At Davies Wealth Management, we’re excited to explore the cutting-edge world of wealth tech solutions for affluent investors. The financial landscape is rapidly evolving, and high-net-worth individuals need innovative tools to manage their complex portfolios effectively.

In this post, we’ll examine how wealth tech in Stuart, Florida and beyond is revolutionizing investment strategies for the affluent. From advanced robo-advisors to AI-powered planning tools and blockchain solutions, these technologies are reshaping the way we approach wealth management.

Robo-Advisors Evolve for High Net Worth Clients

Robo-advisors have transformed since their inception, now catering to the unique needs of high-net-worth individuals. These sophisticated platforms use advanced algorithms to manage complex portfolios, offering customization and efficiency that once belonged exclusively to human advisors.

Algorithmic Sophistication Meets Wealth Complexity

Today’s robo-advisors for affluent investors are designed for complex financial needs. They use machine learning and artificial intelligence to analyze vast amounts of data, including market trends, economic indicators, and individual client preferences. This allows for real-time portfolio adjustments and risk management that human advisors can’t match in speed or precision.

Some robo-advisors report that their AI strategies can harvest up to 26% more losses than traditional methods, potentially leading to significant tax savings for high-net-worth clients. Wealthfront’s Risk Parity fund uses AI to balance risk across multiple asset classes, a strategy particularly beneficial for larger portfolios.

Tailoring Technology to Individual Wealth Profiles

High-net-worth individuals often have complex financial situations that require more than a one-size-fits-all approach. Modern robo-advisors meet this challenge by offering unprecedented levels of customization.

Some platforms provide a hybrid model that combines robo-advisory services with human oversight. This allows for the incorporation of alternative investments (such as private equity or real estate), which often form crucial components of affluent investors’ portfolios.

The Human Touch in a Digital World

While robo-advisors have made significant strides, the most effective wealth management strategies for high-net-worth individuals often involve a combination of algorithmic precision and human insight. This hybrid approach allows for the best of both worlds: data-driven decision-making and empathetic, personalized advice.

This model has proven particularly effective for complex tasks like estate planning and philanthropic strategies, which require a deep understanding of a client’s values and long-term goals.

As we transition to our next topic, it’s important to note that while robo-advisors have revolutionized portfolio management, they represent just one facet of the wealth tech revolution. The next frontier in financial technology lies in AI-powered planning tools, which promise to take wealth management to new heights of sophistication and personalization.

AI Transforms Financial Planning

At Davies Wealth Management, we observe how AI-powered financial planning tools revolutionize wealth management for affluent investors. These sophisticated technologies offer unprecedented insights and capabilities that once required teams of human analysts.

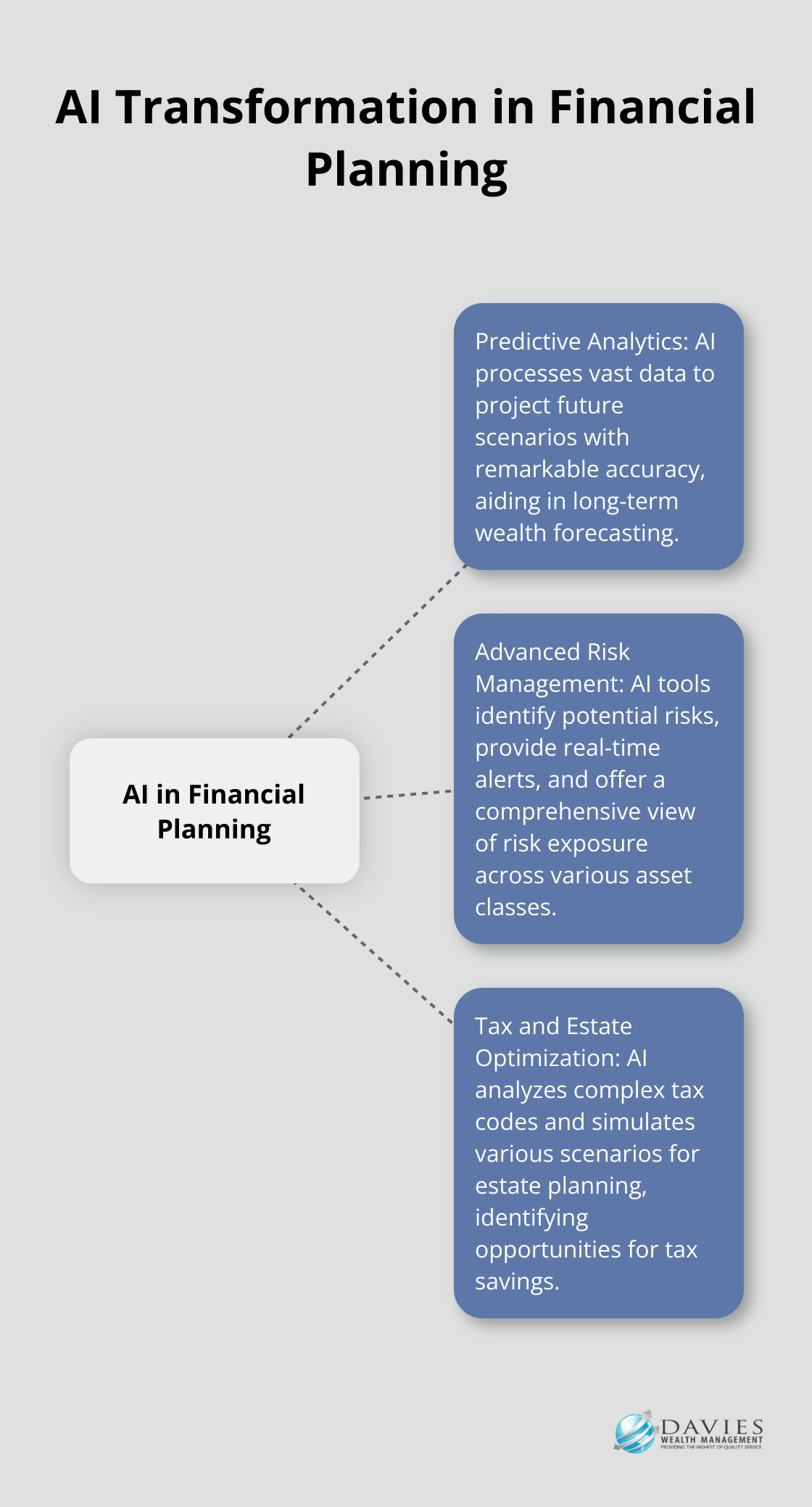

Predictive Analytics for Wealth Forecasting

AI-driven predictive analytics change the game in long-term wealth forecasting. These tools process vast amounts of data, including market trends, economic indicators, and individual financial histories, to project future scenarios with remarkable accuracy. BlackRock’s Aladdin platform provides capabilities to support decision making and investment management.

These forecasts help clients make more informed decisions about major life events, such as retirement timing or business expansions. AI tools provide a clearer picture of potential outcomes for different financial strategies by simulating thousands of economic scenarios.

Advanced Risk Management

AI elevates risk assessment and management to new levels of sophistication. These tools identify potential risks that human advisors might overlook and provide real-time alerts when market conditions change. JPMorgan’s AI-powered system is set to boost productivity and cut costs across non-bank institutions such as asset managers.

This technology allows us to offer clients (especially professional athletes with complex financial situations) a more comprehensive view of their risk exposure across various asset classes and investment strategies.

Tax and Estate Optimization

AI makes significant strides in tax optimization and estate planning. These tools analyze complex tax codes and individual financial situations to identify opportunities for tax savings that human advisors might miss.

In estate planning, AI simulates various scenarios to help clients understand the long-term implications of different wealth transfer strategies. This proves particularly valuable for clients with complex family situations or significant philanthropic goals.

As AI continues to reshape financial planning and wealth management, the most effective approach combines AI’s power with the nuanced understanding and personal touch that only human advisors provide. This hybrid model leverages cutting-edge technology while delivering personalized service.

The next frontier in wealth tech solutions extends beyond AI and into the realm of blockchain and cryptocurrency. These technologies promise to further transform how affluent investors manage and grow their wealth.

How Blockchain Transforms Wealth Management

Blockchain technology revolutionizes wealth management, reshaping how affluent investors track assets, diversify portfolios, and transfer wealth. This innovative system offers unprecedented security, transparency, and efficiency in financial operations.

Secure Asset Tracking

Blockchain provides unparalleled security and transparency in asset tracking. Each transaction records on a distributed ledger, creating an immutable audit trail. This level of transparency proves particularly valuable for high-net-worth individuals who manage complex portfolios across multiple asset classes.

The Luxembourg Stock Exchange exemplifies this transformation. It implemented a blockchain-based security system that allows real-time tracking of asset ownership and transaction history. Security tokens have the potential to significantly improve efficiency and transparency and make transactions safer.

Alternative Investment Democratization

Tokenization, powered by blockchain, opens new avenues for investment in previously illiquid assets. Real estate and private equity investments can take years to sell, but tokenization allows these assets to be traded more readily.

Masterworks (a platform for fine art investment) successfully tokenized works by artists like Banksy and Basquiat. This allows investors to own shares in multi-million dollar artworks for as little as $20, democratizing access to this exclusive asset class.

Streamlined Wealth Transfer

Smart contracts on the blockchain revolutionize estate planning and wealth transfer. These self-executing contracts automatically distribute assets according to predetermined conditions, reducing the need for intermediaries and minimizing disputes.

Ethereum (the second-largest cryptocurrency platform) supports complex smart contracts that handle multi-generational wealth transfer strategies. A smart contract could program to release funds to beneficiaries at specific ages or life events, ensuring responsible wealth distribution over time.

Challenges and Considerations

While blockchain offers exciting possibilities, it’s important to approach these innovations with a balanced perspective. The technology still faces regulatory hurdles and potential security risks (as with any new financial technology). Investors should work with experienced advisors to navigate these new opportunities while maintaining focus on overall financial health and long-term goals.

Integration with Traditional Finance

The future of wealth management lies in the integration of blockchain with traditional financial expertise. This combination promises to provide more comprehensive and personalized financial solutions. Forward-thinking firms (like Davies Wealth Management) explore ways to leverage blockchain’s benefits while maintaining the personalized service and expertise that affluent clients expect.

Final Thoughts

The landscape of wealth management evolves rapidly, driven by innovative wealth tech solutions that cater to affluent investors’ unique needs. From sophisticated robo-advisors to AI-powered financial planning tools and blockchain-based asset management, these technologies reshape how high-net-worth individuals manage and grow their wealth. Wealth tech in Stuart, Florida and beyond continues to advance, offering new opportunities for those who embrace innovation.

At Davies Wealth Management, we leverage cutting-edge solutions while maintaining a personalized approach to wealth management. Our team of experts understands the latest wealth tech innovations and applies them to your unique financial situation. We help you navigate the exciting world of wealth tech, whether you’re a professional athlete with complex financial needs or an individual seeking to secure your financial future.

We invite you to explore these innovative solutions with us at Davies Wealth Management. Our tailored approach combines the power of advanced technology with personalized expertise (ensuring your wealth management strategy aligns with your long-term goals). Let’s work together to harness the potential of wealth tech and secure your financial future.

Leave a Reply