Retirement healthcare costs can be a significant financial burden for many retirees. At Davies Wealth Management, we understand the importance of planning for these expenses to ensure a comfortable and secure retirement.

This guide will provide you with practical strategies to estimate, budget, and fund your healthcare costs in retirement. We’ll explore current trends, funding options, and tools to help you make informed decisions about your financial future.

What Are Retirement Healthcare Costs in 2025?

The Current Landscape of Retirement Healthcare Expenses

Healthcare costs in retirement represent a significant financial consideration that many people underestimate. In 2025, the landscape of retirement healthcare expenses continues to evolve, presenting both challenges and opportunities for retirees.

According to Fidelity Investments, the average 65-year-old couple today will spend around $12,800 on health care in their first year of retirement. This figure represents a substantial portion of many retirees’ savings and highlights the importance of thorough financial planning.

Breaking Down Retirement Healthcare Expenses

The healthcare cost estimate includes various healthcare-related costs. Medicare Part A covers hospital stays, while Part B handles outpatient services and preventive care. Part D is essential for managing prescription drug costs. However, these plans don’t cover everything, leaving retirees responsible for deductibles, copayments, and services not covered by Medicare.

For instance, in 2025, the standard monthly premium for Medicare Part B will be $185.00, an increase of $10.30 from $174.70 in 2024. Additionally, Medicare Part A requires a deductible for each inpatient hospital benefit period. These out-of-pocket expenses can quickly add up, especially for those with chronic health conditions or those who require frequent medical care.

Factors Influencing Healthcare Costs in Retirement

Several factors contribute to the high cost of healthcare in retirement:

- Increasing life expectancy: The average life expectancy for a 65-year-old is approximately 81.95 years, meaning retirees should prepare for potentially 30-plus years of retirement and associated healthcare costs.

- Rising cost of medical care and prescription drugs: Healthcare costs have increased at rates 1.5 to 2 times higher than general inflation, putting additional pressure on retirement budgets.

- Geographic location: Costs can vary widely depending on where you live, with some states having significantly higher healthcare costs than others. This variation makes it essential to consider healthcare expenses when deciding where to retire.

Looking Ahead: Healthcare Cost Trends

We anticipate that healthcare costs will continue to rise. The trend of healthcare inflation outpacing general inflation is likely to persist, making it important for individuals to factor these increasing costs into their retirement plans.

One positive development is the implementation of the Inflation Reduction Act, which provides for a delay in selecting drugs for negotiation if they are biological products. This change could provide some relief for retirees with high prescription drug expenses.

