High-income earners face unique challenges when it comes to growing and preserving their wealth. At Davies Wealth Management, we understand the complexities of navigating the financial landscape for those in higher tax brackets.

This blog post explores investment strategies for high-income earners, focusing on tax-efficient options, diversification techniques, and wealth preservation methods. We’ll provide insights into maximizing returns while minimizing risks in a high-stakes investment environment.

Navigating the High-Income Investment Landscape

High-income earners face a unique set of challenges when it comes to investing and growing their wealth. These individuals often grapple with complex tax implications, heightened scrutiny from regulatory bodies, and the need for sophisticated investment strategies to match their financial goals.

The Tax Efficiency Imperative

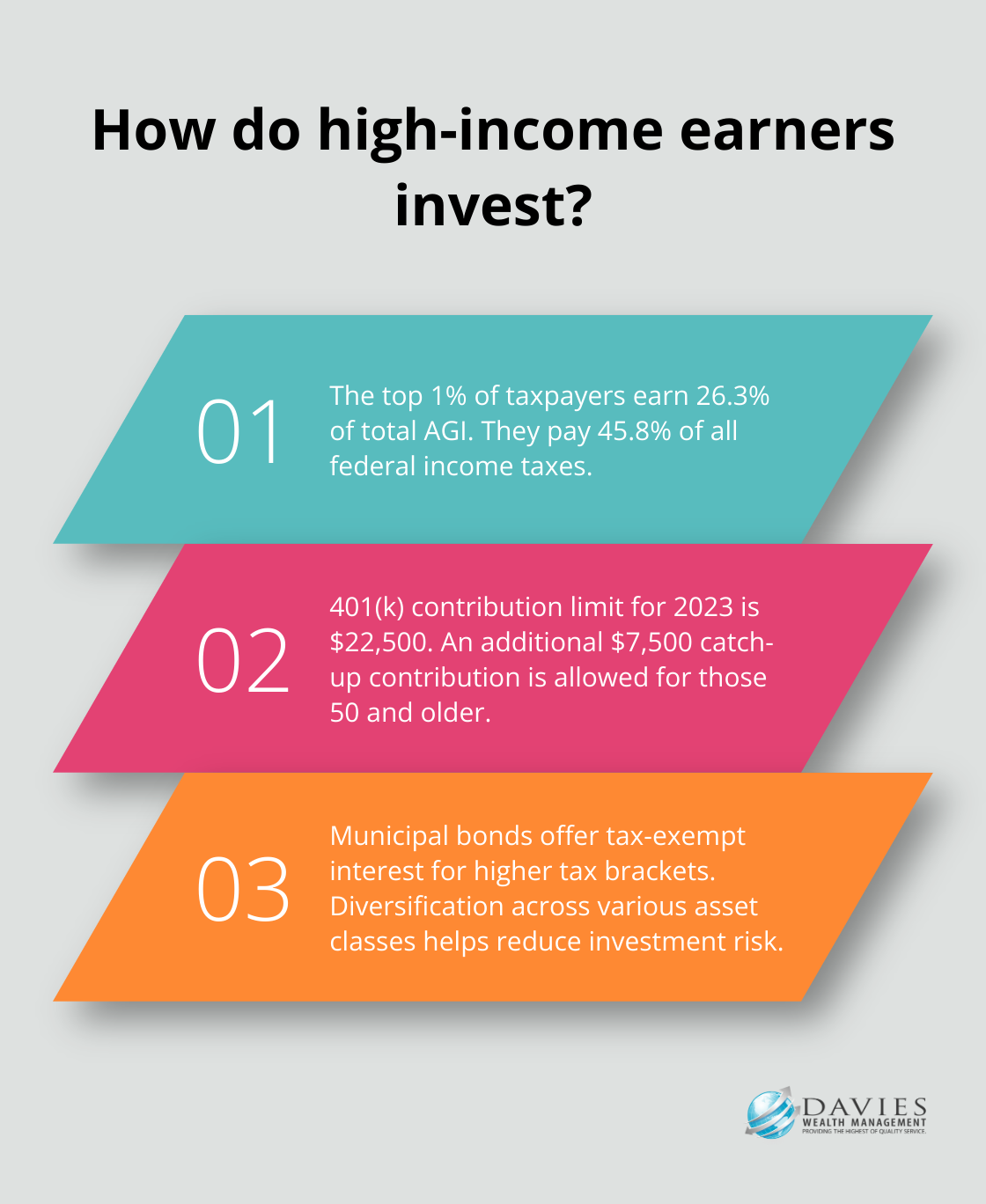

One of the most significant hurdles for high-income investors is the impact of taxes on their investment returns. As income increases, so does the tax burden, potentially eroding a substantial portion of investment gains. The top 1 percent of taxpayers earned 26.3 percent of total AGI and paid 45.8 percent of all federal income taxes. This statistic underscores the critical need for tax-efficient investing strategies.

To combat this, investors should maximize contributions to tax-advantaged accounts such as 401(k)s and IRAs. For 2023, the contribution limit for 401(k)s is $22,500, with an additional $7,500 catch-up contribution for those 50 and older. These contributions can significantly reduce taxable income while allowing for tax-deferred growth.

Another effective strategy is the strategic use of municipal bonds. These investments offer tax-exempt interest, making them particularly attractive for those in higher tax brackets. However, it’s important to carefully evaluate the yield of municipal bonds against taxable alternatives to ensure they provide a superior after-tax return.

Balancing Risk and Reward

High-income investors often have the capacity to take on more risk, but this doesn’t mean they should. The key is to find the right balance between pursuing growth opportunities and preserving wealth. This balance is particularly important for professional athletes (a group that requires a nuanced approach to risk management due to short career spans and potentially volatile income streams).

