At Davies Wealth Management, we understand that the retirement transition can be both exciting and daunting. Moving from a structured work life to retirement is a significant change that requires careful planning and preparation.

This blog post will guide you through the key steps to ensure a smooth transition from your career to retirement. We’ll cover financial planning, lifestyle adjustments, and gradual transition strategies to help you navigate this important life stage with confidence.

How to Build Your Financial Foundation for Retirement

Evaluate Your Current Financial Picture

The first step in preparing for retirement requires a clear view of your current financial situation. Take stock of all your assets, liabilities, income sources, and expenses. Create a comprehensive list of your retirement accounts, savings, investments, and any debts you have. Include potential sources of retirement income such as Social Security benefits or pensions.

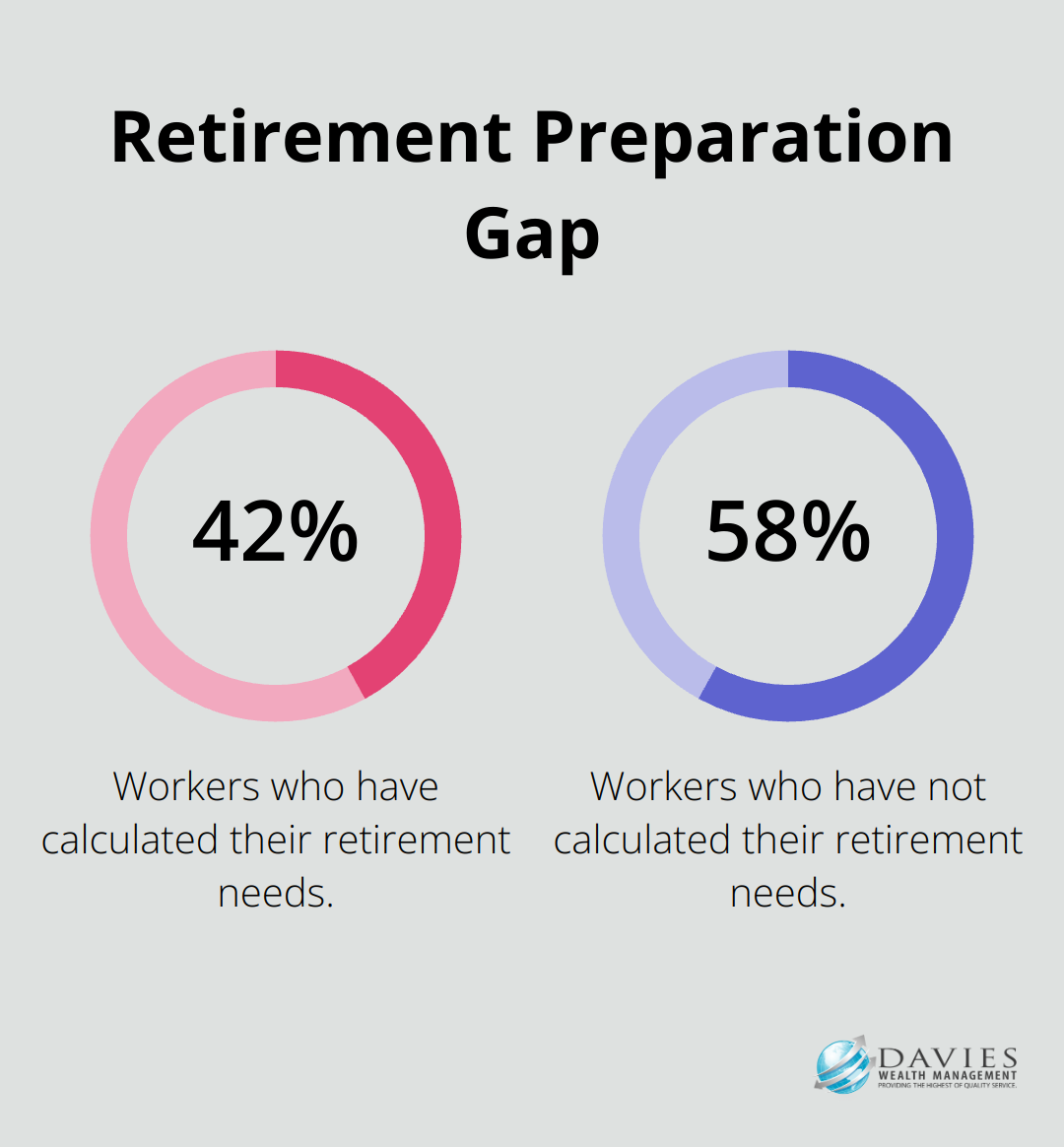

A study by the Employee Benefit Research Institute found that only 42% of workers have calculated how much money they’ll need in retirement. Don’t join the unprepared majority. Use online retirement calculators or work with a financial advisor to estimate your retirement needs based on your desired lifestyle.

Set Clear and Achievable Retirement Goals

After you have a clear picture of your finances, set realistic retirement goals. Consider factors like your desired retirement age, expected lifestyle, and potential healthcare needs. Be specific about what you want your retirement to look like. Do you plan to travel extensively? Pursue expensive hobbies? Or live a more modest lifestyle?

Your goals should follow the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of a vague goal like “save more for retirement,” set a specific target like “increase my 401(k) contributions by 2% each year for the next five years.”

Maximize Your Retirement Savings

With clear goals in mind, it’s time to supercharge your retirement savings. If you’re not already maxing out your retirement accounts, now is the time to do so. Catch-up contributions can help boost your savings. For example, a SIMPLE IRA or a SIMPLE 401(k) plan may permit annual catch-up contributions up to $3,500 in 2023 for those eligible.

Don’t overlook other tax-advantaged accounts like IRAs. For 2023, you can contribute up to $6,500 to an IRA (with an additional $1,000 catch-up contribution for those 50 and older). If you’re self-employed or have a side business, consider setting up a SEP IRA or Solo 401(k) to further boost your retirement savings.

Consider Strategic Downsizing or Relocation

As you approach retirement, evaluate whether your current living situation aligns with your retirement goals. Downsizing to a smaller home can free up equity, reduce expenses, and simplify your lifestyle. However, it’s important to note that downsizing may not be cost-free, as you’ll need to consider moving expenses and other associated costs.

Relocating to an area with a lower cost of living can also significantly stretch your retirement dollars. For example, moving from a high-cost city to a more affordable region could reduce your housing expenses by 30% or more. However, factor in all costs associated with moving, including potential changes in taxes, healthcare access, and proximity to family and friends.

With a solid financial foundation in place, the next step involves preparing for the significant lifestyle changes that come with retirement. Let’s explore how you can smoothly transition into this new phase of life.

Embracing Your New Lifestyle in Retirement

Retirement marks a significant shift from a career-focused life to one of personal freedom and exploration. At Davies Wealth Management, we understand that this transition involves more than financial planning. It requires a thoughtful approach to reshaping your daily routine, finding new sources of fulfillment, and maintaining your health and social connections. Our experience has shown that proactive planning for your new lifestyle is essential to a satisfying retirement.

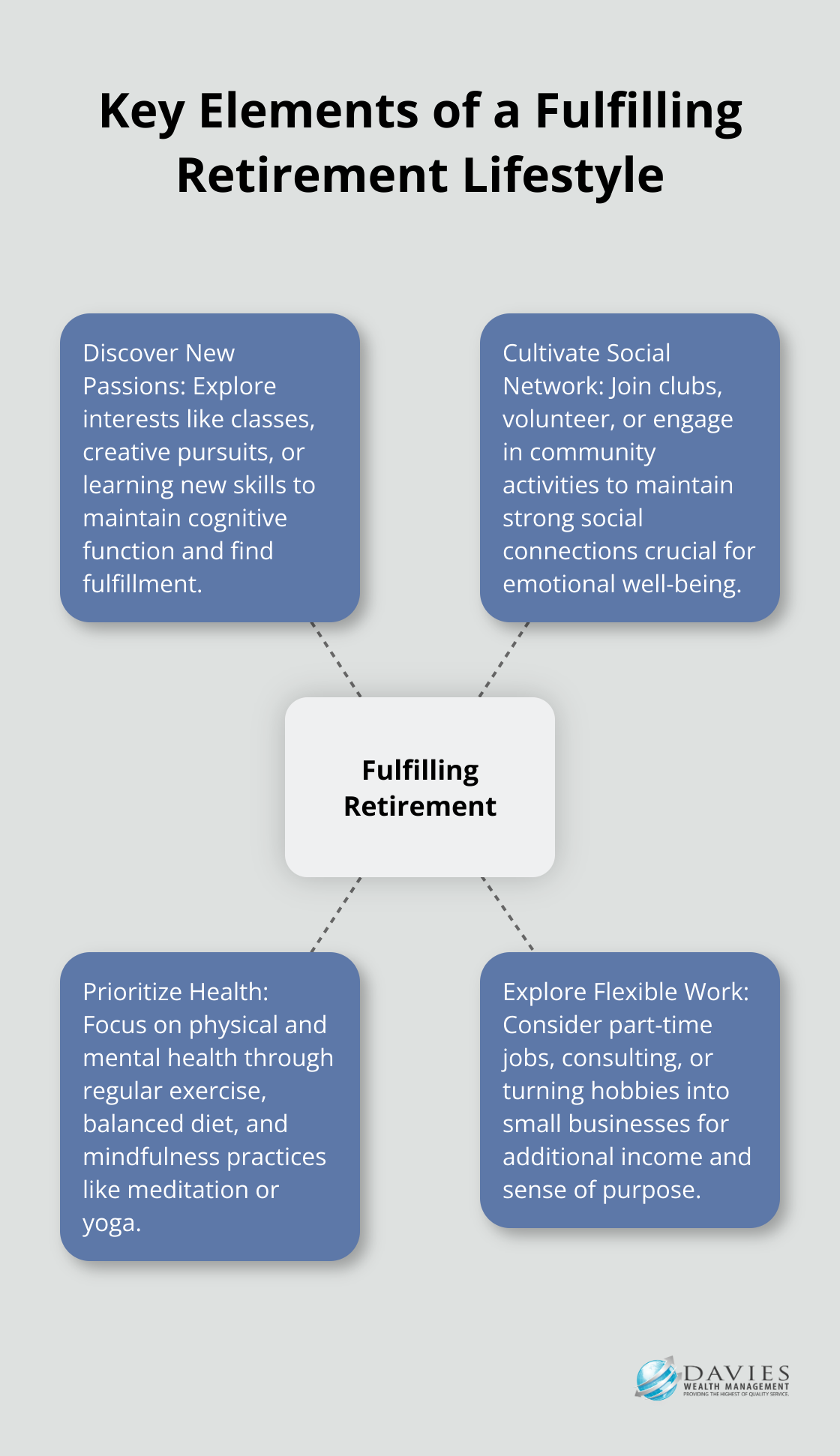

Discover New Passions and Pursuits

Retirement offers the perfect opportunity to explore interests you may have postponed during your working years. Start with a list of activities you’ve always wanted to try. Take classes at a local community college, join a book club, or learn a new skill like photography or gardening. The National Institute on Aging reports that mentally stimulating activities can help maintain cognitive function as we age.

Many retirees find fulfillment in creative pursuits. Painting, writing, or woodworking can provide a sense of purpose and accomplishment. Local art centers or community workshops often offer classes tailored to beginners, making it easy to start your new hobby.

Cultivate a Vibrant Social Network

Strong social connections are vital for your emotional well-being in retirement. Robust evidence documents social connection factors as independent predictors of mental and physical health, with some of the strongest evidence on mortality. Keep your social calendar full by joining local clubs or organizations aligned with your interests.

Volunteering is an excellent way to stay socially engaged while giving back to your community. Websites like VolunteerMatch.org can help you find opportunities that match your skills and interests. Many retirees find that volunteering provides a sense of purpose and structure to their days.

Prioritize Your Health and Wellness

Plan for your healthcare needs as a critical aspect of retirement preparation. Research Medicare options and supplemental insurance plans to ensure comprehensive coverage. The National Council on Aging offers free resources to help you navigate these choices.

Focus on maintaining your physical health through regular exercise and a balanced diet. The Centers for Disease Control and Prevention recommends at least 150 minutes of moderate-intensity aerobic activity per week for older adults. Join a gym that offers senior-focused classes or find a walking group in your neighborhood.

Mental health is equally important. Many retirees benefit from mindfulness practices like meditation or yoga. Apps like Headspace or Calm can guide you through daily meditation sessions, helping to reduce stress and improve overall well-being.

Explore Flexible Work Arrangements

While retirement traditionally means leaving the workforce entirely, many retirees find satisfaction in part-time or consulting work. This approach can provide additional income, keep you mentally sharp, and offer a sense of purpose.

Reach out to your former employer about potential consulting opportunities or explore freelance platforms (like Upwork or Freelancer.com). These platforms allow you to leverage your professional skills on a flexible schedule.

Alternatively, turn a hobby into a small business. This can be both financially rewarding and personally fulfilling. Sell handmade crafts on Etsy or offer gardening services in your community. Entrepreneurship in retirement can open an exciting new chapter in your life. Being able to retire early and live an early retirement lifestyle is exactly like being your own boss. Both are wonderful!

As you plan for these lifestyle changes, you’ll create a retirement that’s not just financially secure, but rich in experiences, relationships, and personal growth. The next step in your journey involves developing strategies for a gradual transition into this new phase of life.

How to Ease Into Retirement Gradually

Explore Phased Retirement Options

Many employers now offer phased retirement programs. These allow you to reduce your work hours gradually over time, easing into retirement while still earning income. Phased retirement models give employees more control over how they exit the workforce, fostering higher levels of engagement and satisfaction. If your employer doesn’t have a formal program, consider proposing a reduced schedule or job-sharing arrangement.

Self-employed individuals or business owners might gradually transfer responsibilities to a successor or sell portions of their business over time. This approach can provide a steady income stream while allowing you to step back from day-to-day operations.

Test Drive Your Retirement Budget

Before you fully retire, try to live on your projected retirement budget for several months. This real-world test can help you identify potential financial challenges and adjust your plans accordingly. Start by calculating your expected retirement income (including Social Security, pensions, and withdrawals from retirement accounts). Then, track your expenses carefully to see how they align with your income.

During this trial period, you might discover areas where you can cut back or reallocate funds. You might find that you spend less on work-related expenses but more on leisure activities. This insight can help you refine your budget and ensure it’s realistic for your retirement lifestyle.

Upskill for Your Next Chapter

Retirement doesn’t mean the end of learning and growth. In fact, acquiring new skills can fulfill you as you transition into this new phase of life. Try to take courses related to your hobbies or interests. Many universities offer free or low-cost online courses through platforms like Coursera or edX.

If you plan to work part-time or volunteer in retirement, now is the time to update your skills. For instance, if you’re interested in nonprofit work, you might take a course in grant writing or nonprofit management. These new skills can open doors to exciting opportunities in retirement.

Maintain Professional Connections

As you transition to retirement, it’s important to maintain your professional network. These connections can provide opportunities for part-time work, consulting gigs, or volunteer positions. Attend industry events, join professional associations, or participate in online forums related to your field.

LinkedIn can be a valuable tool for staying connected with former colleagues and industry peers. Regular engagement on this platform can keep you informed about industry trends and potential opportunities that align with your retirement goals.

Seek Expert Guidance

Navigating the transition to retirement can be complex. Professional financial advisors, such as those at Davies Wealth Management, can provide personalized strategies to support your unique needs and goals. Financial planning is essential at every stage of life, including during your working years when it’s about balancing tax-efficient retirement savings with budgeting. Whether you’re a professional athlete looking to plan for life after sports or an executive considering a phased retirement, expert guidance can ensure you’re well-prepared for a fulfilling retirement.

Final Thoughts

The retirement transition requires careful planning and preparation across financial, lifestyle, and emotional aspects. We encourage you to start your preparations early, which will allow you to make informed decisions and adjust your strategies as needed. A proactive approach will help you enter retirement with confidence and ensure a smooth transition into this new chapter of your life.

Professional guidance can prove invaluable as you navigate this important life stage. At Davies Wealth Management, we specialize in helping individuals plan for a secure and enjoyable retirement. Our team of experts provides personalized advice tailored to your unique situation and goals.

We invite you to embrace retirement as an exciting opportunity to redefine your life on your own terms. With thoughtful planning and the right support, you can look forward to a retirement that’s financially secure and rich in experiences. Visit our website to learn more about how we can assist you in creating a comprehensive retirement plan that aligns with your vision for the future.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply