At Davies Wealth Management, we understand the importance of effective tax-saving strategies for salaried employees. Reducing your tax burden can significantly impact your financial well-being and help you achieve your long-term goals.

In this blog post, we’ll explore practical ways to minimize your tax liability and maximize your take-home pay. From retirement account contributions to leveraging employee benefits, we’ll cover key tactics that can help you keep more of your hard-earned money.

Tax-Saving Strategies for Salaried Employees

Maximizing Deductions

Salaried employees often overlook numerous tax-saving opportunities. Understanding and implementing effective tax strategies can significantly boost your financial well-being. The standard deduction for 2025 is $30,000 for married couples filing jointly. However, itemizing deductions might prove more beneficial if your qualifying expenses exceed these amounts.

Common itemized deductions include mortgage interest, state and local taxes (up to $10,000), and charitable contributions. If you donate to charity, maintain detailed records of your contributions. The IRS allows you to deduct up to 60% of your adjusted gross income for cash donations to qualifying organizations.

Leveraging Tax Credits

Tax credits directly lower your tax bill dollar-for-dollar, unlike deductions which reduce your taxable income. The Child Tax Credit can provide up to $2,000 per qualifying child under 17. For those pursuing higher education, the American Opportunity Tax Credit offers up to $2,500 per eligible student for the first four years of post-secondary education.

The Saver’s Credit rewards low to moderate-income taxpayers for contributing to retirement accounts. Depending on your income and filing status, you could receive a credit of up to 50% of your contributions (with a maximum credit of $1,000 for single filers or $2,000 for married couples filing jointly).

The Power of Tax-Advantaged Accounts

Tax-advantaged accounts offer a powerful way to reduce your tax burden while saving for the future. Traditional 401(k) and IRA contributions are made with pre-tax dollars, which lowers your taxable income for the year. For 2025, you can contribute up to $23,500 to a 401(k) and $7,000 to an IRA if you’re under 50.

Health Savings Accounts (HSAs) offer triple tax benefits: contributions are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses. In 2025, individuals can contribute up to $4,300, and families can contribute up to $8,550 to their HSAs.

Staying Informed and Seeking Professional Advice

Tax laws change frequently, so staying informed is essential for maximizing your tax savings. Consider consulting with a financial advisor who specializes in tax planning. They can help you navigate complex tax situations and develop a personalized strategy that aligns with your financial goals.

As we move forward, let’s explore how you can maximize your retirement account contributions to further reduce your tax liability and secure your financial future.

How to Maximize Retirement Account Contributions

Traditional vs. Roth: Choose the Right Account

At Davies Wealth Management, we emphasize the importance of maximizing retirement account contributions as a powerful tax-saving strategy for salaried employees. Strategic use of these accounts can reduce your current tax burden while building a robust nest egg for the future.

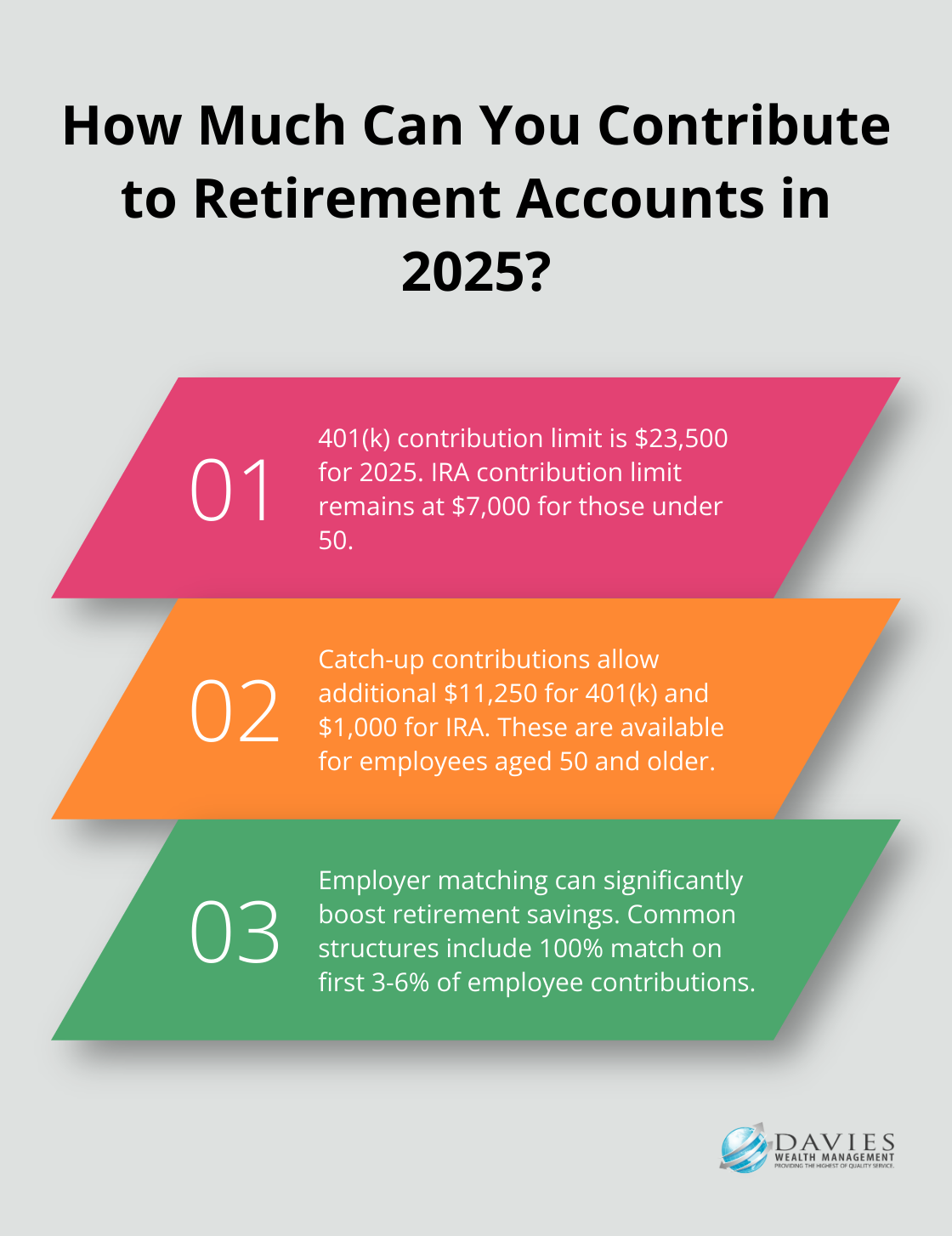

When it comes to retirement savings, you have two main options: traditional accounts and Roth accounts. Traditional 401(k)s and IRAs offer immediate tax benefits by reducing your taxable income in the year you make contributions. For 2025, you can contribute up to $23,500 to a 401(k) and $7,000 to an IRA if you’re under 50. These contributions are made with pre-tax dollars, which effectively lower your taxable income for the year.

Roth accounts provide tax-free growth and withdrawals in retirement. While you make contributions to Roth accounts with after-tax dollars, the long-term tax benefits can be substantial (especially if you expect to be in a higher tax bracket during retirement).

Maximize Employer Matching

If your employer offers a 401(k) match, you should contribute at least enough to take full advantage of this benefit. Employer matching contributions can vary, with common structures including a 100% match on the first 3% of employee contributions, plus a 50% match on the next 3-5%, or a 100% match on the first 4-6% of employee contributions. This is essentially free money that can significantly boost your retirement savings while reducing your tax liability.

Catch-Up Contributions: A Boost for Older Savers

The IRS allows catch-up contributions for employees aged 50 and older to help accelerate retirement savings. In 2025, you can contribute an additional $11,250 to your 401(k) and an extra $1,000 to your IRA. These catch-up contributions help you build your retirement nest egg faster and provide additional tax savings during your peak earning years.

Optimize Your Contribution Strategy

To maximize the tax benefits of retirement accounts, implement a strategic contribution plan. Start by contributing enough to your 401(k) to receive the full employer match. Then, if you’re eligible, max out your IRA contributions. If you still have funds available for retirement savings, return to your 401(k) and increase your contributions up to the annual limit.

The key to maximizing retirement account contributions is consistency and early planning. You can take full advantage of compound growth while minimizing your tax burden over time if you start early and contribute regularly. As we move forward, let’s explore how you can leverage employee benefits for additional tax savings, further enhancing your overall financial strategy.

Maximizing Employee Benefits for Tax Savings

Health Savings Accounts: The Triple Tax Advantage

Health Savings Accounts (HSAs) offer unparalleled tax benefits. In 2025, you can contribute up to $4,300 for individual coverage or $8,550 for family coverage. These contributions are tax-deductible, grow tax-free, and allow tax-free withdrawals for qualified medical expenses. Unlike Flexible Spending Accounts (FSAs), HSA funds roll over year to year, which allows you to build a substantial medical expense nest egg.

To maximize your HSA, contribute the full amount allowed if possible. Use other funds for current medical expenses to allow your HSA to grow. In retirement, you can use HSA funds for any purpose without penalty (though non-medical withdrawals will be taxed as income).

Flexible Spending Accounts: Plan Carefully

FSAs allow you to set aside pre-tax dollars for medical or dependent care expenses. For 2025, you can contribute up to $3,050 to a healthcare FSA. While FSAs typically have a use-it-or-lose-it policy, some plans allow a $610 carryover or a 2.5-month grace period.

To optimize your FSA, estimate your annual healthcare or dependent care expenses carefully. Consider upcoming procedures, regular prescriptions, or childcare costs. You can use FSA funds for a wide range of items (from contact lenses to sunscreen).

Commuter Benefits: Reduce Taxable Income

Many employers offer commuter benefits, which allow you to pay for parking and transit costs with pre-tax dollars. In 2025, you can set aside up to $300 per month for parking and $300 for transit. This benefit directly reduces your taxable income and can potentially save you hundreds of dollars annually.

To make the most of commuter benefits, calculate your monthly commuting costs and adjust your contributions accordingly. If your commute varies, choose a conservative estimate to avoid losing funds.

Employee Stock Purchase Plans: Invest in Your Company

Some companies offer Employee Stock Purchase Plans (ESPPs), which allow you to purchase company stock at a discount (typically 10-15% below market price). This discount is treated as taxable income, but any gains from selling the stock may qualify for capital gains tax rates if held long enough.

Try to participate in your company’s ESPP if available, especially if you believe in the company’s long-term prospects. However, ensure you diversify your portfolio to manage risk. Disqualified dispositions don’t qualify for preferential tax treatment since you sold the stock before meeting both holding period requirements.

Life and Disability Insurance: Tax-Free Benefits

Many employers offer group life and disability insurance as part of their benefits package. The premiums for these policies are often paid with pre-tax dollars, reducing your taxable income. In the event of a claim, the benefits received are typically tax-free.

Review your employer’s life and disability insurance offerings and consider supplementing them with individual policies if needed. This strategy can provide comprehensive coverage while optimizing your tax situation.

Final Thoughts

Tax-saving strategies for salaried employees can significantly impact your financial well-being. These strategies include maximizing retirement account contributions, leveraging employee benefits, and taking advantage of available deductions and credits. Tax laws change frequently, so you must stay informed about these changes to optimize your tax strategy.

Your financial situation is unique, and what works for one person may not be ideal for another. We at Davies Wealth Management recommend you consult with a financial advisor who can provide personalized advice tailored to your specific circumstances and goals. A professional advisor can help you navigate complex tax situations and develop a comprehensive financial plan that aligns with your long-term objectives.

Davies Wealth Management specializes in providing tailored financial solutions to help our clients achieve their goals. Our team of experts can work with you to create a personalized tax strategy that maximizes your savings while ensuring you’re on track to meet your broader financial objectives. You can take control of your financial future and make the most of your income with professional guidance.

Leave a Reply