Ultra-high-net-worth individuals (UHNWIs) face unique financial challenges that require specialized wealth management services. These individuals, with assets exceeding $30 million, demand tailored strategies to preserve and grow their wealth.

At Davies Wealth Management, we recognize the critical role that top ultra-high-net-worth wealth management firms play in addressing these complex needs. This blog post unveils the leading firms in this exclusive sector, exploring their distinctive offerings and the key services they provide to their elite clientele.

What Sets Ultra-High-Net-Worth Wealth Management Apart?

Ultra-high-net-worth individuals (UHNWIs) represent a unique segment of the financial world, typically defined as those with a net worth of at least $30 million. This elite group faces distinct financial challenges that require specialized wealth management services tailored to their complex needs.

The Complexity of UHNW Finances

UHNWIs often have intricate financial portfolios that span multiple asset classes, jurisdictions, and generations. Their wealth may be tied up in various forms, including private businesses, real estate holdings, and complex investment structures. This diversity necessitates a comprehensive approach to wealth management that goes beyond traditional financial planning.

A UHNW client might need assistance with the sale of a family business, which could involve complex tax implications, succession planning, and the reinvestment of proceeds. A 2023 study by Capgemini revealed that global HNWI wealth increased by 4.7% in 2023, highlighting the need for specialized services in this area.

Tailored Solutions for Unique Challenges

UHNWIs require wealth managers who can provide bespoke solutions for their unique situations. This might include:

- Global investment strategies that navigate international markets and regulations

- Advanced tax planning to optimize wealth across multiple jurisdictions

- Philanthropic advisory services to align charitable giving with personal values and tax efficiency

- Risk management strategies to protect substantial assets from market volatility and other threats

This underscores the importance of comprehensive wealth management services that can address all aspects of a UHNW client’s financial life.

The Role of Specialized Wealth Management

Specialized wealth management firms play a crucial role in helping UHNWIs navigate their complex financial landscapes. These firms often employ teams of experts in various fields, including investment management, tax law, estate planning, and even lifestyle management.

The importance of specialized wealth management for UHNWIs cannot be overstated. A 2025 outlook by Deloitte suggests that investment management firms face elevated risks and rewards as they look to grow revenue, streamline processes, and use AI in their services.

Addressing Unique Professional Needs

Some wealth management firms specialize in serving specific professional groups within the UHNW segment. For example, professional athletes face unique challenges such as short career spans and fluctuating incomes. Specialized services address these specific needs, ensuring that wealth is not only managed effectively during peak earning years but also preserved and grown for long-term financial security.

As we explore the top firms in ultra-high-net-worth wealth management, it becomes clear that the ability to provide truly tailored, comprehensive solutions sets the best apart from the rest. These firms must navigate the complexities of substantial wealth while adapting to the ever-evolving financial landscape.

Top Ultra-High-Net-Worth Wealth Management Firms Revealed

Industry Leaders in UHNW Wealth Management

The ultra-high-net-worth (UHNW) wealth management sector features a select group of firms that excel in addressing the complex needs of the world’s wealthiest individuals. These firms distinguish themselves through comprehensive services, global reach, and adept navigation of intricate financial challenges faced by UHNWIs.

J.P. Morgan Private Client offers a suite of tailored financial services, including personal banking, wealth management, lending, and business banking. UBS Global Wealth Management and Credit Suisse consistently rank among the top-tier firms serving UHNW clients. These institutions have built their reputations on decades of experience, extensive global networks, and the ability to offer a wide range of sophisticated financial solutions.

The landscape, however, continues to evolve. Boutique firms and independent wealth managers increasingly gain market share by offering more personalized services and agile decision-making processes. Multi-family offices like Rockefeller Capital Management have experienced significant growth, attracting UHNW clients with their holistic approach to wealth management.

Selection Criteria for Top Firms

The evaluation of top UHNW wealth management firms relies on several key factors. Assets under management (AUM) serves as a primary metric, with the largest firms managing hundreds of billions or even trillions of dollars.

Client satisfaction plays an equally important role in the selection process. The Spear’s index, which ranks the best wealth managers for UHNWIs, employs a proprietary weighted scoring system. This system considers factors such as reputation, client base, and service quality, ensuring a comprehensive evaluation beyond mere size.

Profiles of Industry Leaders

J.P. Morgan Private Bank stands out for its global reach and comprehensive suite of services. The firm’s ability to leverage the broader resources of JPMorgan Chase & Co. allows it to offer UHNW clients access to institutional-grade investment opportunities and cutting-edge research.

UBS Global Wealth Management has established a strong presence in Europe and Asia, with particular expertise in sustainable investing. The firm leads in developing ESG (Environmental, Social, and Governance) investment solutions for UHNW clients, reflecting the growing interest in impact investing among this demographic.

Credit Suisse, despite recent challenges, maintains a significant position in UHNW wealth management, particularly in emerging markets. The firm’s strength lies in its ability to provide sophisticated structured products and alternative investments tailored to UHNW clients’ risk profiles.

While these global giants dominate the industry, Davies Wealth Management has carved out a unique niche, particularly in serving professional athletes. Our specialized expertise in addressing the complex financial needs of athletes (including short career spans and fluctuating incomes), combined with our personalized approach, positions us as a top choice for this specific segment of UHNW individuals.

Emerging Trends Shaping the Industry

The UHNW wealth management landscape continues to transform. According to a recent Capgemini report, wealth management firms will likely face sluggish economic growth, low return potential from many assets, and an evolving competitive landscape in the coming years.

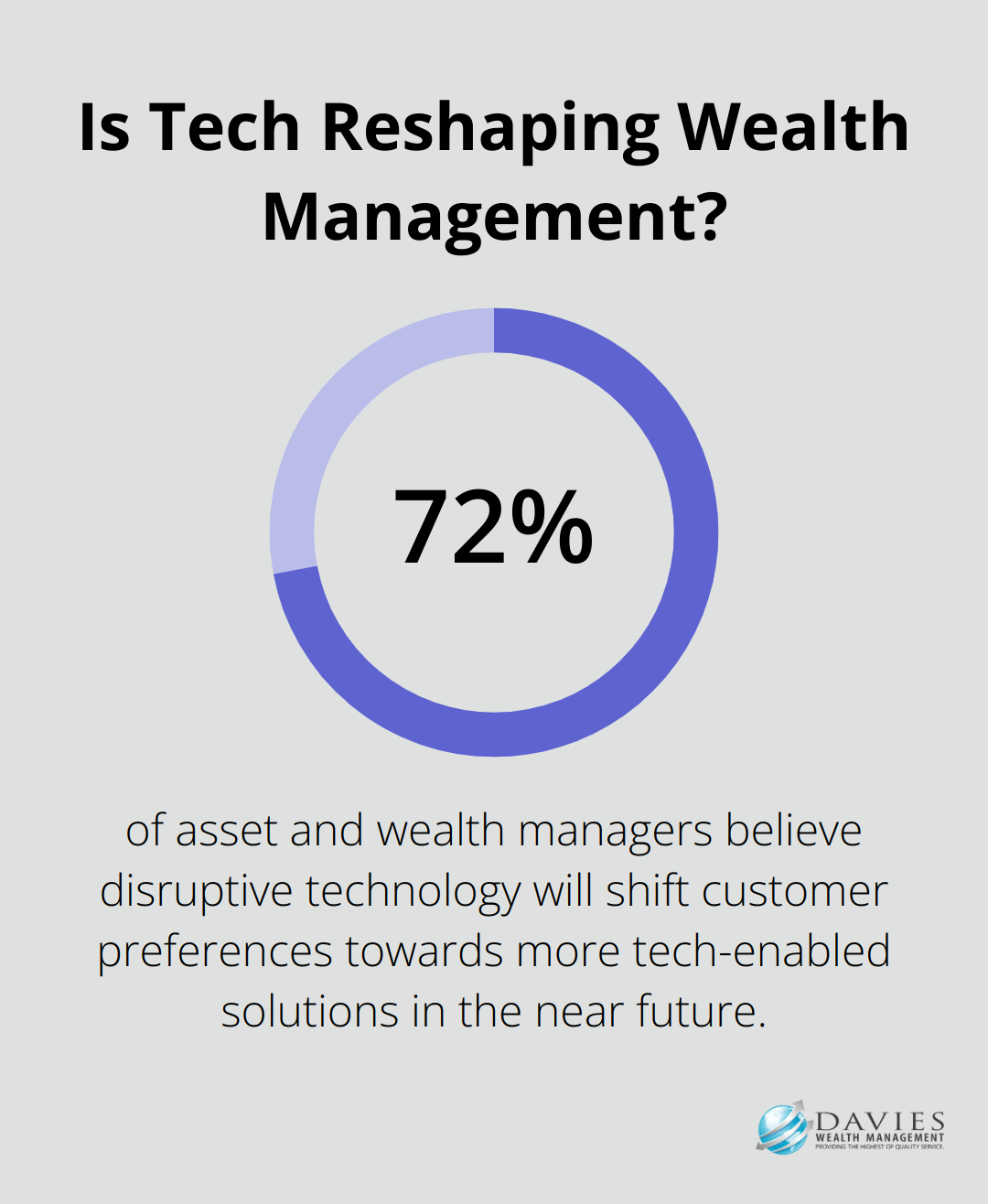

Technology plays an increasingly vital role in UHNW wealth management. Firms that effectively leverage AI, big data, and blockchain technology to enhance their service offerings are likely to gain a competitive edge. A recent industry survey revealed that 72% of asset and wealth managers believe disruptive technology will shift customer preferences towards more tech-enabled solutions in the near future.

As we explore the key services offered by these top firms, it becomes clear that the ability to combine global expertise with personalized service, cutting-edge technology, and specialized knowledge in areas like sustainable investing and alternative assets sets the industry leaders apart.

Key Services Offered by Top Ultra-High-Net-Worth Wealth Management Firms

Top ultra-high-net-worth (UHNW) wealth management firms provide a comprehensive suite of services tailored to meet the complex financial needs of their elite clientele. These services extend far beyond traditional investment management, encompassing a wide range of specialized offerings designed to preserve and grow substantial wealth across generations.

Sophisticated Investment Strategies

UHNW wealth managers employ advanced investment strategies that leverage global opportunities and alternative assets. Alternative investments have emerged as a crucial avenue for ultra-high-net-worth (UHNW) clients seeking greater diversification, long-term growth, and unique opportunities. Many firms offer access to private equity and venture capital investments, which are typically unavailable to retail investors.

Diversification strategies for UHNW clients often include allocations to real estate, commodities, and even art and collectibles. Some wealth management firms have dedicated teams that specialize in these niche areas, providing expert guidance on valuation, acquisition, and portfolio integration.

Tax Optimization and Global Planning

Given the complex tax situations of UHNW individuals, top wealth management firms offer sophisticated tax planning services. This includes cross-border tax planning to minimize liabilities, utilizing tax-advantaged investment vehicles, and staying compliant with international regulations.

Many UHNW wealth managers work closely with tax attorneys to implement strategies such as opportunity zone investments (which can provide significant tax benefits while also supporting economic development in designated areas).

Multigenerational Wealth Transfer

Estate planning and wealth transfer are critical services offered by top UHNW wealth management firms. These services often involve the creation of complex trust structures, family governance frameworks, and succession plans for family-owned businesses.

Creative Planning suggests that there are eight important wealth planning services every ultra-high-net-worth family should consider implementing. Leading wealth management firms increasingly offer family education programs and workshops to prepare the next generation for responsible wealth stewardship.

Impact Investing and Philanthropy

As social and environmental concerns become increasingly important to UHNW individuals, top wealth management firms have expanded their offerings in impact investing and strategic philanthropy. These services help clients align their investments with their values while also achieving financial returns.

Wealth managers respond by developing proprietary impact measurement tools and forging partnerships with leading philanthropic organizations to provide clients with comprehensive support for their charitable endeavors.

Final Thoughts

Ultra-high-net-worth wealth management firms operate in a complex landscape that demands specialized expertise and tailored solutions. Top firms offer comprehensive services beyond traditional investment management, providing sophisticated strategies for tax optimization, multigenerational wealth transfer, and impactful philanthropy. Industry leaders like J.P. Morgan Private Client, UBS Global Wealth Management, and Credit Suisse have established themselves as preferred options for UHNWIs, while boutique firms and independent wealth managers make their mark with personalized services.

The future of ultra-high-net-worth wealth management will be shaped by technological advancements, changing client preferences, and evolving global economic conditions. Firms that effectively harness AI, big data, and blockchain technology while maintaining a human touch will thrive in this competitive landscape. As the ultra-high-net-worth segment grows and diversifies, wealth management firms must stay ahead of the curve, offering innovative solutions to meet the evolving needs of their elite clientele.

At Davies Wealth Management, we understand the intricacies of managing substantial wealth, particularly for professional athletes facing unique financial challenges. Our specialized focus allows us to provide tailored strategies that address the specific needs of UHNWIs (ensuring their financial security both during and after their careers). The firms that successfully navigate this complex landscape while delivering exceptional value will lead the way in ultra-high-net-worth wealth management for years to come.

Leave a Reply