Finding the right financial advisor in Stuart, Florida can be a game-changer for your financial future. The unique economic landscape of this coastal city demands specialized knowledge and expertise.

At Davies Wealth Management, we understand the importance of partnering with a local financial advisor who can navigate the specific challenges and opportunities in Stuart. This guide will help you identify and choose the best financial advisor in Stuart, Florida to meet your individual needs and goals.

Why Stuart’s Financial Landscape Demands Local Expertise

Stuart, Florida’s unique economic environment presents both challenges and opportunities for investors. Stuart’s coastal location contributes to its economic development strategy, aiming for long-term sustainability and regional competitiveness. The city’s growing population and diverse industries create a complex financial ecosystem that requires specialized knowledge to navigate effectively.

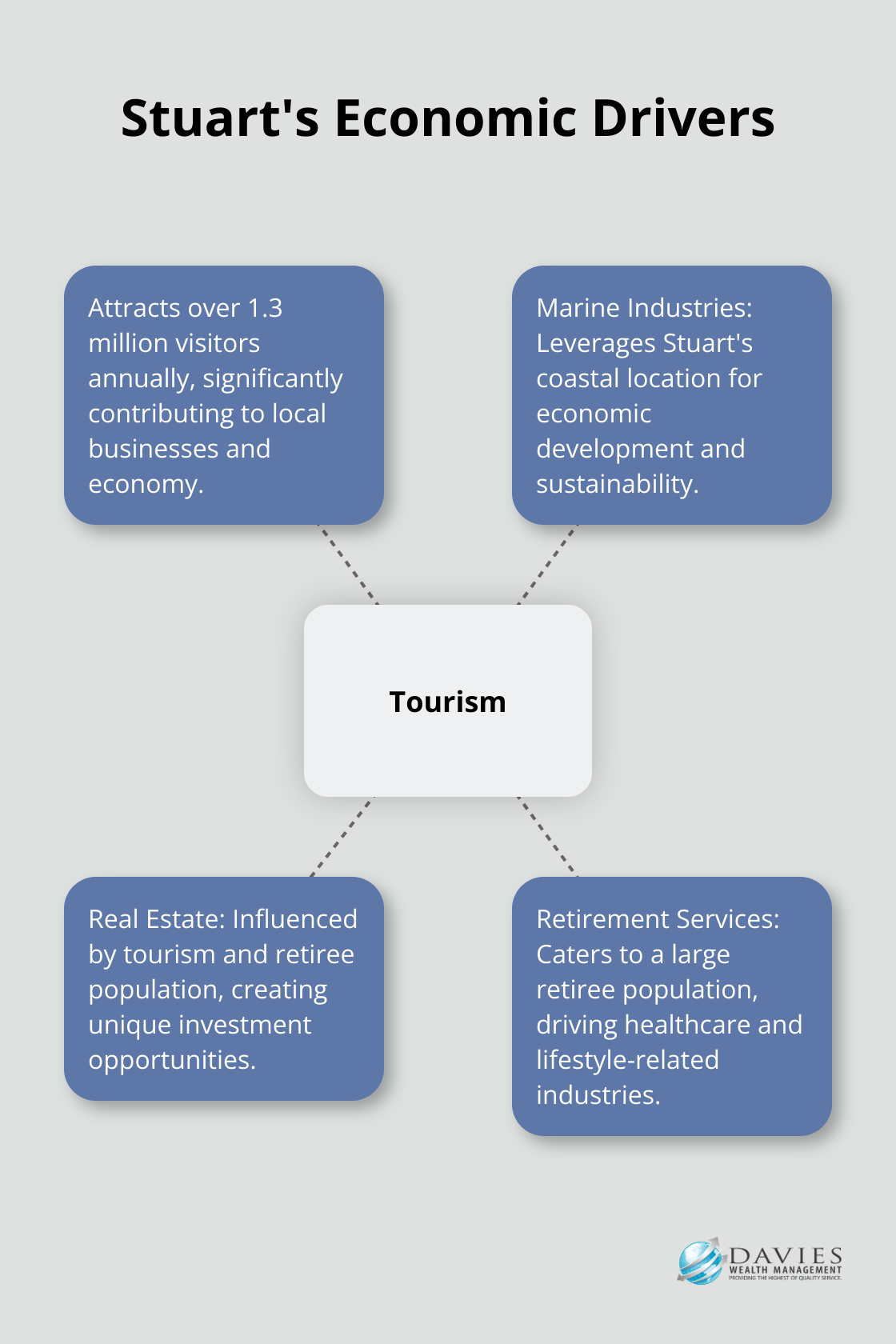

Stuart’s Economic Drivers

Stuart’s economy relies heavily on tourism, marine industries, and real estate. The Martin County Office of Tourism and Marketing reports that the area attracts over 1.3 million visitors annually, which contributes significantly to local businesses and property values. These factors create unique investment opportunities and risks that local financial advisors understand and leverage best.

Navigating Local Tax Implications

Florida’s tax-friendly environment, with no state income tax, makes Stuart an attractive location for retirees and high-net-worth individuals. However, this also means that property taxes and sales taxes play a more significant role in local finances. A local financial advisor can help you optimize your tax strategy within this framework, potentially saving you thousands of dollars each year.

Addressing Stuart-Specific Retirement Concerns

Stuart has a large retiree population. This demographic shift creates specific financial planning needs, from healthcare considerations to estate planning. Local advisors know the retirement communities, healthcare facilities, and lifestyle options available in Stuart, allowing them to provide more targeted advice for retirees or those who plan for retirement in the area.

The Value of Local Market Knowledge

National trends matter, but local nuances often determine the success of your financial plan. A financial advisor with roots in Stuart invests in specialized knowledge that can help you navigate the city’s unique financial waters with confidence and precision. This local expertise can make a substantial difference in financial outcomes for Stuart residents.

Tailored Strategies for Stuart’s Unique Landscape

Financial advisors who understand Stuart’s economic landscape can craft strategies that are not just theoretically sound, but practically effective in this specific market. They can help you capitalize on local opportunities (such as real estate investments or marine industry-related ventures) while mitigating risks unique to the area (like potential impacts of coastal weather events on property values).

The next chapter will explore the key factors you should consider when choosing a financial advisor in Stuart, Florida. These factors will help you identify an advisor who not only understands the local landscape but also aligns with your personal financial goals and values.