One effective strategy is to diversify across various asset classes. Diversification helps you reduce the risk of investing everything in a company that goes under by buying hundreds or thousands of securities at a time. A mix of stocks, bonds, real estate, and alternative investments tailored to each client’s risk tolerance and financial goals is often recommended.

For those seeking higher returns, private equity and venture capital can offer unique opportunities. However, these investments come with increased risk and reduced liquidity. It’s essential to approach them with caution and as part of a broader, well-balanced portfolio strategy.

The Role of Professional Guidance

The complex landscape of high-income investing requires expertise and continuous education. Tax laws change, market conditions fluctuate, and new investment opportunities emerge. Staying informed about these changes is important for making sound financial decisions.

Working with financial professionals who understand the unique challenges faced by high-income earners is highly beneficial. These experts stay abreast of the latest tax strategies, investment trends, and regulatory changes to provide comprehensive, up-to-date advice.

Tailored Strategies for High Earners

High-income investors should consider strategies that align with their specific financial situations. This might include:

- Tax-loss harvesting to offset capital gains

- Utilizing Qualified Opportunity Zones for tax-advantaged real estate investments

- Exploring Charitable Remainder Trusts (CRTs) for philanthropic goals and tax benefits

Each of these strategies requires careful consideration and professional guidance to implement effectively.

As we move forward, let’s explore how diversification plays a crucial role in wealth preservation for high-income earners.

How to Diversify for Wealth Preservation

Strategic Asset Allocation

Diversification stands as a fundamental principle for wealth preservation among high-income earners. At Davies Wealth Management, we emphasize the importance of spreading investments across various asset classes to reduce risk and optimize potential returns.

For high-net-worth individuals, asset allocation extends beyond the traditional stock and bond mix. We recommend a more sophisticated approach that includes a broader range of asset classes. Diversification reduces portfolio risk, but it’s important to note that 100% portfolio diversification may not be possible.

