Tax planning strategies can make a significant difference in your financial well-being. At Davies Wealth Management, we understand the importance of smart tax planning to maximize your savings and secure your financial future.

In this post, we’ll explore effective techniques to optimize your tax situation, from understanding deductions and credits to implementing tax-efficient investment strategies. By applying these methods, you can potentially reduce your tax burden and keep more of your hard-earned money.

What’s Your Tax Situation?

Income Sources Matter

The first step in assessing your tax situation requires you to identify all your income sources. This includes your salary, investment income, rental income, and any side hustles. Each type of income faces different tax treatment. For example, in 2025, long-term capital gains will incur taxes at 0%, 15%, or 20% (depending on your income level), while short-term gains will face taxation as ordinary income. This knowledge empowers you to make strategic decisions about when to sell investments.

Deductions and Credits: Your Tax-Saving Tools

Deductions and credits can slash your tax bill. Common deductions include mortgage interest, state and local taxes, and charitable contributions. For the 2025 tax year, the standard deduction rises to $30,000 for married couples filing jointly. If your itemized deductions exceed these amounts, itemizing could save you more money.

Tax credits prove even more valuable as they directly reduce your tax bill dollar-for-dollar. The Child Tax Credit, for instance, can provide up to $2,000 per qualifying child. The American Opportunity Tax Credit offers up to $2,500 per eligible student for education expenses. These credits can make a substantial difference in your overall tax liability.

Your Tax Bracket: A Key Factor

Your tax bracket plays a vital role in effective tax planning. For 2025, seven federal tax brackets range from 10% to 37%, with the top rate applying to individual single taxpayers with incomes greater than $626,350. These marginal rates only apply to income within that specific bracket.

Knowing your bracket helps you make strategic decisions. For example, if you find yourself near the top of your current bracket, you might consider deferring income to the next year or increasing your retirement contributions to lower your taxable income.

Professional Athletes and Unique Tax Challenges

Professional athletes often face complex tax situations due to multiple income streams and short career spans. Their income can fluctuate significantly from year to year, and they may earn money in multiple states (or even countries). This complexity requires specialized tax planning strategies to maximize savings and ensure long-term financial stability.

The Importance of Tailored Tax Strategies

Every individual’s financial picture differs, which necessitates a personalized approach to tax planning. Factors such as your career, investment portfolio, family situation, and long-term financial goals all influence your optimal tax strategy. A one-size-fits-all approach often fails to capture the nuances of your unique situation.

As we move forward, we’ll explore how to maximize deductions and credits to further reduce your tax burden and keep more of your hard-earned money in your pocket.

How to Maximize Your Tax Deductions and Credits

At Davies Wealth Management, we know that maximizing deductions and credits is a key aspect of effective tax planning. This strategy can significantly reduce your tax liability and increase your overall savings. Let’s explore some key ways to optimize your tax situation.

Standard Deduction vs. Itemizing

For the 2025 tax year, the standard deduction is set at $30,000 for married couples filing jointly. If your itemized deductions don’t exceed this amount, you should take the standard deduction. However, if your itemized deductions surpass the standard deduction, itemizing could lead to substantial tax savings.

Common itemized deductions include mortgage interest, state and local taxes (SALT), and charitable contributions. The SALT deduction is capped at $10,000, which can impact high-income earners in states with high tax rates. If you’re close to the threshold, consider bunching deductions by making two years’ worth of charitable contributions in a single year to push you over the itemization limit.

Often Overlooked Deductions

Many taxpayers miss out on valuable deductions simply because they’re unaware of them. For instance, self-employed individuals can deduct health insurance premiums for themselves and their families. Educators can deduct up to $300 for out-of-pocket classroom expenses. If you’ve moved for a new job, you might be able to deduct moving expenses (if you meet certain criteria).

Another often-overlooked deduction is the home office deduction for self-employed individuals. If you use a portion of your home exclusively for business purposes, you may be able to deduct a percentage of your mortgage interest, property taxes, utilities, and maintenance costs.

Powerful Tax Credits

Tax credits are even more valuable than deductions because they directly reduce your tax bill dollar-for-dollar. The Child Tax Credit (worth up to $2,000 per qualifying child) is a significant benefit for families. For those pursuing higher education, the American Opportunity Tax Credit offers up to $2,500 per eligible student for education expenses.

The Earned Income Tax Credit (EITC) is another powerful credit designed to benefit low to moderate-income workers. The credit amount varies based on income, filing status, and number of children. For the 2025 tax year, the maximum EITC amount for families with three or more children is $7,430.

Specialized Tax Planning for Athletes

Professional athletes often face complex tax situations due to multiple income streams and short career spans. Their income can fluctuate significantly from year to year, and they may earn money in multiple states (or even countries). This complexity requires specialized tax planning strategies to maximize savings and ensure long-term financial stability.

The Importance of Professional Guidance

Tax laws change frequently, and what worked last year might not be the best strategy this year. That’s why it’s important to work with experienced professionals who stay up-to-date with the latest tax regulations and can provide personalized advice tailored to your specific situation. As we move forward, we’ll explore tax-efficient investment strategies that can further optimize your financial position and help you keep more of your hard-earned money.

How to Invest Tax-Efficiently

Leverage Tax-Advantaged Accounts

Tax-advantaged accounts serve as powerful tools for efficient investing. In 2025, you can contribute up to $23,500 to a 401(k) plan (with an additional $7,500 catch-up contribution for those 50 or older). These contributions reduce your taxable income for the year, potentially lowering your tax bracket.

Individual Retirement Accounts (IRAs) offer another avenue for tax-advantaged investing. Traditional IRAs allow for tax-deductible contributions (subject to income limits), while Roth IRAs offer tax-free growth and withdrawals in retirement. The contribution limit for IRAs in 2025 stands at $7,000 (with an additional $1,000 catch-up contribution for those 50 and older).

Health Savings Accounts (HSAs) provide a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2025, individuals can contribute up to $4,150, and families can contribute up to $8,300 to an HSA.

Master Capital Gains and Losses

Understanding capital gains taxation proves essential for tax-efficient investing. Long-term capital gains (assets held for more than a year) incur taxes at preferential rates of 0%, 15%, or 20%, depending on your income. Short-term gains face taxation as ordinary income, which can reach up to 37% for high earners.

Tax-loss harvesting involves offsetting capital gains with capital losses. This strategy can lower your tax bill and better position your portfolio going forward. For example, if you have $10,000 in capital gains and $8,000 in realized losses, you’ll only pay taxes on $2,000 of gains. You can even deduct up to $3,000 of net losses against your ordinary income.

The wash-sale rule warrants attention. If you sell a security at a loss and buy the same or a “substantially identical” security within 30 days before or after the sale, the IRS will disallow the loss for tax purposes.

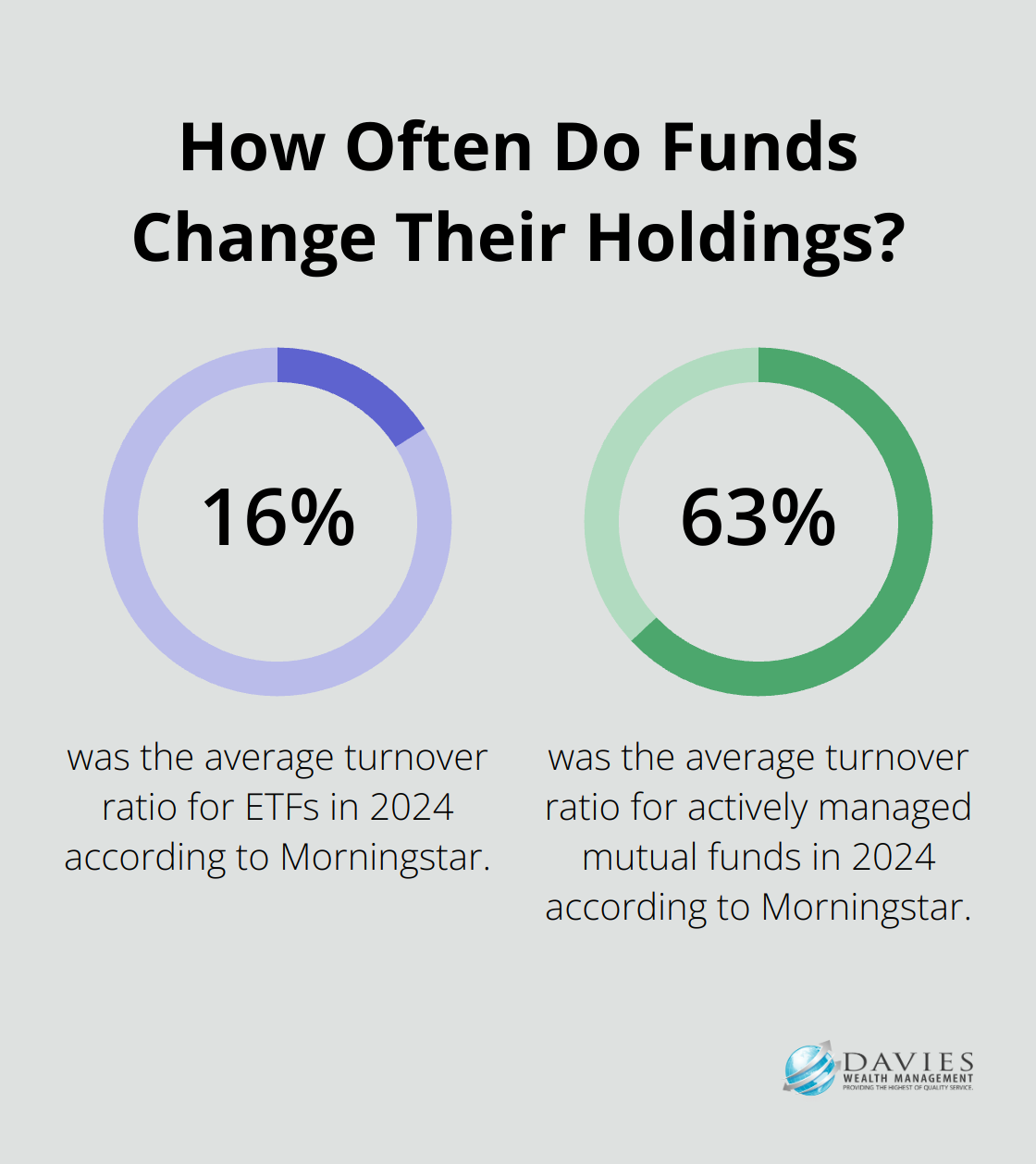

Choose Tax-Efficient Investment Vehicles

Your choice of investments can significantly impact your tax bill. Exchange-Traded Funds (ETFs) generally offer more tax efficiency than actively managed mutual funds due to their structure and lower turnover. In 2024, the average ETF had a turnover ratio of 16%, compared to 63% for actively managed mutual funds (according to Morningstar).

Municipal bonds can benefit high-income investors. Mostly due to their tax benefits, munis yield less than comparable bonds that are subject to income taxes. While yields might be lower than taxable bonds, the after-tax return can exceed that of other options for investors in high tax brackets.

For taxable accounts, tax-managed funds aim to minimize distributions of capital gains and dividends. These funds employ various strategies to reduce taxable events, potentially leading to higher after-tax returns.

Tailor Your Strategy

Your unique financial situation demands a personalized approach to tax-efficient investing. High-income professionals, business owners, and professional athletes often face complex tax scenarios that require specialized strategies. Try to work with experienced financial advisors who can navigate these intricacies and maximize your wealth-building potential.

Final Thoughts

Effective tax planning strategies can significantly impact your financial well-being and potentially save you thousands of dollars each year. Understanding your tax situation, maximizing deductions and credits, and implementing tax-efficient investment strategies will help you keep more of your hard-earned money. These actions will accelerate your progress toward your financial goals.

Tax laws change frequently, making it essential to stay informed about updates that could affect your financial plan. What worked last year might not be the optimal approach this year, so you should review and adjust your tax strategy regularly. Working with a qualified tax advisor can provide personalized guidance tailored to your unique financial situation (including complex scenarios faced by business owners and athletes).

At Davies Wealth Management, we specialize in developing comprehensive financial plans that incorporate tax-efficient strategies. Our team works diligently to create personalized solutions that align with your goals and maximize your financial potential. For expert guidance on tax planning strategies and comprehensive wealth management, visit Davies Wealth Management to learn how we can help you secure your financial future.

Leave a Reply