STOCKS ADVANCE FOR 9th WEEK IN A ROW DESPITE WORRISOME MANUFACTURING, HOUSING, TRADE DEFICIT AND LABOR MARKET DATAWeekly Market Update — December 30, 2023 |

||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

Weekly Market Performance

*Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD. This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results. |

||||||||||||||||||||||||||||||||

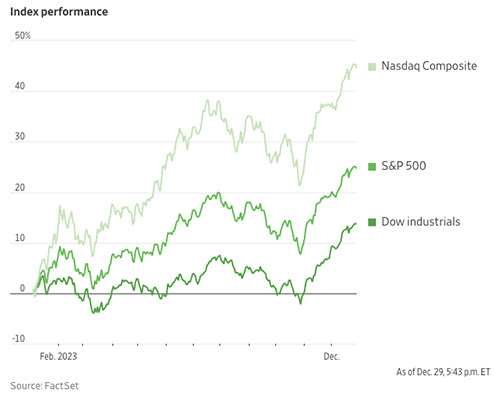

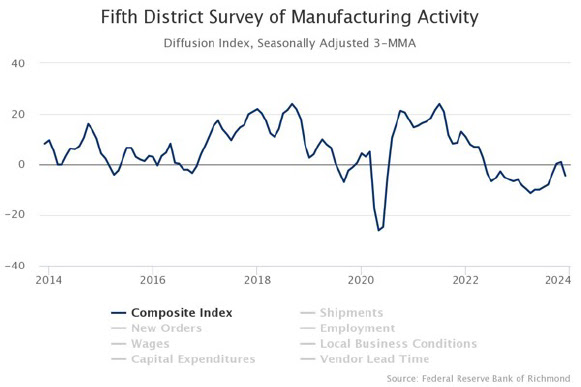

Stocks Advance for 9th Week in a RowEquity investors rejoiced again this week as Wall Street rose for the 9th consecutive week and built on its year-end rally, although the gains were muted relative to previous weeks. The 9th consecutive weekly gain for the S&P 500 Index is its longest since 2004 and it is less than 1% from its all-time high. The week closed out a strong year for all the major indexes, led by NASDAQ, which recorded its sixth-biggest annual gain since the index was launched in 1971. As happens every year, trading volumes and market action was soft most of the week, with trading closed Monday and many investors out of the office. From a macro perspective, there was a decent amount of data to report, but the manufacturing data in the mid-Atlantic region and Chicago region of the country was mostly sour. Specifically, the index of Mid-Atlantic manufacturing activity fell sharply in December and indicated the fastest pace of contraction since February. Then two days later, a similar index of business activity in the Chicago region came in much lower than expected as it moved back into contraction territory. |

||||||||||||||||||||||||||||||||

Economic Data This WeekBesides manufacturing data, there was a lot more economic data this week, covering the labor market, our trade deficit, wholesale and retail inventories and various aspects of the housing market, including that:

|

||||||||||||||||||||||||||||||||

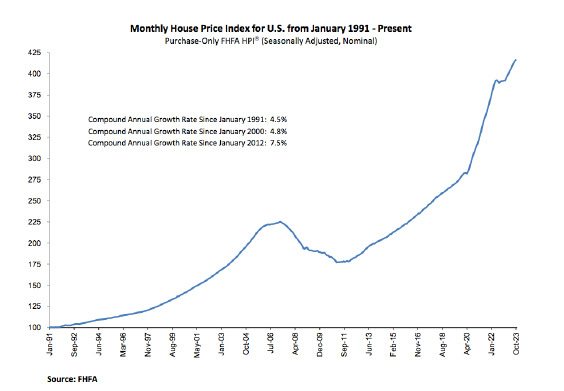

House Prices up 6.3% Over 12 MonthsOn Tuesday, the Federal Housing Finance Agency reported that U.S. house prices rose in October, up 0.3% from September. House prices rose 6.3% from October 2022 to October 2023. The previously reported 0.6% price increase in September was revised to a 0.7% increase. For the nine census divisions, seasonally adjusted monthly price changes from September 2023 to October 2023 ranged from -0.3 percent in the New England division to +1.1 percent in the Middle Atlantic division. The 12-month changes ranged from +2.6 percent in the Mountain division to +9.9 percent in the Middle Atlantic division. “U.S. house price gains remained strong over the last 12 months.” said Dr. Nataliya Polkovnichenko, Supervisory Economist in FHFA’s Division of Research and Statistics. “On a monthly basis, price appreciation moderated in October, with four divisions exhibiting slowdowns from the previous month.” |

||||||||||||||||||||||||||||||||

| Sources

census.gov;richmondfed.org;fhfa.gov;msci.com;fidelity.com;nasdaq.com;wsj.com; morningstar.com; |

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ LET’S GET SOCIAL

Facebook: https://www.facebook.com/DaviesWealthManagement

Twitter: https://twitter.com/TDWealthNet

Linkedin: https://www.linkedin.com/in/daviesrthomas

Youtube Channel: https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

**Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply