Portfolio rebalancing in Stuart, Florida, and beyond is a critical strategy for maintaining a well-structured investment portfolio. At Davies Wealth Management, we understand the importance of this practice in achieving optimal returns and managing risk.

This blog post will explore the art of portfolio rebalancing, including its definition, purpose, and various strategies for implementation. We’ll also discuss practical considerations and tools to help you effectively rebalance your investments.

What Is Portfolio Rebalancing?

Definition and Core Concept

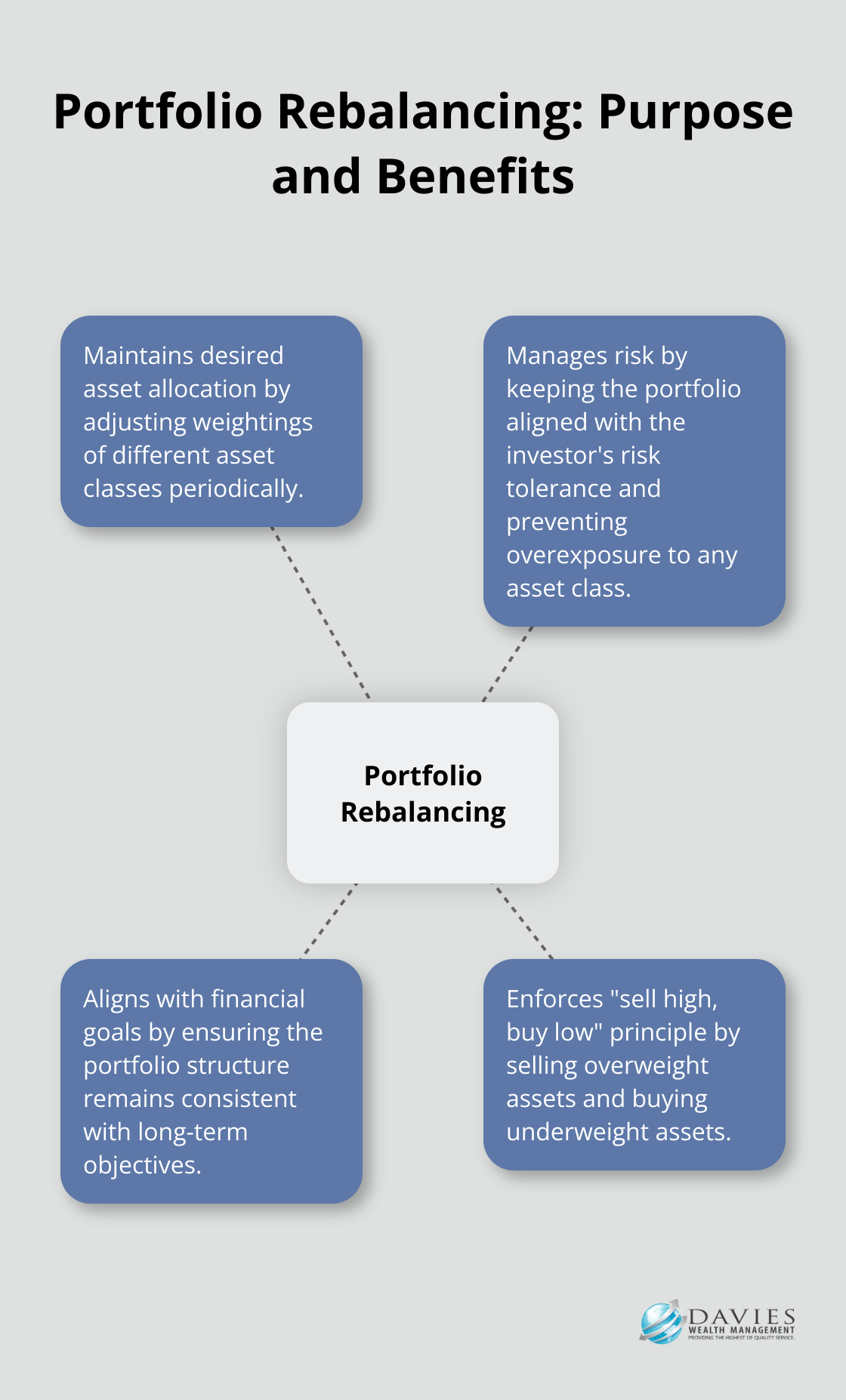

Portfolio rebalancing is a fundamental investment strategy that maintains a well-structured and risk-appropriate investment portfolio. It involves periodic adjustments to the weightings of different asset classes in your portfolio to maintain your desired asset allocation.

The Purpose of Rebalancing

The primary purpose of rebalancing is to keep your investment portfolio aligned with your risk tolerance and financial goals. Over time, as different assets perform differently, your portfolio’s composition can drift away from its original allocation. For example, if stocks outperform bonds over a period, your portfolio may become overweight in stocks and underweight in bonds. This shift can expose you to more risk than you initially intended.

Maintaining Desired Asset Allocation

Rebalancing helps maintain your desired asset allocation by selling assets that have become overweight in your portfolio and buying more of the underweight assets. This process essentially forces you to “sell high and buy low,” which is a fundamental principle of successful investing.

Risk Management Through Rebalancing

One of the most significant benefits of portfolio rebalancing is risk management. By keeping your asset allocation in check, you effectively control the level of risk in your portfolio. For instance, if your target allocation is 60% stocks and 40% bonds, but market movements have pushed it to 75% stocks and 25% bonds, you’re now exposed to more market risk than you initially planned for. Rebalancing brings your portfolio back to your comfort level.

Personalized Rebalancing Strategies

Each investor’s situation is unique (e.g., professional athletes with short career spans or business owners planning for retirement). That’s why it’s important to work closely with a financial advisor to develop personalized rebalancing strategies that align with specific financial goals and risk tolerance. An effective rebalancing strategy can optimize returns while managing risk.

As we move forward, we’ll explore various strategies for effective portfolio rebalancing, including time-based, threshold-based, and hybrid approaches. These strategies will provide you with a comprehensive toolkit to maintain your ideal portfolio composition and achieve your financial objectives.

How to Implement Effective Portfolio Rebalancing Strategies

Portfolio rebalancing stands as a cornerstone of successful investing. Let’s explore practical strategies for effective portfolio rebalancing that can significantly impact financial outcomes.

Time-Based Rebalancing

Time-based rebalancing involves portfolio adjustments at set intervals. This could occur monthly, quarterly, or annually. Many investors prefer annual rebalancing, which allows for regular portfolio maintenance without excessive trading costs.

A Vanguard study found that annual rebalancing strikes an optimal balance between risk control and cost minimization. However, the ideal frequency varies based on individual circumstances. For instance, professional athletes with fluctuating incomes might benefit from more frequent rebalancing to account for sudden cash influxes from contracts or endorsements.

Threshold-Based Rebalancing

Threshold-based rebalancing triggers adjustments when asset allocations deviate by a certain percentage from their targets. For example, an investor might rebalance when any asset class drifts more than 5% from its target allocation.

This method responds more actively to market movements than time-based approaches. While rebalancing doesn’t always improve returns, it’s an important step for keeping risk in check.

Hybrid Approaches

Many investors succeed with hybrid approaches that combine time and threshold strategies. For instance, an investor might check their portfolio quarterly but only rebalance if allocations have drifted beyond a certain threshold.

This approach proves particularly effective for business owners who experience seasonal income fluctuations. It allows for regular portfolio review while avoiding unnecessary trading costs.

Tax-Aware Rebalancing

Tax considerations play a crucial role in rebalancing, especially for high-net-worth individuals. Tax-efficient rebalancing strategies can minimize the tax impact of portfolio adjustments.

One effective technique uses new contributions to rebalance the portfolio. Directing new investments to underweight asset classes can help avoid selling appreciated assets and triggering capital gains taxes.

Another strategy prioritizes rebalancing in tax-advantaged accounts (like IRAs or 401(k)s), where trades don’t trigger immediate tax consequences. Tax-aware strategies can help minimize short-term capital gains and wash sales.

The implementation of these strategies requires careful planning and execution. While these approaches provide a framework, the optimal rebalancing strategy depends on an individual’s unique financial situation, goals, and risk tolerance. Professional guidance can prove invaluable in developing a personalized rebalancing approach that aligns with specific needs and objectives.

As we move forward, we’ll explore the practical aspects of implementing these rebalancing strategies, including determining the ideal rebalancing frequency and leveraging tools and technologies for efficient portfolio management.

How Often Should You Rebalance Your Portfolio?

Finding Your Ideal Rebalancing Frequency

Portfolio rebalancing frequency can significantly impact your investment outcomes. While annual rebalancing is common, it’s not a universal solution. Professional athletes with irregular income streams might benefit from more frequent rebalancing. A Vanguard study indicated that quarterly or monthly rebalancing can provide better risk control, albeit with potentially higher costs.

Business owners with seasonal income fluctuations might find semi-annual rebalancing more suitable. The goal is to balance maintaining your target asset allocation with minimizing transaction costs and tax implications.

Leveraging Technology for Efficient Rebalancing

Modern portfolio management tools have transformed the rebalancing process. Robo-advisors can automatically rebalance your portfolio based on predetermined parameters. A Cerulli Associates report projects that assets managed by robo-advisors will reach $1.26 trillion by 2023, highlighting the growing popularity of these automated solutions.

However, it’s important to combine these tools with human expertise. Advanced portfolio management software, when used in conjunction with professional advisors’ insights, can ensure that rebalancing decisions align with overall financial strategies.

Adapting to Market Conditions

Market volatility can significantly affect your portfolio’s composition. More frequent rebalancing might be necessary during periods of high volatility. For example, during the COVID-19 market crash in March 2020, rebalancing portfolios showed benefits in turbulent markets.

Considering Life Events

Life events play a critical role in rebalancing decisions. Major changes like marriage, divorce, or career transitions often require a reassessment of your investment strategy. For professional athletes, signing a new contract or transitioning to retirement are pivotal moments that require careful portfolio adjustments.

Seeking Professional Guidance

Implementing effective portfolio rebalancing is a dynamic process that requires ongoing attention and expertise. Factors such as rebalancing frequency, technological tools, market conditions, and life events all contribute to maintaining a well-balanced portfolio that aligns with your financial goals. Professional guidance (like that offered by Davies Wealth Management) can help you navigate these complex decisions and ensure your investment strategy remains on track.

Final Thoughts

Portfolio rebalancing in Stuart, Florida and beyond forms a key part of successful investing. It helps manage risk, capitalize on market movements, and align with long-term financial goals. Your rebalancing strategy should match your unique financial situation, considering factors like investment goals, risk tolerance, and time horizon.

Regular review and adjustment of your rebalancing approach will ensure your portfolio remains optimally positioned. Major life events, market shifts, or changes in financial goals may require a reassessment of your rebalancing tactics. Professional athletes with short career spans and fluctuating incomes might need different strategies compared to business owners planning for retirement.

At Davies Wealth Management, we specialize in crafting personalized rebalancing strategies that align with your unique financial objectives. Our team of experts can guide you through the complexities of portfolio management (whether you’re a professional athlete, business owner, or individual seeking financial security). To learn more about how we can help optimize your investment strategy, visit our website at Davies Wealth Management.

✅ Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

Book an Appointment Today

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

Read the Latest Blog Posts

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

Subscribe for Weekly Insights

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

Connect with Davies Wealth Management

Website: tdwealth.net

Podcast: 1715tcf.com

Follow Us on Social Media:

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply