At Davies Wealth Management, we understand that starting your investment journey can feel overwhelming. That’s why we’ve created this comprehensive guide to provide investment advice for beginners.

In this post, we’ll break down the basics of investing, help you create a solid strategy, and outline practical steps to get started.

Whether you’re looking to build wealth, save for retirement, or achieve other financial goals, this guide will equip you with the knowledge and confidence to begin your investment journey.

What Is Investing and Why Should You Start?

The Essence of Investing

Investing is an asset or item acquired to generate income or gain appreciation. It’s one of the most effective ways to build wealth over time. When you invest, you buy assets that have the potential to increase in value or generate income. Appreciation is the increase in the value of an asset over time.

The Power of Compound Interest

One of the main reasons to start investing early is the power of compound interest. This concept allows your money to grow exponentially over time. For example, if you invest $1,000 with an annual return of 7%, after 30 years, you’d have about $7,612 without adding a single penny more. This growth occurs because you earn returns not just on your initial investment, but also on the returns from previous years.

Types of Investments

There are several types of investments to consider:

- Stocks: When you buy stocks, you purchase a small piece of ownership in a company. Stocks have historically provided the highest returns over long periods but come with higher volatility.

- Bonds: These are essentially loans you make to governments or corporations. Bonds typically offer lower returns than stocks but are generally considered less risky.

- Mutual Funds: These are professionally managed pools of money invested in a diversified portfolio of stocks, bonds, or other securities. They offer an easy way to diversify your investments.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, ETFs are baskets of securities that trade like individual stocks on an exchange. They often have lower fees than mutual funds and can be more tax-efficient.

Understanding Risk Tolerance

Your risk tolerance is your ability to withstand fluctuations in the value of your investments. It’s important to understand your risk tolerance before investing. Factors that influence risk tolerance include your age, financial goals, and personal comfort level with market volatility.

Many financial advisors (including those at Davies Wealth Management) work closely with their clients to determine their risk tolerance and create an investment strategy that aligns with their comfort level and financial objectives. This personalized approach helps ensure that you don’t take on more risk than you can handle, which is especially important for long-term investing success.

Investing is not about getting rich quick. It’s about consistently growing your wealth over time. The next chapter will guide you through the process of creating your investment strategy, helping you take the first steps towards your financial goals.

How to Create a Winning Investment Strategy

Assess Your Financial Situation

The first step in creating your investment strategy is to take a hard look at your current financial situation. Calculate your net worth by subtracting your liabilities from your assets. A recent Federal Reserve survey reported increases in median and mean income across different types of families between 2019 and 2022.

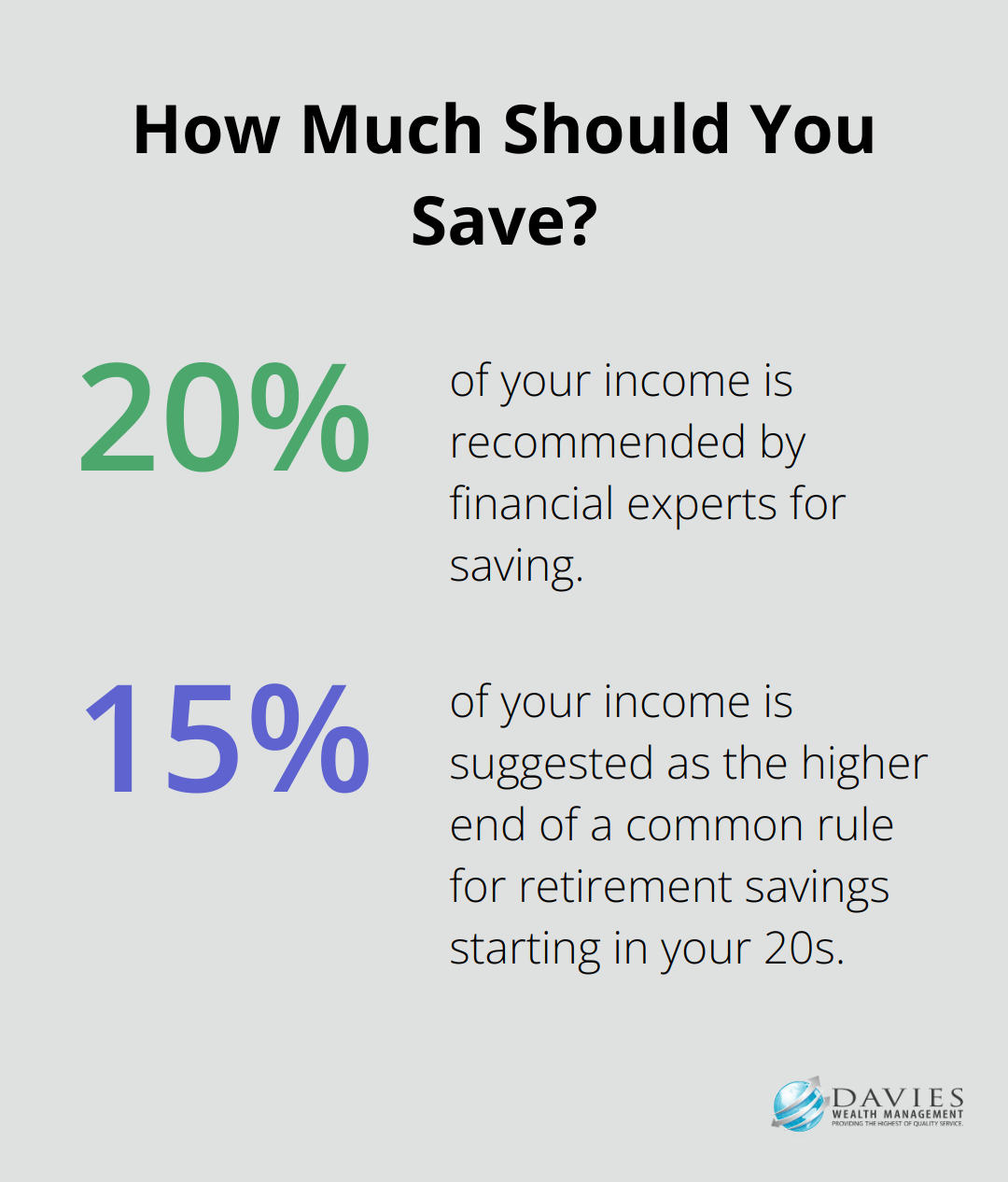

Next, evaluate your cash flow. Determine your monthly income and expenses to identify how much you can realistically set aside for investing. Financial experts often recommend saving at least 20% of your income, but even small amounts can make a difference over time.

Define Your Investment Goals

Clear, specific investment objectives will guide your strategy. Consider your goals: retirement, a down payment on a house, or your children’s education. Each goal has a different time horizon and risk profile.

For retirement, a common rule suggests saving 10-15% of your income starting in your 20s. If you start later, you may need to save more. For example, starting at age 35 might require saving 20-25% of your income to reach the same retirement goal.

Determine Your Asset Allocation

Asset allocation involves dividing your investments among different asset categories, such as stocks, bonds, and cash. Your allocation should reflect your risk tolerance and investment timeline.

The “100 minus your age” rule for stock allocation is a classic starting point. For instance, if you’re 30 years old, you might consider allocating 70% of your portfolio to stocks and 30% to bonds. However, this is just a guideline. Many financial advisors now recommend a higher stock allocation due to increased life expectancies.

Implement Diversification Strategies

Diversification is a key risk management technique. It involves spreading your investments across various financial instruments, industries, and other categories to reduce risk. A well-diversified portfolio might include:

- U.S. stocks (large-cap, mid-cap, and small-cap)

- International stocks (developed and emerging markets)

- Bonds (government and corporate)

- Real estate investment trusts (REITs)

- Commodities

Vanguard found that global diversification can provide benefits, even when one country or region outperforms others.

Seek Professional Guidance

Creating an investment strategy is an ongoing process that requires regular review and adjustment as your life circumstances and financial goals evolve. Professional guidance can prove invaluable in this process. For instance, Davies Wealth Management specializes in creating tailored investment strategies that align with clients’ unique situations and goals. They offer particular expertise for professional athletes, who often have short career spans and fluctuating incomes, developing strategies that account for these unique circumstances.

As you move forward in your investment journey, the next step is to put your strategy into action. Let’s explore the practical steps to start investing and how to implement your carefully crafted plan.

How to Start Investing Today

Choose the Right Investment Account

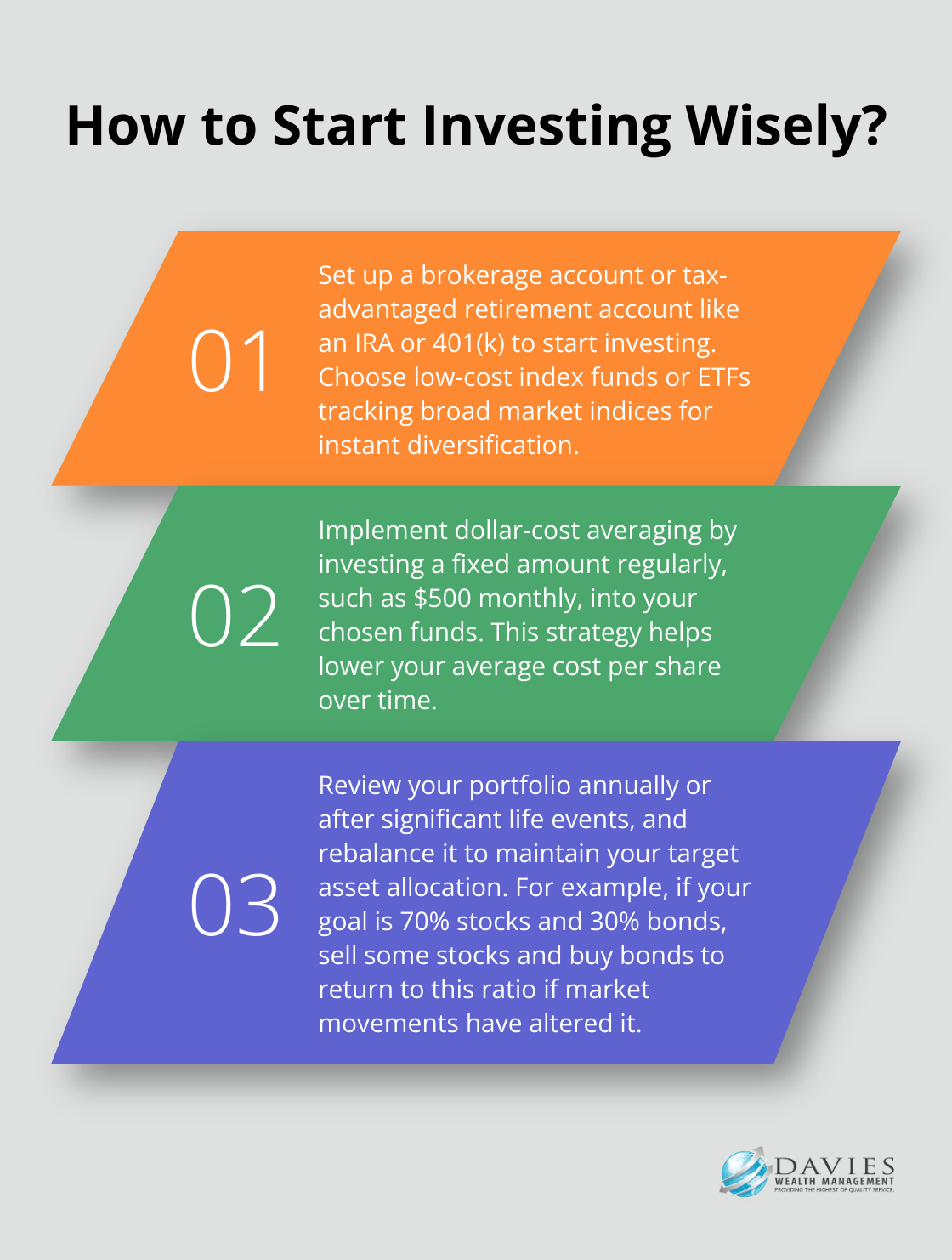

The first step to start investing involves selecting an appropriate investment account. For most beginners, a brokerage account serves as an excellent starting point. These accounts allow you to buy and sell various securities, including stocks, bonds, and ETFs. Many online brokers offer commission-free trades and educational resources for new investors.

If you plan to save for retirement, consider tax-advantaged accounts like Individual Retirement Accounts (IRAs) or your employer-sponsored 401(k). The Investment Company Institute reports that about 60 million American workers actively participated in 401(k) plans as of 2020, which highlights their popularity.

Select Your Investments Wisely

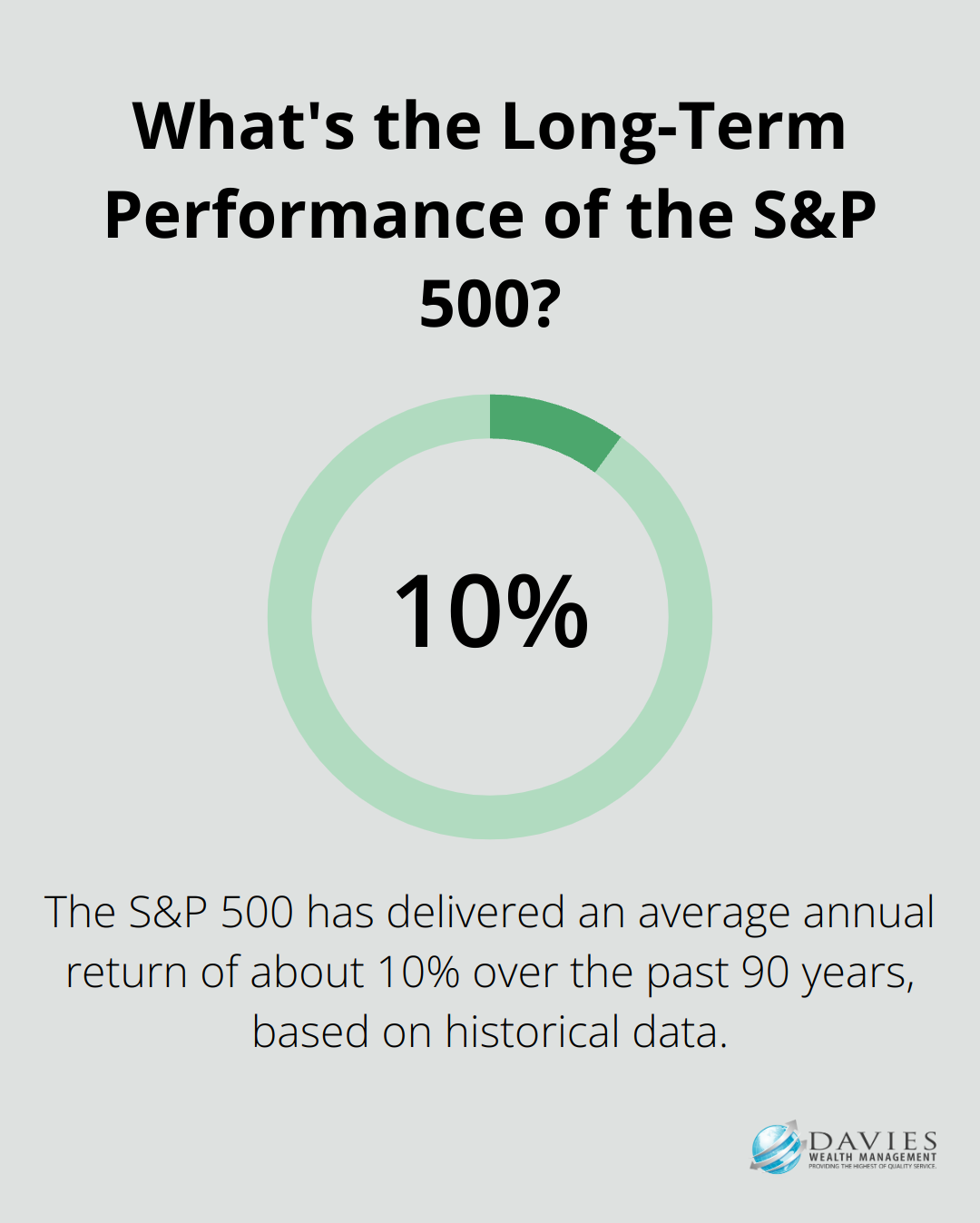

After you set up your account, you need to choose your investments. For beginners, low-cost index funds or ETFs that track broad market indices like the S&P 500 often provide a solid foundation. These investments offer instant diversification and can be a great way for both beginning and advanced investors to invest in the stock market.

The S&P 500 has delivered an average annual return of about 10% over the past 90 years (according to historical data). However, past performance doesn’t guarantee future results, so you should conduct your own research or consult with a financial advisor.

Implement Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you make regular, periodic constant stock purchases over an investment horizon of T periods. Money not initially invested in stocks is parked in an alternative investment.

For example, if you decide to invest $500 monthly in a specific fund, you’ll buy more shares when prices are low and fewer when prices are high. Over time, this can potentially lower your average cost per share.

Monitor and Rebalance Your Portfolio

Regular portfolio review ensures your investments align with your goals and risk tolerance. Try to review your portfolio at least annually or when significant life events occur.

Rebalancing involves adjusting your portfolio back to your target asset allocation. For instance, if your target is 70% stocks and 30% bonds, but market movements have shifted this to 80% stocks and 20% bonds, you’d sell some stocks and buy bonds to return to your original allocation.

Seek Professional Guidance

Creating and maintaining an investment strategy requires ongoing attention and adjustment as your life circumstances and financial goals evolve. Professional guidance can prove invaluable in this process. Financial advisors help create comprehensive plans covering retirement, taxes, estate planning, insurance needs, and major life transitions.

Final Thoughts

Starting your investment journey marks a significant step towards financial security. Understanding investment basics, creating a solid strategy, and taking practical steps will set you up for success. Patience plays a vital role in reaping the rewards of compound interest and market growth over time.

Continuous learning about market trends and economic indicators will help you refine your strategy. The investment landscape evolves constantly, so staying informed allows you to make better decisions. We recommend you start small, maintain consistency, and gradually build your portfolio as your confidence and knowledge grow.

For personalized investment advice for beginners, consider consulting with financial professionals. At Davies Wealth Management, we create comprehensive investment strategies tailored to individual needs and goals. Our team stands ready to help you navigate the complexities of investing and build a secure financial future.

Leave a Reply