Risk Management Strategies for High-Net-Worth Individuals

At Davies Wealth Management, we understand that high-net-worth individuals face unique challenges when it comes to protecting and growing their wealth. Risk management for the affluent requires a sophisticated approach that goes beyond traditional strategies.

This comprehensive guide explores the multifaceted world of risk management for high-net-worth individuals, covering everything from market volatility to advanced tax planning. We’ll provide practical insights and actionable strategies to help safeguard your financial future.

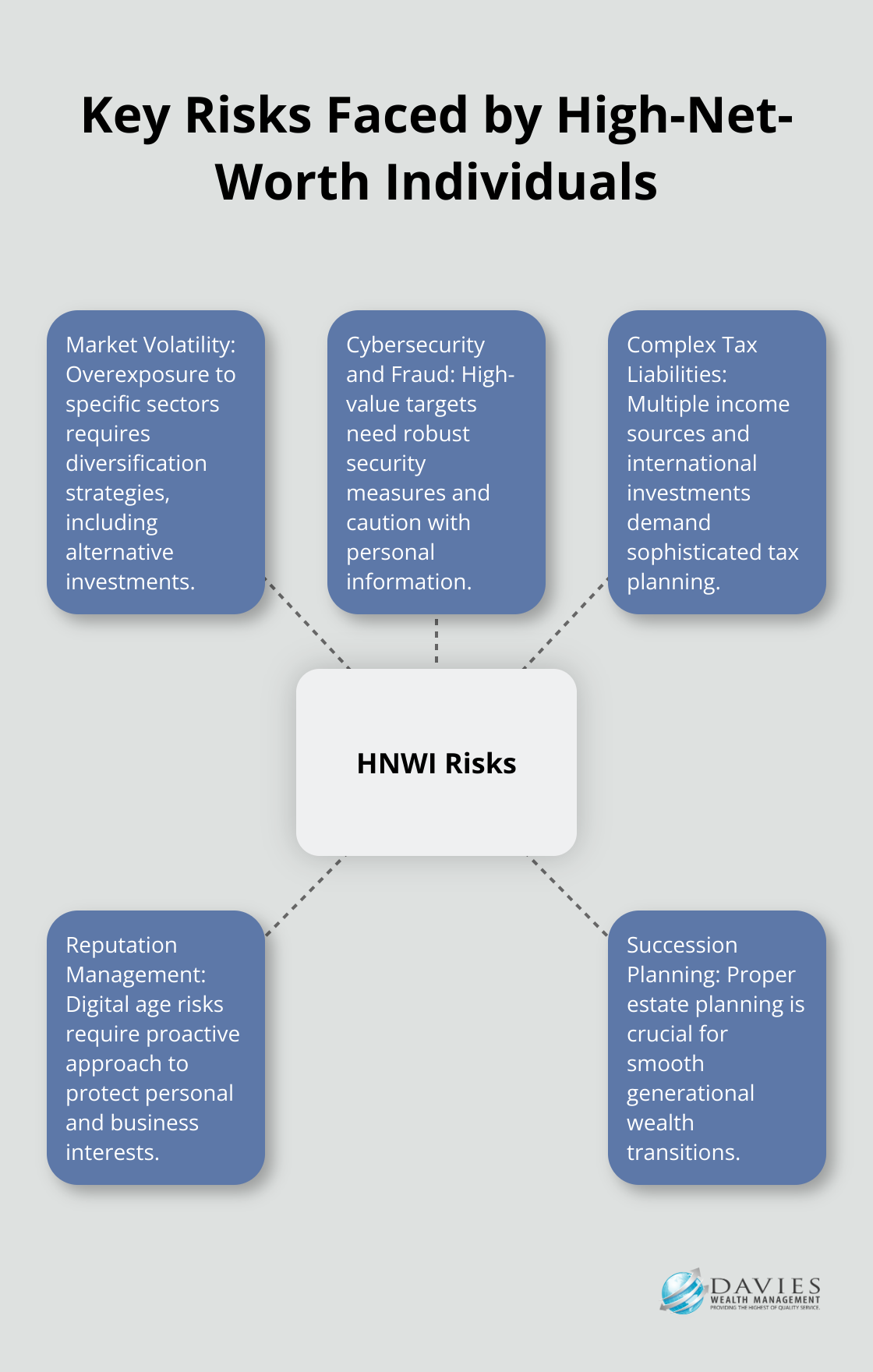

Key Risks for High-Net-Worth Individuals: A Quick Overview

High-net-worth individuals face several unique financial risks:

- Market Volatility: Exposure to specific sectors requires diversified investment strategies

- Cybersecurity: Increased likelihood of targeted attacks necessitates robust security measures

- Complex Taxes: Multiple income sources and international investments demand sophisticated tax planning

- Reputation Management: Digital age risks require proactive approach to protect personal and business interests

- Succession Planning: Proper estate planning crucial for smooth generational wealth transitions

Understanding these risks is the first step in developing a comprehensive wealth protection strategy.

Detailed Analysis of Risks Faced by High-Net-Worth Individuals

High-net-worth individuals (HNWIs) encounter a unique set of financial risks that demand careful management and strategic planning. This chapter explores several key areas where wealthy individuals must focus their risk management efforts.

Market Volatility and Concentrated Positions

Market volatility, Inflation and valuations rank as top issues in the wealth management investment outlook. Many wealthy individuals have amassed their fortune through a single company or industry, which leads to overexposure to specific market sectors.

To address this risk, diversification is essential. However, it extends beyond spreading investments across different stocks. True diversification for HNWIs often involves exploring alternative investments such as private equity, real estate, and hedge funds. These asset classes can provide uncorrelated returns and help smooth out portfolio performance during market turbulence.

Cybersecurity and Fraud

As wealth increases, so does the likelihood of becoming a target for cybercriminals and fraudsters. HNWIs often face specific targeting due to the potential for high payoffs. Strategic and future-focused wealth management firms need to set their sights on retaining clients by addressing these concerns.

Protection against these threats requires a multi-faceted approach. This includes the use of robust cybersecurity measures, regular password updates, and caution when sharing personal information. It’s also vital to work with financial institutions that prioritize security and have strong fraud prevention measures in place.

Complex Tax Liabilities

HNWIs often face intricate tax situations that can pose significant financial risks if not managed properly. The complexity stems from multiple income sources, international investments, and potential estate tax liabilities. A misstep in tax planning can result in substantial penalties and missed opportunities for tax efficiency.

Effective tax management for HNWIs often involves strategies such as tax-loss harvesting, charitable giving, and the use of trusts. Higher-net-worth investors are more likely to benefit from tax-loss harvesting. However, these strategies require careful planning and execution to ensure compliance with ever-changing tax laws.

Reputation Management

In today’s digital age, reputation management has become a critical risk factor for HNWIs. Negative publicity or social media controversies can quickly escalate, potentially impacting business relationships, investment opportunities, and personal life. A proactive approach to reputation management (including careful social media use and strategic philanthropic efforts) can help mitigate this risk.

Succession Planning and Wealth Transfer

Many HNWIs face challenges related to succession planning and wealth transfer. Without proper planning, family businesses and accumulated wealth can be at risk during generational transitions. This risk extends beyond financial considerations to include family dynamics and potential conflicts. Comprehensive estate planning, clear communication with heirs, and the establishment of family governance structures can help address these complex issues.

As we move forward, it’s important to recognize that these risks don’t exist in isolation. They often interact and compound, creating a complex risk landscape that requires sophisticated management strategies. In the next section, we’ll explore comprehensive risk management approaches that can help HNWIs navigate these challenges effectively.

Mastering Risk Management for High-Net-Worth Individuals

At Davies Wealth Management, we have developed a comprehensive approach to risk management that extends beyond traditional strategies. Our experience with high-net-worth individuals, including professional athletes, has demonstrated that effective risk management requires a multifaceted approach. This chapter explores how we help our clients navigate the complex landscape of wealth preservation and growth.

Diversification: Beyond Traditional Assets

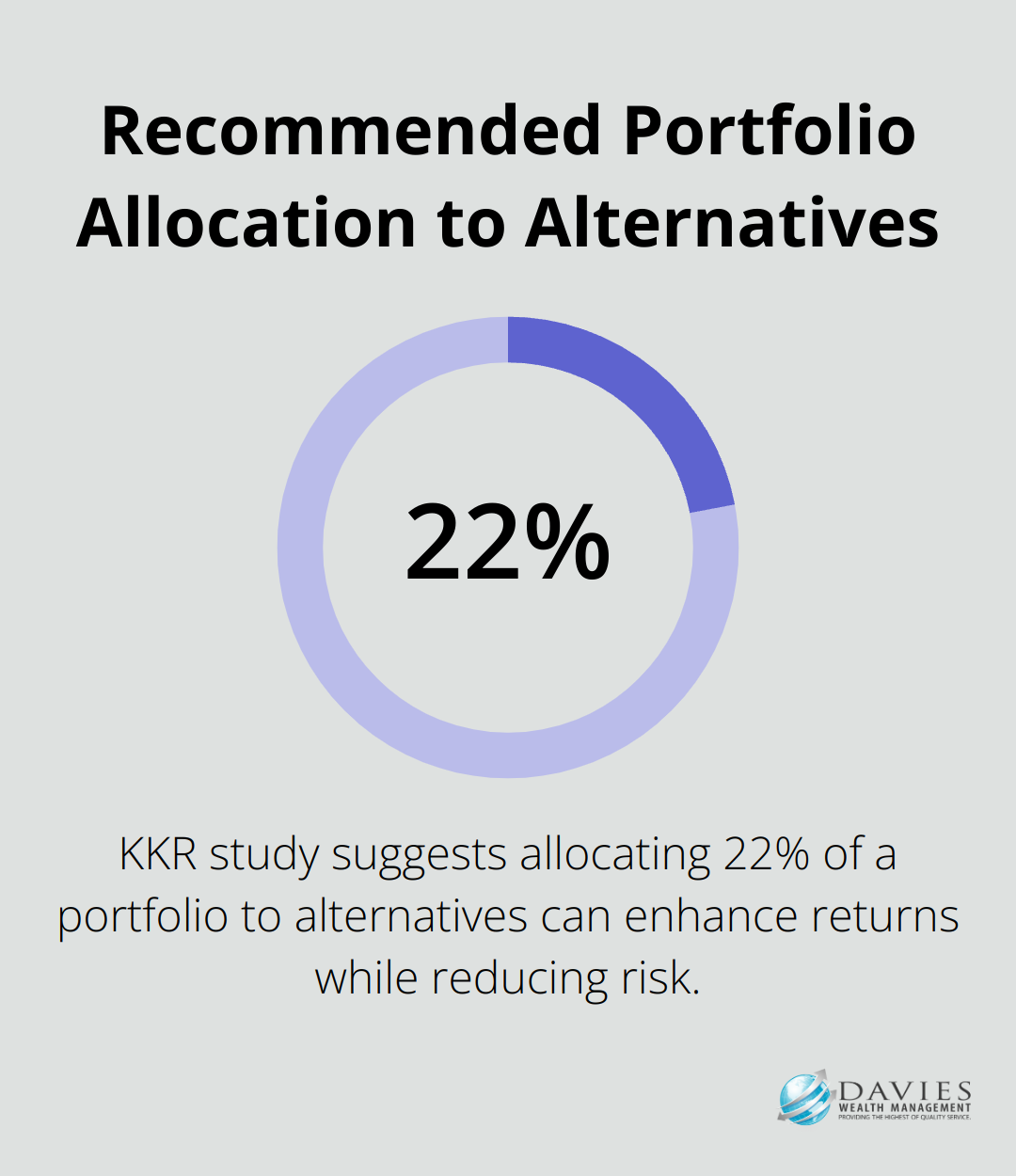

Diversification remains a fundamental strategy, but for high-net-worth individuals, it takes on new dimensions. We advocate for a broader approach that includes alternative investments such as private equity, real estate, and commodities. A study by KKR suggests that allocating 22% of a portfolio to alternatives can potentially enhance returns while reducing risk. For our clients, we often recommend a mix that includes both traditional and alternative assets, tailored to individual risk tolerance and financial goals.

Implementing Dynamic Hedging Strategies

Sophisticated hedging techniques protect wealth in volatile markets. Options strategies, such as protective puts or collar strategies, provide downside protection while allowing for upside potential. Options on futures can be potentially more cost efficient versus adjacent markets, given their larger notional sizes. We work closely with our clients to implement these strategies in alignment with their overall financial plan.

The Importance of Regular Portfolio Rebalancing

Market fluctuations can quickly throw a carefully constructed portfolio out of balance. We advocate for regular rebalancing (typically quarterly or semi-annually) to maintain the desired asset allocation. Portfolio rebalancing primarily functions to keep portfolio risk aligned with the investor’s risk tolerance. For our high-net-worth clients, including professional athletes with potentially shorter earning windows, this consistent approach to risk management is particularly important.

Comprehensive Insurance Solutions for Wealth Protection

Insurance plays a vital role in wealth protection, especially for high-net-worth individuals. Beyond standard policies, we explore specialized coverage such as umbrella liability insurance, key person insurance for business owners, and even kidnap and ransom insurance for clients with international exposure. The Insurance Information Institute recommends that high-net-worth individuals consider umbrella policies with limits of at least $5 million to $10 million.

Effective risk management is an ongoing process that requires constant vigilance, regular review, and adjustment as market conditions and personal circumstances change. Our team stays abreast of the latest financial trends and regulatory changes to ensure our clients’ wealth is protected and positioned for growth in any economic environment. As we move forward, we will explore advanced tax planning and legal considerations that further enhance the comprehensive risk management strategy for high-net-worth individuals.

Navigating Tax and Legal Complexities for High-Net-Worth Individuals

Strategic Tax Planning

High-net-worth individuals face complex tax situations that require sophisticated planning. To navigate the complex landscape of tax laws and regulations, it is crucial for high-net-worth individuals to implement strategic tax-planning strategies. Tax-loss harvesting stands out as an effective strategy. This method involves the sale of underperforming investments to offset capital gains. A Vanguard study indicates that tax-loss harvesting can add up to 0.35% in after-tax returns annually.

Charitable giving offers another powerful tool for tax optimization. Donor-advised funds provide immediate tax deductions while allowing flexibility in charitable distributions over time. For individuals aged 70½ or older, qualified charitable distributions from IRAs can satisfy required minimum distributions without increasing taxable income.

Estate Planning for Wealth Preservation

Effective estate planning for wealth preservation ensures wealth transfer according to one’s wishes while minimizing tax implications. Some of the goals of HNWIs include protecting inheritances for heirs, minimizing estate taxes, avoiding the probate process, and appointing the right trustee. Irrevocable life insurance trusts (ILITs) provide liquidity for estate taxes without increasing the taxable estate. The federal estate tax exemption for 2023 stands at $12.92 million per individual (set to decrease in 2026).

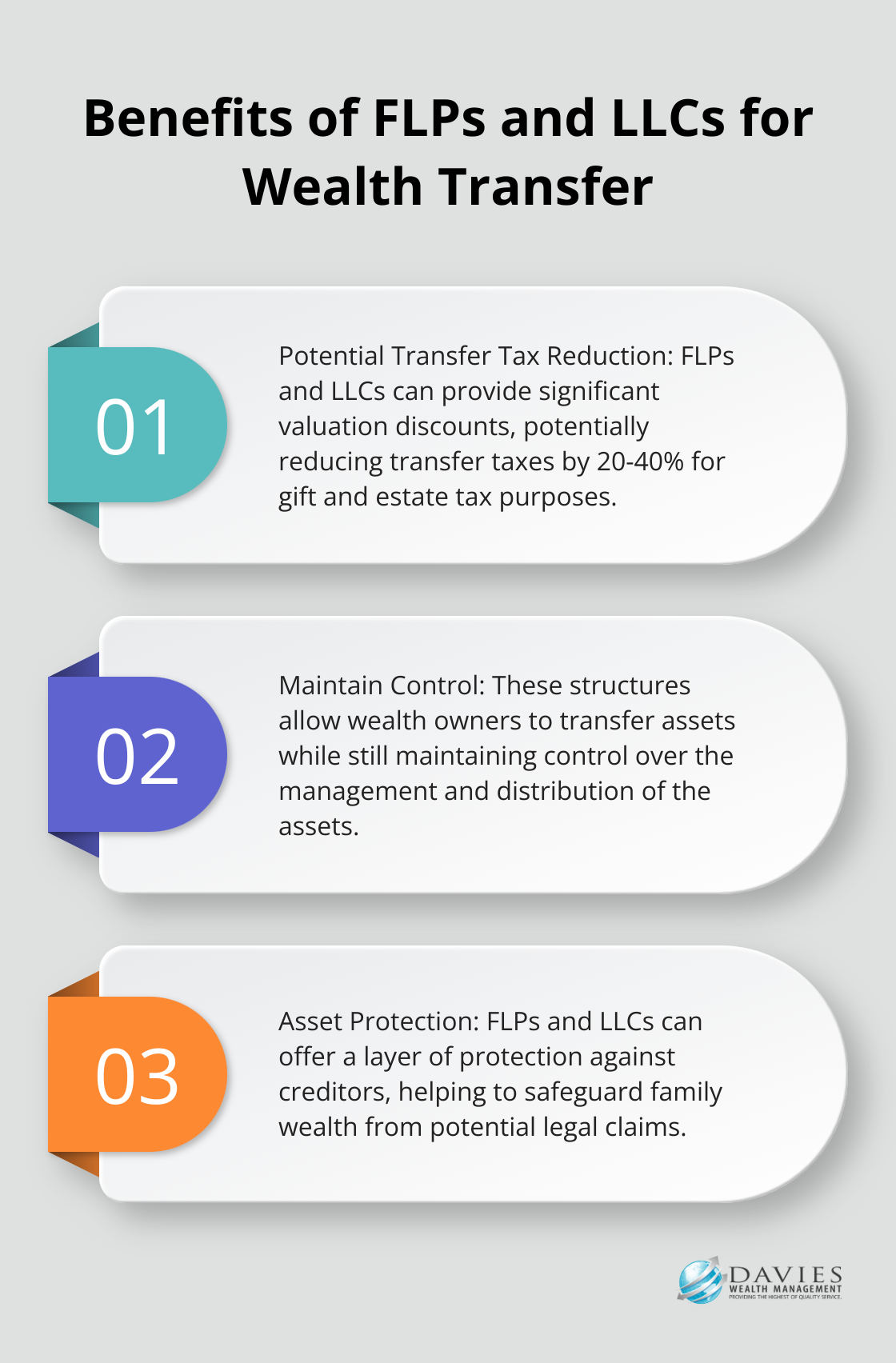

Family limited partnerships (FLPs) and limited liability companies (LLCs) serve as valuable tools for wealth transfer while maintaining control. These structures can provide significant benefits for high-net-worth individuals:

Asset Protection Strategies

High-net-worth individuals benefit from sophisticated asset protection strategies. Domestic asset protection trusts (DAPTs) offer protection from creditors while allowing the grantor to remain a discretionary beneficiary. However, it’s important to note that DAPTs can’t protect assets from known creditors. Currently, 19 states allow DAPTs, with Nevada and South Dakota often considered the most favorable jurisdictions due to their strong asset protection laws.

Foreign asset protection trusts can provide an additional layer of security for those with international interests. However, these require careful consideration due to complex reporting requirements and potential tax implications.

Global Investment Considerations

As wealth grows, many high-net-worth individuals expand their investment horizons internationally. This global approach requires careful navigation of international tax laws. The Foreign Account Tax Compliance Act (FATCA) imposes strict reporting requirements on U.S. taxpayers with foreign financial assets exceeding certain thresholds.

The utilization of tax treaties between countries can help minimize double taxation on foreign investments. The U.S. has tax treaties with over 60 countries, which can provide reduced withholding rates on dividends, interest, and royalties.

Tax attorneys and international tax specialists play a vital role in ensuring global investment strategies remain tax-efficient and compliant with all relevant regulations. This expertise proves particularly valuable for managing the finances of professional athletes (who often have international income sources) and handling complex cross-border tax situations.

Final Thoughts

Risk management for high-net-worth individuals requires a comprehensive and personalized approach. Every wealthy individual faces unique challenges, from market volatility to complex tax liabilities, which demand tailored strategies. Professional wealth management experts bring invaluable knowledge and objectivity to the table, helping clients navigate the intricate financial landscape effectively.

At Davies Wealth Management, we specialize in creating customized risk management strategies for high-net-worth individuals (including professional athletes with unique financial needs). Our team of experts collaborates closely with clients to develop comprehensive plans that address all aspects of wealth preservation and growth. We understand that effective risk management is an ongoing process that requires regular review and adjustment.

As you navigate the complex world of wealth management, the right expertise can significantly impact your ability to protect and grow your assets. Whether you seek to optimize your investment portfolio, minimize tax liabilities, or plan for generational wealth transfer, Davies Wealth Management stands ready to help you achieve your financial goals with confidence.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply