Retirement income planning in Stuart, Florida presents unique challenges and opportunities for local residents. The city’s distinctive financial landscape requires tailored strategies to ensure a comfortable retirement.

At Davies Wealth Management, we understand the specific factors that influence retirement planning in this area. Our expert advice can help you navigate the complexities of creating a robust retirement income plan that addresses Stuart’s cost of living, healthcare expenses, and potential natural disaster risks.

What Makes Stuart’s Retirement Landscape Unique?

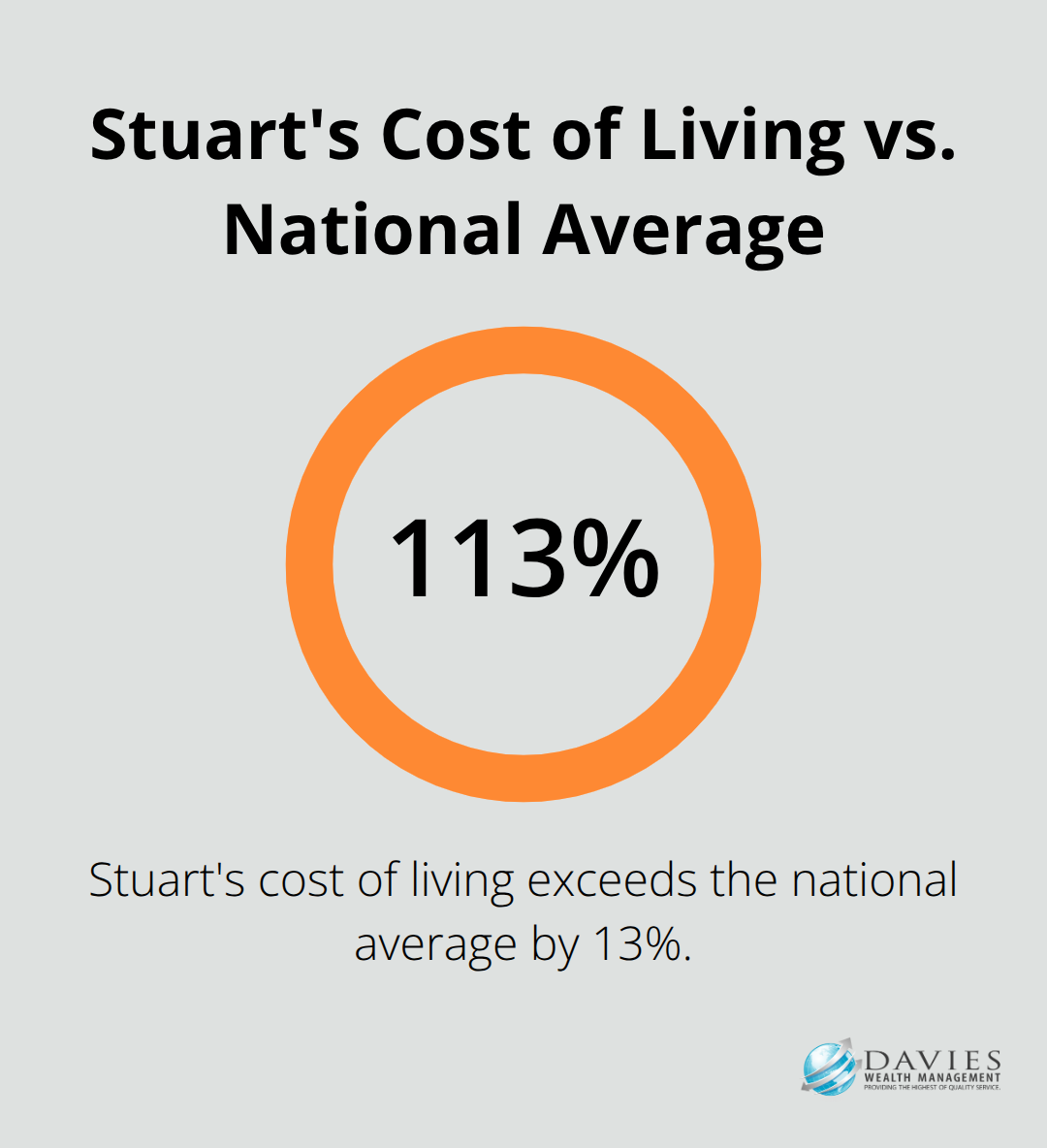

Stuart’s Cost of Living and Housing Market

Stuart, Florida’s retirement landscape stands out due to its distinct local economy, demographics, and geographical features. The cost of living in Stuart exceeds the national average by about 13%, which significantly affects retirement planning. Housing costs play a central role in this equation. With home prices down 32.1% compared to last year, selling for a median price of $241K, Stuart offers more affordable housing options compared to many other parts of Florida. This situation presents both opportunities and challenges for retirees. While lower housing costs can extend retirement savings, it’s important to account for potential property tax increases and maintenance costs associated with Florida’s climate.

Healthcare Considerations in Stuart

Healthcare forms a critical component of retirement planning, and Stuart offers unique considerations in this area. Assisted living costs in Stuart can range from about $4,000 to $8,000 per month, depending on the specific facility and level of care needed. However, memory care costs in Stuart average $6,301 monthly, surpassing the national median of $5,200. These figures highlight the necessity to incorporate healthcare costs into your retirement income strategy.

Stuart’s Tax-Friendly Environment

Florida’s tax structure provides significant benefits to retirees in Stuart. The absence of state income tax means Social Security retirement benefits, pension income, and income from an IRA or a 401(k) are all untaxed at the state level. Property taxes in Florida average 0.79% of a home’s assessed value (with rates varying by county). Additionally, Stuart homeowners may qualify for a homestead exemption of up to $50,000, potentially reducing their property tax burden. These tax advantages can substantially impact your retirement income planning, allowing for more flexible budgeting and potentially higher disposable income.

Climate and Lifestyle Factors

Stuart’s climate and lifestyle offerings contribute to its appeal as a retirement destination. Known as the “Sailfish Capital of the World,” Stuart provides ample opportunities for fishing and water-related activities. The city’s pedestrian-friendly downtown enhances quality of life, offering easy access to shops, restaurants, and parks. However, it’s important to consider the potential impact of Florida’s hurricane season on property maintenance and insurance costs.

Local Economic Trends

Understanding Stuart’s local economic trends can help shape effective retirement strategies. The city’s typical household income of around $53,829 offers a reasonable standard of living for many residents. However, retirees should consider how local economic factors might affect their retirement income over time. Factors such as tourism trends, real estate market fluctuations, and changes in local industries can all influence the cost of living and financial planning needs.

These unique aspects of Stuart’s retirement landscape underscore the importance of tailored financial strategies. A comprehensive retirement income plan should account for Stuart’s specific cost of living, healthcare expenses, tax advantages, lifestyle opportunities, and local economic trends. The next section will explore the essential components of a robust retirement income plan tailored to Stuart’s distinctive environment.

Building a Resilient Retirement Income Plan in Stuart

Creating a robust retirement income plan in Stuart, FL requires a strategic approach that accounts for the city’s unique economic environment. A well-structured plan will help you build a resilient financial foundation for your retirement years.

Diversify Your Income Streams

One of the most effective ways to ensure financial stability in retirement is to diversify your income sources. In Stuart’s dynamic economic landscape, relying on a single income stream can expose you to unnecessary risk. Consider a mix of:

- Social Security benefits

- Retirement account withdrawals (401(k)s, IRAs)

- Pension payments (if applicable)

- Rental income from investment properties

- Part-time work or consulting gigs

A new report from the National Institute on Retirement Security indicates that about 40% of older Americans rely solely on Social Security for retirement income. This approach can leave you vulnerable to economic fluctuations. A diversified income strategy creates a more stable financial base.

Optimize Social Security Benefits

While Social Security shouldn’t be your only income source, it’s important to maximize these benefits. The age at which you start claiming Social Security can significantly impact your monthly payments. In Stuart, where the cost of living exceeds the national average by 13%, every dollar counts.

If you postpone claiming benefits beyond full retirement age, your monthly payment could increase by a certain percentage for each month you delay. This boost can make a substantial difference in your long-term financial security.

Manage Retirement Assets in Stuart’s Economy

Stuart’s unique economic environment requires careful management of your retirement assets. Here are some strategies to consider:

- Real Estate Investments: Stuart’s housing market shows some volatility (home values down 6.3% over the past year), which may present opportunities for savvy investors. However, you must factor in potential property tax increases and maintenance costs.

- Tax-Efficient Withdrawals: Florida’s tax-friendly environment for retirees means you can potentially keep more of your retirement income. Develop a withdrawal strategy that minimizes your overall tax burden.

- Healthcare Planning: With memory care costs in Stuart averaging $6,301 monthly, it’s essential to incorporate healthcare expenses into your retirement plan. Consider long-term care insurance or set aside a dedicated healthcare fund.

- Inflation Protection: Stuart’s cost of living exceeds the national average, so protecting your purchasing power is vital. Try investments that have historically outpaced inflation, such as certain types of bonds or dividend-growing stocks.

- Emergency Fund: Florida’s hurricane season can bring unexpected expenses. Maintain a robust emergency fund to cover potential property damage or evacuation costs.

These strategies can help you create a retirement income plan tailored to Stuart’s unique financial landscape. However, retirement planning is not a one-size-fits-all process. It’s beneficial to work with a financial advisor who understands the local economic conditions and can help you navigate the complexities of retirement planning in Stuart, FL. The next section will explore how to address specific retirement challenges unique to Stuart’s environment.

How Stuart Retirees Can Overcome Local Challenges

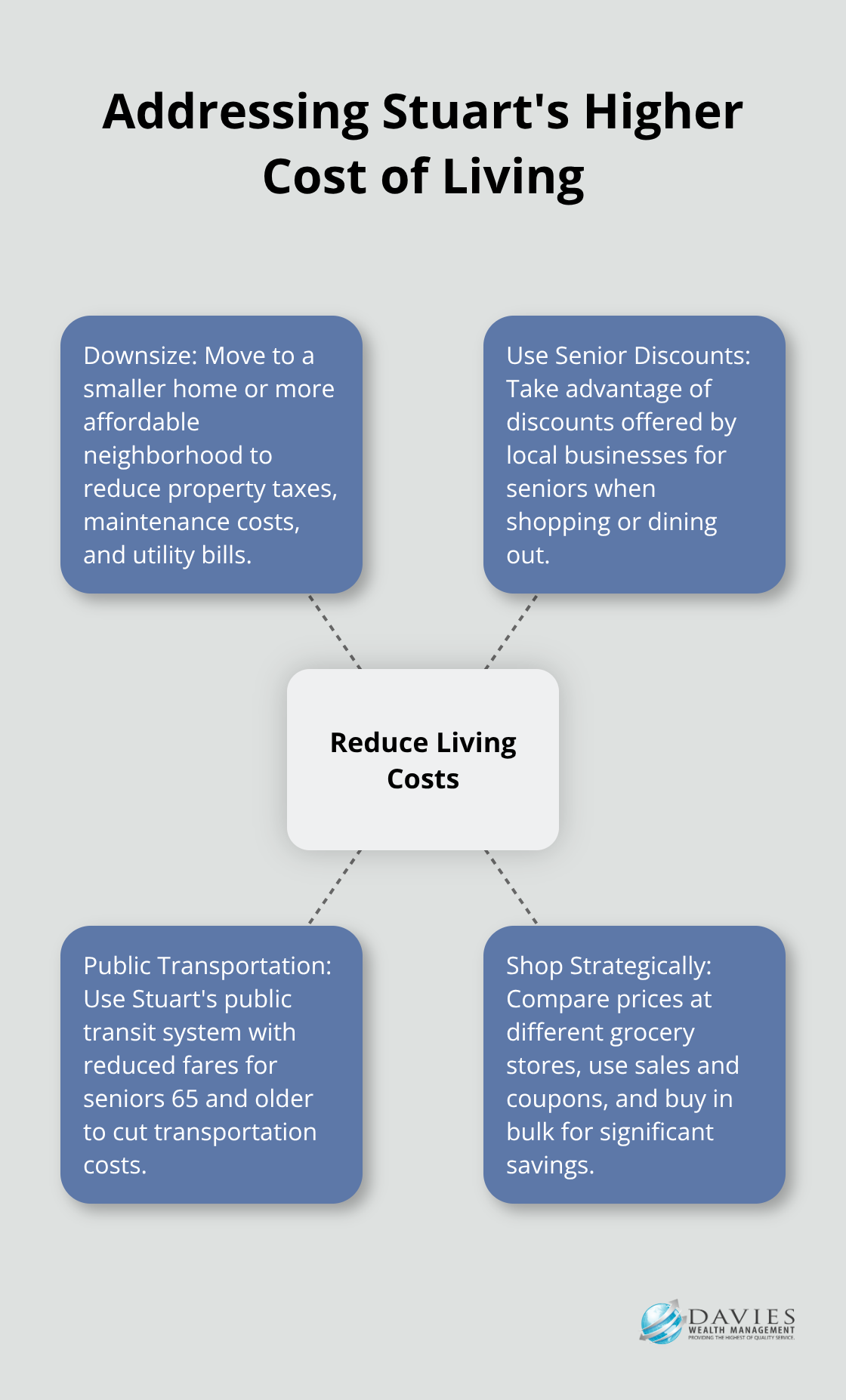

Addressing Stuart’s Higher Cost of Living

Stuart’s cost of living exceeds the national average by 13%, which can put pressure on retirement budgets. To combat this, retirees can:

- Downsize: Move to a smaller home or a more affordable neighborhood. This action can reduce property taxes, maintenance costs, and utility bills.

- Use senior discounts: Many local businesses offer discounts for seniors. Ask about these opportunities when shopping or dining out.

- Use public transportation: Stuart’s public transit system can help cut transportation costs. Seniors 65 and older qualify for reduced fares.

- Shop strategically: Compare prices at different grocery stores and use sales and coupons. Buying in bulk often leads to significant savings.

Handling Healthcare Expenses in Retirement

Healthcare costs can quickly deplete retirement savings. In Stuart, where memory care costs average $6,301 monthly, planning for these expenses is essential. Retirees should consider:

- Long-term care insurance: This can cover costs not typically included in Medicare, such as assisted living or in-home care.

- Maximizing Medicare benefits: Understand what your Medicare plan covers and consider a supplemental plan to fill any gaps.

- Health Savings Account (HSA): If still working, contribute to an HSA. These accounts offer triple tax benefits and can be used for healthcare expenses in retirement.

- Prioritize health: Regular exercise, a balanced diet, and preventive care can help reduce long-term healthcare costs.

Protecting Assets from Natural Disasters

Stuart’s coastal location makes it vulnerable to hurricanes and flooding. To safeguard assets from these risks:

- Review insurance coverage: Ensure your homeowner’s insurance adequately covers potential hurricane damage. Consider additional flood insurance (standard policies often exclude this coverage).

- Build an emergency fund: Set aside 3-6 months of living expenses in an easily accessible account to cover unexpected costs or temporary relocation.

- Invest in home improvements: Hurricane-resistant windows, reinforced garage doors, and a properly secured roof can protect your home (and potentially lower insurance premiums).

- Diversify your investment portfolio: Include investments not tied to local real estate to spread your risk.

Leveraging Stuart’s Tax Advantages

Florida’s tax-friendly environment offers significant benefits to Stuart retirees:

- No state income tax: This means distributions from pensions, 401(k)s, 403(b)s and IRAs are not taxed at the state or local level.

- Property tax benefits: Florida homeowners may qualify for a homestead exemption of up to $50,000, potentially reducing their property tax burden.

- Tax-efficient withdrawal strategies: Develop a plan that minimizes your overall tax burden, taking advantage of Florida’s tax structure.

Embracing Stuart’s Lifestyle Opportunities

Stuart offers unique lifestyle benefits that can enhance retirement:

- Outdoor activities: Known as the “Sailfish Capital of the World,” Stuart provides ample opportunities for fishing and water-related activities.

- Community engagement: Stuart’s pedestrian-friendly downtown offers easy access to shops, restaurants, and parks, fostering an active retirement lifestyle.

- Cultural experiences: Engage in local events, museums, and theaters to enrich your retirement years without excessive spending.

By embracing innovation and adapting to local challenges, Stuart retirees can overcome obstacles and enjoy a fulfilling retirement in this beautiful coastal city.

Final Thoughts

Retirement income planning in Stuart, Florida demands a tailored approach to address the city’s unique financial landscape. Stuart residents must consider the higher cost of living, healthcare expenses, and potential natural disaster risks when creating their retirement strategies. We recommend diversifying income streams, optimizing Social Security benefits, and aligning asset management with local economic conditions to build a robust financial plan.

Stuart’s tax-friendly environment offers significant advantages for retirees, including no state income tax and potential property tax benefits. Residents can maximize these benefits through tax-efficient withdrawal strategies and careful financial planning. Professional guidance can prove invaluable in navigating the complexities of retirement income planning in Stuart, Florida.

At Davies Wealth Management, we specialize in helping Stuart residents create personalized retirement plans that address their specific needs and goals. Our team of experts understands the local economic landscape and can provide tailored advice to help you secure your financial future. We invite you to contact us for assistance in building a retirement plan that allows you to enjoy the lifestyle you’ve always envisioned in beautiful Stuart, Florida.

Leave a Reply