Investment planning in Stuart, Florida presents unique opportunities and challenges for residents of this coastal gem. With its thriving local economy and attractive tax environment, Stuart offers a distinctive landscape for financial growth.

At Davies Wealth Management, we understand the intricacies of building wealth in this vibrant community. Our tailored strategies help Stuart residents navigate local market trends, optimize retirement savings, and secure their financial future in the Sunshine State.

What Drives Stuart’s Economic Engine?

Stuart, Florida’s economic landscape presents a diverse array of industries and opportunities. The local market trends shape a unique investment environment for Stuart residents.

A Thriving Marine Economy

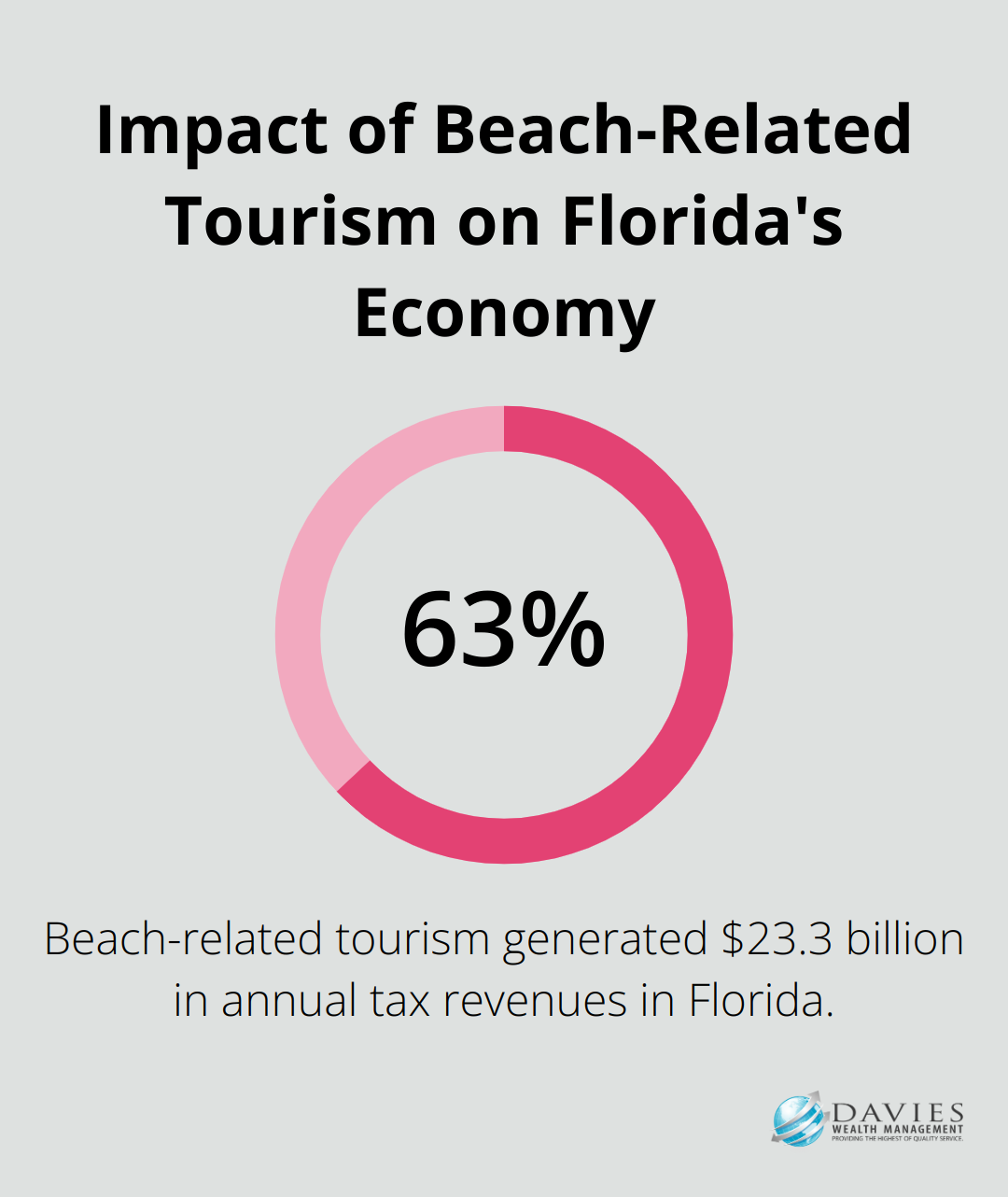

Stuart’s economy finds its anchor in the robust marine industry. The city’s strategic location on the St. Lucie River and its proximity to the Atlantic Ocean have created a thriving ecosystem of boat manufacturers, marinas, and fishing charters. Beach-related tourism in Florida generated $23.3 billion annually in tax revenues, accounting for 63% of the 2023 figures, highlighting the significant impact of marine-related activities on the state’s economy.

Tourism and Hospitality Boom

Tourism remains a cornerstone of Stuart’s economic vitality. While specific data for Martin County’s tourism revenue increase in 2024 is not available, the sector continues to play a crucial role in the local economy.

Healthcare and Education Sectors

Stuart’s healthcare sector continues to expand rapidly. Martin Health System, the largest employer in the area, drives job creation and economic stability. The education sector also contributes to the local economy, with Indian River State College’s expansion attracting young professionals and creating a skilled workforce.

Real Estate Market Dynamics

The real estate market in Stuart offers compelling opportunities for investors. As of August 2024, condos in Mariner Cay, Stuart FL have list prices ranging from $329,900 up to $549,900, indicating a diverse range of options for potential buyers and investors.

Investment Opportunities in Stuart’s Economy

Stuart’s diverse economic base and strategic location create fertile ground for investment. The city’s growth sectors (marine industry, tourism, healthcare, and education) offer a range of possibilities for savvy investors. These opportunities extend from real estate ventures to local business investments, allowing residents to capitalize on Stuart’s economic evolution.

As we move forward, it’s important to consider how these local economic factors influence investment strategies tailored specifically for Stuart residents.

Smart Investing in Stuart’s Unique Economy

Leveraging Local Strengths

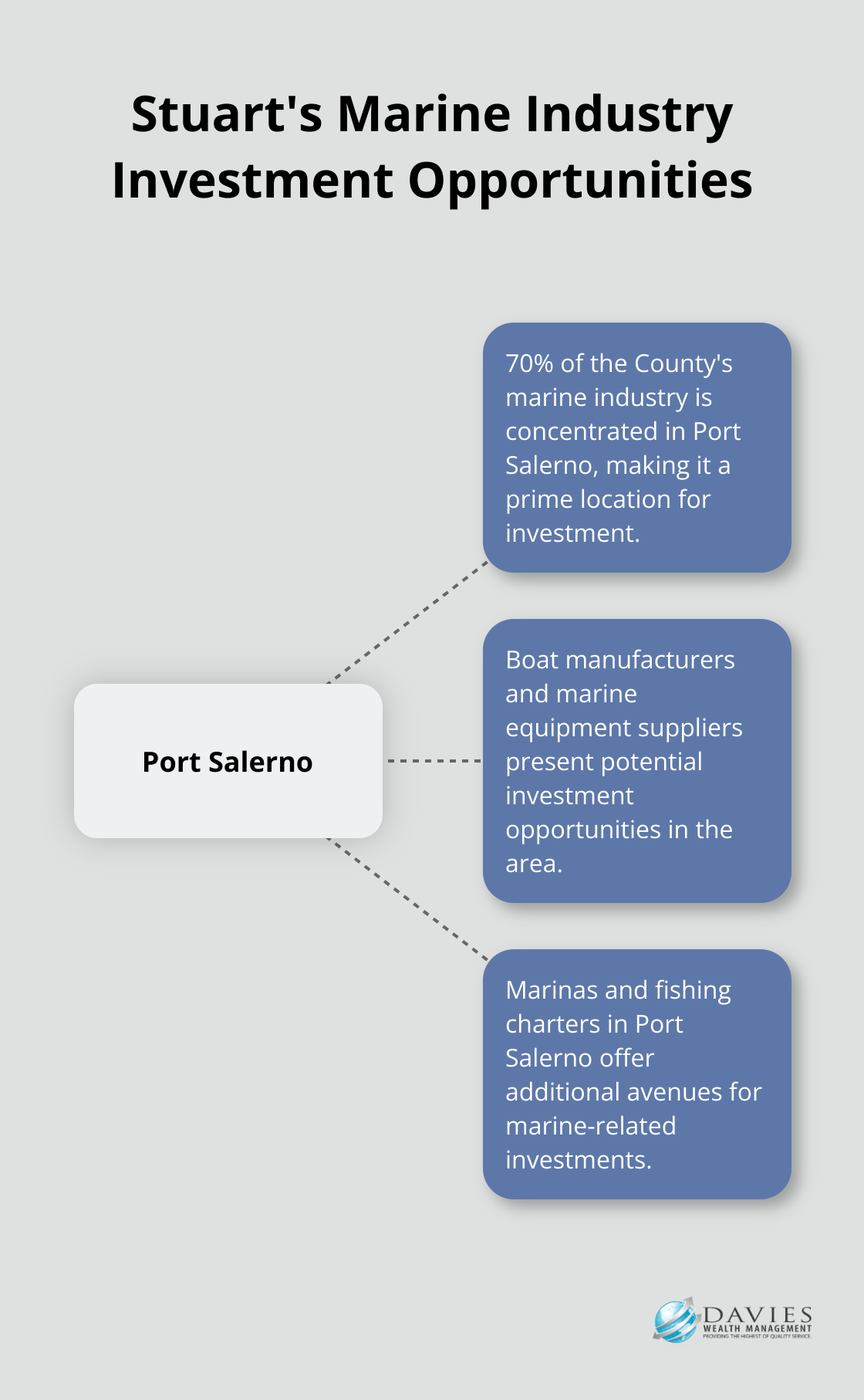

Stuart’s thriving marine industry and tourism sector offer unique investment opportunities. We recommend the allocation of a portion of your portfolio to local businesses and real estate that benefit from these economic drivers. For example, 70% of the County’s marine industry is in Port Salerno, indicating potential investment opportunities in this area.

The healthcare sector in Stuart, anchored by Martin Health System, presents another avenue for local investment. Consider healthcare-focused Real Estate Investment Trusts (REITs) or stocks of companies that supply medical equipment to local hospitals.

Global Diversification for Stability

While local investments can offer growth, we emphasize the importance of global diversification to mitigate risk. We typically suggest the allocation of 60-70% of a portfolio to a mix of U.S. and international stocks, bonds, and alternative investments. This approach helps protect against localized economic downturns and currency fluctuations.

For Stuart residents nearing retirement, we often recommend an increase in allocation to defensive assets like high-quality bonds and dividend-paying stocks. These can provide steady income streams, which prove vital in a coastal economy where tourism-related income can fluctuate seasonally.

Tax-Efficient Strategies for Florida Residents

Florida’s lack of a state income tax offers unique advantages for investors. We help our clients maximize this benefit through several strategies:

- Municipal Bonds: These tax-free investments can be particularly attractive for high-income Stuart residents.

- Roth IRA Conversions: With no state income tax, the cost of converting traditional IRAs to Roth IRAs can be lower in Florida compared to other states.

- Tax-Loss Harvesting: We actively monitor portfolios to offset capital gains with losses, reducing overall tax liability.

- Qualified Opportunity Zones: Stuart has designated areas that qualify for this program, offering tax benefits for long-term investments in local development projects.

Tailored Approach to Investment

At Davies Wealth Management, we tailor these strategies to each client’s unique situation, ensuring their investment approach aligns with both their financial goals and Stuart’s economic realities. Our team stays informed about local economic trends and tax law changes to continually optimize our clients’ portfolios.

As we move forward, it’s important to consider how these investment strategies can be applied to retirement planning in Stuart, Florida. The next section will explore how to maximize retirement savings in a no-income-tax state and address healthcare considerations for retirees in this coastal community.

Retirement Planning in Stuart: Maximizing Your Golden Years

Leveraging Florida’s Tax-Friendly Environment

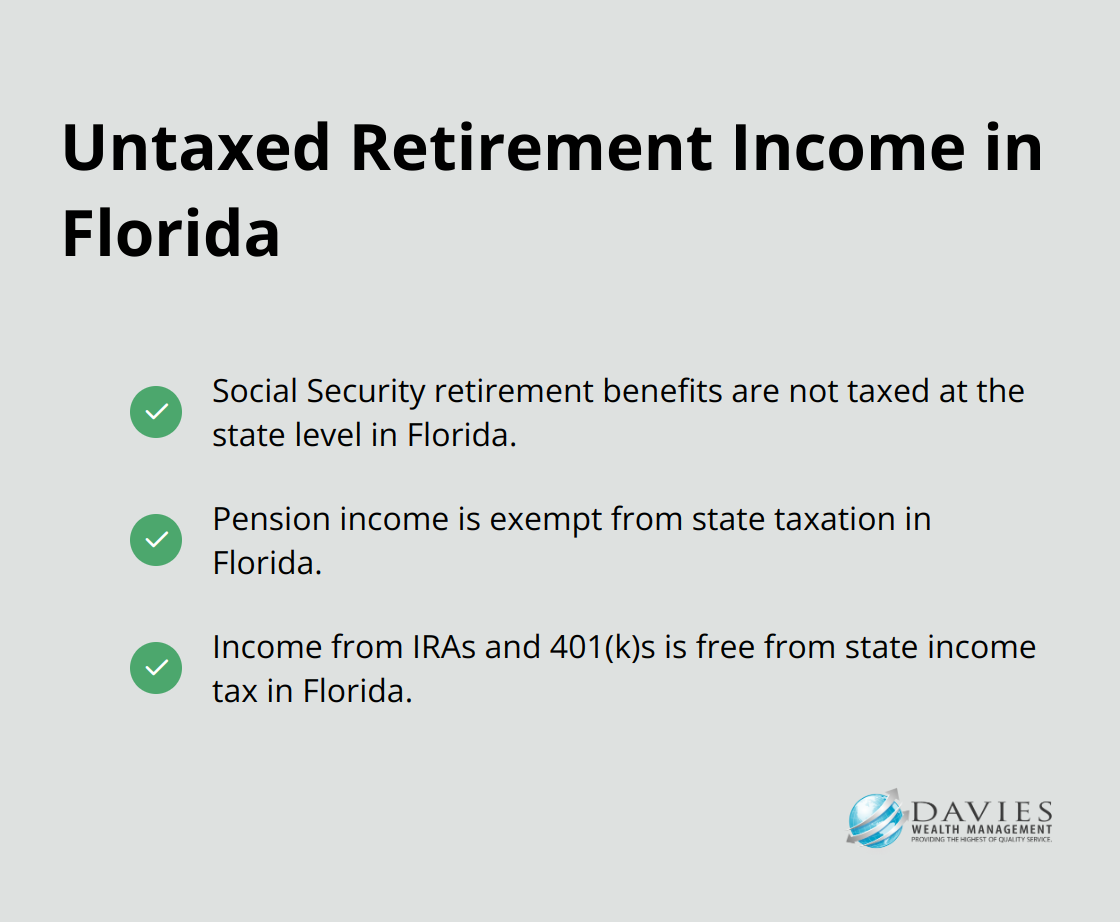

Stuart, Florida presents a unique retirement landscape that planners can use for financial success. Florida has no state income tax, which means Social Security retirement benefits, pension income and income from an IRA or a 401(k) are all untaxed. This creates opportunities for retirees to extend their savings further, but it’s important to navigate this advantage strategically.

Florida’s tax-friendly environment allows retirees to keep more of their hard-earned money. To maximize this benefit, we recommend increasing contributions to tax-advantaged accounts like 401(k)s and IRAs.

For those over 50, catch-up contributions offer an additional boost. In 2025, individuals can contribute an extra $7,500 to 401(k) plans and $1,000 to IRAs above standard limits. This strategy can significantly accelerate retirement savings growth.

Addressing Healthcare Costs in Retirement

While Stuart offers a pleasant retirement lifestyle, healthcare costs remain a critical consideration. To mitigate potential expenses, we suggest exploring long-term care insurance options early, ideally in your 50s or early 60s when premiums are more affordable. Using the Cost of Care Survey tool, you and your family can calculate the cost of long-term care across the US, now and in the future.

Additionally, Health Savings Accounts (HSAs) offer a triple tax advantage for healthcare savings. Contributions are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses. For Stuart residents, maxing out HSA contributions can provide a valuable cushion for future healthcare needs.

Estate Planning Strategies for Wealth Preservation

Effective estate planning protects and transfers wealth to future generations. Florida’s homestead exemption offers significant protection for primary residences, shielding them from most creditors. Under Florida’s homestead laws, your primary residence – your homestead – enjoys substantial protection from creditor claims and forced sale. This makes real estate an attractive component of a comprehensive estate plan for Stuart residents.

For high-net-worth individuals, utilizing Florida’s favorable trust laws can be beneficial. The state allows for self-settled asset protection trusts, providing an extra layer of security for your assets.

Tailored Retirement Solutions

Retirement planning in Stuart requires a nuanced approach that balances tax advantages, healthcare considerations, and estate planning strategies. We recommend implementing targeted financial strategies that leverage local benefits to create a robust retirement plan. This approach ensures financial security and peace of mind in your golden years.

At Davies Wealth Management, we specialize in creating customized retirement plans that take advantage of Stuart’s unique financial landscape. Our team stays informed about Florida’s evolving retirement and estate laws to provide the most up-to-date and effective strategies for our clients.

Final Thoughts

Stuart, Florida offers a unique landscape for investment planning, blending coastal charm with economic vitality. The city’s thriving industries create diverse investment opportunities for residents to grow their wealth. However, navigating this complex financial terrain requires more than just knowledge of local economic trends.

Personalized financial planning proves essential to leverage Stuart’s advantages effectively while mitigating potential risks. Each individual’s financial situation, goals, and risk tolerance are unique, necessitating a tailored approach to investment planning in Stuart, Florida. This is where Davies Wealth Management steps in.

We specialize in creating customized financial strategies that align with the specific needs and aspirations of Stuart residents. Our team’s deep understanding of the local economic landscape, combined with expertise in investment management, positions us uniquely to help you achieve your financial goals. For residents seeking to secure their financial future, Davies Wealth Management offers the expertise and local insight necessary to navigate Stuart’s unique investment landscape.

Leave a Reply