At Davies Wealth Management, we understand the challenges high-income earners face when it comes to managing their tax burden. The impact of taxes on your wealth can be significant, but there are effective strategies to minimize your tax liability.

In this post, we’ll explore tax strategies for high-income earners that can help you keep more of your hard-earned money. From maximizing retirement account contributions to leveraging tax-advantaged investments, we’ll cover practical approaches to reduce your tax bill while staying compliant with IRS regulations.

How to Maximize Retirement Account Contributions

At Davies Wealth Management, we recognize the power of retirement account contributions in reducing tax burdens for high-income earners. This chapter explores effective strategies to optimize your financial future through these tax-advantaged accounts.

Traditional IRA and 401(k) Contributions

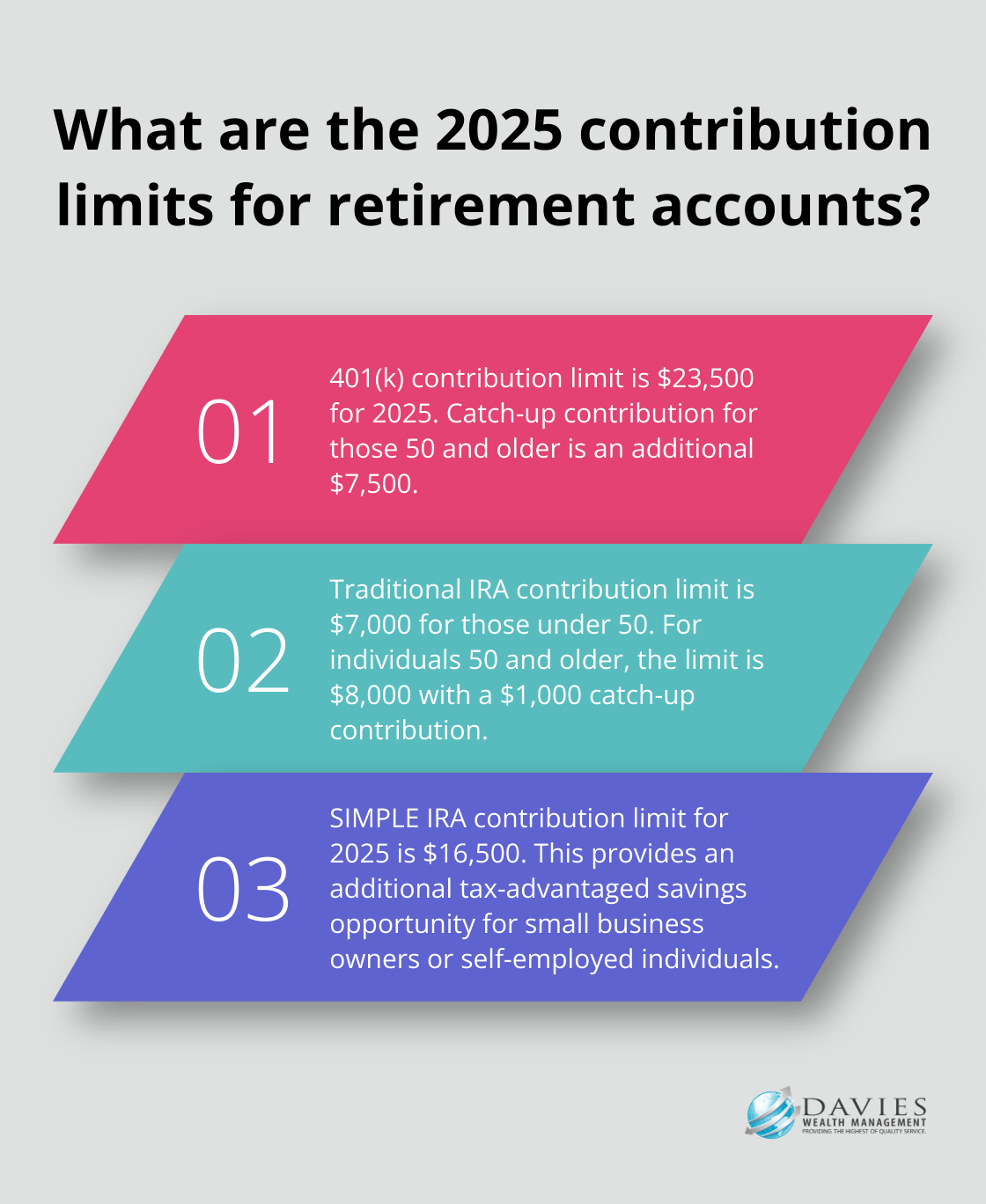

The 2025 contribution limit for 401(k) plans stands at $23,500. This amount can reduce your taxable income and potentially lower your tax bracket. We advise our clients to contribute at least enough to receive their full employer match (it’s essentially free money).

Traditional IRA contributions may offer tax deductions, depending on your income and workplace retirement plan coverage. The 2025 contribution limit is $7,000 for those under 50, and $8,000 for those age 50 or older.

Roth IRA Strategies for High Earners

While high-income earners often face limits on direct Roth IRA contributions, alternative strategies exist to benefit from these tax-free growth accounts.

The Roth IRA conversion ladder involves moving funds from a pretax retirement account to a Roth IRA in smaller increments over multiple years. You’ll pay taxes on the converted amount each year, but this can prove beneficial if you anticipate a higher tax bracket in retirement.

The Backdoor Roth IRA strategy involves making a non-deductible contribution to a traditional IRA, then immediately converting it to a Roth IRA. This approach doesn’t provide an immediate tax deduction but allows for tax-free growth.

Catch-Up Contributions

For individuals 50 or older, additional opportunities exist to boost retirement savings and reduce taxable income. In 2025, 401(k) plans allow an extra $7,500 in catch-up contributions (bringing the total potential contribution to $31,000).

IRA catch-up contributions for those 50 and older amount to an additional $1,000, increasing the total to $8,000 for 2025.

Mega Backdoor Roth Strategy

Some 401(k) plans offer a “mega backdoor Roth” option. This strategy is specifically for people with a 401(k) plan that allows after-tax contributions. It can significantly increase your tax-free retirement savings.

Employer-Sponsored Plans Beyond 401(k)s

Don’t overlook other employer-sponsored retirement plans. SIMPLE IRAs (with a 2025 contribution limit of $16,500) and SEP IRAs can provide additional tax-advantaged savings opportunities for small business owners or self-employed individuals.

As we move forward, let’s explore how tax-advantaged investments can further reduce your tax burden and enhance your wealth-building strategy.

Tax-Advantaged Investments for High Earners

At Davies Wealth Management, we recommend tax-advantaged investments to our high-income clients as a powerful way to reduce their tax burden while growing wealth. These investment vehicles offer unique benefits that can significantly impact your overall financial strategy.

Municipal Bonds: Tax-Free Income Stream

Municipal bonds, or “munis,” are debt securities issued by state and local governments to fund public projects. The key advantage for high-income earners is that the interest income from these bonds is typically exempt from federal taxes and often state taxes if you reside in the issuing state.

For example, if you’re in the 37% federal tax bracket, a municipal bond yielding 3% would have a tax-equivalent yield higher than 3%. This makes municipal bonds particularly attractive for those in higher tax brackets.

It’s important to consider the overall return and risk profile of municipal bonds compared to other investments. While they offer tax advantages, they may have lower yields than corporate bonds or stocks. We analyze each client’s specific situation to determine if municipal bonds are the right fit.

Real Estate: Depreciation and Passive Income

Real estate investments can offer substantial tax benefits through depreciation deductions and the potential for passive income. The IRS allows you to deduct the depreciation of your investment property over time, which can offset rental income and reduce your overall tax liability.

For tax years beginning in 2024, the maximum section 179 expense deduction is $1,220,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $3,050,000.

Moreover, real estate investments can generate passive income, which is often taxed at a lower rate than ordinary income. The 2025 tax rates for qualified dividends and long-term capital gains (which can apply to real estate investments) range from 0% to 20%, depending on your income level.

1031 Exchanges: Deferring Capital Gains

For active real estate investors, 1031 exchanges offer a powerful tax deferral strategy. This IRS code section allows you to sell an investment property and reinvest the proceeds into a like-kind property while deferring capital gains taxes.

For example, if you sell a rental property for $1,000,000 that you originally purchased for $600,000, you could potentially defer taxes on the $400,000 gain by reinvesting in another qualifying property. This strategy allows you to preserve more capital for reinvestment and potentially grow your real estate portfolio more quickly.

It’s important to note that 1031 exchanges have strict rules and timelines. You must identify potential replacement properties within 45 days of selling your original property and complete the purchase within 180 days. Working with experienced professionals is essential to navigate this complex process successfully.

Qualified Opportunity Zone Investments

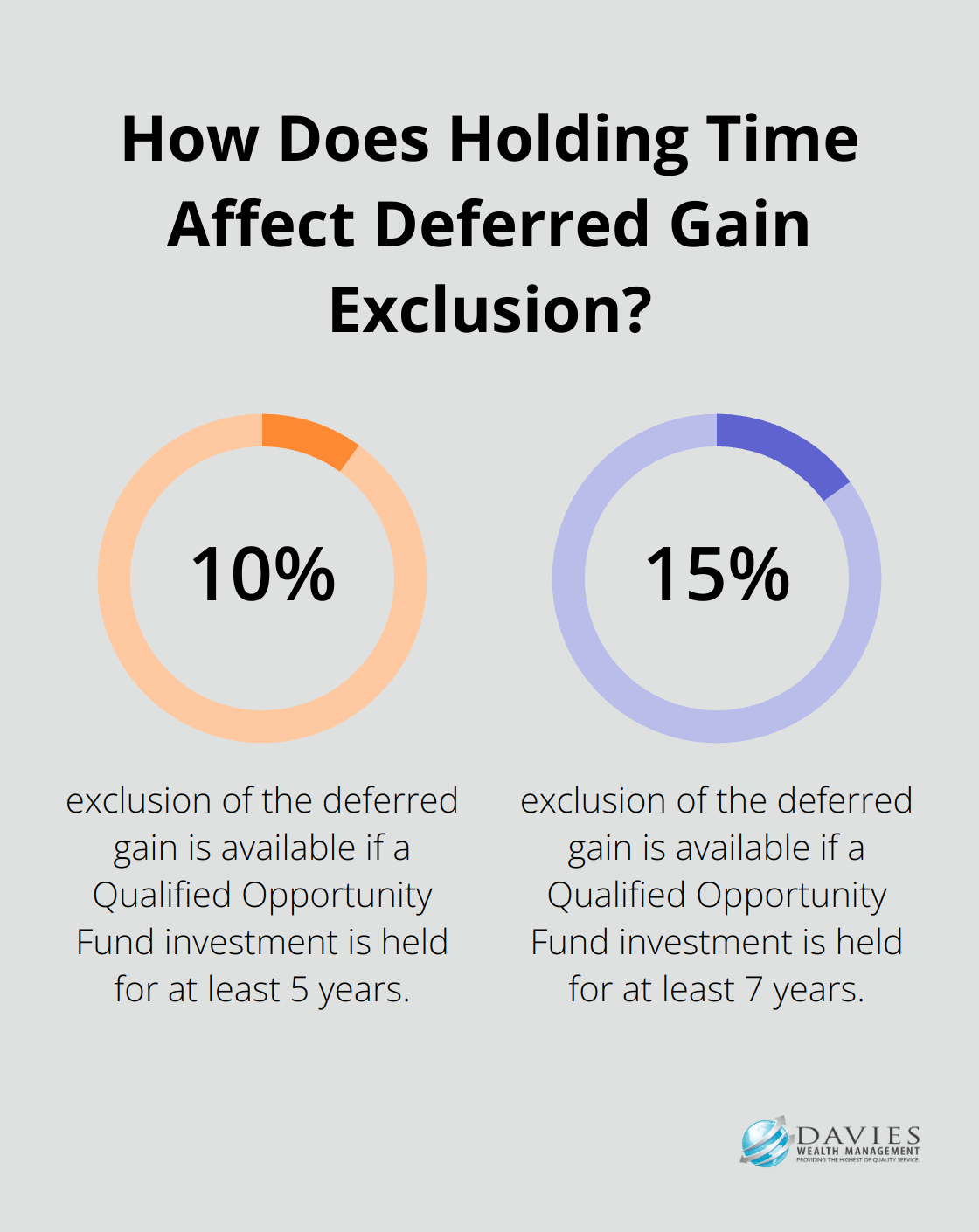

Qualified Opportunity Zone (QOZ) investments present another tax-advantaged option for high-income earners. These investments allow you to defer capital gains taxes by reinvesting gains into designated economically distressed communities. If the QOF investment is held for at least 5 years, there is a 10% exclusion of the deferred gain. If held for at least 7 years, the 10% exclusion becomes 15%.

As we move forward, let’s explore how tax-loss harvesting strategies can further optimize your investment portfolio and minimize your tax liabilities.

How Tax-Loss Harvesting Can Boost Your Portfolio

Understanding Tax-Loss Harvesting

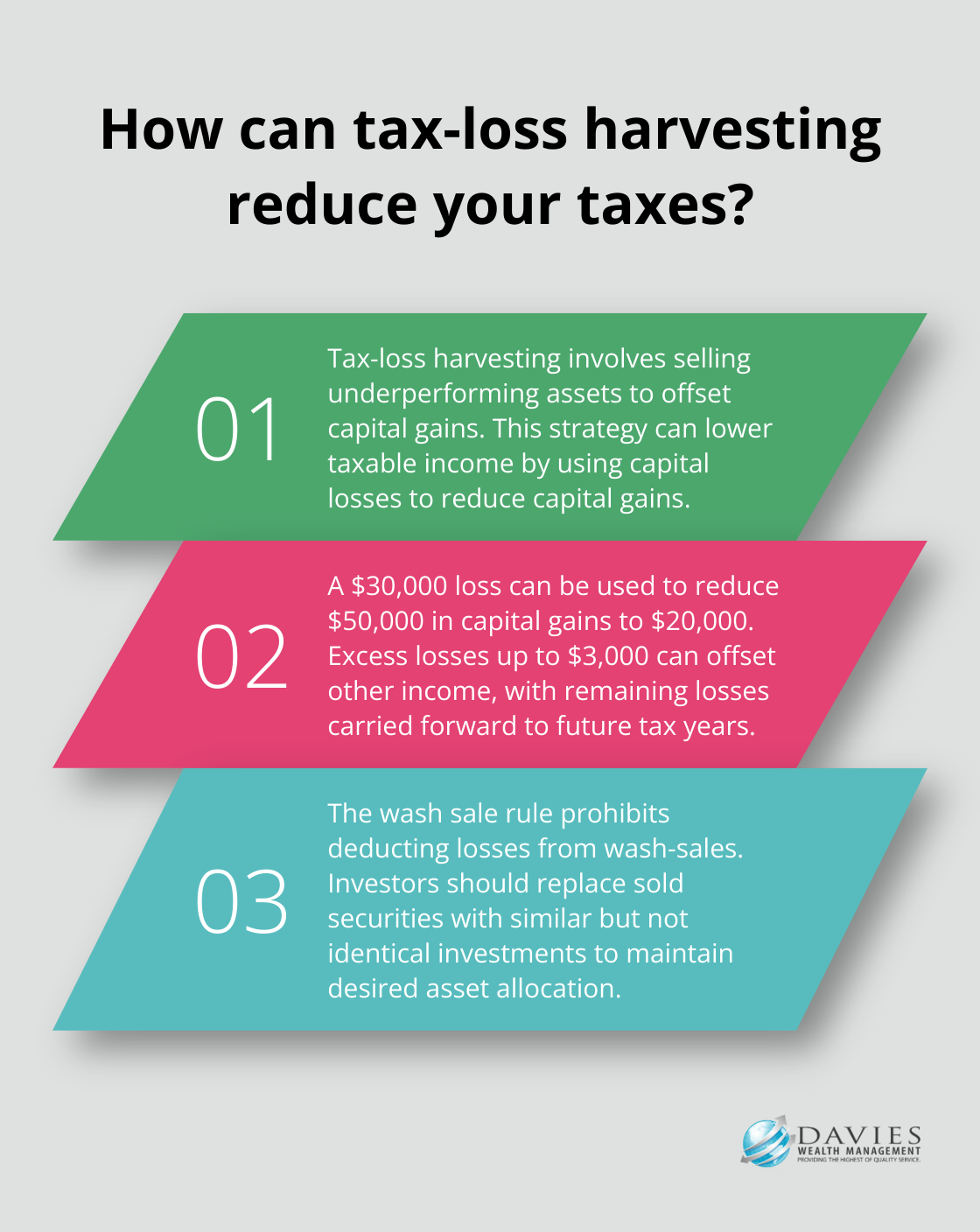

Tax-loss harvesting is a tax-efficient investing strategy that allows you to sell down assets to help reduce the amount of current taxes you have to pay on your investments. This approach involves the strategic sale of underperforming assets to offset capital gains, potentially reducing overall tax burden.

The mechanics of tax-loss harvesting capitalize on the volatility inherent in financial markets. When an investment in your portfolio decreases in value, selling it creates a capital loss. You can then use this loss to offset capital gains from other investments, effectively lowering your taxable income.

For example, if you realize $50,000 in capital gains this year and sell an underperforming stock at a $30,000 loss, you can use that loss to reduce your taxable gains to $20,000. This strategy can lead to significant tax savings, especially for those in higher tax brackets.

It’s important to note that if your capital losses exceed your capital gains, you can use up to $3,000 of the excess to offset other income. Any remaining losses can carry forward to future tax years, providing ongoing tax benefits.

Timing and Selection in Tax-Loss Harvesting

Effective tax-loss harvesting requires careful timing and selection of assets. We recommend a regular review of your portfolio, particularly during market downturns, to identify potential harvesting opportunities. However, it’s essential to balance tax considerations with your overall investment strategy and long-term financial goals.

When selecting assets for tax-loss harvesting, consider factors such as the asset’s future growth potential, its role in your portfolio diversification, and any transaction costs associated with selling and buying replacement securities.

Navigating the Wash Sale Rule

A critical aspect of tax-loss harvesting is understanding and adhering to the wash sale rule. This IRS regulation explicitly prohibits investors from deducting their losses from wash-sales. The purpose of this rule is to prevent the potential misuse of tax-loss harvesting.

To comply with this rule while maintaining your desired asset allocation, consider replacing the sold security with a similar but not identical investment. For example, if you sell shares of a technology sector ETF at a loss, you might replace it with a different technology sector ETF or individual tech stocks.

Leveraging Technology for Tax-Loss Harvesting

Modern portfolio management tools have made tax-loss harvesting more accessible and efficient. Many robo-advisors now offer automated tax-loss harvesting features. These tools continuously monitor your portfolio for harvesting opportunities and execute trades accordingly.

While these automated solutions can be helpful, we believe in combining technology with human expertise. Our approach involves the use of advanced portfolio analysis tools in conjunction with our advisors’ experience to make nuanced decisions that align with each client’s unique financial situation and goals.

Implementing Tax-Loss Harvesting Strategies

To implement tax-loss harvesting effectively, try to:

- Regularly monitor your portfolio for potential losses

- Identify securities with unrealized losses that fit your harvesting criteria

- Sell these securities to realize the loss (while considering transaction costs)

- Reinvest the proceeds in a similar (but not identical) security to maintain your overall investment strategy

- Keep detailed records of all transactions for tax reporting purposes

Tax-loss harvesting is a sophisticated strategy that requires careful planning and execution. When implemented effectively, it can significantly enhance your after-tax returns and contribute to long-term wealth accumulation.

Final Thoughts

Tax strategies for high-income earners offer powerful tools to optimize your tax situation and enhance overall financial well-being. These approaches include maximizing retirement account contributions, leveraging tax-advantaged investments, and implementing tax-loss harvesting strategies. Your unique financial situation, goals, and risk tolerance should guide the implementation of these strategies to align with your wealth management objectives.

We strongly recommend you consult with a qualified tax professional or financial advisor due to the complexity of tax laws and their potential impact on your financial future. At Davies Wealth Management, we provide tailored wealth management solutions, including tax-efficient strategies for high-income earners. Our team of experts can help you navigate the intricacies of tax planning and develop a comprehensive financial plan that aligns with your goals.

To learn more about how we can assist you in implementing these tax strategies and optimizing your overall financial plan, visit our website. We can help you take control of your financial future and build lasting wealth (for generations to come). Let us guide you towards maximizing your wealth-building potential through effective tax planning and personalized financial strategies.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply