Stuart residents face unique financial challenges that require strategic planning and smart decision-making. Rising living costs and market volatility make wealth consolidation more important than ever.

We at Davies Wealth Management understand the local financial landscape. The right approach can transform your financial situation and build lasting prosperity in our community.

How Do You Build a Financial Foundation That Actually Works?

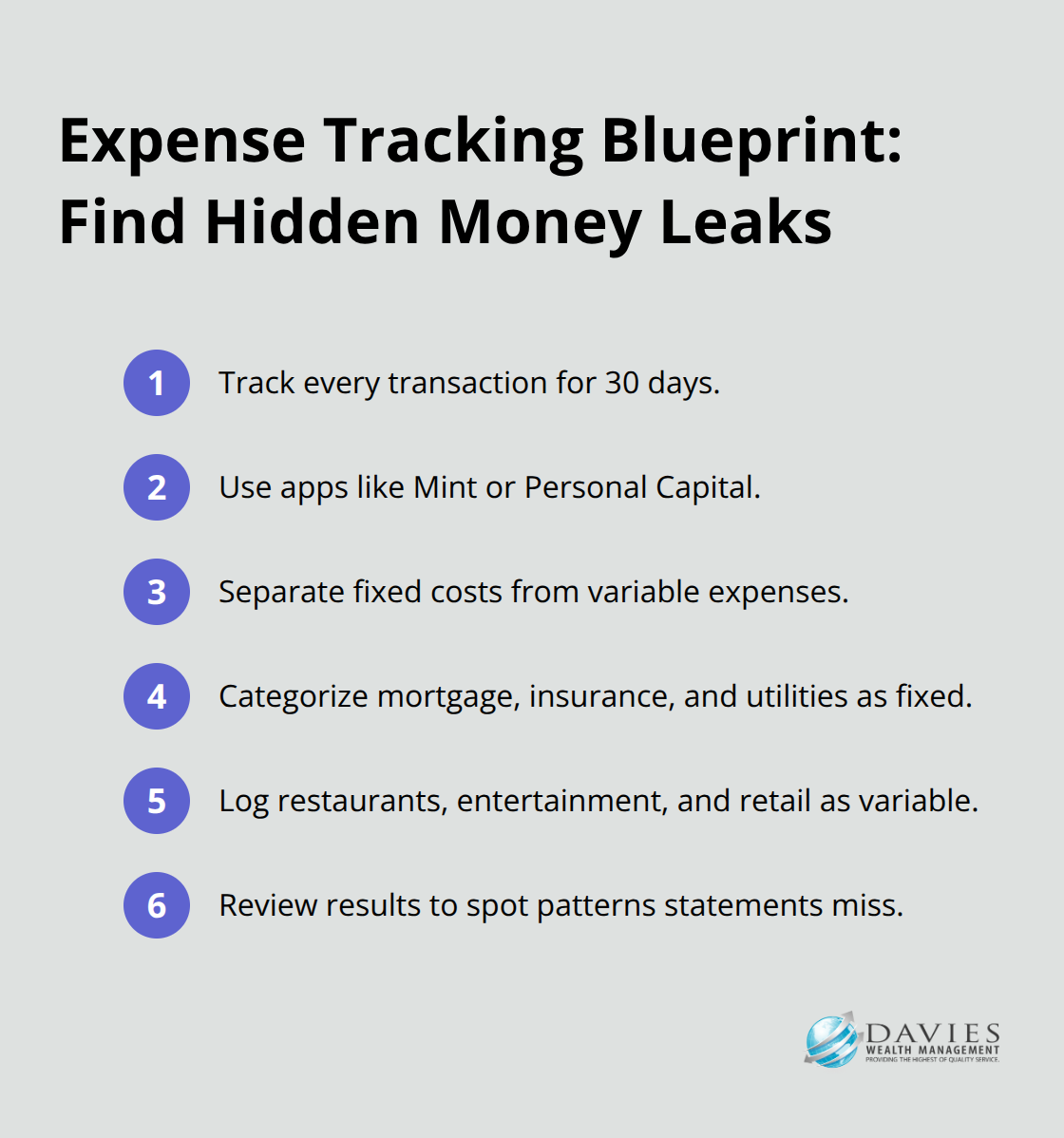

Track Every Dollar to Find Hidden Money Leaks

Financial plans collapse without accurate data, and most Stuart residents underestimate their true expenses.

Start with a 30-day expense period where you track every transaction through apps like Mint or Personal Capital. Separate fixed costs like mortgage payments, insurance premiums, and utilities from variable expenses such as restaurant meals, entertainment, and retail purchases. This detailed approach exposes spending patterns that monthly bank statements completely miss.

Stop the Silent Wealth Killers

Stuart’s median household income reaches $80,701, yet many residents battle cash flow problems despite solid earnings. The culprit lies in subscription creep and lifestyle inflation that quietly destroys financial stability. Cancel unused subscriptions immediately-the average American pays $273 monthly for services they rarely use. Review your last three months of credit card and bank statements to spot recurring charges you forgot about. Set up automatic transfers that move 20% of your income to savings before you pay any bills (this pay-yourself-first strategy forces you to live on 80% of your income and builds wealth without willpower).

Create Goals That Actually Drive Action

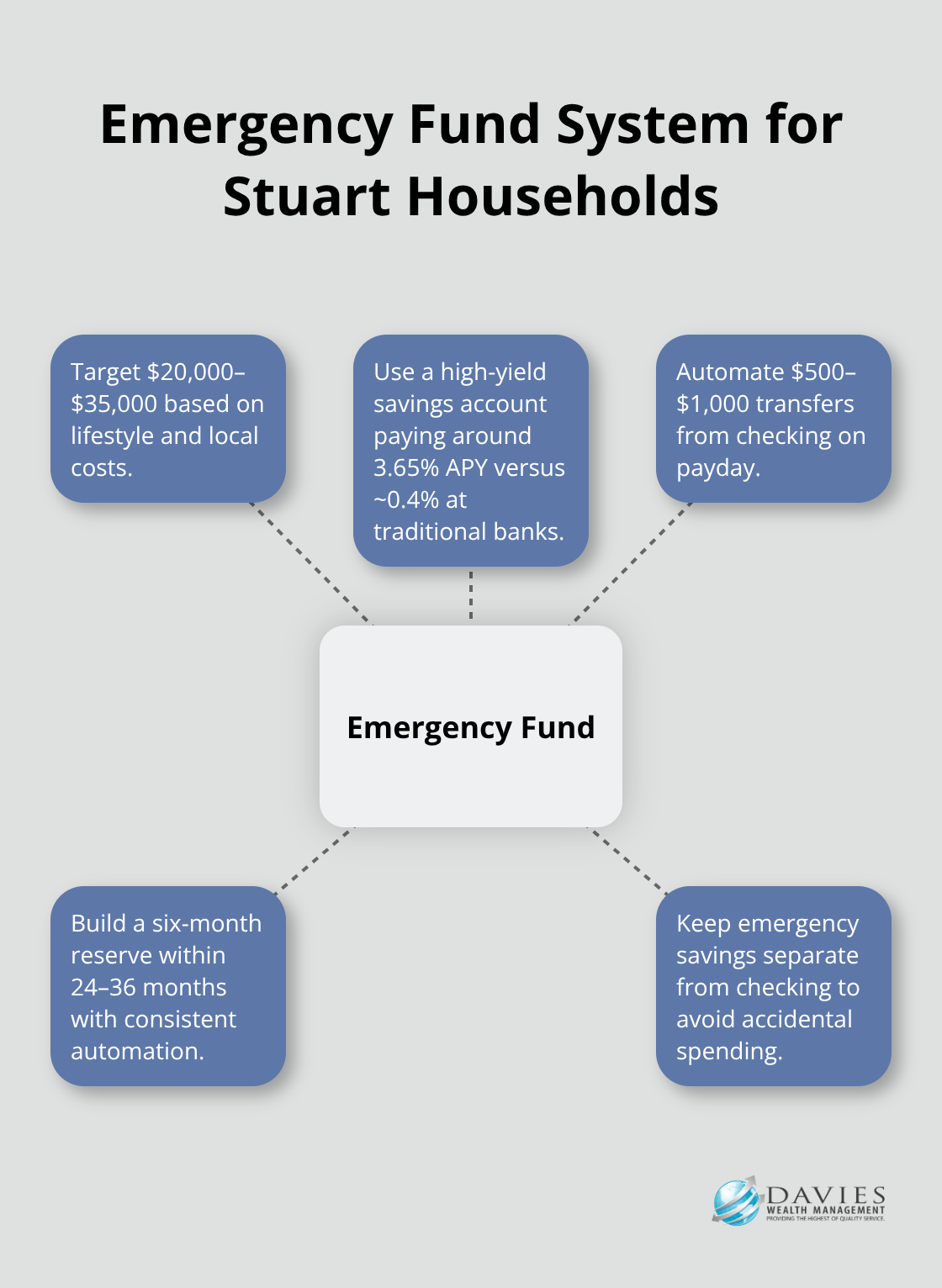

Financial goals without specific timelines and dollar amounts remain wishful thoughts. Target a six-month emergency fund first-for Stuart residents, this means $20,000-$35,000 depending on your lifestyle. Next, try to invest 15% of your gross income for retirement through employer 401k plans and IRAs. Set up automatic contributions that increase by 1% annually until you reach this target. Create separate savings accounts for major purchases like home improvements or vacation funds. This bucket approach prevents you from raiding your emergency fund for planned expenses and keeps your wealth-building strategy on track for the investment opportunities that Stuart’s growing market presents.

Where Should Stuart Residents Invest Right Now?

Target Stuart’s Hot Real Estate Markets

Stuart’s real estate market presents compelling opportunities, with Martin County showing a median sale price of $435K last month. Focus on rental properties near downtown Stuart or along the waterfront, where vacation rental demand drives consistent cash flow. Properties within walking distance of Flagler Avenue command premium rents from seasonal residents. Purchase investment properties with 20-25% down payments to secure favorable interest rates and positive cash flow from day one. Consider duplex properties that allow you to live in one unit while rent the other, which reduces your housing costs while you build equity.

Max Out These Tax Shelters Before Anything Else

Traditional and Roth IRAs offer $7,000 annual contributions for 2024, with an additional $1,000 catch-up contribution for those over 50. Choose Roth IRAs if you expect higher tax rates in retirement (this applies to most Stuart residents under 40). Contribute to employer 401k plans up to the $23,000 limit and focus on funds with expense ratios below 0.5%. Health Savings Accounts provide triple tax benefits – deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses. HSAs become retirement accounts after age 65, which makes them superior to traditional IRAs for high earners.

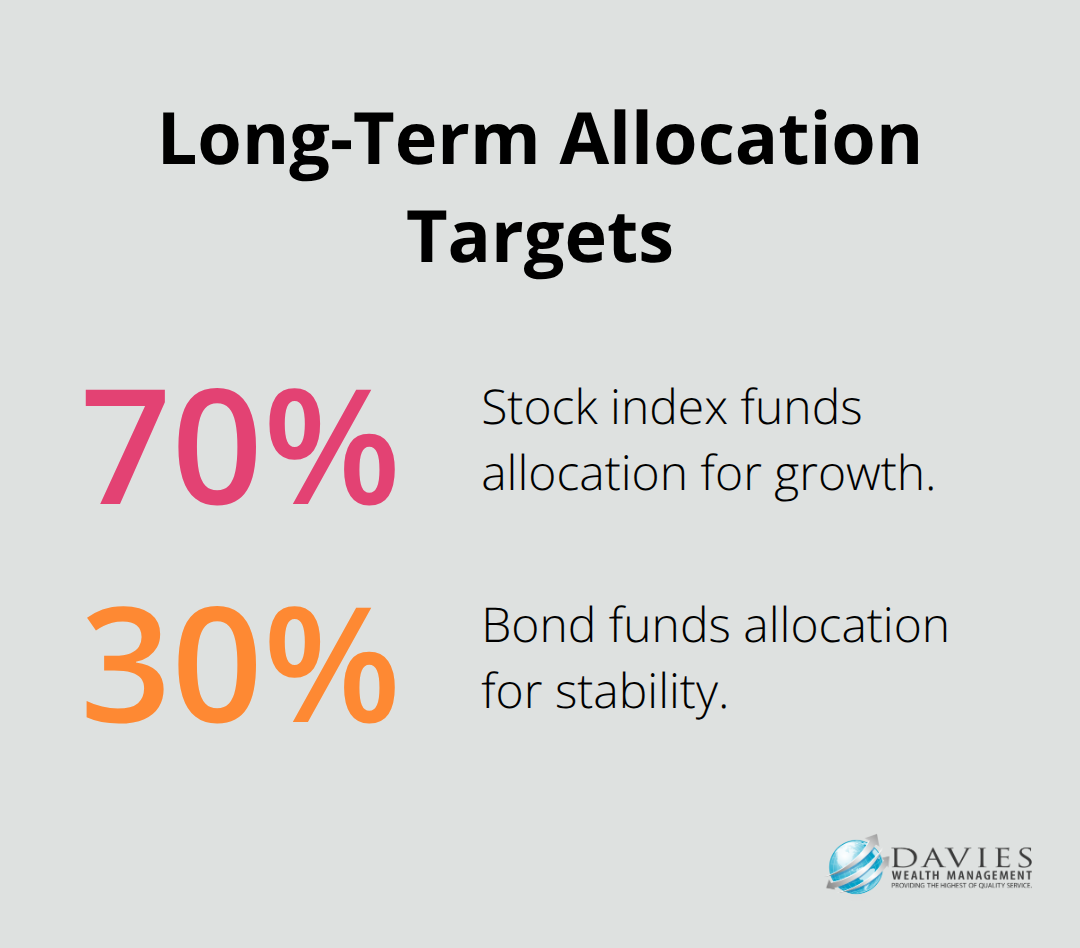

Build Wealth Through Strategic Asset Allocation

Allocate 70% of your portfolio to stock index funds and 30% to bond funds if you have 20+ years until retirement. Vanguard Total Stock Market Index and Total Bond Market Index provide instant diversification with expense ratios of 0.03%. Rebalance quarterly to maintain your target allocation and sell high-performance assets to buy underperformers.

This systematic approach captured 11.01% average annual returns over the past decade. Add international exposure through emerging markets funds and target 10-15% of your stock allocation to capture growth outside U.S. markets.

Smart investment choices create the foundation for wealth, but debt can destroy even the best portfolio returns. The next step involves aggressive debt elimination strategies that free up cash flow for additional investments.

How Do You Eliminate Debt and Build Financial Security?

Attack High-Interest Debt First for Maximum Impact

Credit card debt costs Stuart residents an average of 24.71% annually according to Federal Reserve data, which destroys wealth faster than most investments can build it. List all debts with balances, minimum payments, and interest rates. Pay minimums on everything, then throw every extra dollar at the highest-rate debt until it disappears. This debt avalanche method saves thousands in interest compared to equal payments across all debts. Personal loans from credit unions in Martin County offer rates between 8-12% for debt consolidation, which cuts credit card interest by more than half. Apply for consolidation loans only if you commit to close the paid-off credit cards immediately.

Build Your Emergency Fund Through Automatic Systems

Stuart’s cost of living requires emergency funds between $20,000-$35,000 for most households. Open a high-yield savings account at Ally Bank or Marcus by Goldman Sachs, which currently pay around 3.65% annually (compared to 0.4% at traditional banks). Set up automatic transfers of $500-$1,000 monthly from checking to emergency savings on payday. This systematic approach builds a six-month fund within 24-36 months without reliance on discipline.

Keep emergency money separate from checking accounts to prevent accidental spending on non-emergencies.

Protect Your Foundation With Strategic Insurance Coverage

Term life insurance costs around $26 monthly for healthy adults and protects families from financial devastation. Purchase coverage worth 10-12 times your annual income through employers or independent agents. Disability insurance replaces 60-70% of income if injuries prevent work, which matters more than life insurance for most working families. Umbrella policies provide $1 million in liability coverage for $200-$300 annually and protect assets from lawsuits. Review insurance annually because life changes like marriage, children, or home purchases require coverage adjustments that many Stuart residents overlook until problems arise.

Accelerate Debt Elimination With Extra Income

Side income from freelance work or part-time jobs accelerates debt payoff dramatically. Apply 100% of extra earnings to debt elimination rather than lifestyle upgrades. A $500 monthly side hustle eliminates $25,000 in credit card debt 3.5 years faster than minimum payments alone. Tax refunds, bonuses, and gift money should target debt reduction first before any discretionary spending. This aggressive approach frees up monthly cash flow that you can redirect toward investments and wealth accumulation once debts disappear.

Final Thoughts

Financial success in Stuart demands systematic execution of proven strategies rather than complex investment schemes. Track expenses meticulously, eliminate high-interest debt aggressively, and automate savings to build emergency funds worth six months of expenses. Max out tax-advantaged accounts like 401k plans and IRAs while you target Stuart’s real estate market for additional income streams.

Wealth consolidation becomes achievable when you combine disciplined budgets with strategic asset allocation across diversified portfolios. Most Stuart residents can build substantial wealth when they invest 15% of income consistently and rebalance quarterly to maintain target allocations. Professional guidance becomes valuable when your financial situation involves complex tax planning or estate considerations (especially for high-net-worth individuals).

We at Davies Wealth Management provide comprehensive wealth management solutions that include investment management, retirement planning, and tax-efficient strategies tailored to individual circumstances. Long-term wealth accumulation requires patience and consistency rather than market timing or speculative investments. Focus on controllable factors like expense reduction, debt elimination, and systematic investment while you avoid emotional decisions that derail financial progress.

Leave a Reply