Luxury assets have long captivated investors seeking unique opportunities beyond traditional financial markets. From fine art to rare wines, these exclusive investments offer potential benefits like portfolio diversification and hedging against inflation.

At Davies Wealth Management, we’ve observed a growing interest in luxury asset investments among our clients. However, it’s essential to understand both the allure and the risks associated with these high-end acquisitions.

In this post, we’ll explore various types of luxury assets, their potential advantages, and the challenges investors may face when venturing into this glamorous yet complex market.

Exploring the World of Luxury Assets

Luxury assets represent a diverse and fascinating realm of investment opportunities. The interest in these unique assets has increased, and it’s important to understand the various options available.

Fine Art and Collectibles

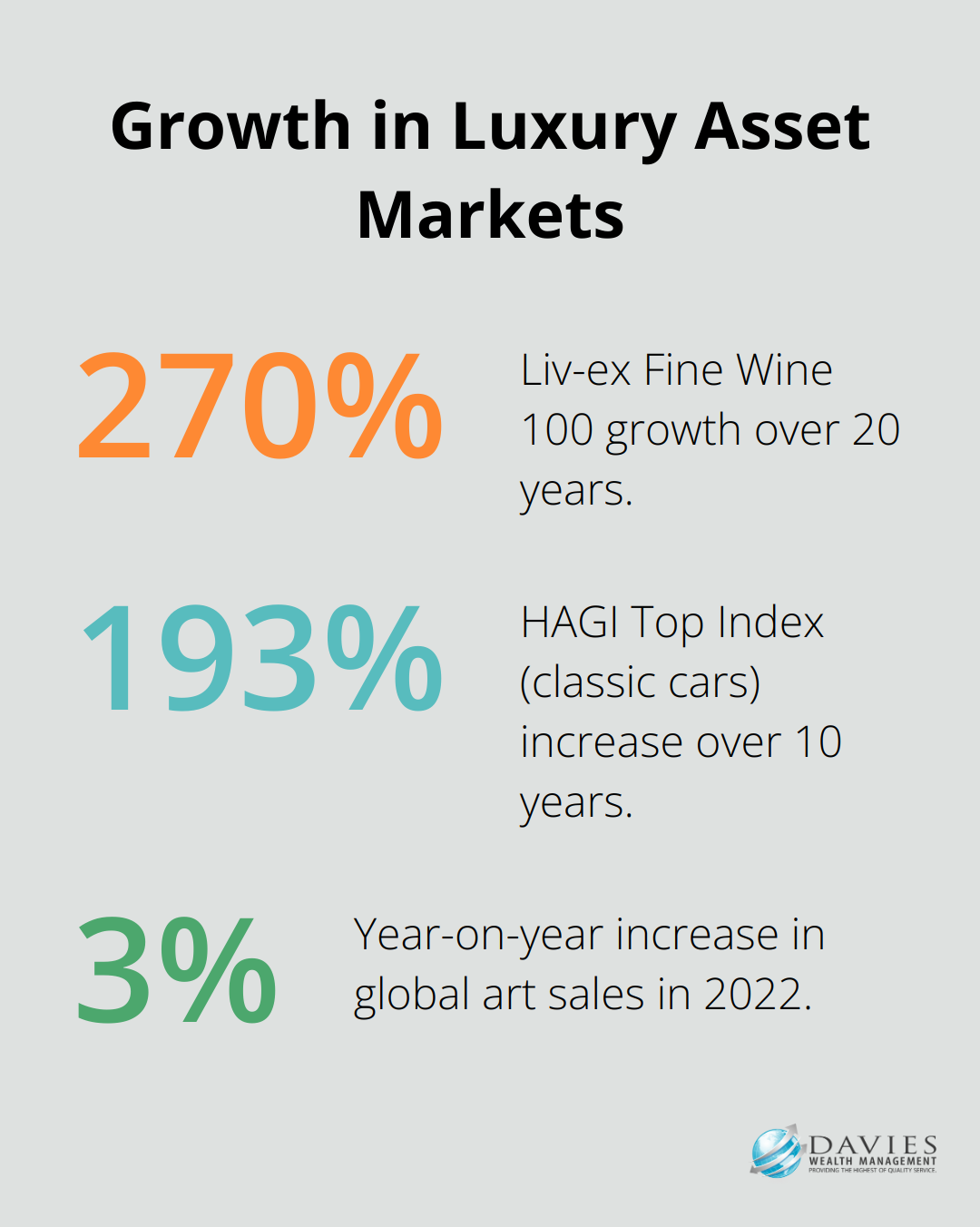

The art market has shown remarkable resilience and growth. In 2022, global art sales increased 3% year-on-year to an estimated USD 67.8 billion. Paintings, sculptures, and even digital art (NFTs) fall into this category. Art investments require significant expertise and often substantial capital.

Luxury Real Estate

High-end properties in prime locations have historically been solid investments. The Knight Frank Prime International Residential Index showed that coastal and rural locations in sunnier climes saw average price growth of 8.4% in 2022, marginally ahead of ski resorts which were up 8.3% on average. These properties not only offer potential appreciation but can also generate rental income.

Rare Wines and Spirits

The fine wine market has outperformed many traditional assets. The Liv-ex Fine Wine 100 has risen over 270% in the past 20 years. Rare whiskies have also seen significant appreciation, with some bottles fetching millions at auction.

High-End Watches and Jewelry

Certain luxury watches have shown impressive returns. For instance, some Rolex models have appreciated by over 100% in the past decade (according to Bob’s Watches). Similarly, rare colored diamonds have seen substantial price increases, with some appreciating by 12% annually over the past 10 years (as reported by the Fancy Color Research Foundation).

Classic Cars and Vintage Vehicles

While the classic car market can be volatile, certain models have proven to be excellent investments. The HAGI Top Index, which tracks rare classic car prices, has shown a 193% increase over the past 10 years. However, storage, maintenance, and insurance costs can be significant for these assets.

Understanding these luxury asset categories is important for anyone considering portfolio diversification. Each category comes with its own set of challenges and opportunities, requiring careful consideration and expert guidance. As we move forward, we’ll explore the potential benefits that these luxury assets can offer to investors.

Why Invest in Luxury Assets?

Luxury assets offer a unique set of advantages that can complement traditional investment strategies. These high-end acquisitions can enhance portfolios when approached thoughtfully.

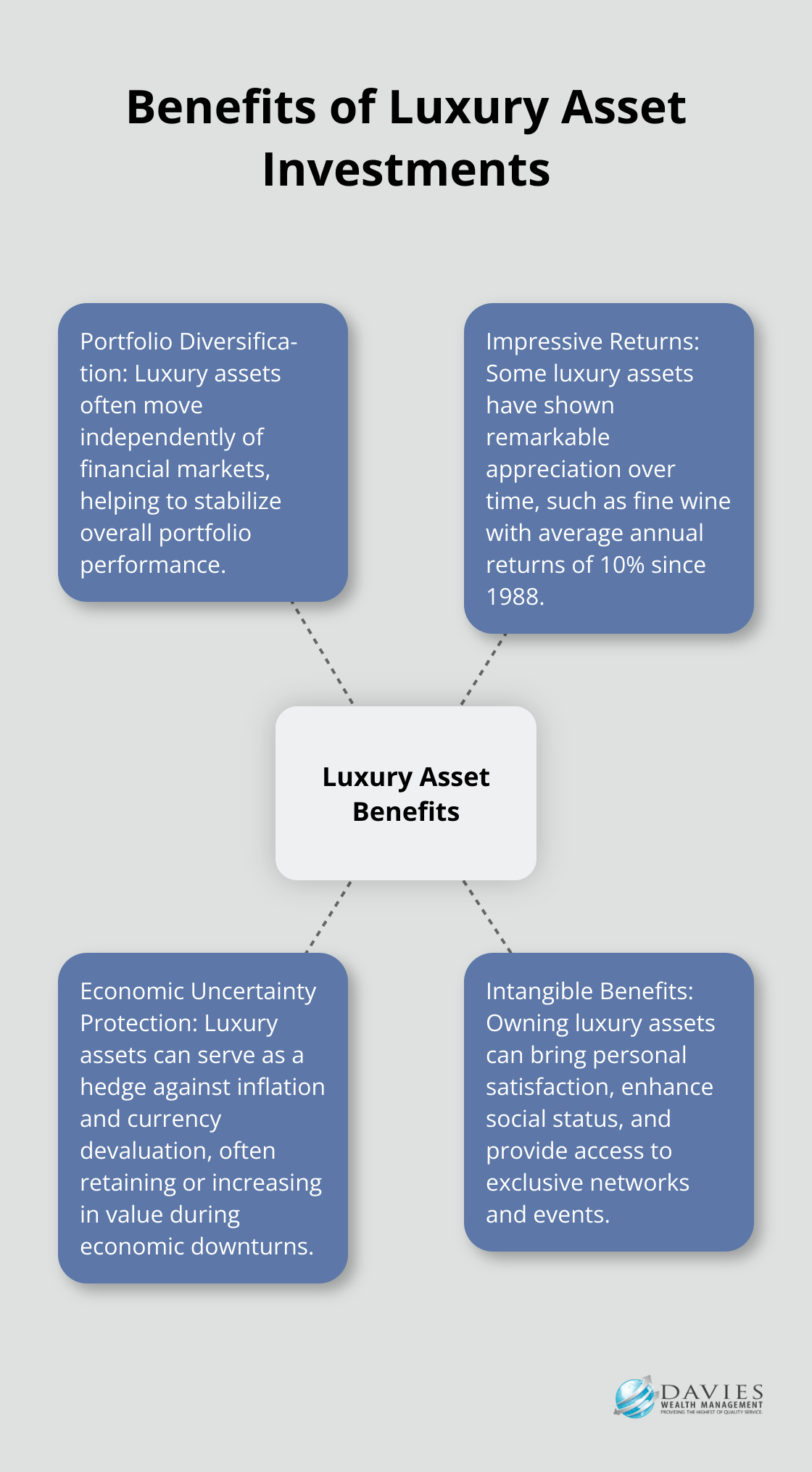

Portfolio Diversification

Luxury assets provide an excellent opportunity for portfolio diversification. Unlike stocks and bonds (which are subject to market fluctuations), luxury items often move independently of financial markets. This lack of correlation can help stabilize your overall portfolio during economic downturns. For instance, during the 2008 financial crisis, the art market showed resilience, with certain segments even experiencing growth while traditional markets struggled.

Impressive Returns

Some luxury assets have demonstrated remarkable appreciation over time. The wine market serves as a prime example. Fine wine investment has consistently delivered average annual returns of 10% since 1988. Similarly, certain vintage watches have seen astronomical price increases. A Patek Philippe Nautilus 5711/1A, which retailed for about $30,000 in 2015, now commands prices of approximately $132,000 on the secondary market.

Economic Uncertainty Protection

Luxury assets can serve as a hedge against inflation and currency devaluation. As the value of money decreases over time, tangible assets like art, jewelry, and rare collectibles often retain or increase in value. Gold jewelry has historically been a popular inflation hedge, with its value typically rising during periods of economic uncertainty. For example, when the stock market collapsed in 2007, investment demand for gold spiked and continued to rise, and gold doubled in value between 2007 and 2011.

Intangible Benefits

Beyond financial returns, luxury assets offer unique personal satisfaction. Owning a piece of fine art or a rare vintage car can bring joy and a sense of accomplishment. This emotional value is an important factor to consider when evaluating luxury investments. Additionally, these assets can enhance your social status and open doors to exclusive networks and events, which can lead to further investment opportunities.

While luxury assets offer numerous benefits, they also come with their own set of challenges and risks. In the next section, we’ll explore the potential drawbacks and considerations investors should keep in mind when venturing into the world of luxury asset investments.

The Hidden Costs of Luxury Investments

The Price of Exclusivity

Luxury assets come with hefty price tags. Patek Philippe watches cost around $48,000 on average, though prices range from around $9,000 to $525,000 depending on the model. A single bottle of fine wine might require tens of thousands of dollars. The expenses don’t end at purchase. Ongoing maintenance costs can be substantial. For instance, a classic car might demand specialized care costing upwards of $5,000 annually (not including potential restoration work).

Liquidity Challenges

Luxury assets lack liquidity. Unlike stocks or bonds, you can’t sell a piece of fine art or a vintage car instantly. Finding the right buyer can take months or even years. This illiquidity can create problems if you need quick access to funds. A study found that it takes an average of 178 days to sell a work of art.

Market Volatility

The luxury asset market can be highly unpredictable. Trends and tastes change rapidly, affecting values dramatically. The classic car market illustrates this volatility. The global Classic cars market size was valued at USD 39.7 billion in 2024 and is anticipated to reach USD 77.8 billion by 2032, at a CAGR of 8.7%. This unpredictability highlights the need for thorough research and expert guidance before making any luxury investment.

Authentication Concerns

Fraud poses a significant risk in the luxury asset market. Counterfeit watches, fake artwork, and even fraudulent wine have all made headlines. Authentication can be costly and time-consuming. The high value and easy transportation factors turn luxury goods into a great channel for money laundering, requiring robust AML compliance.

Storage and Insurance Expenses

Proper storage and insurance for luxury assets can surprise investors with their costs. A comprehensive insurance policy for a valuable art collection might cost 1-2% of the collection’s value annually. Climate-controlled storage for fine wines can run up to $4 per bottle per month. These ongoing expenses can significantly reduce potential returns if not carefully managed. In fact, hidden costs can reduce investment returns by up to 2% per year, according to a study by the Securities and Exchange Commission.

Final Thoughts

Luxury assets offer potential for impressive returns and portfolio diversification. However, they come with significant risks, including high initial costs, ongoing expenses, and lack of liquidity. Market volatility, authentication concerns, and storage requirements further complicate the investment process.

At Davies Wealth Management, we emphasize the importance of thorough research and expert guidance when considering luxury asset investments. Understanding the intricacies of each asset class is crucial for making informed decisions. We recommend consulting with specialists in specific luxury markets and financial advisors who can help assess how these investments fit into your overall financial strategy.

Davies Wealth Management offers personalized advice to help navigate this sophisticated market. Our team can assist in evaluating luxury investment opportunities within the context of your broader financial plan. Luxury assets can be a smart strategy for some investors, but they require a measured approach to determine if they’re a suitable addition to your portfolio.

Leave a Reply