Professional athletes face unique financial challenges that require smart investment strategies. Their careers are often short-lived, with unpredictable income streams and high-pressure lifestyles that can lead to overspending.

At Davies Wealth Management, we understand the importance of athlete investment planning to secure long-term financial stability. This blog post explores essential strategies for professional athletes to manage their wealth effectively and build a secure financial future beyond their playing years.

Why Do Athletes Face Unique Financial Hurdles?

Professional athletes operate in a financial landscape unlike any other profession. Their careers are often short-lived, with the average NFL career lasting just 3.3 years. This brief window of high earnings creates a pressing need for smart financial planning.

The Rollercoaster of Athletic Income

Income for athletes is notoriously unpredictable. A player might sign a multi-million dollar contract one year, only to face a career-ending injury the next. This volatility makes it challenging to plan for the long term. Athletes must learn to manage their finances as if each paycheck could be their last.

Lifestyle Inflation and Spending Pressures

The sudden influx of wealth often leads to lifestyle inflation. Many athletes feel pressure to maintain a certain image, which results in excessive spending on luxury items, expensive cars, and lavish homes. A 2009 Sports Illustrated article revealed that 78% of former NFL players have gone bankrupt or are under financial stress within two years of retirement.

Planning for Life After Sports

The transition from active play to retirement presents a significant financial challenge. Athletes must prepare for a potentially long retirement, starting as early as their 30s. This requires a different approach to financial planning than the average person who might retire in their 60s.

The Need for Specialized Financial Guidance

Given these unique challenges, athletes require specialized financial advice. A wealth manager with experience in sports finance can help navigate the complexities of athletic careers, including contract negotiations, endorsement deals, and long-term investment strategies.

The next chapter will explore essential investment strategies that can help athletes secure their financial future, both during and after their playing careers.

Winning Investment Strategies for Athletes

Professional athletes need a game plan for their finances just as much as they do for their sport. Here’s how athletes can make their money work as hard as they do on the field.

Diversify Your Portfolio Like a Pro

Developing a diversified investment portfolio tailored to your risk tolerance, financial goals, and time horizon is crucial. Experienced investors recommend spreading investments across different asset classes to manage risk and potentially improve returns over time.

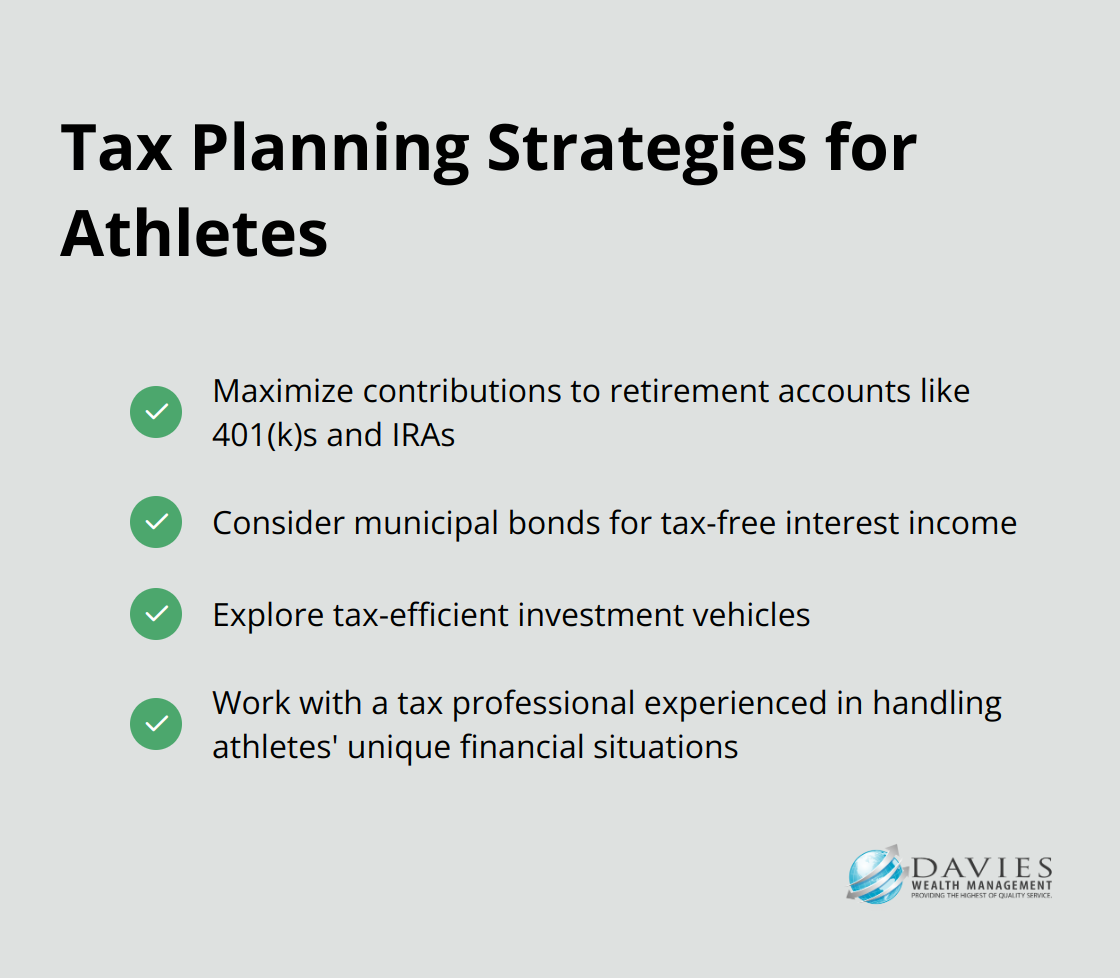

Tax-Efficient Plays to Maximize Earnings

Tax planning for athletes with non-traditional income can be challenging. Here are some strategies to consider:

Cash Flow Management: The Unsung Hero

Budgeting and cash flow management remain crucial for financial success. Athletes should aim to live on a portion of their income while saving and investing the rest. Using budgeting tools can help track spending and make informed financial decisions.

Alternative Investments: Beyond Traditional Markets

Real estate and private equity investments can offer diversification beyond traditional markets. As of September 2024, demand for growth capital in sports-related investments is increasing, with owners considering selling additional equity stakes or borrowing to fund growth projects like stadium improvements.

The next chapter will explore the importance of building a strong financial team to support these investment strategies and ensure long-term financial success for professional athletes.

Building Your Financial Dream Team

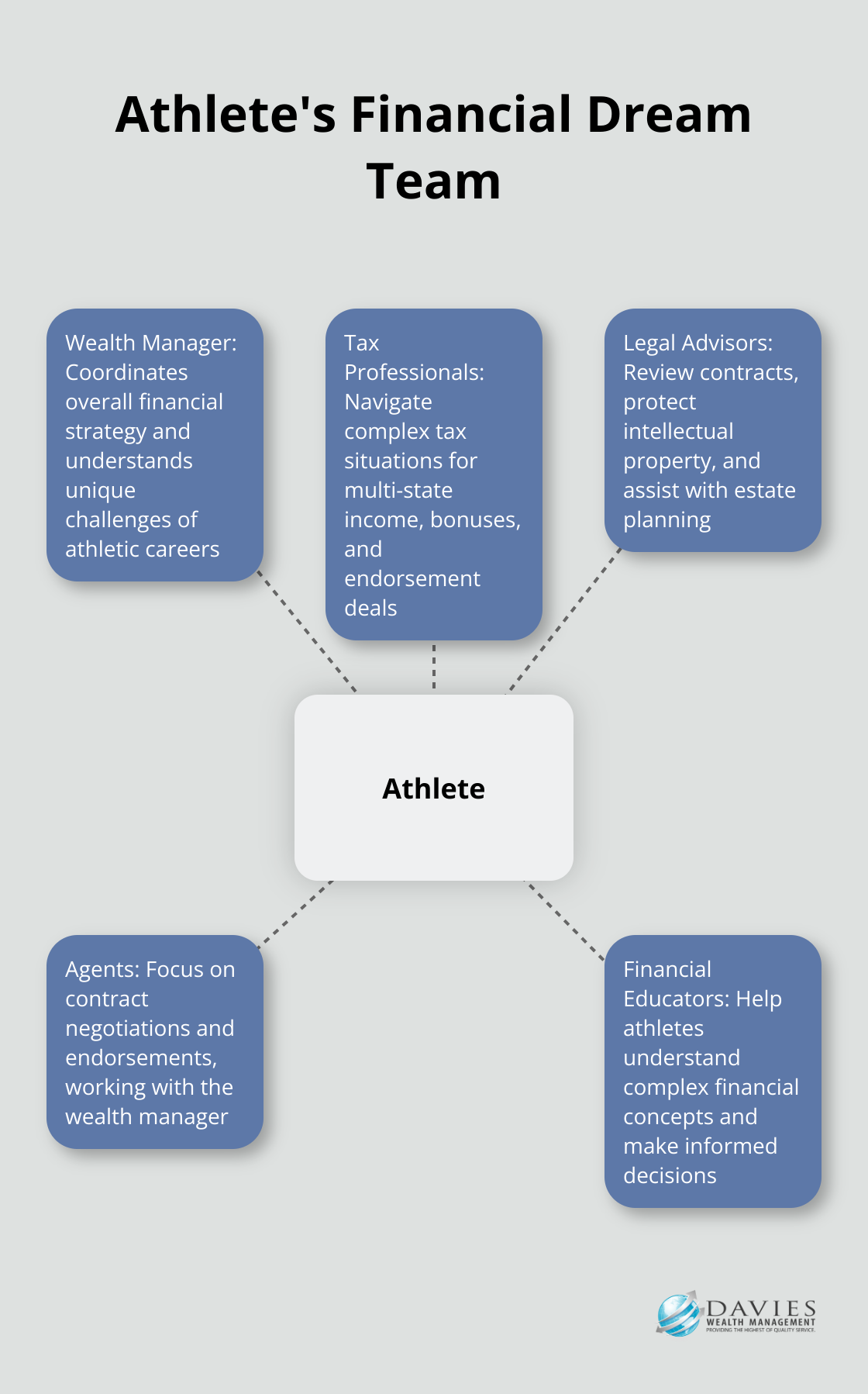

Professional athletes need more than just raw talent and physical prowess to succeed financially. They need a team of financial experts working behind the scenes to protect and grow their wealth. The right financial team can make or break an athlete’s long-term financial success.

The Quarterback: Your Wealth Manager

A wealth manager with experience in sports finance should be the cornerstone of your financial team. They coordinate your overall financial strategy, much like a quarterback calls plays on the field. Look for someone who understands the unique challenges of athletic careers, including irregular income streams and potential early retirement.

When selecting a wealth manager, consider their track record with other athletes. Ask for references and check their credentials. The right wealth manager will have a deep understanding of contract negotiations, endorsement deals, and investment strategies tailored to athletes’ needs.

The Defensive Line: Tax Professionals and Legal Advisors

Tax planning for athletes is complex due to multi-state income, bonuses, and endorsement deals. A tax professional experienced in sports finance can help you navigate these waters, potentially saving you thousands of dollars each year.

Legal advisors are equally important. They review contracts, protect your intellectual property, and help with estate planning. Don’t skimp on legal counsel – a single poorly worded contract could cost you millions.

The Special Teams: Agents and Financial Educators

While agents primarily focus on contract negotiations and endorsements, they play a vital role in your financial team. A good agent will work closely with your wealth manager to ensure your contracts align with your overall financial strategy.

Financial educators are often overlooked but can be game-changers. They can help you understand complex financial concepts, empowering you to make informed decisions about your money. Many professional sports leagues offer financial education programs (take advantage of these resources).

Coordinating Your Financial Team

A comprehensive approach to financial management involves coordinating these various financial professionals. This strategy can lead to long-term financial success, both during and after an athlete’s playing career.

Building your financial dream team is an investment in your future. Take the time to assemble the right professionals (it’s worth the effort). You’ll be setting yourself up for financial success long after you’ve left the playing field.

Final Thoughts

Professional athletes face unique financial challenges that require careful planning and strategic investment. Athlete investment strategies can help secure a stable financial future beyond the playing years. Early financial planning plays a vital role in sports careers, positioning athletes to weather uncertainties and enjoy financial stability after retirement.

At Davies Wealth Management, we specialize in helping professional athletes navigate their complex financial landscapes. Our team understands the intricacies of athlete investment and provides tailored solutions to address the unique needs of sports professionals. We offer comprehensive wealth management services designed to support athletes throughout their careers and beyond.

Davies Wealth Management empowers athletes with the knowledge and tools they need to make informed financial decisions. We develop personalized investment strategies that align with our clients’ goals and risk tolerance (our expertise in sports finance makes us an ideal partner for athletes). Professional athletes can transform their short-term high earnings into lasting financial security with the right approach and guidance.

Leave a Reply