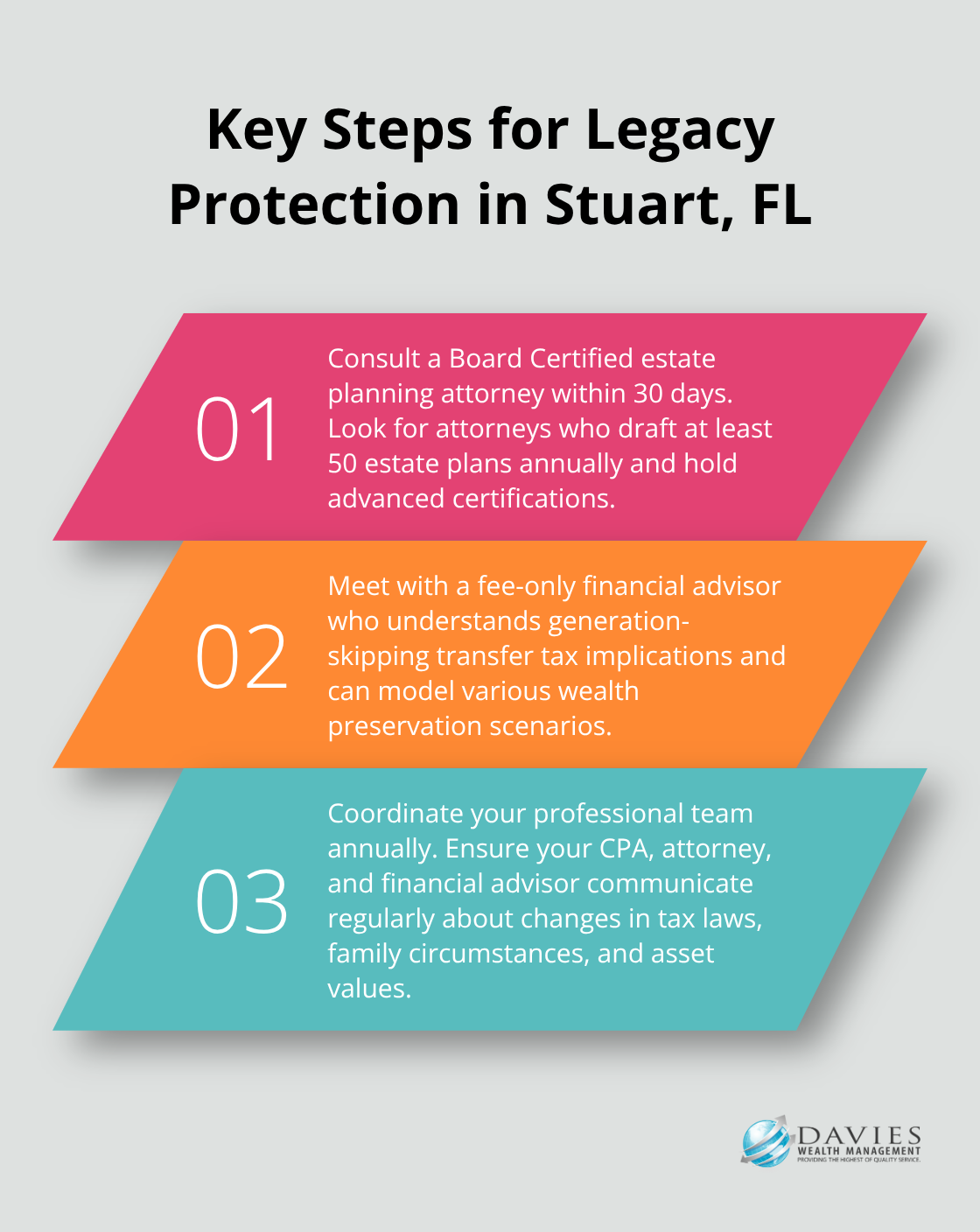

Find an Attorney Who Understands Florida’s Complexities

Stuart estate planning attorneys charge around $495 per hour, but the right attorney saves you far more than their fees cost. Look for attorneys who draft at least 50 estate plans annually and hold advanced certifications from the National Association of Estate Planners & Councils. The Florida Bar’s Board Certified Estate Planning specialists represent a small percentage of all attorneys but handle the most complex cases successfully. Ask potential attorneys about their experience with Florida’s homestead laws and self-settled spendthrift trusts. Many general practice attorneys miss critical details that cost families hundreds of thousands in unnecessary taxes and probate expenses.

Financial Advisors Must Coordinate Tax and Investment Strategies

Your financial advisor should work directly with your estate planning attorney to align investment strategies with wealth transfer goals. Fee-only advisors eliminate conflicts of interest that arise when advisors earn commissions from insurance or investment products they recommend. The advisor should understand generation-skipping transfer tax implications and how different asset classes affect your estate tax exposure (particularly important for estates exceeding $13.61 million). Most importantly, they must model various scenarios to show how different strategies impact your family’s long-term wealth accumulation.

Professional Team Coordination Prevents Costly Mistakes

The most expensive estate planning failures happen when professionals work in isolation rather than as a coordinated team. Your CPA, attorney, and financial advisor must communicate regularly about changes in tax laws, family circumstances, and asset values. Schedule annual meetings with all advisors present to review and update your strategies. Document these meetings and require written summaries of recommended changes. Insurance agents, trust officers, and investment managers also need regular updates about your overall plan (this coordination becomes especially important when you implement complex strategies like charitable remainder trusts or family limited partnerships where timing and execution details determine success or failure).

Final Thoughts

Legacy protection starts with three immediate actions that Stuart families must take now. Schedule consultations with a Board Certified estate planning attorney and fee-only financial advisor within 30 days. Gather your financial documents including property deeds, investment statements, and insurance policies for comprehensive review.

Proactive wealth preservation delivers compound benefits over time. Families who implement protection strategies early typically save 15-25% more wealth than those who wait until retirement. Your children and grandchildren benefit from tax-free growth in properly structured trusts for decades (while professional liability protection shields your assets from unexpected claims that could otherwise destroy years of hard work).

Stuart residents face unique opportunities with Florida’s favorable trust laws and tax environment. The state’s self-settled spendthrift trusts provide creditor protection unavailable in many other states. We at Davies Wealth Management help families navigate these complex strategies and coordinate with qualified professionals to protect your legacy for generations.

Leave a Reply