Stuart’s crypto regulations have become increasingly complex as federal and state authorities tighten oversight. The regulatory landscape shifts monthly, creating compliance challenges for local investors.

We at Davies Wealth Management see clients struggling with tax reporting requirements and documentation standards. Understanding these rules protects your investments and prevents costly penalties.

What Laws Apply to Stuart Crypto Holders

Federal Tax Requirements Hit Hard

Stuart residents face stringent federal reporting requirements that catch many off guard. You may have to report transactions with digital assets such as cryptocurrency and non fungible tokens (NFTs) on your tax return, while any crypto-to-crypto trades trigger taxable events regardless of dollar amounts. According to Chainalysis data, Americans traded over $1 trillion in digital assets in 2024, yet most investors underreport their obligations.

Florida imposes no state income tax on crypto gains, which gives Stuart residents a significant advantage over investors in high-tax states like California or New York. However, federal capital gains rates still apply: 0%, 15%, or 20% depending on your income bracket. Short-term trades face ordinary income rates up to 37%, which makes holding periods critical for tax optimization.

The number 0% seems to be not appropriate for this chart. Please use a different chart type.

Business Registration Creates Compliance Burdens

Crypto businesses that operate in Stuart must navigate multiple regulatory layers. Virtual Asset Service Providers need federal FinCEN registration as Money Service Businesses, plus Florida state licensing through the Office of Financial Regulation. The compliance costs typically range from $50,000 to $200,000 annually for mid-sized operations.

Exchange Reporting Requirements Intensify

Stuart’s crypto exchanges and trading platforms face additional reporting requirements under the Bank Secrecy Act. They must maintain transaction records for five years and report suspicious activities that exceed $5,000. The SEC’s first priority is determining which crypto assets qualify as securities to provide more clarification for projects, investors, and other stakeholders.

Local businesses should prepare for enhanced scrutiny as federal agencies coordinate oversight efforts more aggressively. These compliance requirements directly impact how investors must document their transactions and maintain records for tax purposes.

How Do Stuart Investors Stay Compliant?

Documentation Systems Prevent Audit Problems

Stuart crypto investors must implement systematic documentation practices that extend far beyond basic transaction records. The IRS requires detailed records for every crypto transaction, including timestamps, fair market values, counterparties, and business purposes. Specialized crypto tax software like CoinTracker or Koinly automatically imports exchange data and calculates gains with precision. These platforms cost $50 to $300 annually but prevent thousands in potential penalties.

Manual spreadsheet methods create significant audit risks, particularly when investors handle DeFi transactions or NFT trades that traditional tax software cannot process. Professional-grade documentation protects investors from IRS scrutiny and provides the detailed records required for complex portfolio analysis.

Tax Deadlines Require Strategic Preparation

Federal tax deadlines for crypto transactions follow standard income tax schedules, with Form 8949 and Schedule D due April 15th. Quarterly estimated payments become mandatory when crypto gains exceed $1,000 in tax liability. Stuart investors who miss quarterly deadlines face penalties of 0.5% per month on unpaid amounts.

Form 1099-K reporting thresholds require exchanges to report payments over $5,000 for 2024. This change affects crypto investors who receive significant payments for goods or services. Professional tax preparation becomes essential for investors with complex portfolios that involve staking rewards, airdrops, or cross-chain transactions.

Professional Advisory Services Reduce Risk

Qualified financial advisors with cryptocurrency expertise help navigate compliance complexities that general practitioners often overlook. Advisors should hold CFP or CPA credentials with specific crypto education through organizations like the Digital Asset Council of Financial Professionals. Advisory fees typically range from 0.5% to 1.5% of assets under management.

Proper advisory structuring can reduce unnecessary taxes through strategic loss harvesting and holding period optimization. These strategies often save 10% to 25% in tax obligations for active crypto investors. The regulatory changes expected in 2025 will make professional guidance even more valuable for Stuart residents.

What Changes Are Coming in 2025?

Federal Legislation Creates New Compliance Requirements

The House of Representatives has passed comprehensive cryptocurrency legislation that establishes clear regulatory frameworks between the SEC and CFTC. Tim Scott, Chair of the Senate Banking Committee, plans to finalize this legislation by the end of the month, though government shutdown concerns may cause delays.

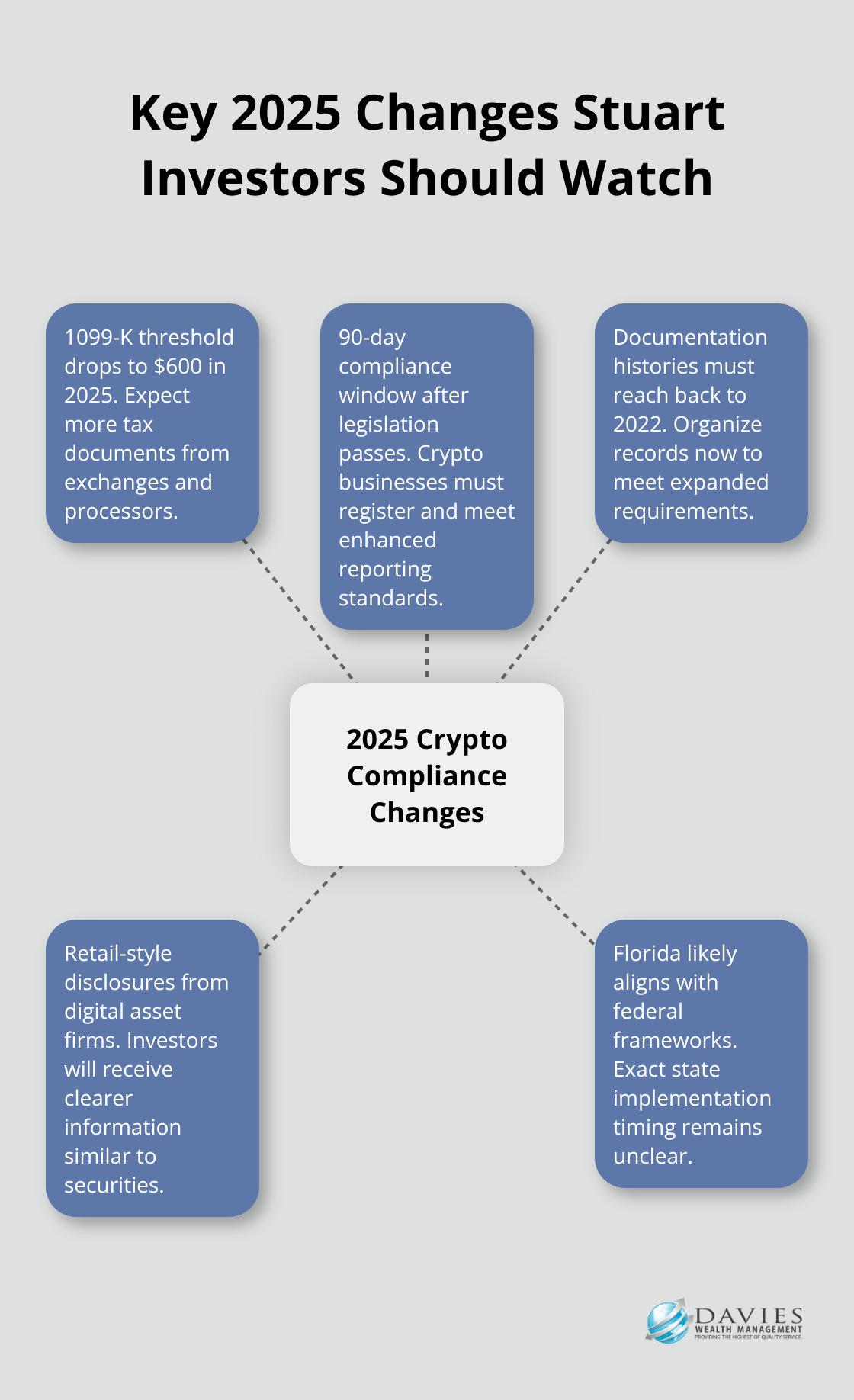

The new rules will require digital asset firms to provide retail financial disclosures similar to traditional securities. This change directly impacts how Stuart investors receive information about their crypto investments. The Senate Agriculture Committee simultaneously votes on market structure regulations that will define which digital assets qualify as commodities versus securities.

These definitions will determine which regulatory body oversees specific cryptocurrencies and affect tax treatment for Stuart residents. The legislation mandates that digital asset firms enhance consumer protection through standardized disclosure requirements.

Implementation Timeline Demands Immediate Preparation

Stuart investors face a compressed timeline for compliance with new federal requirements. The legislation includes mandatory registration for crypto businesses and enhanced reporting standards that take effect within 90 days of passage.

Form 1099-K reporting thresholds will drop to transactions over $600 starting in 2025. This means Stuart residents will receive significantly more tax documents from exchanges and payment processors. Florida has indicated it will align state regulations with federal frameworks, but the exact implementation timeline remains unclear.

Documentation Requirements Expand Significantly

The new regulations require detailed transaction histories that date back to 2022. Stuart investors must organize their documentation systems immediately to meet these enhanced standards. Professional tax preparation becomes mandatory for most crypto investors once these regulations take effect.

Crypto businesses must maintain comprehensive records that include customer identification, transaction amounts, and counterparty information. The enhanced documentation requirements will affect both individual investors and businesses that accept cryptocurrency payments (including small retailers and service providers).

Final Thoughts

Stuart’s crypto regulations present a complex web of federal requirements, state advantages, and evolving compliance standards that demand immediate attention. Congress finalizes comprehensive legislation that will reshape how investors document transactions and report gains. The regulatory landscape shifts rapidly as new federal frameworks take effect within months.

Stuart residents benefit from Florida’s tax-free environment for crypto gains, but federal obligations remain stringent. The upcoming changes in 2025 will expand documentation requirements significantly and make professional guidance essential rather than optional. Form 1099-K thresholds drop to $600 and will generate substantially more tax documents for local investors.

We at Davies Wealth Management help clients navigate complex compliance requirements while we optimize tax strategies in this evolving regulatory environment. Professional guidance becomes increasingly valuable as crypto regulations continue to expand throughout 2025. Our comprehensive wealth management solutions address the unique challenges that crypto investors face with these new federal requirements.

Leave a Reply