Stuart, Florida, is a unique coastal gem with a thriving economy and distinct financial landscape. At Davies Wealth Management, we understand the specific challenges and opportunities that Stuart residents face when it comes to protecting and growing their wealth.

This blog post explores essential wealth protection strategies tailored for Stuart, Florida residents. We’ll cover everything from diversification and real estate investments to estate planning and asset protection techniques, all designed to help you safeguard your financial future in this beautiful coastal community.

What Drives Stuart’s Economy?

A Thriving Marine Economy

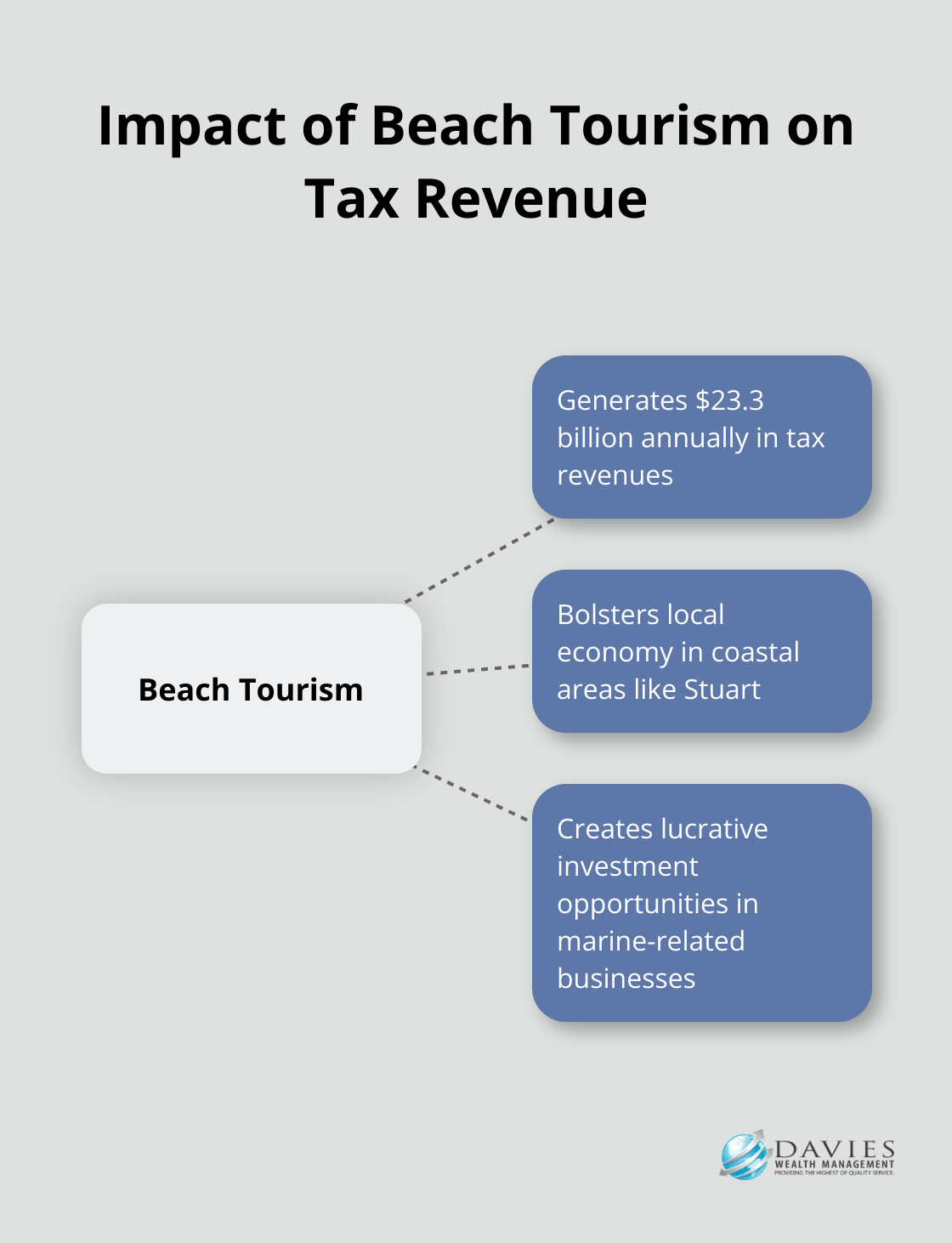

Stuart, Florida’s economic landscape thrives on its diverse industries and favorable tax environment. The city’s marine sector stands as a cornerstone of its economy. Stuart’s strategic location on Florida’s Treasure Coast transforms it into a hub for marine-related businesses. Recent data reveals that beach-oriented tourists generate $23.3 billion annually in tax revenues. This not only bolsters the local economy but also presents lucrative investment opportunities for investors who recognize the potential of this sector.

Healthcare: A Major Economic Driver

The healthcare sector emerges as another pillar of Stuart’s economy. Martin Health System, the largest employer in the area, wields significant influence over local job creation and economic stability. This growing sector not only provides employment opportunities but also attracts skilled professionals to the area, which further stimulates economic growth. The expansion of healthcare services in Stuart (including specialized clinics and research facilities) points to a promising future for this sector.

Real Estate: A Goldmine of Opportunities

Stuart’s real estate market offers a wide array of investment possibilities. As of June 2025, there were 695 homes for sale in Stuart, a 1.9% increase compared to May 2025. This diversity in the real estate sector provides investors with options across different price points and property types. From beachfront properties to inland developments, Stuart’s real estate landscape caters to various investment strategies and preferences.

Tax Benefits: A Retiree’s Paradise

One of the most significant advantages for Stuart residents is Florida’s lack of state income tax. This allows retirees and working professionals to keep more of their hard-earned money. Florida has no state income tax, which means Social Security retirement benefits, pension income, and income from an IRA or a 401(k) are all untaxed. For high-net-worth individuals, this tax benefit can translate into substantial savings over time, providing more capital for investments and wealth protection strategies.

Education and Skilled Workforce

Stuart’s growing educational sector, particularly through Indian River State College, plays a crucial role in attracting skilled professionals and influencing economic growth. The presence of quality educational institutions not only enhances the local workforce but also contributes to the overall economic stability of the region. This focus on education and skill development positions Stuart as a competitive location for businesses looking for a talented labor pool.

As we move forward to explore wealth protection strategies, it’s essential to understand how these economic factors shape the financial landscape of Stuart. The next section will discuss how residents can leverage these unique economic characteristics to build and protect their wealth effectively.

How Stuart Residents Can Protect Their Wealth

At Davies Wealth Management, we understand that wealth protection in Stuart, Florida requires a tailored approach that aligns with the unique economic landscape of this coastal community. Our strategies focus on local opportunities while addressing risks specific to the area.

Leveraging Stuart’s Real Estate Market

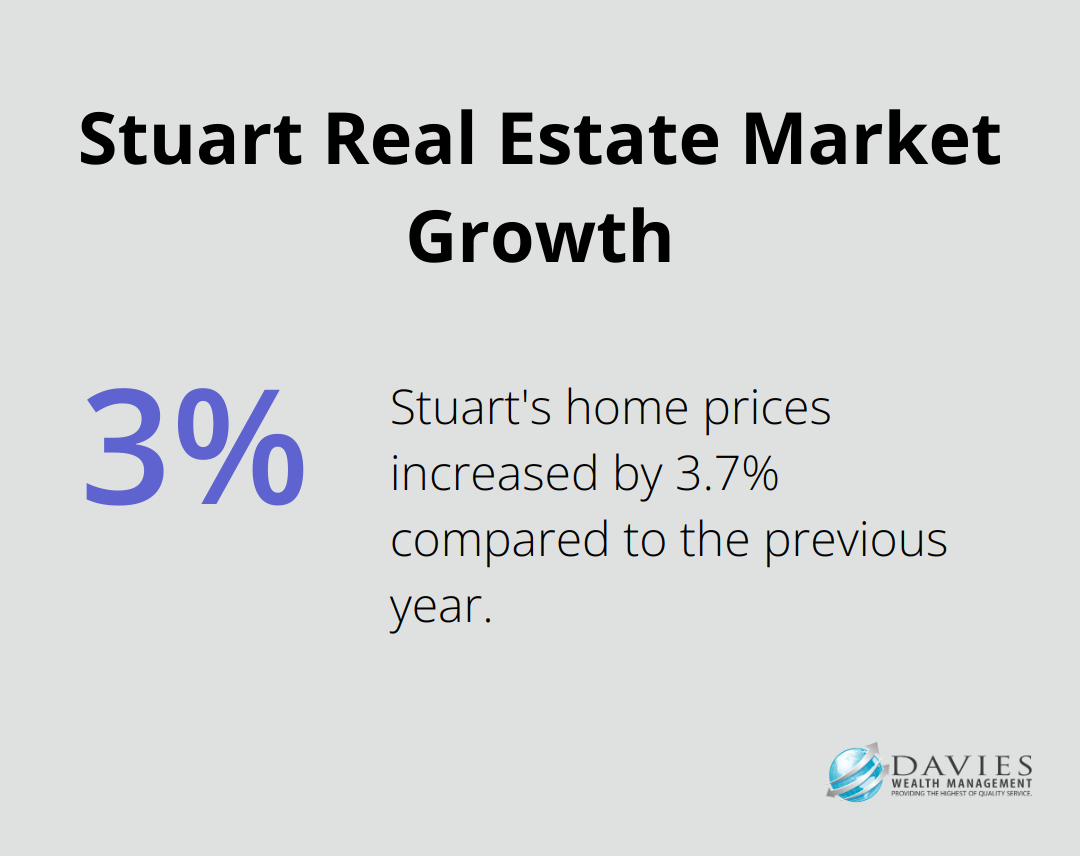

Stuart’s real estate market presents compelling investment opportunities. As of June 2025, Martin County home prices were up 3.7% compared to the previous year, with a median selling price of $513K. This growth in property values indicates a strong market for both residential and commercial properties.

For those interested in the residential market, condos in popular areas like Mariner Cay have listed between $329,900 and $549,900 (as of August 2024). These properties can serve as personal residences or rental investments, capitalizing on Stuart’s appeal to tourists and seasonal residents.

Portfolio Diversification Beyond Local Markets

While Stuart’s economy is robust, we advise our clients to diversify their portfolios beyond local investments. A well-balanced portfolio typically includes a mix of stocks, bonds, and alternative investments. Given the current global economic climate, we recommend a 60-70% allocation to U.S. and international stocks to mitigate risk and capture growth opportunities across various markets.

For Stuart residents looking to benefit from the local healthcare sector’s growth, we suggest healthcare-focused Real Estate Investment Trusts (REITs). These investments can provide exposure to expanding medical facilities in the area while offering potential for steady income and capital appreciation.

Tax Efficiency Strategies

Florida’s tax-friendly environment benefits Stuart residents, but additional strategies can enhance tax efficiency. We often recommend municipal bonds for high-income clients, as they offer tax-free income opportunities. Higher-income investors are likely to benefit more from municipal bonds than individuals in other tax brackets.

For those over 50, we emphasize catch-up contributions for retirement accounts. In 2025, the catch-up contribution limits for 401(k)s and IRAs increased to $7,500 and $1,000 respectively. These higher limits allow for accelerated retirement savings while providing tax advantages.

Comprehensive Insurance Solutions

Insurance plays a vital role in wealth protection. For Stuart residents, we recommend a comprehensive approach that includes property insurance (to protect against potential hurricane damage), liability insurance (to safeguard assets from lawsuits), and long-term care insurance (to mitigate future healthcare costs).

We advise clients to consider long-term care insurance in their 50s or early 60s when premiums are generally more affordable. As of February 2025, the average annual premium for a single male at age 60 is $1,200. This foresight can protect wealth from depletion by unexpected healthcare expenses in later years.

Health Savings Accounts (HSAs) offer another powerful tool. They provide a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. This makes HSAs an excellent vehicle for both current healthcare needs and future retirement expenses.

These strategies form the foundation of a robust wealth protection plan for Stuart residents. The next section will explore how estate planning and asset protection techniques specific to Florida law can further safeguard your financial legacy.

How Stuart Residents Can Protect Their Assets

Maximize Florida’s Homestead Exemption

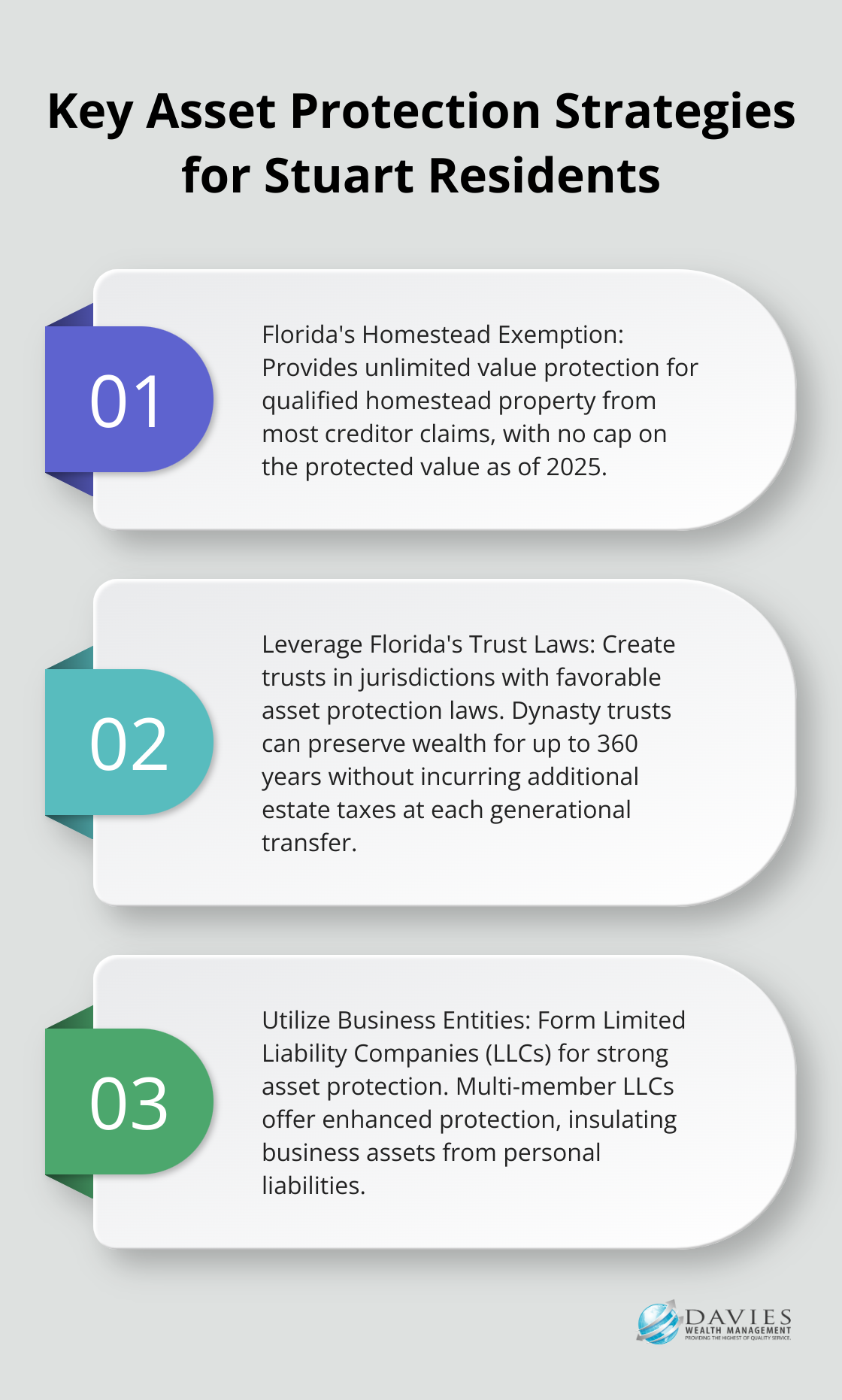

Florida’s homestead exemption stands as a powerful asset protection tool for Stuart residents. This constitutional provision provides unlimited value protection for qualified homestead property from most creditor claims. As of 2025, no cap exists on the value of the homestead that can be protected, which makes it an essential strategy for high-net-worth individuals.

To fully benefit from this exemption, your property must qualify as a homestead under Florida law. This typically requires the property to be your primary residence and that you intend to make it your permanent home. Consider transferring assets into a protected homestead, as this can be done without triggering fraudulent transfer liability.

Leverage Florida’s Trust Laws

Florida’s trust laws provide robust options for asset protection and estate planning. While Florida doesn’t explicitly recognize self-settled asset protection trusts, a Florida resident can create a trust in another jurisdiction with more favorable asset protection laws. These trusts can shield assets from future creditors while potentially allowing you to remain a beneficiary.

For those who want to protect assets for future generations, dynasty trusts offer an excellent solution. These long-term trusts can preserve wealth for multiple generations without incurring additional estate taxes at each generational transfer. Florida law allows these trusts to exist for up to 360 years (as of 2025), which provides extensive protection for family wealth.

Utilize Business Entities for Asset Protection

Stuart residents with business interests should form the right type of business entity to provide significant asset protection. Limited Liability Companies (LLCs) are particularly effective in Florida due to the state’s charging order protection. However, it’s important to note that in Florida, a single-member LLC does not have the asset protection benefit of charging order limitation.

