At Davies Wealth Management, we understand the importance of long-term financial planning for residents of Stuart, FL. Our beautiful coastal city presents unique opportunities and challenges when it comes to securing your financial future.

Long-term finance planning is essential for achieving your life goals, whether it’s buying a home, funding your children’s education, or enjoying a comfortable retirement. In this post, we’ll explore the key aspects of creating a robust financial strategy tailored to Stuart’s specific economic landscape.

What is Long-Term Financial Planning?

The Essence of Long-Term Financial Planning

Long-term financial planning forms the foundation for building lasting wealth and achieving life goals. It transcends simple savings; it creates a comprehensive strategy that aligns with your aspirations and shields you from financial uncertainties.

At its heart, long-term financial planning develops a detailed financial strategy based on your goals. It sets up a long-term, balanced wealth plan and takes the emotion out of money moves, so you can make better financial decisions.

Key Components of a Solid Financial Plan

A robust financial plan consists of several essential elements:

- Budgeting and Cash Flow Management: Understanding your income and expenses is vital for making informed financial decisions.

- Risk Management: This involves securing appropriate insurance coverage to protect against unforeseen events that could derail your financial progress. In Stuart, preparation for potential natural disasters, particularly hurricanes, is necessary. Standard homeowners insurance doesn’t cover flood damage, so additional coverage may be required.

- Investment Strategy: This creates a diversified portfolio that balances risk and potential returns based on your individual goals and risk tolerance.

The Long-Term Perspective

Long-term planning differs significantly from short-term financial management. While short-term planning might focus on immediate needs like paying bills or saving for a vacation, long-term investing requires a broader perspective.

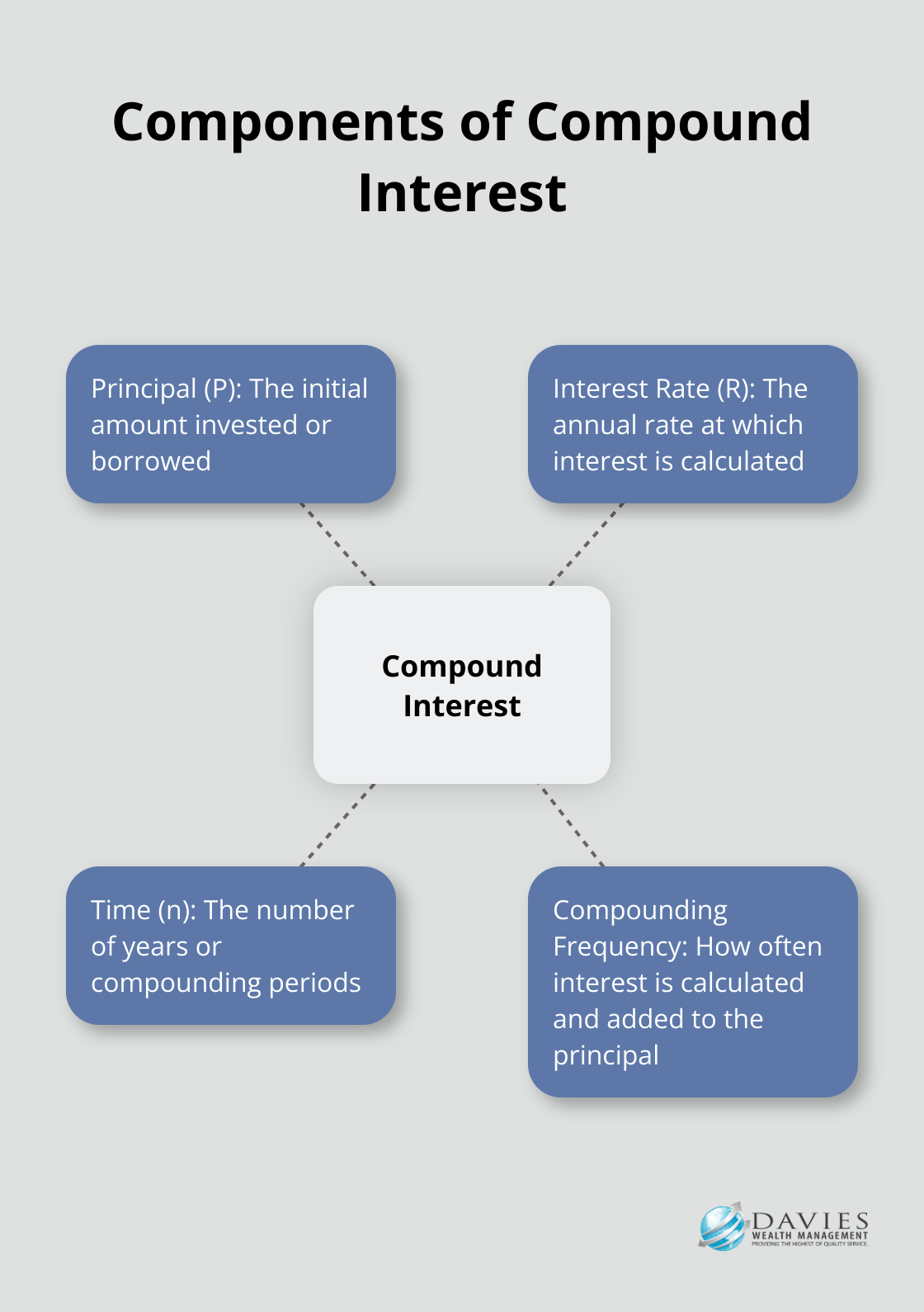

One key difference is the time horizon. Long-term planning often spans 20, 30, or even 40 years into the future. This extended timeframe allows for the power of compound interest to work in your favor. Compound interest can be calculated using the formula A = P(1+R)^n, where A is the accumulated amount, P is the principal, R is the interest rate, and n is the number of compounding periods.

Another distinction is the focus on flexibility and adaptability. Long-term plans need regular reviews and adjustments to account for life changes, economic shifts, and evolving goals. We recommend reviewing your financial plan at least annually to ensure it remains aligned with your objectives.

Lastly, long-term planning often involves more complex strategies, such as tax-efficient investing and estate planning. These elements become increasingly important as your wealth grows over time.

As we move forward, let’s explore the unique considerations for long-term financial planning specific to Stuart, FL. The local economic landscape presents both opportunities and challenges that can significantly impact your financial strategy.

How Stuart’s Economy Shapes Your Financial Future

Stuart’s Economic Pillars

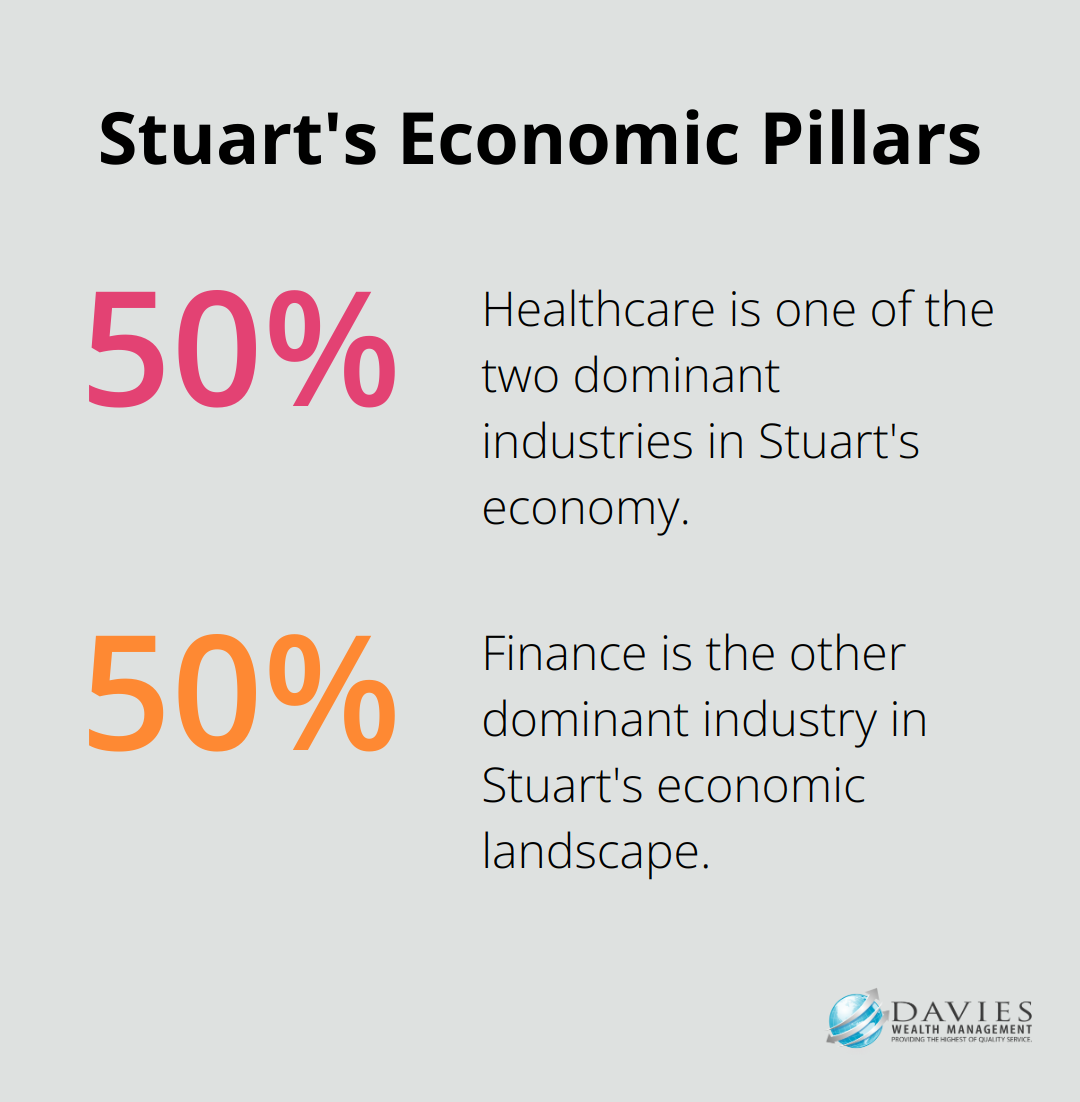

Stuart, Florida’s unique economic landscape presents both opportunities and challenges for long-term financial planning. Understanding these local factors is essential for creating a robust financial strategy that aligns with your goals and the realities of living in this coastal paradise.

Stuart’s economy stands on diverse pillars, with healthcare and finance emerging as the two most dominant industries for economic activity. The city’s proximity to the Atlantic Ocean and the St. Lucie River makes it a hub for fishing, boating, and water-related activities. This not only drives tourism but also supports a thriving marine industry, creating job opportunities and investment potential in these sectors.

Healthcare emerges as a significant economic driver in Stuart. With an aging population and a growing number of retirees, the demand for healthcare services continues to rise. This trend presents opportunities for those in the medical field and related industries, as well as potential investment avenues in healthcare real estate or services.

Real Estate Market Dynamics

The real estate market in Stuart has experienced some changes, with home values averaging $382,217, down 5.6% over the past year according to Zillow. This trend differs from previous growth patterns and may impact long-term investment strategies in the area.

However, Stuart’s coastal location brings unique considerations. Properties in flood-prone areas may require additional insurance, impacting overall housing costs. It’s important to factor these elements into your long-term financial planning to ensure your real estate investments align with your goals while accounting for potential risks.

Florida’s Tax Advantages

One of the most significant benefits of long-term financial planning in Stuart is Florida’s favorable tax environment. The state imposes no personal income tax, which can result in substantial savings over time, especially for high-income earners or retirees drawing from pension funds or retirement accounts.

Additionally, Florida does not levy an estate tax or inheritance tax, making it an attractive location for estate planning. This can particularly benefit those looking to preserve wealth for future generations.

However, it’s important to note that while state taxes are favorable, federal taxes still apply. Strategic tax planning remains essential to maximize the benefits of Florida’s tax-friendly status while ensuring compliance with federal regulations.

Adapting Your Financial Strategy

To capitalize on Stuart’s unique economic landscape, your long-term financial plan should incorporate:

- Diversification strategies that leverage local industries

- Real estate investments that account for coastal risks and opportunities

- Tax-efficient planning to maximize Florida’s favorable tax environment

As we move forward, we’ll explore specific strategies for successful long-term financial planning in Stuart, FL. These strategies will help you navigate the local economic landscape and build a secure financial future in this beautiful coastal city.

Crafting Your Financial Roadmap in Stuart, FL

Define Clear Financial Milestones

We at Davies Wealth Management recommend you start by outlining specific, measurable financial goals. Instead of vague aspirations, set concrete targets. For example, you might aim to “accumulate $1.5 million in retirement accounts by age 65.” This approach provides clarity and motivation.

For Stuart residents, local factors should influence goal-setting. If you want waterfront property, research current prices and project future values. As of August 2025, the average home value in Stuart, FL is $382,217. Try to save 20% for a down payment (about $76,443 for a median-priced home).

Diversify with Local Market Insights

While diversification remains a cornerstone of sound investing, you can tailor your portfolio to Stuart’s economic landscape to enhance returns. We suggest you allocate a portion of your investments to thriving local sectors.

The healthcare sector in Stuart booms due to our growing retiree population. You might research local healthcare real estate investment trusts (REITs) or companies serving this demographic. However, limit any single stock investment to no more than 5% of your portfolio to manage risk.

The marine industry also powers our local economy. You could explore companies manufacturing boats or providing marine services. These investments offer growth potential while supporting our community.

Maximize Florida’s Retirement Benefits

Stuart’s appeal as a retirement destination means your long-term plan should account for potentially higher healthcare costs and longer life expectancy.

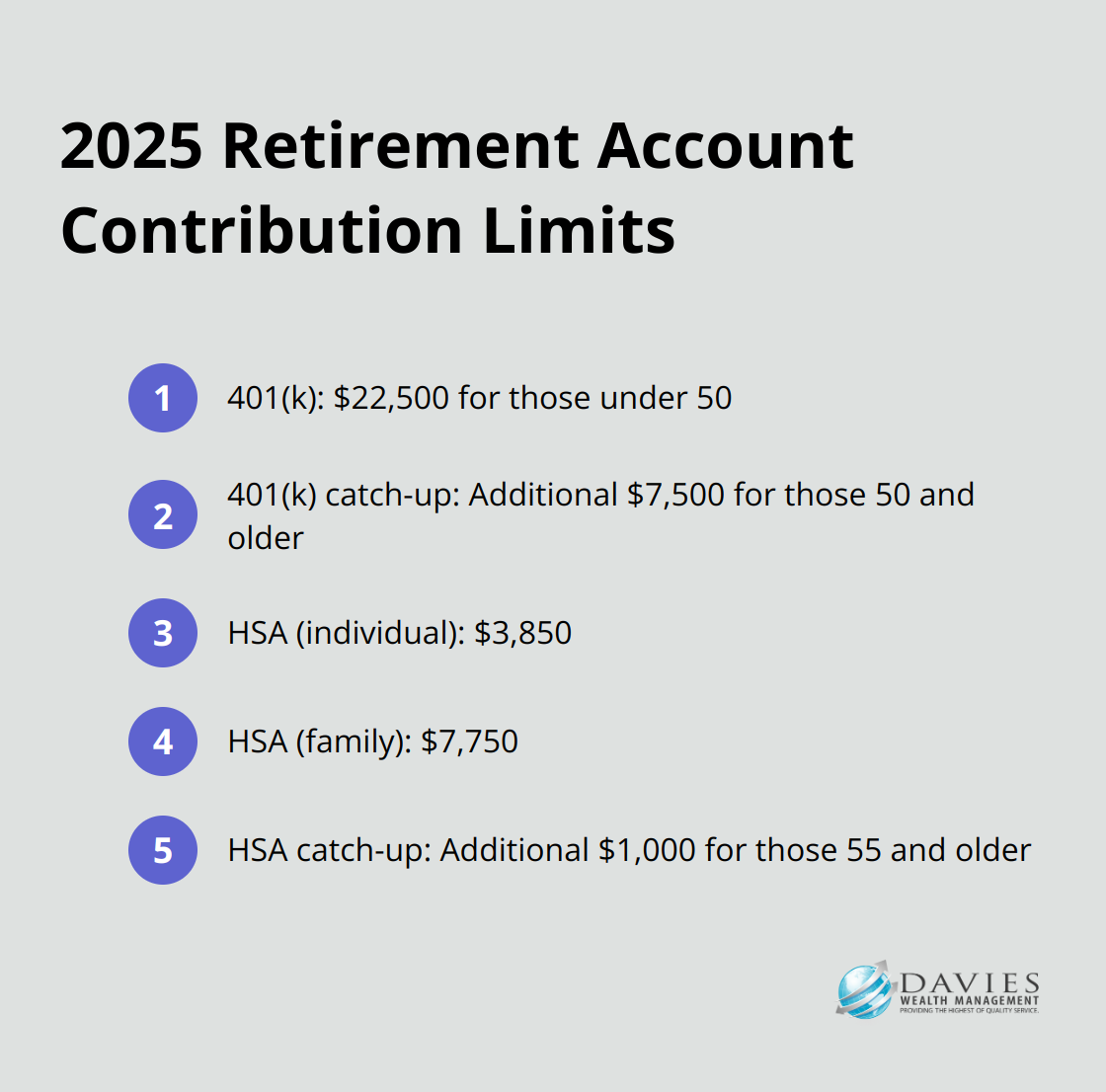

Take advantage of Florida’s tax-friendly environment by maximizing contributions to tax-advantaged accounts like 401(k)s and IRAs. For 2025, the contribution limit for 401(k)s is $22,500 for those under 50, with an additional $7,500 catch-up contribution for those 50 and older.

Consider opening a Health Savings Account (HSA) if you’re eligible. In 2025, you can contribute up to $3,850 for individual coverage or $7,750 for family coverage (with an additional $1,000 catch-up contribution if you’re 55 or older). HSAs offer triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Adapt to Stuart’s Dynamic Economy

Your financial plan should evolve with Stuart’s changing economy. Schedule annual reviews of your strategy, ideally with a financial advisor who understands local economic trends.

Monitor Stuart’s real estate market fluctuations. With home values down 5.6% over the past year, you must reassess your property investments regularly. You might diversify into different types of real estate, such as commercial properties or rental units, to spread risk.

Stay informed about local economic developments. Stuart’s Economic Development Council provides regular updates on business growth and opportunities. Use this information to adjust your investment strategy and career plans accordingly.

Final Thoughts

Long-term finance planning in Stuart, FL requires a tailored approach due to the city’s unique economic landscape. The thriving healthcare sector and vibrant marine industry present distinct opportunities and challenges for financial strategies. Professional guidance can significantly impact the achievement of long-term financial objectives in this coastal paradise.

Davies Wealth Management specializes in creating personalized financial strategies that account for Stuart’s economic factors. We offer tailored solutions for various professions, including professional athletes who face unique financial challenges. Our expertise extends beyond traditional financial planning to provide comprehensive wealth management services.

Take action today to secure your financial future in Stuart, FL. Professional financial advice can provide the clarity and direction you need for retirement planning, real estate investments, or tax strategy optimization. Start your long-term finance planning journey now to work towards financial security and peace of mind in our beautiful city.

Leave a Reply