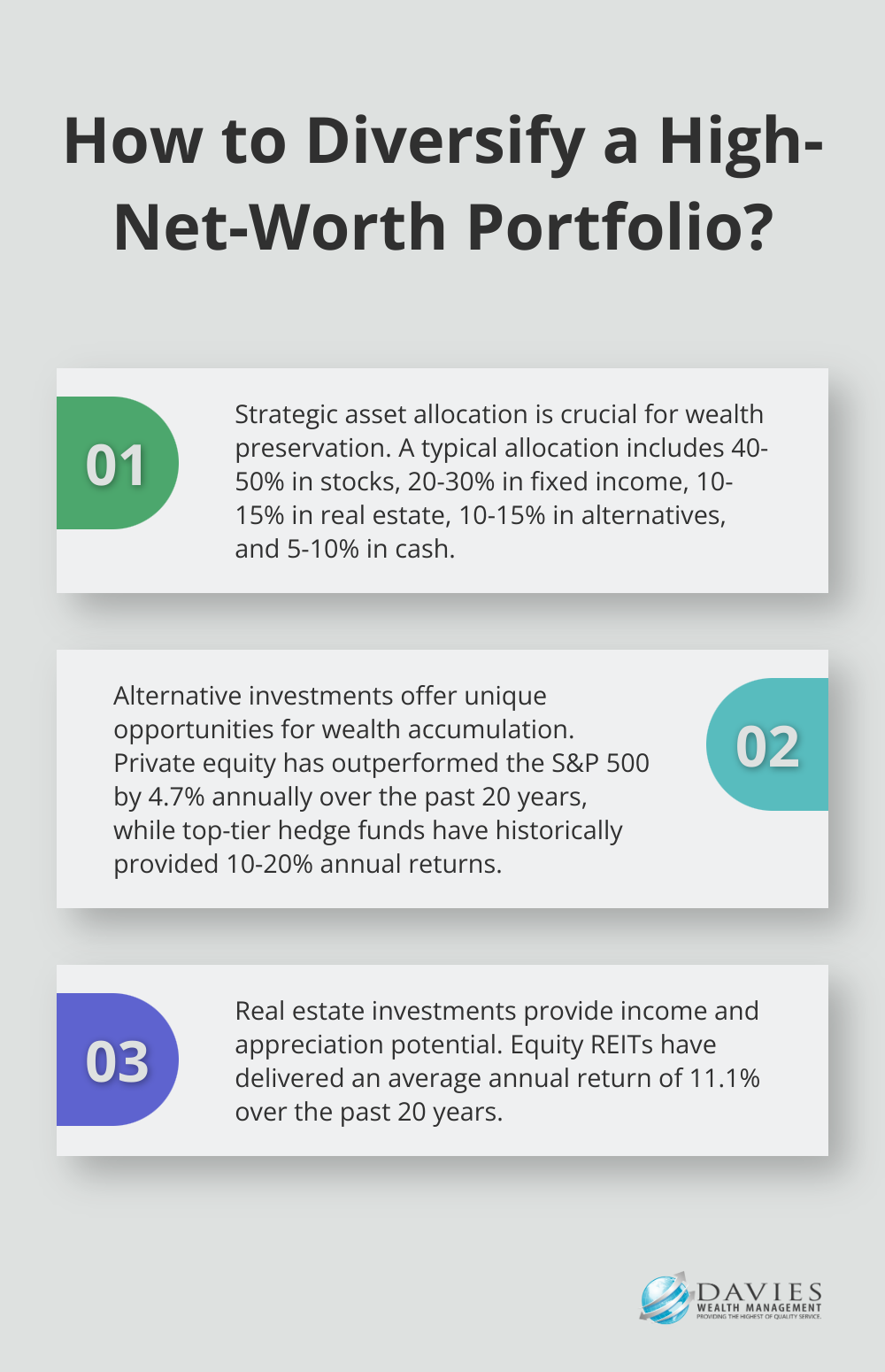

A typical allocation for high-income investors might include:

- 40-50% in domestic and international stocks

- 20-30% in fixed income securities

- 10-15% in real estate

- 10-15% in alternative investments

- 5-10% in cash and cash equivalents

These percentages should be tailored to individual risk tolerance and financial goals. Professional athletes (who often have shorter career spans) might require a more conservative allocation to ensure long-term financial stability.

The Power of Alternative Investments

Alternative investments play a vital role in diversifying a high-net-worth portfolio. Private equity and hedge funds, in particular, offer unique opportunities for wealth accumulation and preservation.

Private equity investments provide access to high-growth potential companies not available in public markets. According to Cambridge Associates, private equity has outperformed the S&P 500 by 4.7% annually over the past 20 years. However, these investments typically require longer holding periods and have higher minimum investment thresholds.

Hedge funds can offer downside protection and non-correlated returns. While performance can vary widely, top-tier hedge funds have historically provided returns in the range of 10-20% annually. It’s essential to conduct thorough due diligence and work with experienced advisors when considering these complex investment vehicles.

Real Estate: A Tangible Asset Class

Real estate investments offer both income potential and long-term appreciation, making them an attractive option for high-income investors. Commercial properties and Real Estate Investment Trusts (REITs) are two popular avenues for real estate investing.

Commercial properties can provide steady cash flow through rental income and potential tax benefits through depreciation. However, they require significant capital and active management. REITs, on the other hand, offer a more liquid and hands-off approach to real estate investing. According to NAREIT, equity REITs have provided an average annual return of 11.1% over the past 20 years.

Balancing Risk and Reward

High-income investors often have the capacity to take on more risk, but this doesn’t mean they should. The key lies in finding the right balance between pursuing growth opportunities and preserving wealth. This balance becomes particularly important for professional athletes (a group that requires a nuanced approach to risk management due to short career spans and potentially volatile income streams).

One effective strategy involves diversifying across various asset classes. A mix of stocks, bonds, real estate, and alternative investments tailored to each client’s risk tolerance and financial goals is often recommended.

As we move forward, let’s explore how tax-efficient investment vehicles can further enhance the wealth preservation strategies of high-income earners.

Optimizing Tax Efficiency for High Earners

Maximizing Retirement Account Contributions

Tax efficiency forms a cornerstone of effective wealth management for high-income earners. The impact of taxes on investment returns can be substantial, which necessitates strategies that minimize tax liabilities while maximizing wealth accumulation.

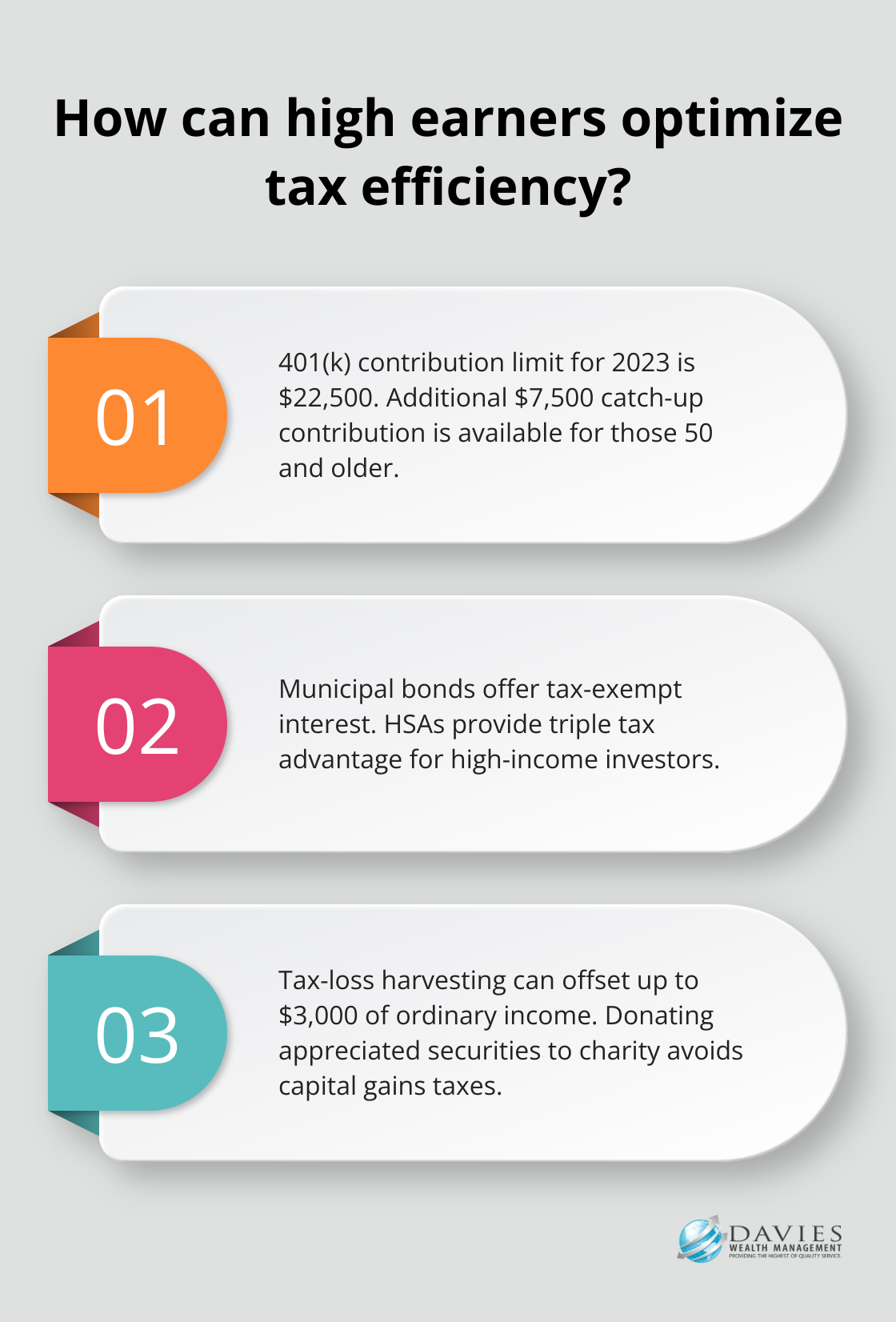

One of the most effective ways to reduce current tax burdens involves the strategic use of retirement accounts. For 2023, the contribution limit for 401(k) plans stands at $22,500, with an additional $7,500 catch-up contribution for those 50 and older. High earners who max out these contributions can significantly reduce their taxable income while building a tax-deferred nest egg for the future.

Those who have maxed out their 401(k) contributions should consider a backdoor Roth IRA strategy. This strategy allows taxpayers to set up a Roth IRA retirement fund even if their income exceeds the IRS earnings ceiling for Roth contributions.

Leveraging Tax-Advantaged Investment Options

Municipal bonds serve as a powerful tool for high-income investors seeking tax-efficient returns. The interest from these bonds typically remains exempt from federal taxes (and often state taxes if you reside in the issuing state). For those in the highest tax brackets, the tax-equivalent yield of municipal bonds can significantly outperform comparable taxable bonds.

Health Savings Accounts (HSAs) offer a triple tax advantage. Contributions to your HSA made by your employer (including contributions made through a cafeteria plan) may be excluded from your gross income.

Minimizing Capital Gains Tax Impact

A strategic approach to capital gains can significantly reduce tax liabilities. Tax-loss harvesting involves selling an investment that’s underperforming and losing money. Then, you use that loss to reduce your taxable capital gains and potentially offset up to $3,000 of ordinary income.

Philanthropically inclined individuals should consider donating appreciated securities to charity instead of cash. This strategy allows you to avoid capital gains taxes on the appreciated value while still receiving a tax deduction for the full market value of the securities.

Tailored Strategies for High Earners

High-income investors should consider strategies that align with their specific financial situations. These might include:

- Utilizing Qualified Opportunity Zones for tax-advantaged real estate investments

- Exploring Charitable Remainder Trusts (CRTs) for philanthropic goals and tax benefits

- Implementing a strategic asset location approach (placing tax-inefficient investments in tax-advantaged accounts)

Each of these strategies requires careful consideration and professional guidance to implement effectively.

Final Thoughts

Investment strategies for high-income earners require a multifaceted approach that balances risk, reward, and tax efficiency. The key to successful wealth management lies in diversification across various asset classes, including stocks, bonds, real estate, and alternative investments. Professional financial advice plays a vital role in navigating the complex landscape of high-income investing, as tax laws, market conditions, and investment opportunities constantly evolve.

Long-term wealth management and legacy planning form essential components of a comprehensive financial strategy. This involves growing and preserving wealth during one’s lifetime while ensuring a smooth transfer of assets to future generations or charitable causes. Strategies such as estate planning, charitable trusts, and strategic gifting can significantly impact the achievement of these goals while potentially providing tax benefits.

Successful wealth management for high-income earners demands a holistic approach that considers individual financial goals, risk tolerance, and life circumstances. We at Davies Wealth Management specialize in crafting personalized wealth management solutions for high-income individuals (including professional athletes with unique financial needs). For personalized advice on investment strategies for high-income earners, we invite you to explore the comprehensive services offered by Davies Wealth Management.

Leave a Reply