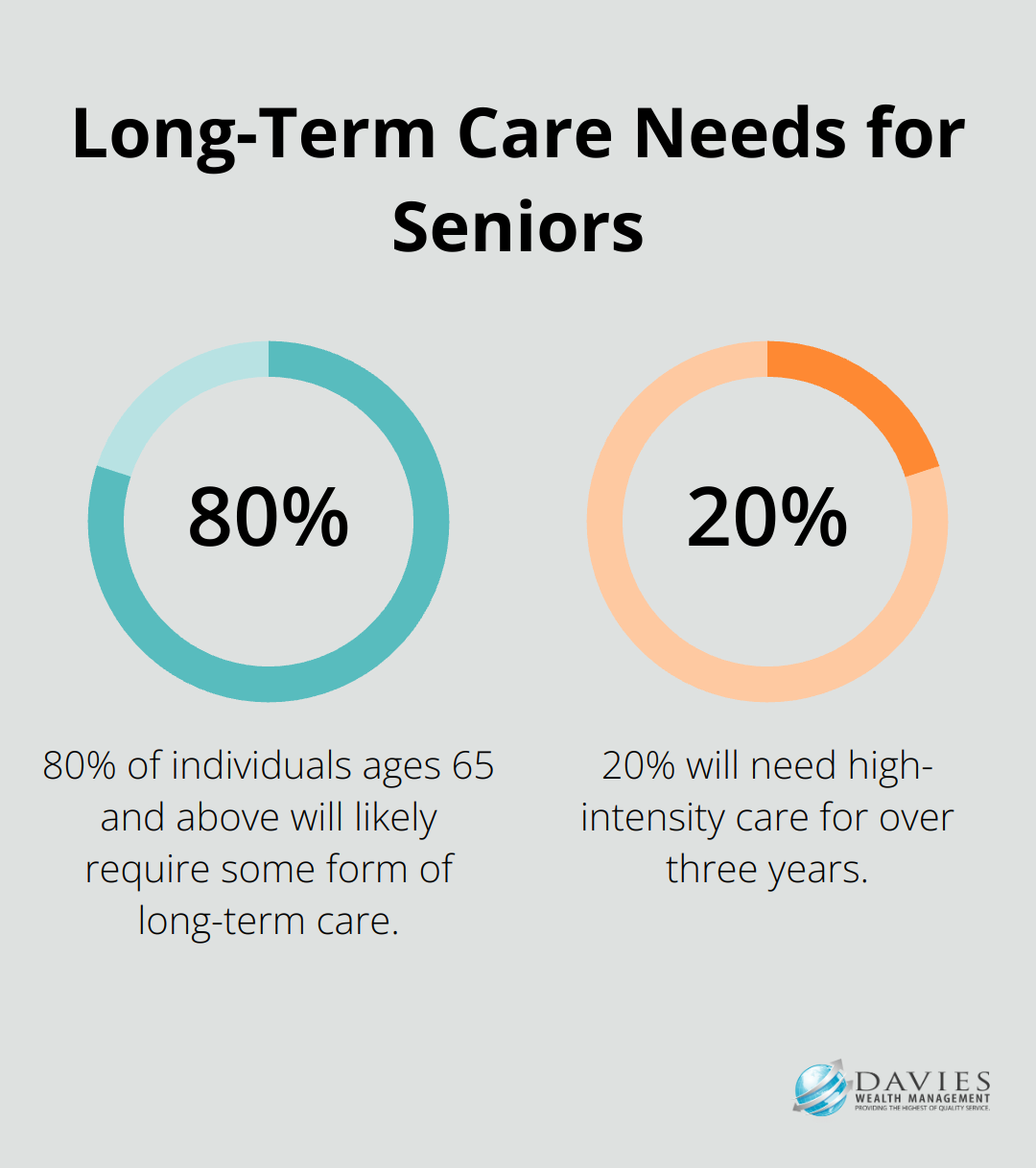

However, long-term care costs remain a significant concern. About 80% of individuals ages 65 and above will likely require some form of long-term care, and nearly 20% will need high-intensity care for over three years. The annual cost for a semi-private room in a nursing home is projected to be around $110,360 in 2025, a figure that’s expected to continue rising in the coming years.

As we move forward, it’s clear that planning for healthcare costs in retirement requires a comprehensive approach. In the next section, we’ll explore strategies for estimating and budgeting these expenses to help you prepare for a financially secure retirement.

How to Estimate and Budget for Healthcare Costs

Utilize Healthcare Cost Calculators

To start estimating your healthcare costs, use online calculators. The AARP Health Care Costs Calculator provides personalized cost estimates based on your health status, location, and coverage choices. Fidelity’s Retiree Health Care Cost Estimate tool offers insights into potential expenses.

These calculators give you a baseline figure, but remember that they provide estimates based on averages. Your actual costs may vary depending on your specific health needs and lifestyle choices.

Account for Inflation and Policy Changes

Healthcare costs will continue their historical trend of rising at a rate 2-2.5 times that of U.S. inflation. When you budget, assume healthcare expenses will increase accordingly. This approach creates a buffer in your retirement plan.

Policy changes can significantly impact healthcare costs. The Inflation Reduction Act’s provisions for Medicare drug price negotiations could lead to savings for some retirees. Stay informed about potential policy shifts and adjust your estimates accordingly.

