At Davies Wealth Management, we’ve seen a growing interest in alternative investment strategies among our clients. These non-traditional approaches offer unique opportunities for portfolio diversification and potential returns.

However, alternative investments also come with their own set of risks and complexities. In this post, we’ll explore the world of alternative investments, their benefits and drawbacks, and how to incorporate them into a well-balanced portfolio.

What Are Alternative Investments?

Alternative investments represent financial assets that exist outside the conventional investment categories of stocks, bonds, and cash. These non-traditional options have gained significant traction, particularly among high-net-worth individuals and professional athletes.

Types of Alternative Investments

Real Estate

Real estate stands as a popular alternative investment choice. This category includes direct property ownership, real estate investment trusts (REITs), and real estate crowdfunding platforms. Commercial real estate investments, for instance, can provide steady income streams and potential appreciation.

Private Equity

Private equity involves investing in private companies or buyouts of public companies. The importance of private equity in the investment landscape continues to grow.

Hedge Funds

Hedge funds employ sophisticated investment strategies, such as short-selling, leverage, and derivatives to generate returns. These funds often require high minimum investments and may impose lock-up periods (periods during which investors cannot withdraw their money).

Commodities

Commodities round out the major categories of alternative investments. This includes physical goods like gold, oil, or agricultural products. Gold prices, for example, have demonstrated the potential for significant returns in this sector.

How Alternatives Differ from Traditional Investments

Alternative investments possess unique characteristics that set them apart from traditional stocks and bonds:

Liquidity

Many alternative investments are illiquid, meaning they can’t be quickly converted to cash without potentially incurring significant losses. Selling a piece of real estate or a stake in a private company typically takes much longer than selling publicly traded stocks.

Market Correlation

Alternative investments often have a low correlation with traditional markets, making them valuable for portfolio diversification. During the 2008 financial crisis, certain hedge fund strategies demonstrated different performance patterns compared to traditional markets.

Fee Structures

The fee structures for alternative investments differ from traditional investments. Many alternative investment managers charge both management fees and performance fees. Hedge funds, for instance, often follow a “2 and 20” model – a 2% annual management fee plus 20% of profits above a certain threshold.

These unique characteristics of alternative investments require careful evaluation. Factors such as an individual’s risk tolerance, liquidity needs, and overall financial goals should determine if and how alternative investments should be incorporated into a portfolio. As we move forward, we’ll explore the benefits and risks associated with these non-traditional investment options.

The Double-Edged Sword of Alternative Investments

Potential for Higher Returns

Alternative investments attract investors with their promise of superior returns. Historically, certain alternative investments have offered higher return potential over the long term compared to traditional investments.

However, these higher returns come with increased risk. The importance of careful manager selection cannot be overstated due to the significant performance spread between top and bottom-performing funds.

Diversification Advantages

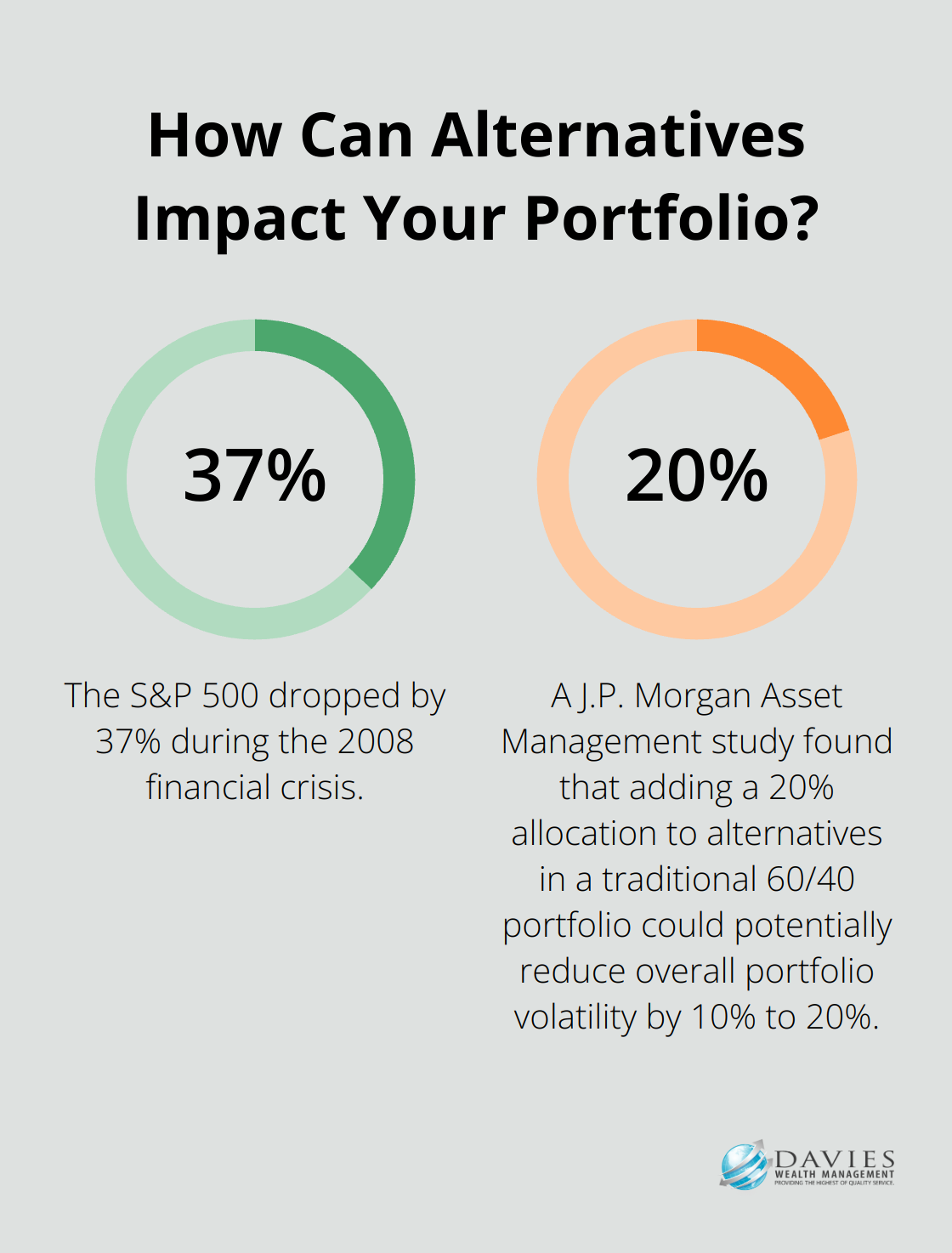

Alternative investments provide valuable diversification benefits due to their low correlation with traditional markets. During the 2008 financial crisis, the S&P 500 dropped by 37%, while certain hedge fund strategies (such as managed futures) delivered positive returns.

This diversification can smooth out portfolio returns over time. A J.P. Morgan Asset Management study found that adding a 20% allocation to alternatives in a traditional 60/40 portfolio could potentially reduce overall portfolio volatility by 10% to 20%.

Complexity and Illiquidity Challenges

The complexity of alternative investments demands a deep understanding of the underlying assets and strategies. Hedge funds often use sophisticated techniques like short-selling and derivatives, which can challenge the average investor’s comprehension.

Illiquidity presents another significant factor. Private equity investments typically lock up capital for 7-10 years, during which investors cannot access their funds. Real estate investments also exhibit illiquidity, with the average time to sell a commercial property in the U.S. ranging from 6 to 12 months (according to CBRE).

Transparency Issues

Limited transparency plagues alternative investments. In February 2022, new rules were proposed to provide fund investors with quarterly statements relating to fund fees and expenses, aiming to address transparency concerns.

To mitigate this risk, thorough due diligence on alternative investment managers becomes essential. This process should examine their track record, investment process, and risk management practices. Prioritizing managers who provide regular, detailed reporting to their investors can also help address transparency concerns.

As we move forward, we will explore strategies for incorporating alternative investments into a well-balanced portfolio, taking into account these unique characteristics and challenges.

How to Integrate Alternative Investments

Determining the Right Allocation

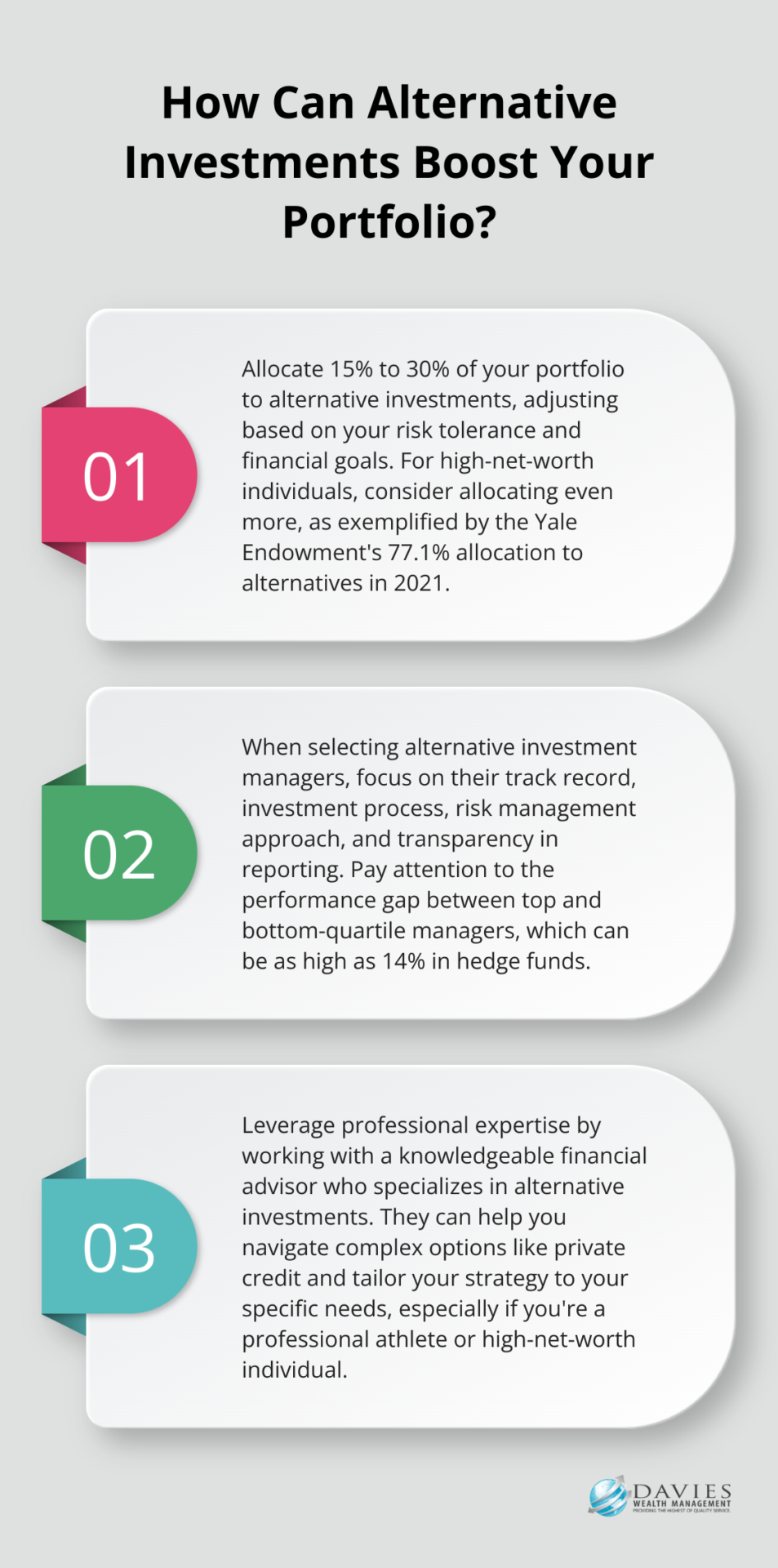

The appropriate allocation to alternative investments varies based on individual circumstances. A general rule of thumb suggests allocating between 15% to 30% of a portfolio to alternatives. High-net-worth individuals and institutional investors often allocate even more.

The Yale Endowment, known for its successful alternative investment strategy, allocated 77.1% of its portfolio to alternatives in 2021. While this level may not suit most individual investors, it demonstrates the potential role alternatives can play in a diversified portfolio. It’s worth noting that sustainable investing has gained importance due to the United Nations’ Sustainable Development Goals (SDGs), creating societal and political pressure for pension funds to address this area.

Conducting Thorough Due Diligence

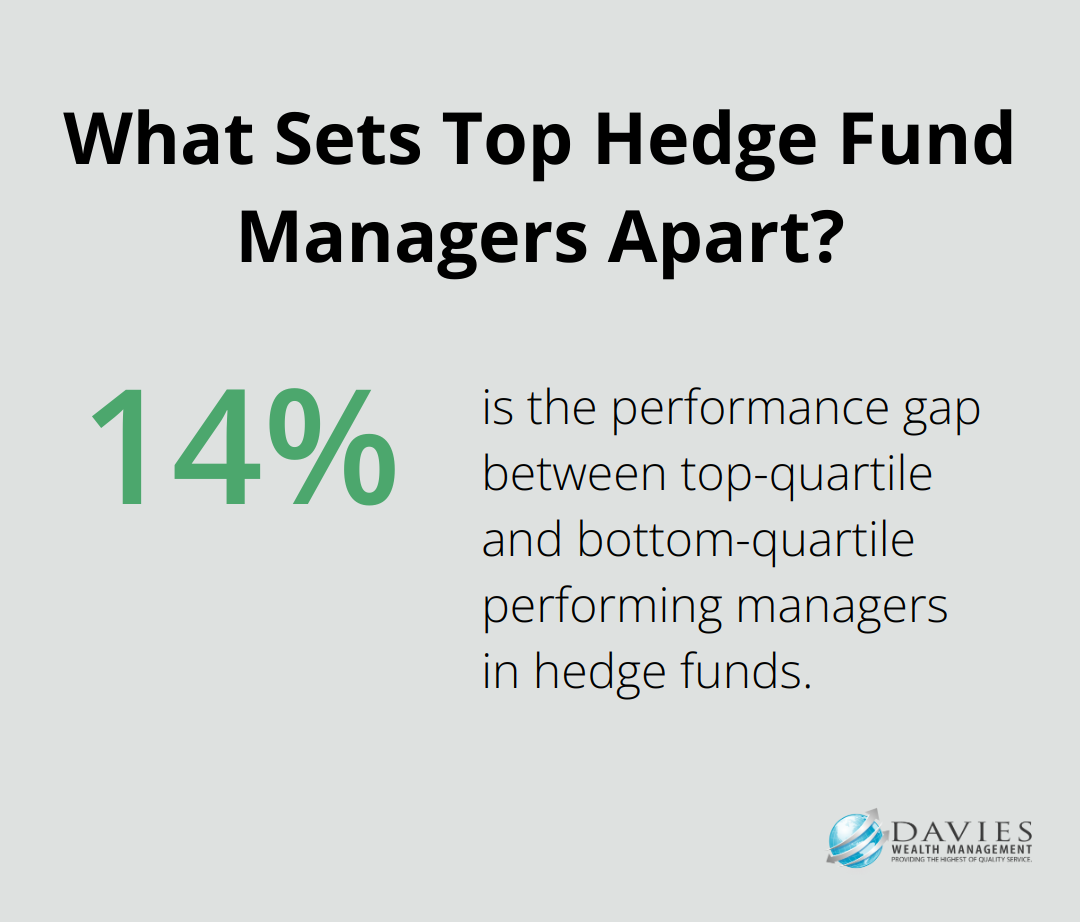

Selecting the right alternative investment managers is important. The performance gap between top and bottom-quartile managers in alternative investments can be significant. In hedge funds, the difference is 14% between top-quartile and bottom-quartile performing managers.

When evaluating managers, consider factors such as:

- Track record: Look for consistent performance over multiple market cycles.

- Investment process: Understand how the manager makes investment decisions.

- Risk management: Assess the manager’s approach to mitigating potential losses.

- Transparency: Prioritize managers who provide regular, detailed reporting.

Leveraging Professional Expertise

The complexity of alternative investments makes working with a knowledgeable advisor invaluable. Professional advisors (such as those at Davies Wealth Management) have extensive experience in alternative investments, particularly in serving professional athletes who often have unique financial needs and opportunities.

Financial advisors stay abreast of the latest trends and opportunities in the alternative investment space. For instance, growing interest in areas like private credit has emerged. The IMF assesses vulnerabilities and potential risks to financial stability in corporate private credit, which is a rapidly growing asset class.

Aligning with Individual Goals

Try to tailor your alternative investment strategy to your specific financial goals and risk tolerance. A young professional athlete might have a higher risk tolerance and longer investment horizon, allowing for a larger allocation to illiquid investments like private equity. In contrast, a retiree might prefer more liquid alternatives, such as certain hedge fund strategies or real estate investment trusts (REITs).

Alternative investments are not a one-size-fits-all solution. They require careful consideration and should be part of a holistic financial plan. Working with experienced professionals and taking a thoughtful approach can potentially enhance your portfolio’s performance and help you navigate market volatility more effectively.

Final Thoughts

Alternative investment strategies offer powerful tools for portfolio diversification and potential return enhancement. These non-traditional assets include real estate, private equity, hedge funds, and commodities, each with unique characteristics that differentiate them from conventional stocks and bonds. While they provide benefits such as higher return potential and diversification, alternative investments also involve increased complexity and risk.

Integrating alternative investments into a well-balanced portfolio requires a thoughtful approach. Determining the appropriate allocation, evaluating managers thoroughly, and aligning investments with individual goals and risk tolerance are essential steps in this process. Given the intricacies involved, professional guidance often proves invaluable.

At Davies Wealth Management, we help clients navigate the complex landscape of alternative investments. Our expertise extends to serving professional athletes, who often face unique financial challenges and opportunities. We tailor our approach to each client’s specific needs and objectives, aiming to enhance portfolio performance and manage risk effectively.

Leave a Reply