Private equity has become a powerful force in the investment world, attracting affluent investors seeking new opportunities for growth and diversification. At Davies Wealth Management, we’ve observed a significant increase in interest from our high-net-worth clients in this alternative asset class.

Private equity offers the potential for higher returns and access to unique investment opportunities not available in public markets. However, it also comes with its own set of challenges and risks that investors must carefully consider before allocating their capital.

What is Private Equity?

Private equity represents a form of investment that involves purchasing ownership stakes in private companies or taking public companies private. This asset class has garnered increasing attention from affluent investors seeking new avenues for growth and diversification.

The Mechanics of Private Equity

Private equity firms raise capital from institutional investors and high-net-worth individuals. They utilize this capital to acquire companies, enhance their operations, and sell them for a profit. The investment horizon typically spans 5-10 years, which exceeds the duration of most traditional investments.

Cambridge Associates provides recent and historical performance benchmark reports for private investments. This data can help investors understand the performance of private equity compared to public markets.

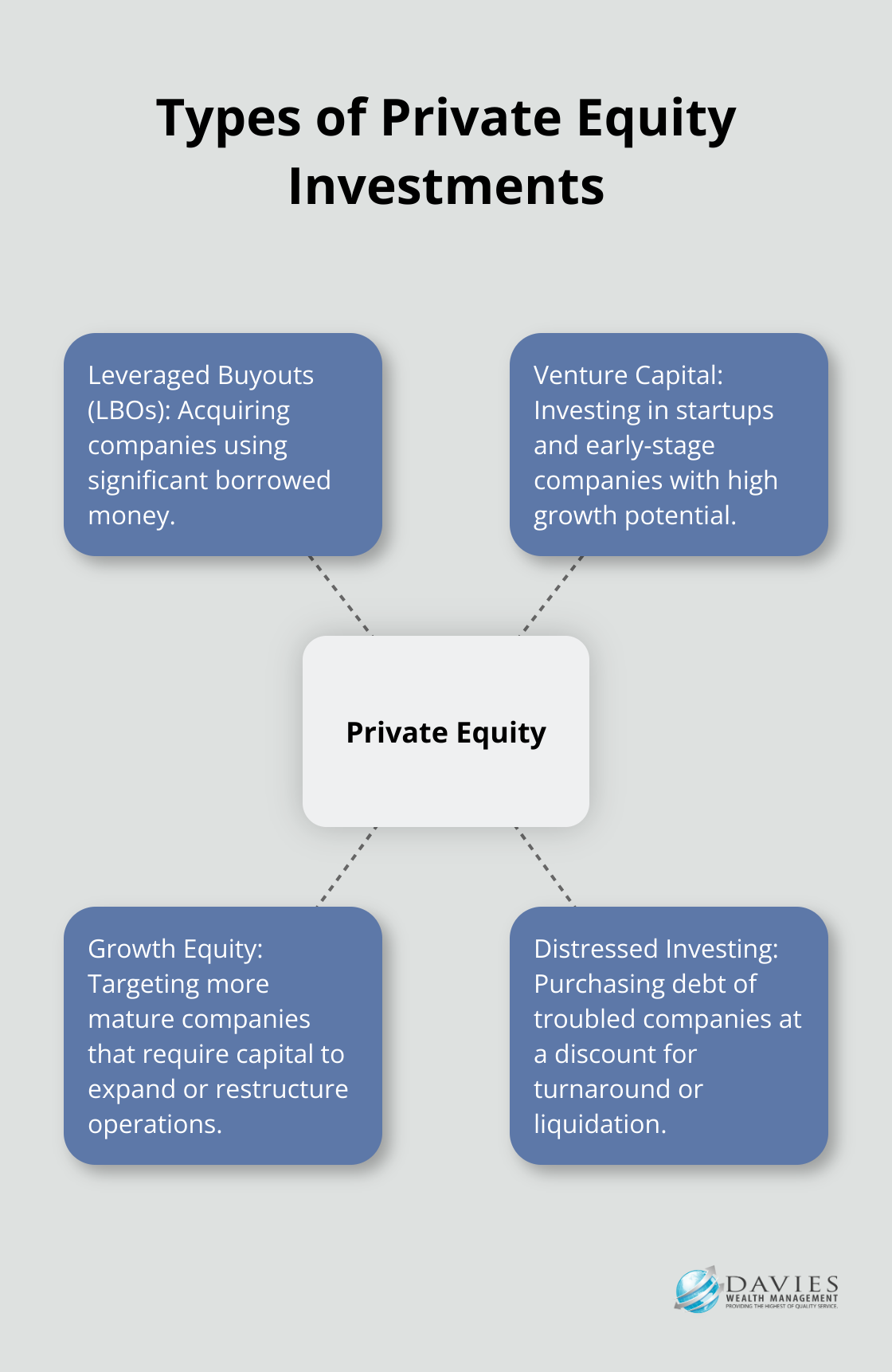

Types of Private Equity Investments

Private equity encompasses several investment types, each with a distinct risk-return profile:

- Leveraged Buyouts (LBOs): This strategy involves acquiring a company using a significant amount of borrowed money. The due diligence process for LBOs includes reviewing the firm’s investment performance at the fund and company levels.

- Venture Capital: This approach focuses on investing in startups and early-stage companies with high growth potential. While it carries higher risk, it can offer substantial returns if successful.

- Growth Equity: This strategy targets more mature companies that require capital to expand or restructure operations.

- Distressed Investing: This method involves purchasing the debt of troubled companies at a discount and profiting from their turnaround or liquidation.

Private Equity vs. Traditional Investments

Private equity differs from traditional investments like stocks and bonds in several key aspects:

- Liquidity: Private equity investments lack liquidity, meaning investors cannot easily sell their stakes. This contrasts with publicly traded stocks, which investors can buy and sell daily.

- Returns: Private equity has historically offered superior returns. Bain & Company projects that private market assets will grow at more than twice the rate of public assets, reaching up to $65 trillion by 2032.

- Access: Regulatory restrictions typically limit private equity investments to accredited investors. This exclusivity can appeal to affluent investors seeking unique opportunities.

- Involvement: Private equity firms often take an active role in managing their portfolio companies, which can lead to operational improvements and value creation.

- Fees: Private equity typically charges higher fees than traditional investments, including management fees and performance fees (often referred to as “carried interest”).

Understanding these differences proves essential for affluent investors considering private equity. Professional guidance can help navigate these complexities and determine if private equity aligns with specific investment goals and risk tolerance.

As we explore the advantages of private equity for affluent investors in the next section, we’ll uncover why this asset class continues to gain traction among high-net-worth individuals and institutions alike.

Why Private Equity Attracts Affluent Investors

Superior Returns and Performance

Private equity has become a magnet for affluent investors due to its potential for exceptional returns. The MSCI World Index represents a free float–adjusted, market capitalization–weighted index that is designed to measure the equity market performance of developed markets.

These impressive returns stem from the active management approach of private equity firms. Through controlling stakes in companies, these firms implement operational improvements, strategic shifts, and financial restructuring to drive value creation. This hands-on approach often results in significant growth and profitability enhancements that public markets struggle to match.

Unique Investment Opportunities

Private equity opens doors to investment opportunities unavailable in public markets. The publicly traded company is disappearing. In 1996, about 8,000 firms were listed in the U.S. stock market. Since then, the national economy has grown significantly, but the number of public companies has nearly halved. As a result, private equity has emerged as a vital avenue for accessing high-growth potential companies.

Furthermore, private equity allows investors to participate in various stages of a company’s lifecycle, from early-stage venture capital investments to mature company buyouts. This breadth of opportunity enables affluent investors to tailor their private equity exposure to their specific risk preferences and investment goals.

Portfolio Diversification Benefits

The incorporation of private equity into an investment portfolio provides significant diversification benefits. Private equity investments often differ from public equity investments in terms of risks, returns, and investor access.

Moreover, private equity investments span a wide range of industries, geographies, and company sizes, further enhancing diversification. This broad exposure mitigates risks associated with specific sectors or regions, resulting in a more balanced and resilient portfolio for affluent investors.