Integrate Healthcare into Your Retirement Plan

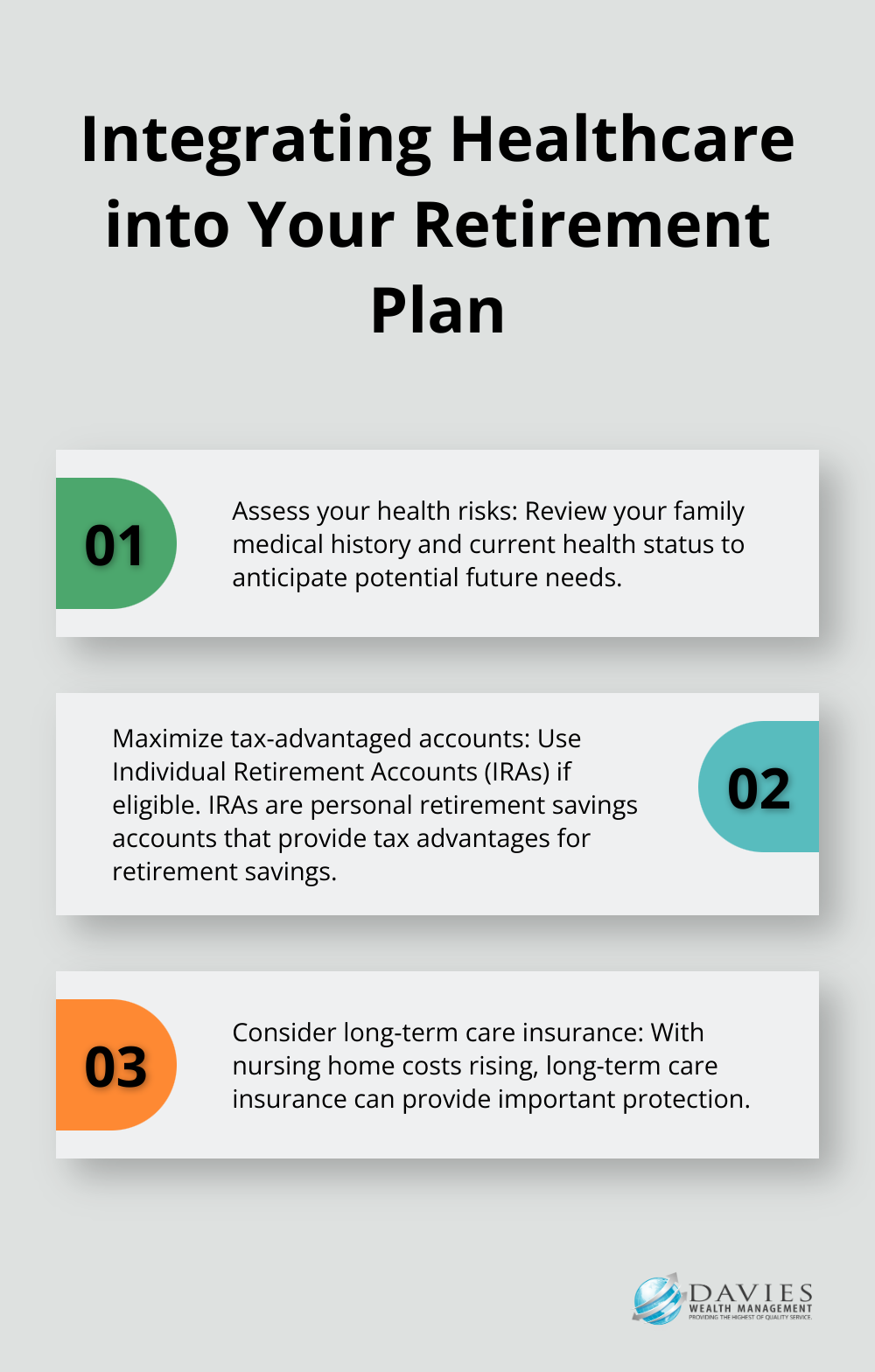

To effectively incorporate healthcare costs into your overall retirement plan, follow these steps:

Seek Professional Guidance

Professional financial advisors can provide valuable insights and strategies for managing healthcare costs in retirement. They can help you create a comprehensive plan that accounts for your unique circumstances and goals.

For example, Davies Wealth Management specializes in creating retirement plans that account for healthcare costs. Their expertise in managing finances for professional athletes (who often face unique healthcare challenges due to their careers) translates into robust strategies for all clients.

A proactive approach to estimating and budgeting for healthcare costs prepares you for a financially secure retirement. The next section will explore various funding options to help you cover these expenses effectively.

How to Fund Healthcare Expenses in Retirement

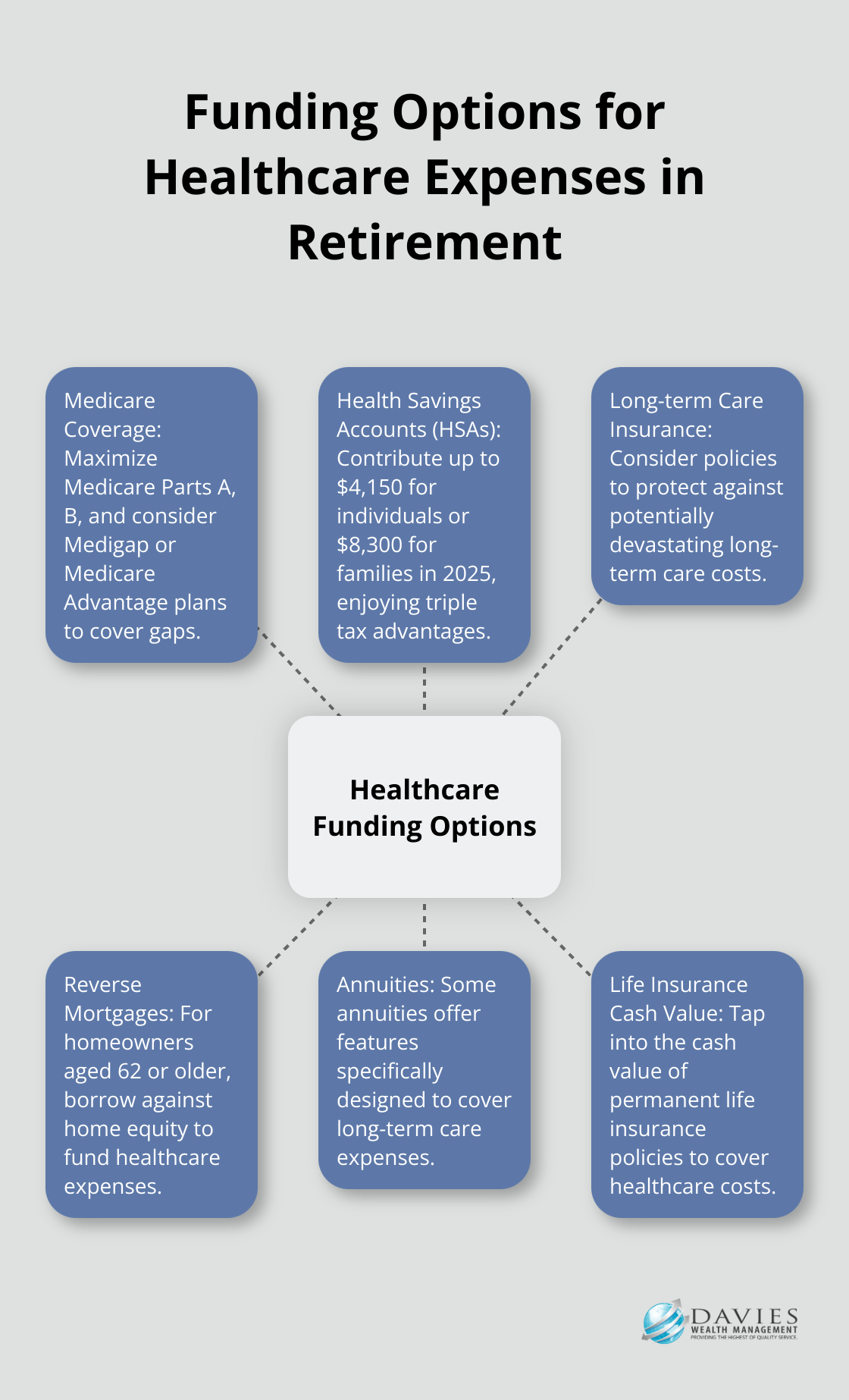

Maximize Medicare Coverage

Medicare forms the foundation of healthcare coverage for most retirees. However, it’s important to understand its limitations. Original Medicare (Parts A and B) covers many healthcare services, but it doesn’t cover everything. For example, in 2025, the standard monthly premium for Medicare Part B will be $185.00 (an increase from previous years).

To address gaps in Medicare coverage, consider a Medicare Supplement (Medigap) policy or a Medicare Advantage plan. These can help cover out-of-pocket costs such as deductibles, copayments, and coinsurance. When you choose between these options, factor in your health needs, budget, and preferred healthcare providers.

Use Health Savings Accounts

Health Savings Accounts (HSAs) serve as powerful tools for funding healthcare expenses in retirement. If you qualify for an HSA, maximize your contributions while you’re still working. In 2025, individuals can contribute up to $4,150, and families can contribute up to $8,300 to their HSAs.

The triple tax advantage of HSAs makes them particularly attractive. Contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are tax-free. After age 65, you can use HSA funds for non-medical expenses without penalty (although you’ll pay income tax on those withdrawals).

Plan for Long-Term Care Needs

Long-term care represents a significant expense that Medicare doesn’t cover. About 70% of seniors will need some type of long-term care during their lives.

Long-term care insurance can protect your assets from these potentially devastating costs. The American Association for Long-Term Care Insurance reports that the average annual premium for a couple aged 55 is about $3,050. While this represents a substantial expense, it’s important to weigh it against the potential cost of long-term care (which can exceed $100,000 per year for a private room in a nursing home).

As an alternative, some life insurance policies offer long-term care riders. These hybrid policies can provide both death benefits and long-term care coverage, offering flexibility in how you use your benefits.

Explore Additional Funding Options

Beyond traditional methods, explore other avenues to fund healthcare expenses in retirement. These may include:

Seek Professional Guidance

Navigating the complexities of healthcare funding in retirement can prove challenging. A financial advisor can provide valuable insights and strategies tailored to your specific situation. They can help you create a comprehensive plan that accounts for your unique circumstances and goals.

Professional wealth management firms (such as Davies Wealth Management) specialize in creating retirement plans that account for healthcare costs. Their expertise in managing finances for various clients, including professional athletes who often face unique healthcare challenges, translates into robust strategies for all clients.

Final Thoughts

Planning for retirement healthcare costs requires a proactive approach. The landscape of healthcare expenses in retirement presents complex challenges, but early preparation can lead to a secure financial future. We recommend the use of health savings accounts, maximization of Medicare coverage, and consideration of long-term care needs to better prepare for these expenses.

Regular reviews and adjustments to your retirement plan will help you adapt to evolving health needs and healthcare landscapes. At Davies Wealth Management, we offer personalized strategies to ensure your retirement plan accounts for potential healthcare costs while aligning with your overall financial goals. Our expertise extends to serving professional athletes, whose unique financial situations often mirror the challenges many retirees face in managing healthcare expenses.

Don’t let retirement healthcare costs catch you off guard. Take control of your financial future by working with experienced professionals who understand the nuances of retirement planning. Davies Wealth Management can help you create a comprehensive retirement plan that addresses healthcare costs and other critical aspects of your financial life.

Leave a Reply