At Davies Wealth Management, we understand that managing wealth involves more than just accumulating assets. It’s about striking the right balance between growing your portfolio and safeguarding what you’ve already built.

This balance is one of the key portfolio management topics for projects we often discuss with our clients. Whether you’re focused on building wealth or preserving it, understanding the strategies and challenges involved in both approaches is essential for long-term financial success.

What Is Wealth Preservation?

The Essence of Protecting Your Assets

Wealth preservation stands as a cornerstone of financial management, often overshadowed by the allure of wealth accumulation. At its core, wealth preservation protects the assets you’ve acquired from potential losses due to market volatility, inflation, taxes, and other financial risks.

The importance of wealth preservation cannot be overstated. While building wealth is essential, safeguarding it proves equally important for long-term financial stability. A study reveals that 80% of high-net-worth individuals prioritize financial independence as their top personal finance goal, underscoring the growing recognition of the need to protect hard-earned assets.

Effective Strategies for Wealth Preservation

Diversification serves as a key strategy for wealth preservation. This approach involves spreading investments across various asset classes to mitigate risk. The Securities and Exchange Commission (SEC) recommends diversifying not just across different stocks, but also across different types of financial instruments and industries.

Another effective approach utilizes tax-efficient investment vehicles. For example, municipal bonds offer tax-free income at the federal level (and sometimes at the state level as well). As of October 1, 2024, the 10-year municipal to Treasury ratio rose above 70%, indicating potential opportunities in municipal bonds.

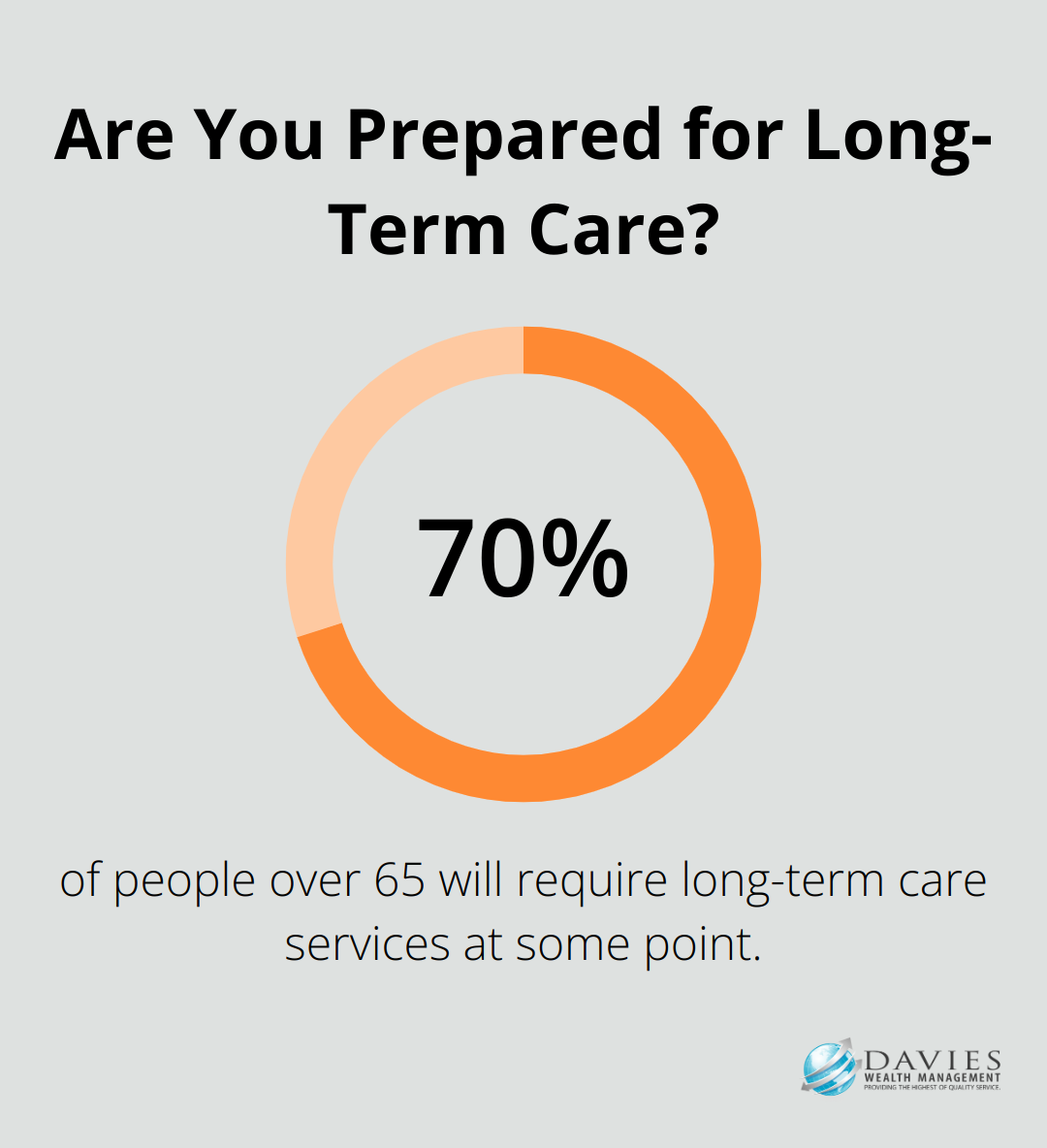

Insurance also plays a pivotal role in wealth preservation. Proper coverage, including life, disability, and long-term care insurance, can protect your assets from unexpected events. The American Association for Long-Term Care Insurance reports that 70% of people over 65 will require long-term care services at some point, making this type of insurance a vital component of a comprehensive wealth preservation strategy.

Debunking Common Misconceptions

A prevalent misconception about wealth preservation suggests that it’s only for the ultra-wealthy. In reality, wealth preservation strategies benefit anyone who has accumulated assets they wish to protect, regardless of the amount. Even those in the early stages of their wealth-building journey can benefit from implementing preservation tactics.

Another myth posits that wealth preservation means avoiding all risk. While it does involve reducing unnecessary risk, it doesn’t mean completely avoiding growth opportunities. The key lies in finding the right balance between preservation and growth based on individual financial goals and risk tolerance.

Some believe that wealth preservation follows a set-it-and-forget-it strategy. However, effective preservation requires regular review and adjustment. Economic conditions, tax laws, and personal circumstances change, necessitating ongoing evaluation and adaptation of wealth preservation strategies.

As we transition to exploring wealth accumulation, it’s important to note that these two concepts (preservation and accumulation) are not mutually exclusive. In fact, they often work in tandem to create a robust financial strategy that both grows and protects your assets over time.

How to Build Wealth Effectively

Understanding Wealth Accumulation

Wealth accumulation involves the growth of financial assets over time. At Davies Wealth Management, we consider this a critical component of long-term financial success. The objective is to increase net worth through strategic investments, savings, and smart financial decisions.

Proven Strategies for Wealth Building

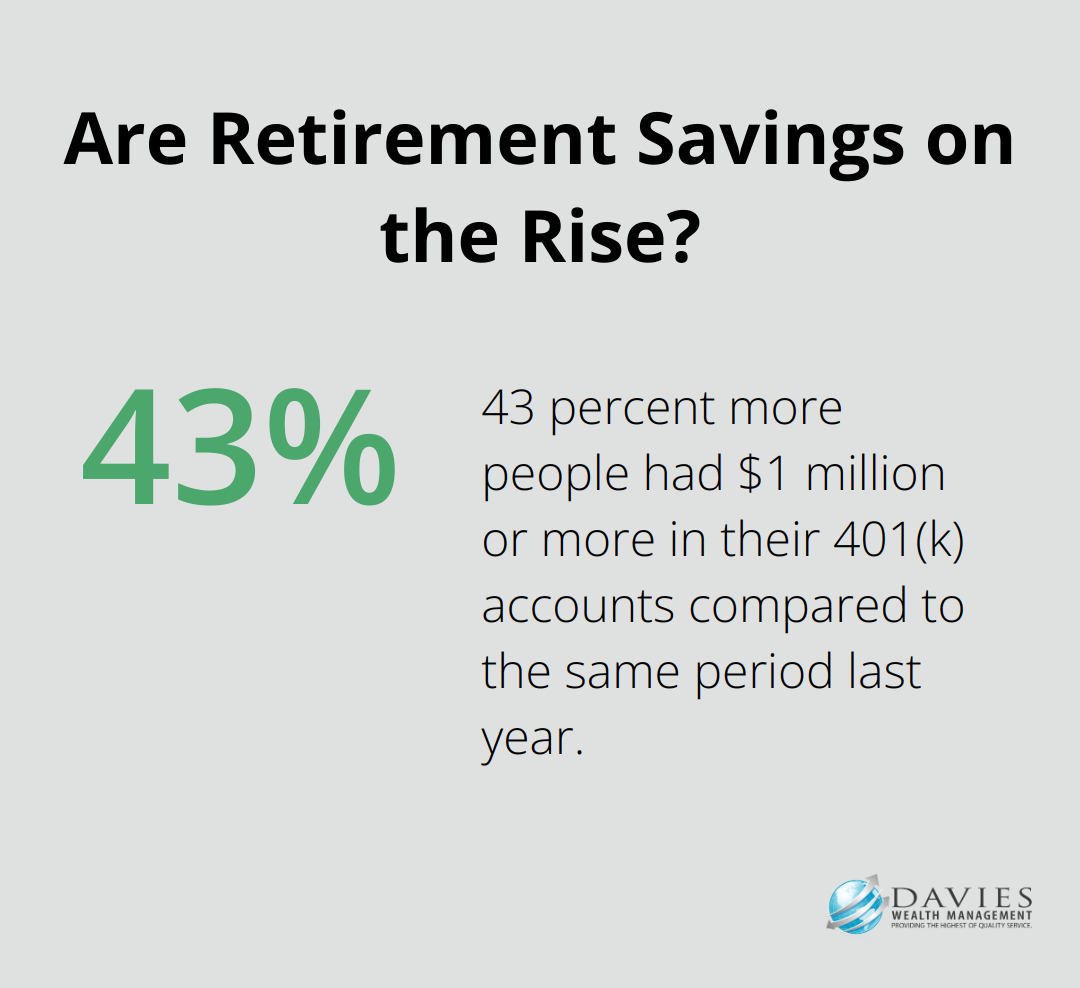

One of the most effective strategies for wealth accumulation is consistent, long-term investing. A study by Fidelity revealed that the number of people with $1 million or more in their 401(k) accounts increased to 485,000, a 43 percent jump from the same three months last year. This highlights the importance of early starts and commitment to investment strategies.

Diversification remains a cornerstone of successful wealth accumulation. The S&P 500 (which represents a broad cross-section of the U.S. stock market) has historically provided an average annual return of around 10.26% since its inception in 1957 through the end of 2023. However, it’s important to spread investments across various asset classes to mitigate risk.

Maximizing Income and Minimizing Taxes

Increasing income is a powerful way to accelerate wealth accumulation. This might involve career advancement, starting a side business, or investing in income-generating assets. For example, rental properties can provide steady cash flow and potential appreciation over time.

Tax-efficient investing is another key strategy. The use of tax-advantaged accounts like 401(k)s and IRAs can significantly boost wealth accumulation efforts. For 2024, the contribution limit for 401(k)s is $23,000 (with an additional $7,500 catch-up contribution for those 50 and older).

Navigating Risks and Challenges

While wealth accumulation offers significant rewards, it comes with risks. Market volatility can impact investment returns, and economic downturns can affect job security and income. The COVID-19 pandemic demonstrated how unexpected events can disrupt financial plans.

Inflation presents another challenge to wealth accumulation. As of October 2024, the U.S. inflation rate stands at 4.9%, which erodes purchasing power over time. This underscores the importance of investment strategies that outpace inflation.

Behavioral finance also plays a role in wealth accumulation. Emotional decision-making (such as panic selling during market downturns) can significantly hinder long-term wealth growth. A study by Dalbar found that the average equity mutual fund investor underperformed the S&P 500 by 4.35% annually over the 20 years ending in 2019, largely due to poor timing decisions.

As we move forward, it’s essential to recognize that wealth accumulation and preservation are not mutually exclusive concepts. The next section will explore how to strike a balance between these two crucial aspects of financial management, ensuring both growth and protection of your hard-earned assets.

Striking the Right Balance: A Dynamic Approach

The Evolution of Financial Priorities

Financial priorities naturally evolve as individuals progress through different life stages. In their 20s and 30s, people often focus heavily on accumulation. However, as individuals approach their 40s and 50s, the balance typically shifts towards preservation.

For example, a 35-year-old tech professional might allocate a larger portion of their portfolio to growth-oriented investments and a smaller portion to more conservative options. In contrast, a 55-year-old executive nearing retirement might reverse this ratio, focusing more on wealth preservation.

Adapting to Life’s Unexpected Turns

Life events significantly impact this balance. Marriage, children, or starting a business often necessitate a shift towards more conservative strategies. Conversely, receiving an inheritance or a substantial salary increase might allow for more aggressive wealth accumulation tactics.

Professional athletes (a key focus area for many wealth management firms) often have short-lived careers with high earnings concentrated in a few years. For them, aggressive wealth accumulation during playing years must balance with robust preservation strategies for long-term financial security.

Tailoring Strategies to Individual Financial DNA

Risk tolerance, financial goals, and time horizon are unique – wealth management strategies should reflect this.

Sophisticated risk assessment tools help determine an individual’s financial DNA. This aids in creating a personalized strategy that balances growth and preservation in a way that resonates with comfort level and goals.

For those aiming to retire early, a more aggressive accumulation strategy in their 30s and 40s might be recommended, gradually shifting towards preservation as they approach their target retirement age. On the other hand, individuals prioritizing leaving a legacy for their children might benefit from a more balanced approach from the outset, with a focus on tax-efficient wealth transfer strategies.

The Importance of Regular Rebalancing

Market fluctuations can disrupt a carefully crafted balance between preservation and accumulation. Regular portfolio rebalancing proves essential.

Reviewing portfolios at least annually (or after significant life events) ensures asset allocation remains aligned with goals and risk tolerance, maintaining the right balance between growth and protection.

Final Thoughts

Wealth preservation and accumulation form the foundation of effective financial management. These strategies work in tandem to grow and protect assets, adapting to individual circumstances, risk tolerance, and life stages. Professional financial advice proves invaluable when navigating the complexities of wealth management, especially for clients with unique financial challenges like professional athletes.

We recommend evaluating your financial goals, risk tolerance, and time horizon to assess your current wealth strategy. Review your asset allocation to ensure it aligns with your objectives, considering recent life changes that might impact your financial priorities. Seeking guidance from a qualified financial advisor can provide valuable insights and help you make informed decisions about portfolio management topics for projects.

For personalized wealth management solutions tailored to your unique situation, we invite you to explore how Davies Wealth Management can help you achieve your financial goals. Our expertise ensures comprehensive solutions that balance growth and protection effectively. We strive to create strategies that address the distinct needs of our clients, aiming for long-term financial success.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply