Stuart’s wealthy families face complex financial decisions that traditional wealth management can’t always address. A family office might be the solution you’ve been looking for.

At Davies Wealth Management, we see families struggling with coordinated investment strategies, tax optimization, and multi-generational planning. The question isn’t whether you need sophisticated wealth management-it’s whether a family office structure fits your specific situation.

How Do Family Offices Actually Work

A family office operates as a private wealth management firm that serves ultra-high-net-worth families with investable assets that typically start at $100 million. Approximately 79,000 families globally control significant wealth through family offices, with many managing substantial portfolios according to industry research.

Single vs Multi-Family Office Structures

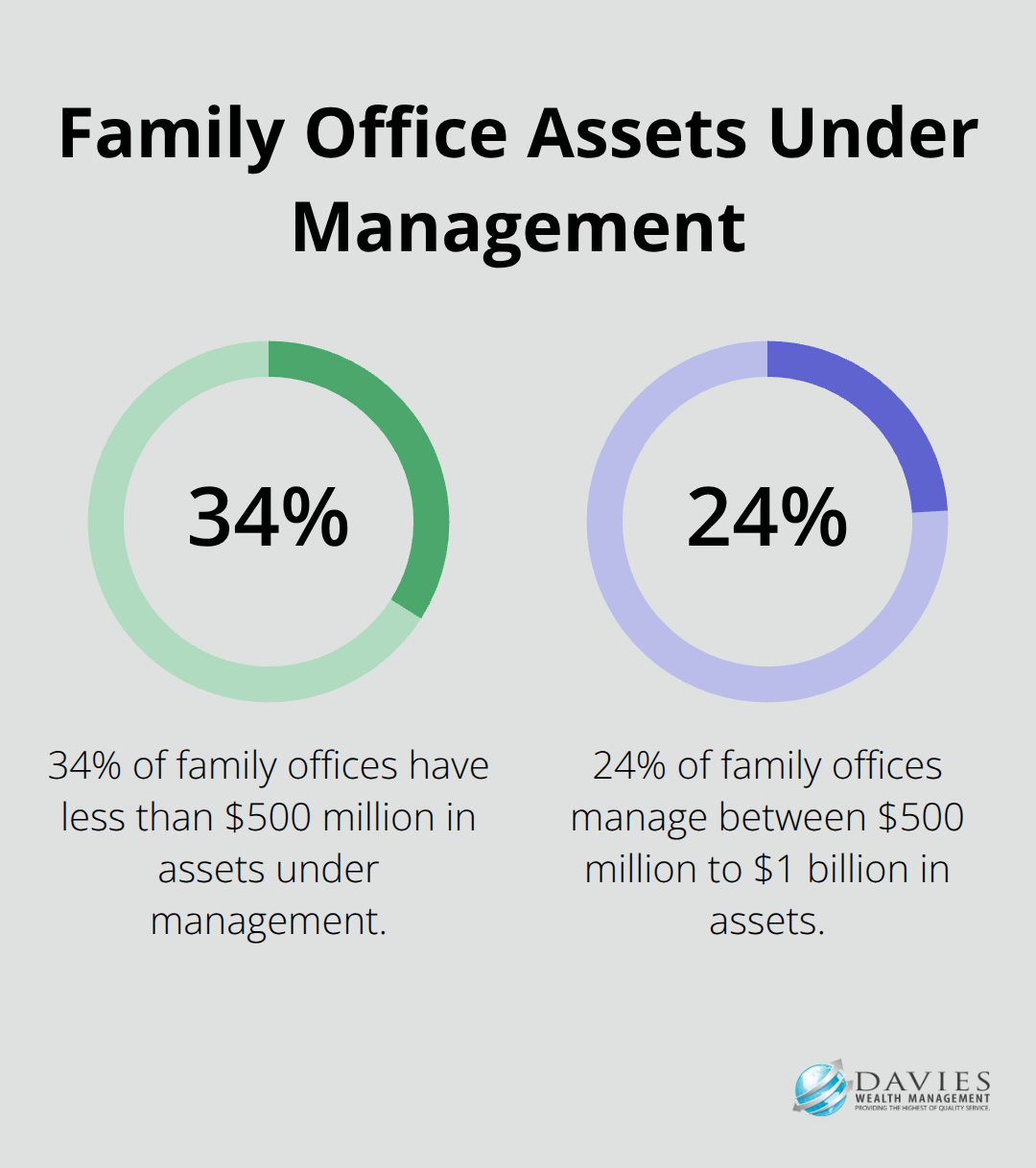

Single family offices serve one family exclusively and provide maximum control and customization but require annual costs that exceed $1 million. Multi-family offices share resources among several families, which reduces individual costs while they maintain institutional-quality services. Research shows that 34% of family offices have less than $500 million in assets under management, while 24% manage between $500 million to $1 billion.

Alternative Investment Access

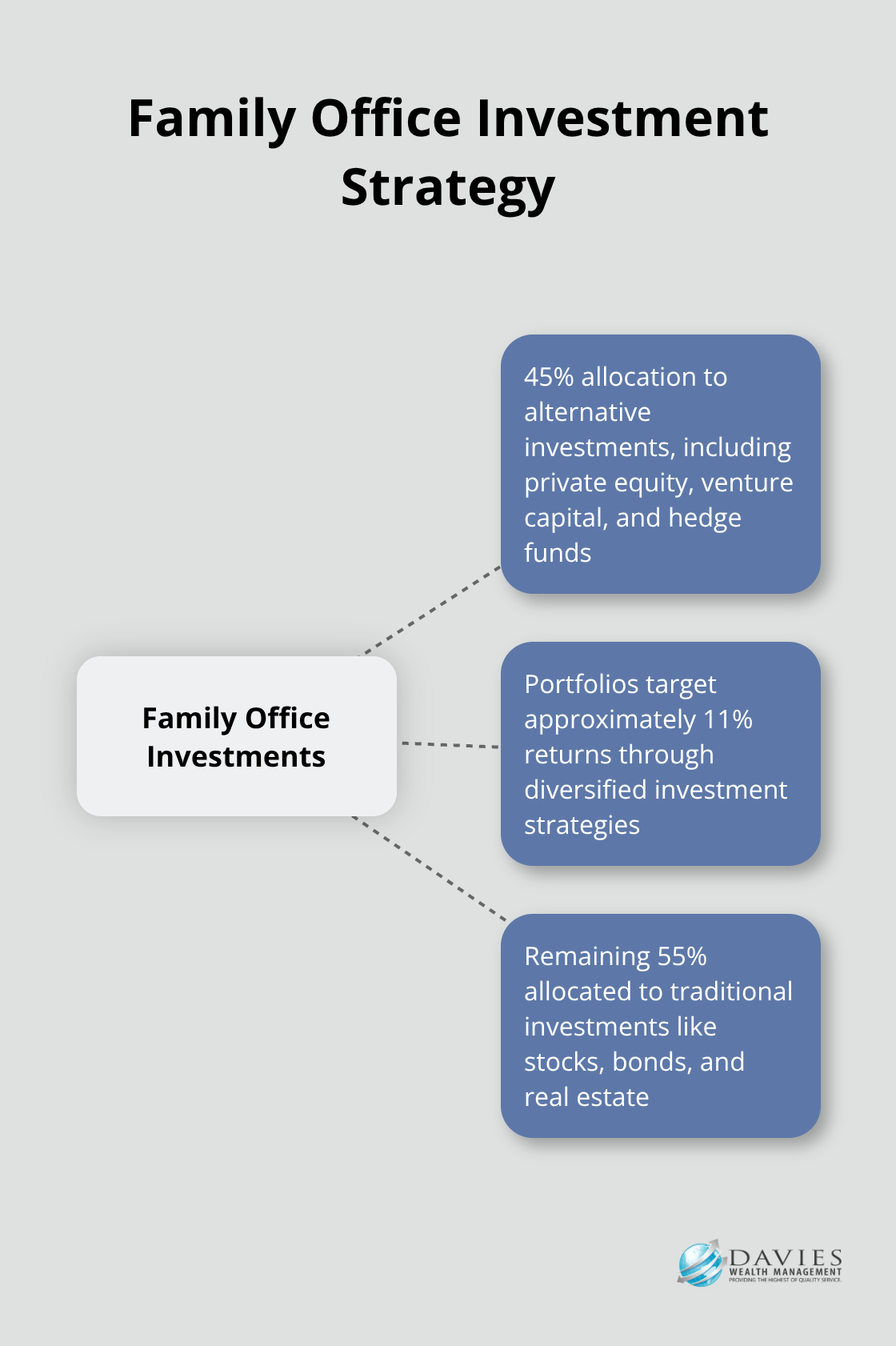

Family offices access alternative investments that remain unavailable to typical wealth management clients, which include private equity, venture capital, hedge funds, and direct real estate investments. These offices employ dedicated investment professionals who can allocate significant portions of portfolios to alternatives, with most family offices (61%) maintaining their current alternative allocations. Investment minimums for these opportunities often start at $1 million per investment, making them accessible only through family office structures.

Comprehensive Service Integration

Family offices coordinate investment management, tax optimization, estate planning, philanthropy, and lifestyle management under one roof. Annual fees typically range from 1-2% of total assets, which means a family with $100 million pays $1-2 million annually for comprehensive services. This fee structure includes dedicated staff, legal counsel, tax professionals, and concierge services that traditional wealth managers charge separately.

The Rockefeller family pioneered this model in the late 19th century and demonstrated how centralized wealth management preserves assets across generations while it maintains family privacy and control. This comprehensive approach becomes particularly valuable when families face complex financial situations that require coordinated expertise across multiple disciplines.

What Real Benefits Do Family Offices Deliver

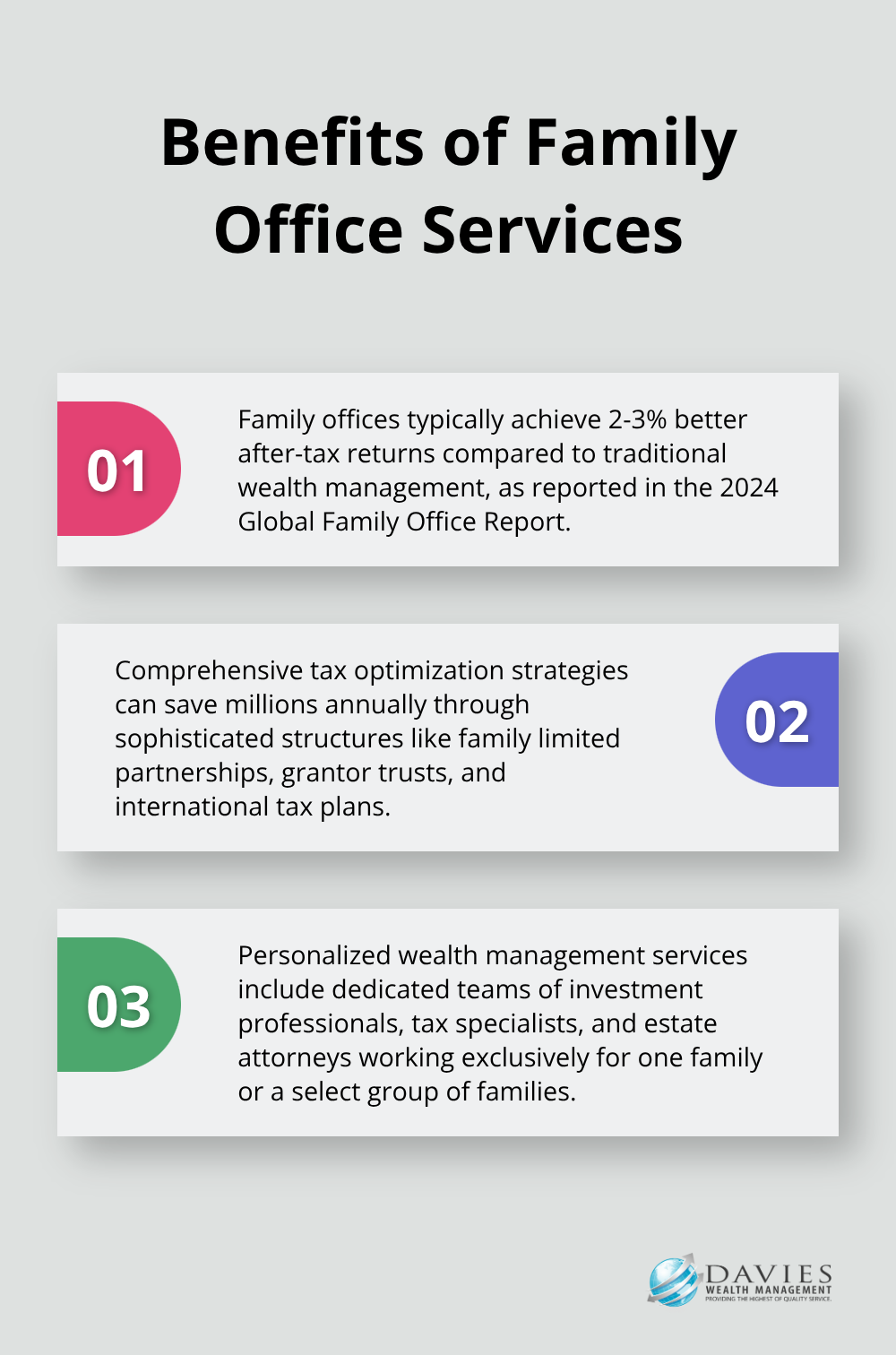

Family offices deliver measurable advantages that traditional wealth management simply cannot match, particularly for families with complex financial situations. The most significant benefit lies in tax optimization strategies that can save millions annually through sophisticated structures like family limited partnerships, grantor trusts, and international tax plans. Families who use comprehensive family office services typically achieve 2-3% better after-tax returns compared to traditional wealth management, according to research from the 2024 Global Family Office Report. This translates to $2-3 million in additional annual returns for a $100 million portfolio, which more than justifies the 1-2% annual fee structure.

Advanced Estate Planning Execution

Family offices excel at complex estate plans that preserve wealth across generations while they minimize tax burdens. The average ultra-high-net-worth family loses 70% of their wealth by the second generation and 90% by the third generation without proper plans, but families with dedicated family offices maintain wealth transfer success rates above 85% according to multi-generational studies. These offices coordinate generation-skipping trusts, charitable remainder trusts, and family governance structures that traditional advisors cannot execute effectively. They also manage the timing of wealth transfers to maximize tax advantages, often saving families 30-40% in estate taxes through strategic plan implementation.

Complete Privacy and Control

Privacy protection represents another substantial advantage, as family offices operate under strict confidentiality agreements and avoid the regulatory disclosure requirements that affect traditional wealth management firms. Family offices maintain complete control over investment decisions, family information, and strategic direction without external interference. This privacy extends to investment strategies, with family offices able to make direct investments and alternative allocations without public scrutiny that affects institutional investors and publicly traded wealth management companies.

Personalized Service Integration

Family offices coordinate all wealth management services through dedicated teams who understand each family’s unique values and objectives. These teams include investment professionals, tax specialists, estate attorneys, and lifestyle managers who work exclusively for one family (in single family offices) or a select group of families. The personalized attention allows for rapid decision-making and custom solutions that traditional wealth managers cannot provide when they serve hundreds of clients simultaneously.

The question becomes whether your family’s wealth complexity and asset level justify these premium services, which requires careful analysis of your specific financial situation.

When Does a Family Office Make Financial Sense

The financial math for family offices becomes compelling at the $30 million threshold, though most industry experts recommend $100 million as the optimal starting point. A family with $50 million pays approximately $500,000-$1 million annually for family office services, which represents 1-2% of total assets. This cost structure makes sense only when the tax savings, investment returns, and coordinated services exceed these fees by substantial margins. Families with assets below $25 million rarely justify family office costs, as the annual expenses consume too much of their wealth without proportional benefits.

Asset Complexity Determines Family Office Value

Family office structures excel when asset complexity exceeds traditional wealth management capabilities. Families with multiple business interests, international holdings, or significant alternative investments require coordination that single advisors cannot provide effectively. The 2024 Global Family Office Report shows that family offices maintain a 45% allocation to alternative investments, with portfolios targeting approximately 11% returns.

Geographic Diversification Benefits

Geographic diversification particularly benefits from family office expertise, as these structures navigate international tax treaties, currency hedging, and cross-border estate planning that traditional advisors handle poorly. Multi-generational families with 15+ family members across different countries find family offices indispensable for governance frameworks and wealth transfer coordination.

Break-Even Analysis for Complex Portfolios

The break-even point typically occurs when comprehensive tax planning and investment coordination justify the substantial annual fees, which happens consistently for families with $75+ million in complex assets that span multiple jurisdictions and investment types. Families who maintain substantial business ownership (above 20% of total wealth) often reach this threshold faster due to sophisticated tax planning opportunities that family offices execute more effectively than traditional advisors. Regular financial plan reviews ensure these strategies remain aligned with evolving family goals and market conditions.

Final Thoughts

Your family office decision depends on three factors: asset complexity, wealth level, and long-term objectives. Families with $100+ million in diverse assets across multiple jurisdictions benefit most from dedicated family office structures. The annual costs of $1-2 million become justified when tax savings and coordinated investment strategies exceed these fees.

Families with $25-75 million should consider multi-family offices or virtual family office arrangements that provide institutional-quality services at reduced costs. These hybrid models offer many family office benefits without the full expense burden of single-family structures. For portfolios below $25 million, traditional wealth management with specialized tax plans delivers better value (particularly for professional athletes and business owners who face unique financial challenges).

We at Davies Wealth Management provide comprehensive wealth management solutions for individuals, families, and businesses. Our team works with clients who face complex financial situations throughout their careers. The right wealth management approach aligns with your family’s specific situation, whether that involves a full family office structure or comprehensive financial planning through experienced advisors who understand your goals.

Leave a Reply