How to Choose the Right Financial Advisor in Stuart

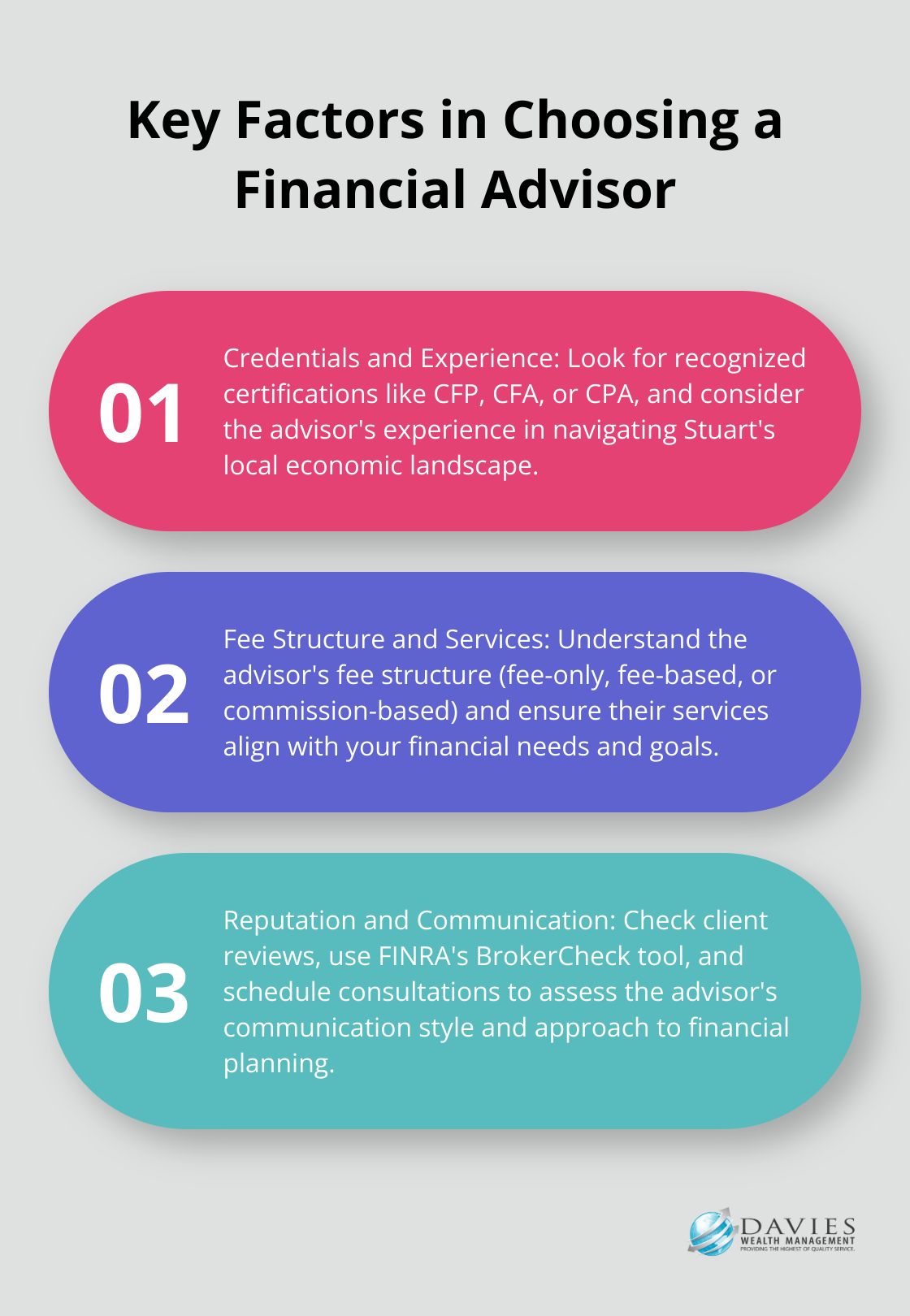

Selecting the ideal financial advisor in Stuart, Florida requires careful consideration of several key factors. The right advisor can significantly impact your financial future, so it’s essential to make an informed decision.

Verify Credentials and Experience

When you evaluate potential financial advisors in Stuart, start by checking their credentials. Look for advisors who hold recognized certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA). These designations indicate a high level of expertise and adherence to ethical standards.

Experience matters equally. In Stuart, many reputable advisors have extensive experience navigating the local economic landscape, which can prove invaluable for your financial planning.

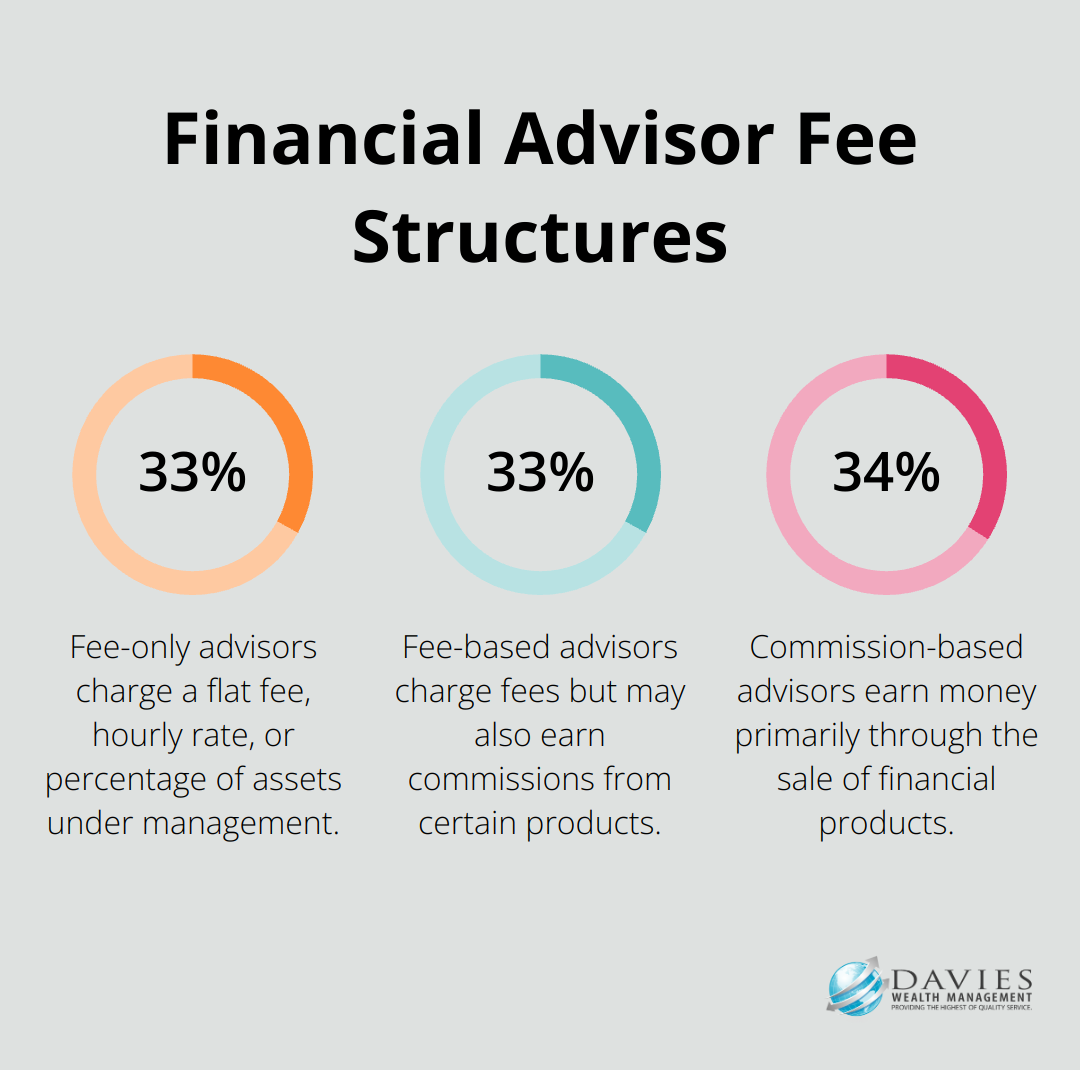

Understand Fee Structures

Financial advisors in Stuart typically use one of three fee structures: fee-only, fee-based, or commission-based. Fee-only advisors charge a flat fee, hourly rate, or a percentage of assets under management. This structure minimizes conflicts of interest as the advisor’s compensation doesn’t tie to specific product sales.

Fee-based advisors charge fees but may also earn commissions from certain products. Commission-based advisors earn money primarily through the sale of financial products. While not inherently problematic, these structures can potentially lead to conflicts of interest.

Evaluate Services and Expertise

Different financial advisors offer varying services and areas of expertise. Some focus on investment management, while others provide comprehensive financial planning (including retirement planning, tax strategies, and estate planning).

In Stuart, where retirees make up a significant portion of the population, expertise in retirement planning and wealth preservation is particularly valuable. For instance, if you’re a professional athlete looking for specialized financial advice, some firms (like Davies Wealth Management) offer tailored strategies to address the unique financial challenges athletes face.

Check Client Reviews and Reputation

Client reviews and reputation can provide valuable insights into an advisor’s performance and client satisfaction. The Financial Industry Regulatory Authority (FINRA) offers a free tool called BrokerCheck, where you can research the background and experience of financial brokers, advisors, and firms.

Local business directories and online review platforms can also offer perspectives from current and former clients. However, consider these alongside other factors, as they may not provide a complete picture of an advisor’s capabilities.

Schedule Consultations

After narrowing down your list of potential advisors, schedule consultations with your top choices. These meetings allow you to ask questions, assess the advisor’s communication style, and determine if their approach aligns with your financial goals. During these consultations, pay attention to how well the advisor listens to your concerns and whether they provide clear, understandable explanations.

Now that you understand how to choose the right financial advisor in Stuart, let’s explore some of the top-rated advisors in the area and what they offer.

Top Financial Advisors in Stuart

Stuart, Florida offers a diverse array of financial advisors, each with unique specializations and services. Finding an advisor that aligns with your specific financial needs and goals is essential for your financial success.

Specialized Expertise in Stuart’s Financial Landscape

Davies Wealth Management stands out in Stuart, offering comprehensive wealth management solutions tailored to the area’s unique economic environment. Their expertise in local tax implications and retirement concerns sets them apart. As of December 13, 2024, general revenue funded pensions include a retirement benefit for retirees of the Florida National Guard, which may be relevant for some Stuart residents. Davies Wealth Management also provides specialized services for professional athletes, addressing the complex financial challenges unique to this demographic.

Family First Financial Planning focuses on personalized financial strategies without product sales or investment management fees. This fee-only structure reduces potential conflicts of interest and appeals to clients seeking unbiased advice.

Fee Structures and Services

Financial advisors in Stuart use various fee structures. Kingdom Commerce Financial Group specializes in business and financial consulting, offering services in inheritance and retirement planning. Their fee structure may differ from fee-only advisors, so understanding how each advisor charges for their services is important.

Peak Capital Management primarily focuses on investment management. If growing your investment portfolio is your main concern, this specialization might be particularly relevant. However, ensure their approach aligns with your risk tolerance and investment goals.

Consultation Process

Most financial advisors in Stuart offer initial consultations at no cost. These meetings typically last 30-60 minutes and provide an opportunity for you to ask questions and assess the advisor’s expertise and communication style.

When scheduling a consultation, prepare a list of questions about the advisor’s experience, investment philosophy, and approach to financial planning. Ask about their typical client profile to ensure you fit within their area of expertise.

During the consultation, the advisor will likely inquire about your financial situation, goals, and risk tolerance. They should provide a high-level overview of how they would approach your financial planning needs.

Evaluating Advisor Credentials

Verify potential advisors’ credentials before making a decision. Look for recognized certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA). These designations indicate a high level of expertise and adherence to ethical standards. As of November 5, 2024, attainment of the CFP® designation requires meeting education and experience requirements set by the CFP Board, proving prior hands-on experience.

Experience matters equally. Many reputable advisors in Stuart have extensive experience navigating the local economic landscape, which can prove invaluable for your financial planning.

Client Reviews and Reputation

Client reviews and reputation provide valuable insights into an advisor’s performance and client satisfaction. The Financial Industry Regulatory Authority (FINRA) offers a free tool called BrokerCheck, where you can research the background and experience of financial brokers, advisors, and firms.

Local business directories and online review platforms can also offer perspectives from current and former clients. Consider these alongside other factors, as they may not provide a complete picture of an advisor’s capabilities.

Final Thoughts

Selecting the right financial advisor in Stuart, Florida will secure your financial future. The unique economic landscape of this coastal city requires specialized knowledge that only local advisors can provide. You must verify credentials, understand fee structures, evaluate services, and check client reviews to identify an advisor who aligns with your financial objectives.

Meeting potential advisors allows you to assess their communication style and expertise. Pay attention to how well they listen to your concerns and provide clear explanations. This process helps you find an advisor who can effectively guide you through Stuart’s complex financial environment.

At Davies Wealth Management, we offer wealth management solutions tailored to Stuart residents’ specific needs. Our team provides personalized advice to help you achieve your financial goals (including investment management, retirement planning, and tax-efficient strategies). For expert guidance from a financial advisor in Stuart, Florida, contact us today.

✅ Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

https://davieswealth.tdwealth.net/appointment-page

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

https://tdwealth.net/articles/

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

- Retirement Income: Transition Into Retirement

- https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

- Beginner’s Guide to Investing Basics

- https://davieswealth.tdwealth.net/investing-basics

Connect with Davies Wealth Management

Website: https://tdwealth.net

Podcast: https://1715tcf.com

Follow Us on Social Media:

- Facebook https://www.facebook.com/DaviesWealthManagement

- X (Twitter) https://x.com/TDWealthNet

- LinkedIn https://www.linkedin.com/in/daviesrthomas

- YouTube https://www.youtube.com/c/TdwealthNetWealthManagement

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply