At Davies Wealth Management, we believe that true financial success starts with the right mindset. A wealth mindset is more than just thinking about money; it’s a fundamental shift in how you perceive and interact with your finances.

Developing a wealth mindset can transform your financial journey, opening doors to opportunities and long-term prosperity. In this post, we’ll explore the key principles of a wealth mindset and provide practical strategies to cultivate this powerful approach to your financial life.

What Is a Wealth Mindset?

The Foundation of Financial Success

The psychology of money plays a critical role in shaping financial decisions, and understanding this can help you shift from a scarcity mindset to a wealth mindset. At Davies Wealth Management, we’ve observed how this mindset can revolutionize our clients’ financial lives.

Scarcity vs. Abundance: A Tale of Two Perspectives

The divide between scarcity and abundance thinking marks a crucial difference in wealth mindsets. Those with a scarcity mindset often perceive limited resources and fierce competition. In contrast, individuals with a wealth mindset recognize abundant opportunities and believe in their ability to create value.

Consider a market downturn: A scarcity thinker might panic and sell investments, while a wealth-minded individual might view it as a chance to acquire quality assets at a discount (positioning themselves for future growth).

The Impact of Positive Financial Thinking

Research supports the power of mindset in financial outcomes. A study in the Journal of Financial Planning revealed that individuals with positive financial attitudes more often engage in beneficial financial behaviors.

Practical Steps to Shift Your Mindset

Developing a wealth mindset doesn’t happen overnight, but you can take concrete steps:

- Establish a financial education routine: Dedicate weekly time to learn about personal finance and investing. Books like “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko offer valuable insights into wealth-building habits.

- Practice financial gratitude: Maintain a daily gratitude journal focused on your financial blessings. This simple act can shift your focus from lack to abundance, fostering a wealth mentality.

- Set ambitious yet achievable financial goals: Whether it’s saving for a house down payment or increasing investment contributions, clear targets can motivate you to think and act like someone building wealth.

The Role of Professional Guidance

While self-education forms a crucial part of developing a wealth mindset, professional guidance can accelerate your journey. Financial advisors can help you cope with the fallout of life’s unexpected events and adapt your strategy to help you stay on track.

As we move forward, let’s explore the key principles that underpin a wealth mindset and how they can shape your financial future.

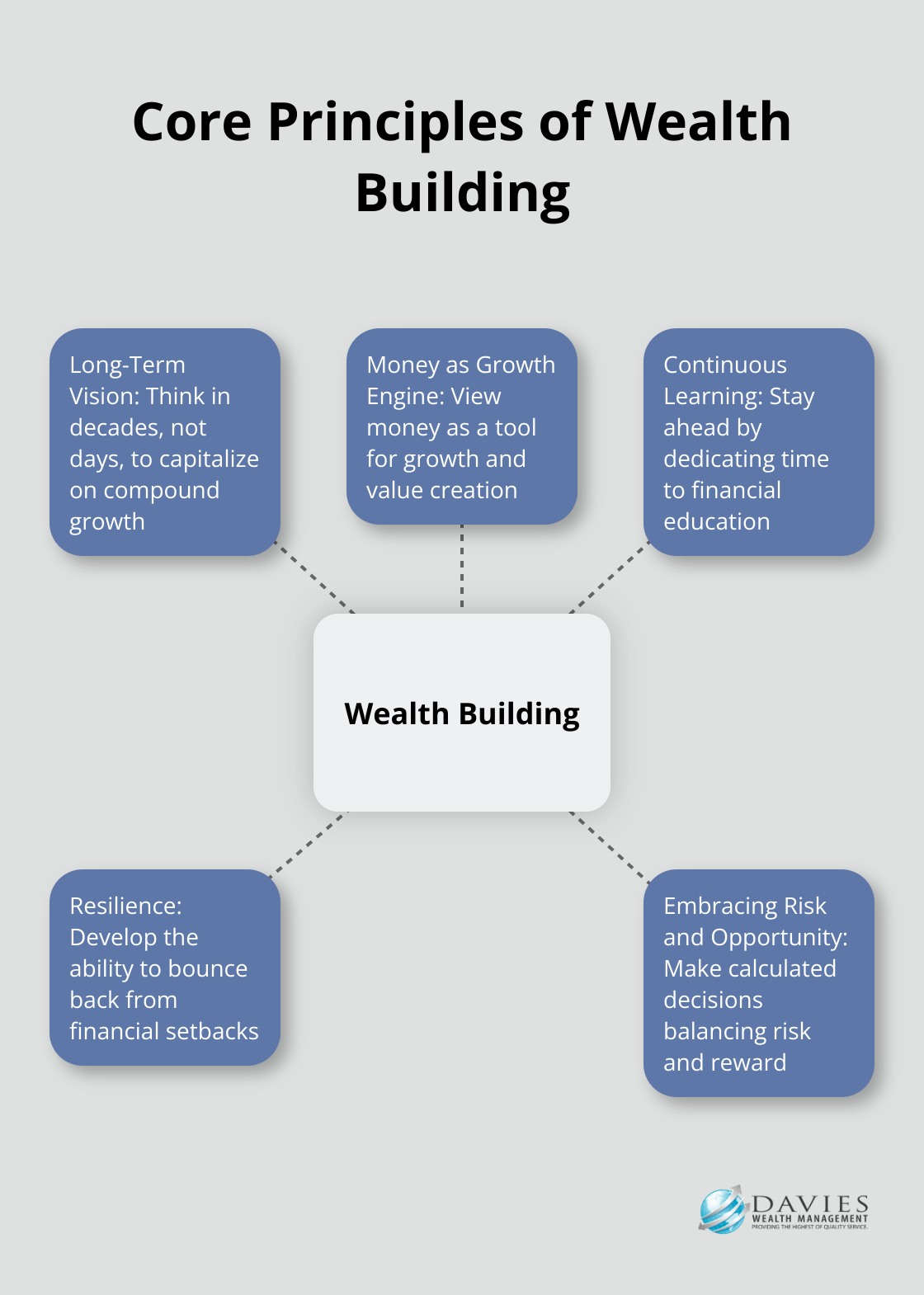

Mastering the Core Principles of Wealth Building

At Davies Wealth Management, we have identified key principles that form the foundation of a wealth mindset. These principles aren’t just theoretical concepts; they’re practical guidelines that can transform your financial outlook and decision-making.

The Power of Long-Term Vision

Successful wealth builders think in decades, not days. This long-term perspective allows them to weather short-term market fluctuations and capitalize on compound growth.

To cultivate this long-term vision:

- Set 5, 10, and 20-year financial goals

- Automate your investments to avoid emotional decision-making

- Review your portfolio quarterly instead of daily

Money as a Growth Engine

When you view money as a tool for growth rather than an end goal, you can dramatically shift your financial behavior. This perspective encourages strategic investment and value creation.

Practical ways to leverage money for growth include:

- Invest in your education or skills development

- Start a side business or freelance venture

- Explore real estate investments for passive income

Continuous Learning: The Ultimate Wealth Builder

In today’s rapidly changing financial landscape, continuous learning is essential. Stay ahead by dedicating time each week to financial education.

Effective learning strategies include:

- Read one finance book per month

- Attend webinars or workshops on investing strategies

- Follow reputable financial news sources and podcasts

Resilience in the Face of Financial Setbacks

Building wealth is rarely a smooth journey. The ability to bounce back from setbacks is important.

To build financial resilience:

- Maintain an emergency fund covering 3-6 months of expenses

- Diversify your investments across different asset classes

- Develop multiple income streams to reduce dependency on a single source

Embracing Risk and Opportunity

A wealth mindset involves a balanced approach to risk and opportunity. It’s about recognizing potential in various situations and making calculated decisions. This doesn’t mean reckless risk-taking, but rather a thoughtful evaluation of risk versus reward.

Strategies to embrace risk and opportunity:

- Conduct thorough research before making investment decisions

- Allocate a small portion of your portfolio to higher-risk, higher-reward investments

- Stay informed about emerging trends and technologies that could impact your financial future

As we move forward, let’s explore practical strategies to develop and reinforce these wealth-building principles in your daily life. The next section will provide actionable steps to cultivate a wealth mindset and set you on the path to long-term financial success.

How to Develop a Wealth Mindset

At Davies Wealth Management, we’ve observed how a wealth mindset can transform financial outcomes. Here are practical strategies to cultivate this powerful perspective:

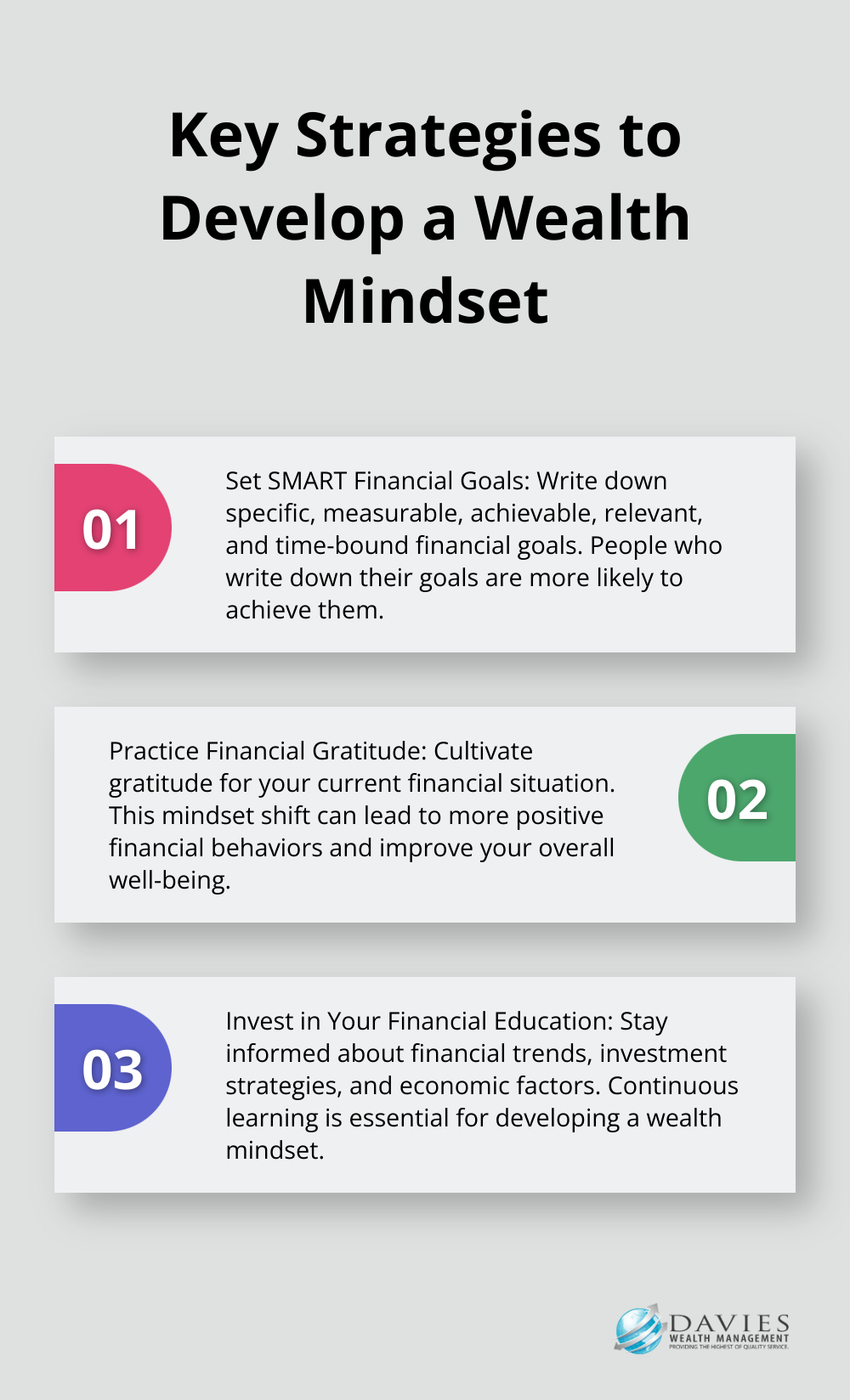

Set SMART Financial Goals

Start by setting Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) financial goals. Research underscores the effectiveness of goal setting in wealth creation. According to a study by Dominican University, people who wrote down their goals were more likely to achieve them. This clarity helps you create actionable plans and measure progress.

To make this process effective:

- Write down your goals and display them prominently

- Break larger goals into smaller, manageable milestones

- Review and adjust your goals quarterly

Practice Financial Gratitude

Cultivate gratitude for your current financial situation, regardless of where you stand. This mindset shift can lead to more positive financial behaviors. Research has shown that gratitude has a positive effect on your mental, emotional, and financial well-being.

Try these exercises:

- Each day, write down three things you’re financially grateful for

- Pause and appreciate your ability to afford a purchase before making it

- Acknowledge your financial progress regularly, no matter how small

Curate Your Financial Circle

The people around you significantly influence your financial mindset. Seek out individuals who share your financial aspirations and demonstrate responsible money management.

To enhance your financial circle:

- Join local investment clubs or online communities focused on wealth building

- Attend financial seminars and networking events

- Consider working with a financial consultant who aligns with your goals (Davies Wealth Management offers personalized guidance to help you navigate your financial journey)

Invest in Your Financial Education

Continuous learning is essential for developing a wealth mindset. Stay informed about financial trends, investment strategies, and economic factors that could impact your wealth.

Effective ways to boost your financial knowledge include:

- Explore online resources, attend workshops, or read about personal finance

- Subscribe to reputable financial newsletters or podcasts

- Take online courses on topics like investing or personal finance

Adopt Wealthy Habits

Successful wealth builders often share common habits. Incorporate these into your routine to reinforce your wealth mindset:

- Track your spending meticulously

- Live below your means and prioritize saving

- Invest consistently (regardless of market conditions)

- Seek multiple income streams

- Prioritize your health to reduce potential medical expenses

Final Thoughts

A wealth mindset transforms your financial future. This powerful perspective shapes your decisions, boosts confidence, and enhances overall life quality. The journey to develop this mindset requires patience and persistence, but the rewards extend far beyond monetary gains.

Davies Wealth Management supports your path to financial success. Our team provides personalized guidance to navigate wealth building complexities. We assist professionals (including athletes) and individuals in aligning their wealth mindset with specific financial goals.

Take action today to implement these wealth mindset principles. Watch as they influence your financial decisions and outcomes. For more information on how we can assist your wealth-building journey, visit our website at Davies Wealth Management.

Leave a Reply