Multi-member LLCs offer even stronger protection. Florida law provides that creditors of individual members cannot force a dissolution of the LLC or gain management rights, which further insulates business assets from personal liabilities.

Use Exemptions and Insurance Strategically

Florida law provides several exemptions that can protect specific types of assets from creditors. The cash value of life insurance policies and annuities is fully protected when the policy insures the owner’s own life. Retirement accounts (including IRAs and 401(k)s) also enjoy strong protection under Florida law.

Try to maximize these exemptions as part of your overall asset protection strategy. Additionally, maintain adequate liability insurance, including umbrella policies, to provide an extra layer of protection against potential lawsuits.

Seek Professional Guidance

Asset protection planning should occur proactively, before any potential threats arise. The strategies outlined here form a solid foundation, but each individual’s situation is unique. Consult with a qualified financial advisor (such as those at Davies Wealth Management) who understands Florida’s specific laws and can tailor a comprehensive strategy to your personal financial situation and goals.

Final Thoughts

Wealth protection in Stuart, Florida requires a tailored approach that considers the unique economic landscape and legal framework of the area. Stuart residents can take advantage of the thriving marine economy, healthcare sector, and real estate opportunities to build and safeguard their wealth. The tax-friendly environment adds another layer of financial advantage, particularly for retirees.

Effective strategies for wealth protection in Stuart include diversified investment portfolios, tax-efficient planning, and comprehensive insurance solutions. The Florida homestead exemption (offering unparalleled security for primary residences), trust laws, strategic business entities, and maximizing exemptions for life insurance and retirement accounts all contribute to a robust financial position. However, each individual’s financial situation demands a personalized approach to wealth management.

Davies Wealth Management offers tailored financial strategies for Stuart residents, helping them navigate the complexities of wealth protection and growth. Our team understands Stuart’s economic landscape and Florida’s legal framework, providing comprehensive wealth management solutions. We strive to help our clients build, protect, and transfer their wealth, aiming to secure their financial legacy for future generations.

Leave a Reply