Active Management and Value Creation

Private equity firms take an active role in managing their portfolio companies. This hands-on approach allows them to implement strategic changes, improve operational efficiency, and drive growth. For affluent investors, this active management strategy offers the potential for substantial value creation that passive investments in public markets may not provide.

Access to Exclusive Deals

Affluent investors who participate in private equity gain access to exclusive deals and investment opportunities. These deals often involve promising companies that are not yet available to the public or are being taken private. This exclusivity appeals to high-net-worth individuals seeking unique ways to grow their wealth and diversify their portfolios.

As we explore the considerations and risks associated with private equity investing in the next section, it’s important to understand that while the potential rewards are significant, they come with their own set of challenges that affluent investors must carefully evaluate.

Navigating the Challenges of Private Equity

Private equity offers enticing opportunities for affluent investors, but it comes with its own set of complexities. This chapter explores the key challenges and considerations investors must understand before allocating capital to this asset class.

The Illiquidity Factor

One of the most significant aspects of private equity is its illiquid nature. Unlike stocks or bonds, investors cannot sell their private equity investments at a moment’s notice. Typical investment horizons span 5-10 years, sometimes even longer. This means capital remains tied up for an extended period, potentially limiting financial flexibility.

For example, a $1 million investment in a private equity fund might not yield returns for several years. Even then, returns often come in stages as the fund exits its investments. This extended timeline can challenge investors who may need access to their capital sooner.

Complex Fee Structures

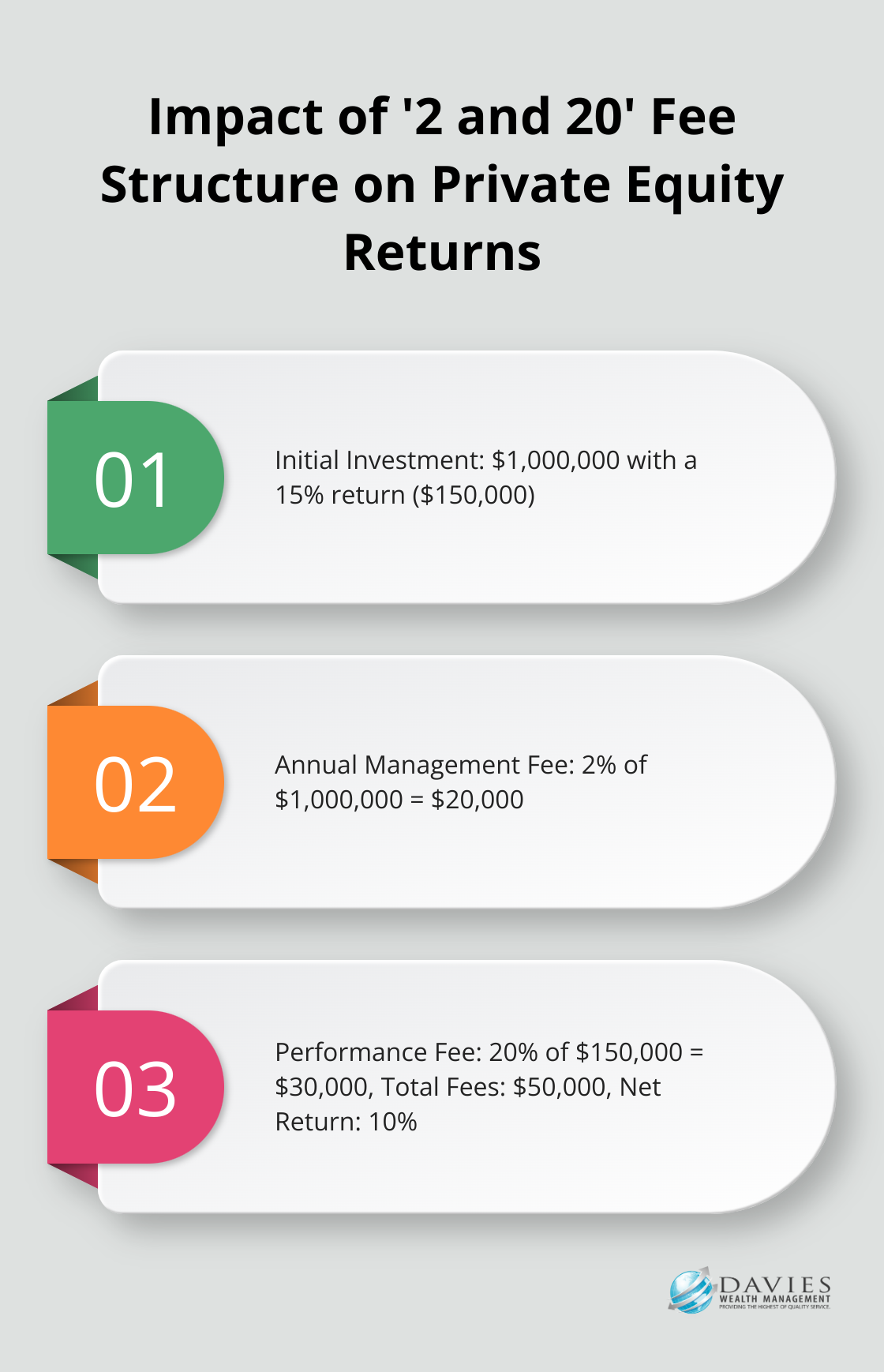

Private equity is known for its higher fees compared to traditional investments. The typical “2 and 20” structure (a 2% annual management fee and 20% of profits above a certain threshold) can significantly impact returns.

To illustrate, on a $1 million investment, an investor pays $20,000 annually in management fees, regardless of performance. If the fund generates a 15% return ($150,000), an additional $30,000 in performance fees applies (20% of $150,000). That’s a total of $50,000 in fees, reducing the net return to 10%.

Some funds have even more intricate fee structures, including transaction fees, monitoring fees, and other charges. Investors must fully understand these fees before committing their capital.

The Importance of Due Diligence

Selecting the right private equity manager is paramount. Investors must scrutinize a fund’s track record, investment strategy, team experience, and operational processes. Key factors to analyze include:

- Historical performance across different market cycles

- Consistency of investment strategy

- Quality and stability of the management team

- Operational infrastructure and risk management processes

While past performance doesn’t guarantee future results, it provides valuable insights into a manager’s capabilities.

Regulatory and Transparency Concerns

Private equity operates in a less regulated environment compared to public markets. While this can offer advantages, it also presents risks. The lack of standardized reporting can make it difficult to compare different private equity opportunities accurately.

Moreover, the opaque nature of private equity investments can sometimes lead to conflicts of interest. For instance, a private equity firm might overvalue its portfolio companies to attract new investors or boost its performance metrics.

The SEC proposed new rules to enhance transparency and investor protection in private funds in 2024. These rules impose significant new requirements on all private fund advisers. Investors need to stay informed about these regulatory developments and their potential impact on investments.

Final Thoughts

Private equity offers affluent investors unique opportunities for portfolio diversification and potentially higher returns. This asset class provides access to exclusive deals and active value creation strategies often unavailable in public markets. However, investors must carefully weigh these benefits against the illiquidity, complex fee structures, and regulatory concerns inherent in private equity investments.

Professional guidance proves essential when navigating the intricacies of private equity and other sophisticated investment strategies. Our team at Davies Wealth Management specializes in helping high-net-worth individuals make informed decisions about their investment portfolios. We provide personalized advice tailored to each client’s financial goals and risk tolerance, ensuring private equity investments align with their overall wealth management strategy.

As the private equity landscape evolves, investors must stay informed and adaptable. With the right approach and expert support, private equity can become a valuable component of a well-diversified investment strategy for affluent investors seeking long-term financial success. Our team stands ready to assist you in optimizing your investment portfolio and achieving your financial objectives.

✅ Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

Book an Appointment Today

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

Read the Latest Blog Posts

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

Subscribe for Weekly Insights

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

Connect with Davies Wealth Management

Website: tdwealth.net

Podcast: 1715tcf.com

Follow Us on Social Media:

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply