High-income earners often face substantial tax burdens, but there are effective strategies to reduce this financial strain. At Davies Wealth Management, we’ve identified 5 outstanding tax strategies for high-income earners that can significantly impact your bottom line.

In this post, we’ll explore various methods to slash your tax bill, from maximizing retirement account contributions to leveraging tax-advantaged investments and advanced planning techniques. These strategies can help you keep more of your hard-earned money while staying compliant with tax laws.

Maximizing Retirement Accounts for Tax Savings

Retirement accounts serve as powerful tools for high-income earners to reduce their tax burden. These accounts offer substantial opportunities to lower taxable income while building wealth for the future.

Traditional IRA and 401(k) Contributions

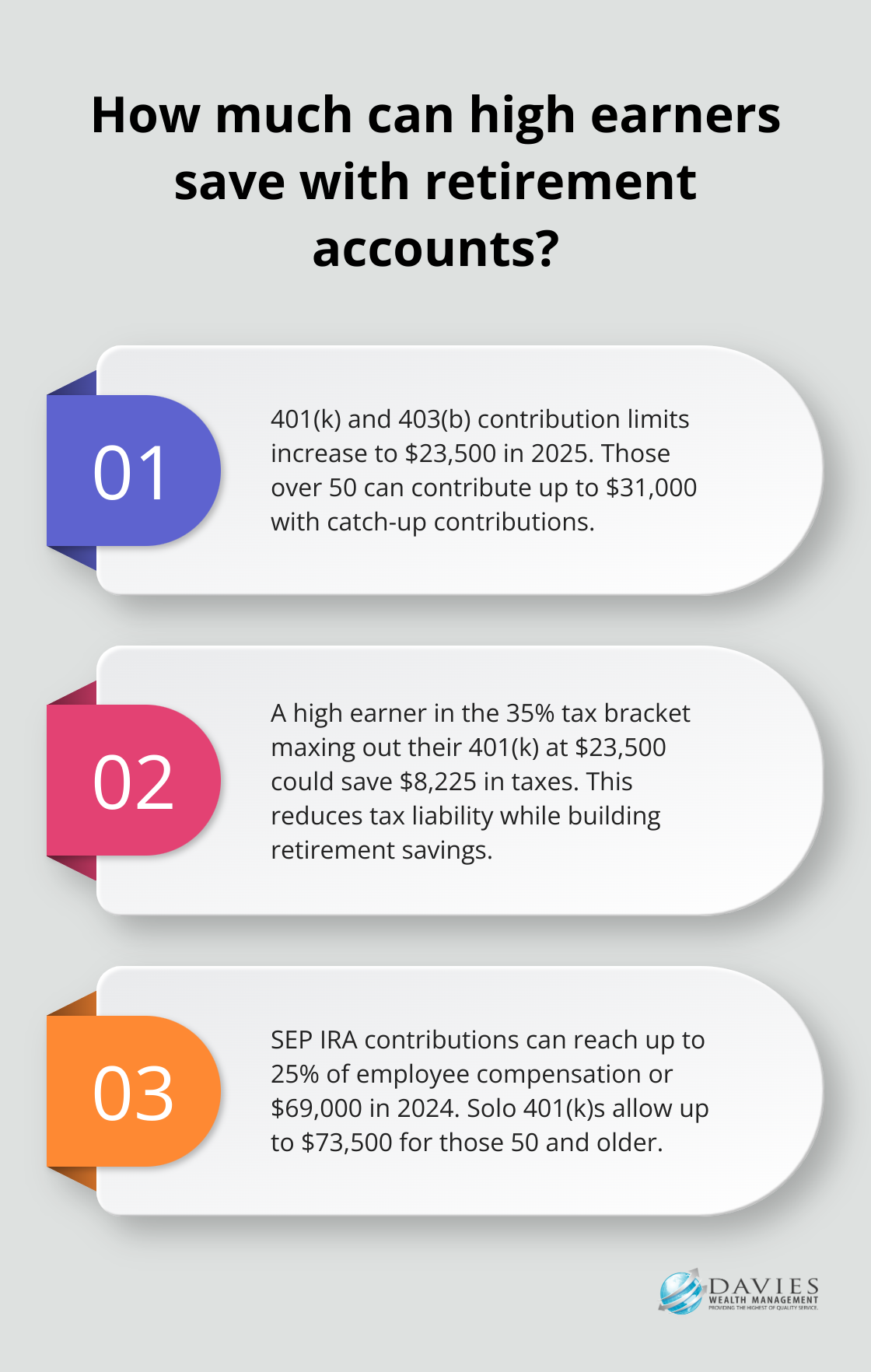

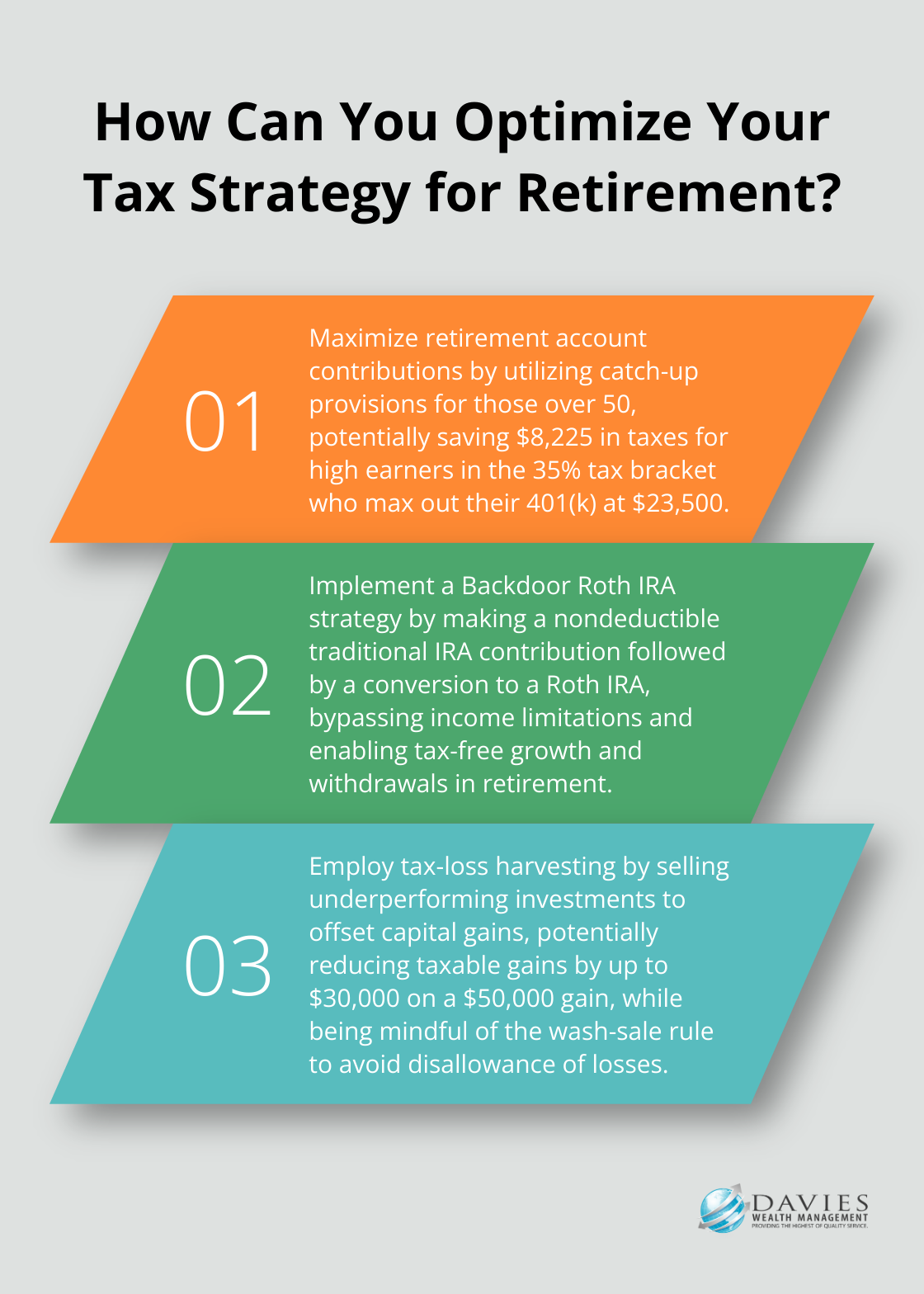

The contribution limit for 401(k) and 403(b) accounts will increase to $23,500 in 2025. Individuals over 50 can make additional catch-up contributions, bringing their total to $31,000. These pre-tax contributions effectively lower taxable income for the year.

For instance, a high earner in the 35% tax bracket who maxes out their 401(k) at $23,500 could potentially save $8,225 in taxes for the year (a significant reduction in tax liability while simultaneously building retirement savings).

Roth IRA Strategies for High Earners

While direct Roth IRA contributions have income limitations, high earners can still benefit from this tax-free growth vehicle. The Backdoor Roth IRA strategy involves making a nondeductible traditional IRA contribution followed by a traditional-to-Roth IRA conversion. This method bypasses income limitations and enables tax-free growth and withdrawals in retirement.

Some 401(k) plans offer a Roth option without income limits, making them an excellent choice for high-income earners seeking tax diversity in retirement.

Self-Employed Retirement Options

Self-employed individuals and small business owners can utilize SEP IRAs and Solo 401(k)s for substantial tax savings. In 2024, SEP IRA contributions can reach up to 25% of the employee’s compensation, or $69,000, whichever is less. Solo 401(k)s allow for even higher contributions, potentially up to $73,500 for those 50 and older.

These contributions reduce current tax liability and grow tax-deferred until withdrawal, offering a dual benefit of immediate tax savings and long-term wealth accumulation.

Strategic Contribution Planning

To maximize the tax benefits of retirement accounts, high-income earners should develop a strategic contribution plan. This plan should account for current income, future tax expectations, and overall financial goals.

Consistent, strategic contributions to these accounts can create a powerful tax-saving strategy that secures financial futures. As we move forward, we’ll explore how tax-advantaged investments can further enhance these strategies and provide additional avenues for tax reduction.

Unlocking Tax-Advantaged Investments

Tax-advantaged investments provide high-income earners with powerful tools to reduce their tax burden while building wealth. These strategies extend beyond traditional retirement accounts, offering additional avenues for tax efficiency.

The Power of Municipal Bonds

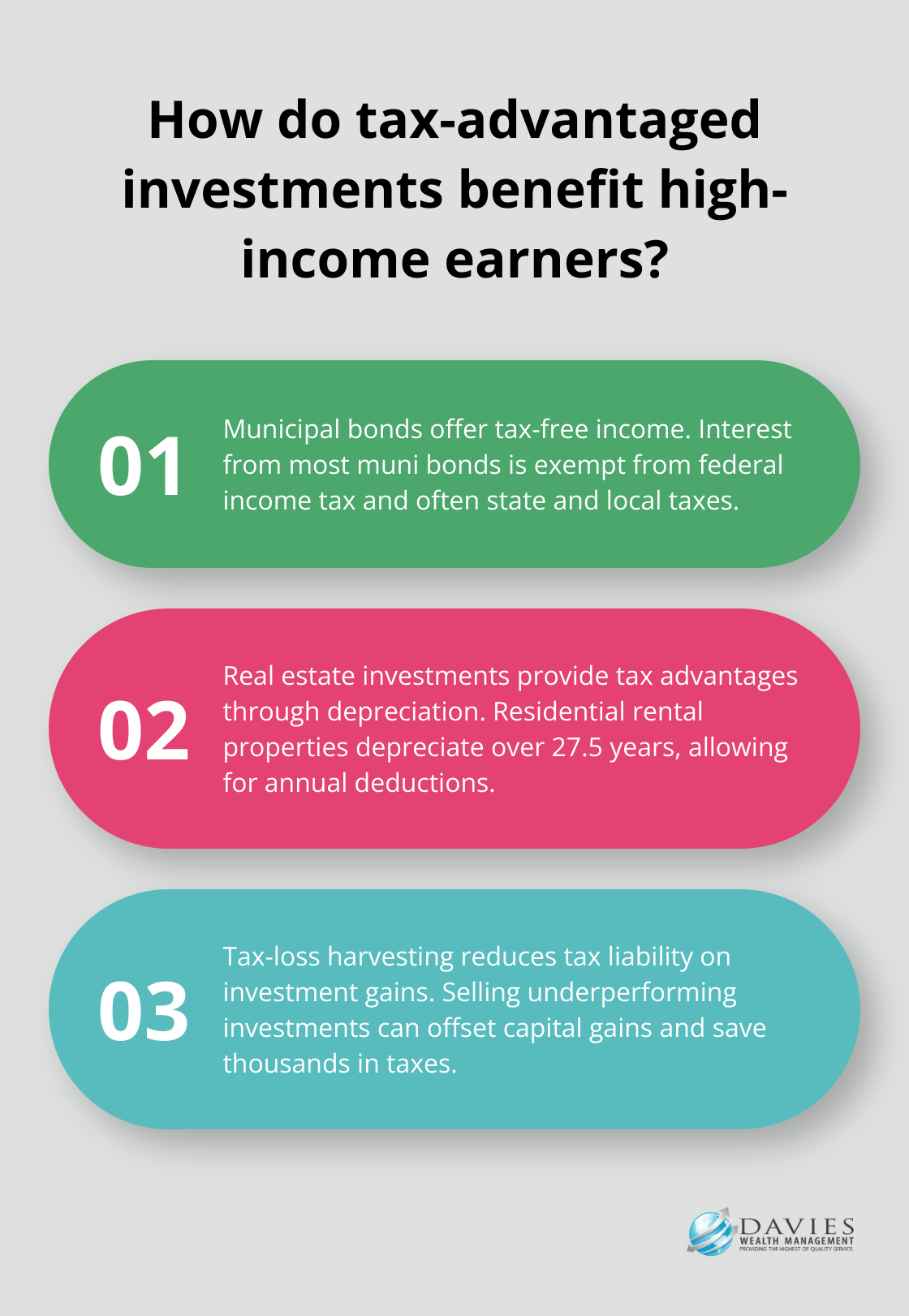

Municipal bonds (muni bonds) present an excellent option for high-income investors seeking tax-free income. State and local governments issue these bonds to fund public projects. The interest earned from most municipal bonds is exempt from federal income tax and often from state and local taxes for residents of the issuing state.

A high-income earner in the 37% federal tax bracket who invests $100,000 in municipal bonds would need to consider the tax-equivalent yield. For example, if a taxable bond yields 9.75%, the tax-equivalent yield for an investor in the 37% tax bracket would be approximately 11.11%.

It’s important to consider the alternative minimum tax (AMT) when investing in municipal bonds, as some private activity bonds may trigger AMT liability. Consultation with a tax professional ensures your municipal bond strategy aligns with your overall tax situation.

Real Estate Investments: A Tax-Efficient Wealth Builder

Real estate investments offer numerous tax advantages for high-income earners. One of the most significant benefits is depreciation, which allows investors to deduct a portion of the property’s value each year as a non-cash expense.

Residential rental properties depreciate over 27.5 years. If you purchase a rental property for $500,000 (excluding land value), you could potentially deduct about $18,182 annually from your taxable income. This deduction can significantly reduce your tax liability, especially when combined with other real estate-related expenses.

Real estate investors can also take advantage of 1031 exchanges to defer capital gains taxes when selling investment properties. This type of tax-deferred exchange allows real estate investors to postpone paying taxes on their gains by reinvesting the proceeds into a like-kind property.

Mastering Tax-Loss Harvesting

Tax-loss harvesting is a sophisticated strategy that can help high-income investors reduce their tax liability on investment gains. This technique involves selling investments that have experienced a loss to offset capital gains from other investments.

If you’ve realized $50,000 in capital gains this year, you could sell underperforming investments with $30,000 in losses to reduce your taxable gains to $20,000. This strategy can save thousands in taxes, especially for those in higher tax brackets.

Tax-loss harvesting requires careful execution to avoid the wash-sale rule, which disallows the loss if you repurchase the same or a substantially identical security within 30 days before or after the sale.

Exploring Advanced Tax-Advantaged Strategies

As we move forward, we’ll examine more sophisticated tax planning techniques that high-income earners can employ to further optimize their tax situation and enhance their overall wealth management strategy. One key strategy is to fully contribute to one or multiple tax-advantaged retirement accounts, such as 401(k), 403(b), or IRAs.

Advanced Tax Planning for High Earners

Strategic Charitable Giving

High-income earners can reduce their tax burden through strategic charitable giving. Donating appreciated assets instead of cash can reduce three kinds of federal taxes: income, capital gains, and estate taxes. This method allows you to avoid capital gains tax on the appreciation and deduct the full fair market value of the donation.

A Donor-Advised Fund (DAF) optimizes charitable giving strategies. You can make a large charitable contribution in a high-income year (perhaps due to a bonus or business sale), receive an immediate tax deduction, and distribute the funds to charities over time.

Qualified Opportunity Zone Investments

Qualified Opportunity Zones (QOZs) offer a tax-advantaged investment option for those with significant capital gains. You can support economic development in QOZs and temporarily defer tax on eligible gains when you invest in a Qualified Opportunity Fund (QOF).

For example, a $1 million capital gain investment in a QOF that grows to $2 million over 10 years would result in taxes only on the original $1 million gain (deferred until 2026). The additional $1 million in appreciation would be tax-free. This strategy diversifies your portfolio while deferring and potentially reducing your tax burden.

Roth Conversion Ladders

High-income earners who expect to be in a lower tax bracket in the future can implement a Roth conversion ladder as an effective long-term tax strategy. This approach involves converting a portion of your traditional IRA to a Roth IRA each year, paying taxes on the converted amount at your current rate.

Spreading these conversions over several years minimizes the tax impact in any given year while building up a tax-free retirement account. Most people are probably safe converting up to the top of the 12% bracket, provided you have money outside your retirement account to pay the taxes.

Tax-Efficient Investment Strategies

High-income earners should focus on tax-efficient investment strategies to minimize their overall tax burden. This includes investing in index funds and ETFs, which typically have lower turnover rates and generate fewer capital gains distributions compared to actively managed funds.

You can also try to place tax-inefficient investments (such as those that generate high dividends or short-term capital gains) in tax-advantaged accounts like IRAs or 401(k)s. This strategy, known as asset location, helps to minimize the tax drag on your investment returns.

Professional Guidance

Advanced tax planning requires careful consideration of your unique financial situation and goals. Working with a professional wealth management firm (like Davies Wealth Management) can help you navigate these complex strategies and ensure you’re maximizing your tax savings while building long-term wealth. Proper financial planning is crucial for making key financial decisions that lead to success, whether you’re a high-income earner or a professional athlete.

Final Thoughts

High-income earners can significantly reduce their tax burden through strategic planning and smart investment choices. The 5 outstanding tax strategies for high income earners we’ve explored offer substantial opportunities to optimize your financial future. These strategies include maximizing retirement account contributions, leveraging tax-advantaged investments, and implementing advanced tax planning techniques.

A comprehensive approach to tax reduction considers your unique financial situation, goals, and risk tolerance. Personalized financial advice proves invaluable when navigating the complex world of tax optimization. A professional advisor can help you identify the most effective strategies for your specific circumstances, ensuring you not only reduce your tax liability but also build long-term wealth.

Davies Wealth Management specializes in helping high-income earners optimize their tax strategies and achieve their financial goals. Our team of experts can guide you through the intricacies of tax-efficient investing, retirement planning, and wealth preservation (tailored to your specific needs). We offer comprehensive wealth management solutions that go beyond tax optimization, ensuring your financial strategy aligns with your long-term objectives.

Leave a Reply