At Davies Wealth Management, we understand the importance of minimizing your tax burden. Implementing effective tax strategies to reduce taxable income can significantly impact your financial well-being.

In this post, we’ll explore smart tactics to help you keep more of your hard-earned money. From maximizing deductions to leveraging tax-advantaged accounts, we’ll provide practical tips to optimize your tax situation.

How to Maximize Tax Deductions

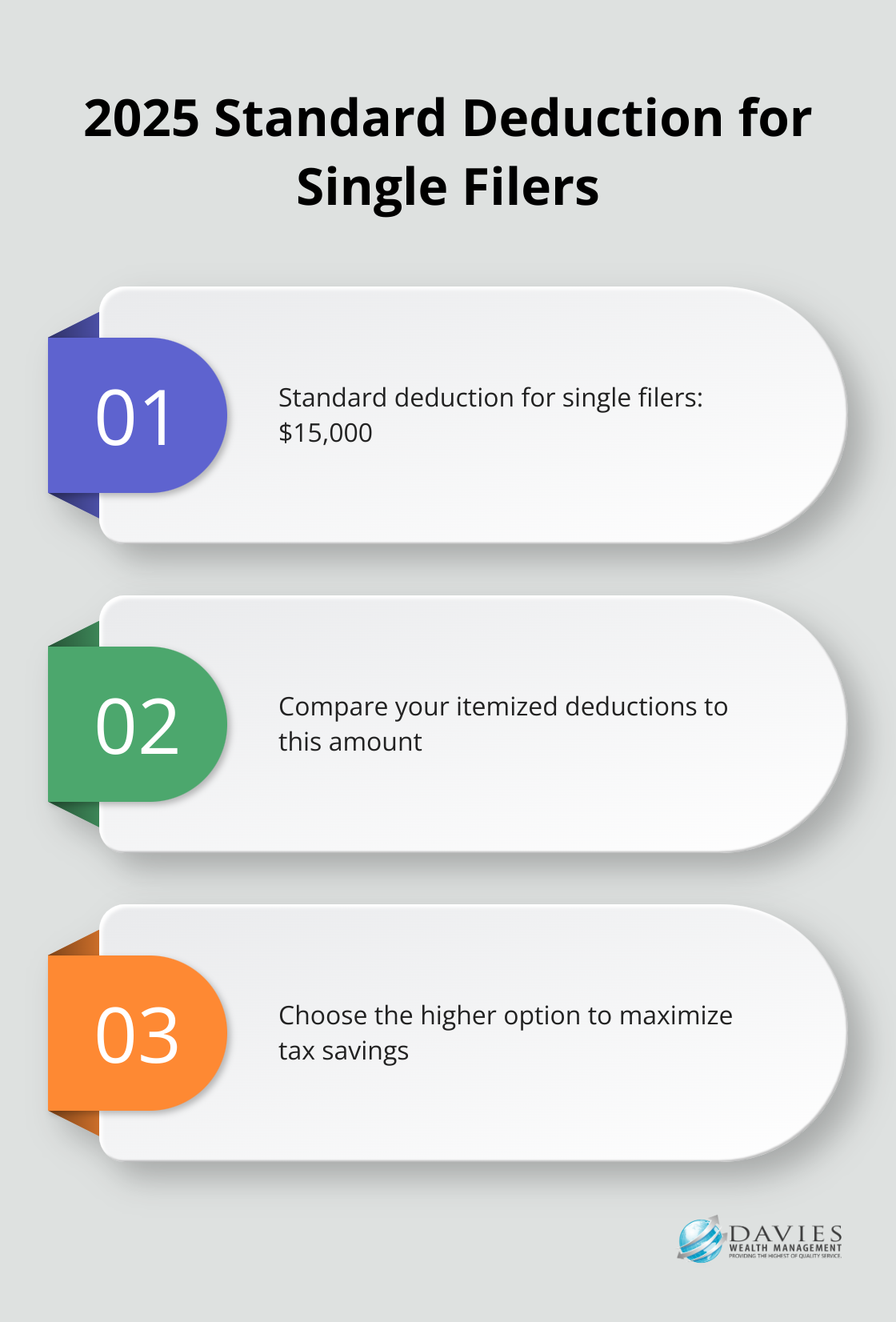

Standard vs. Itemized Deductions: Choose Wisely

The first step to reduce your taxable income is to decide between the standard deduction and itemizing. For the 2025 tax year, the standard deduction rises to $15,000 for single filers. If your itemized deductions exceed these amounts, you should itemize to achieve greater tax savings.

Uncover Often-Overlooked Deductions

Many taxpayers miss out on valuable deductions due to lack of awareness. Self-employed individuals can deduct health insurance premiums (including long-term care coverage). Educators can claim up to $300 for unreimbursed classroom expenses. Even gambling losses are deductible (but only to the extent of your winnings).

State sales tax is another frequently overlooked deduction. Residents of states without income tax can opt to deduct state and local sales taxes instead of state and local income taxes. This strategy proves particularly beneficial if you’ve made substantial purchases during the year.

Accurate Record-Keeping: Your Key to Success

Meticulous record-keeping is essential to maximize deductions. The IRS requires documentation to support your claims, and good records help identify all possible deductions. Use a dedicated credit card for deductible expenses to simplify tracking. Consider apps or software to scan and organize receipts throughout the year.

For charitable contributions, maintain detailed records of donations. Keep receipts for cash gifts and acknowledgment letters for non-cash donations valued over $250. If you use your vehicle for charitable work, track your mileage (you can deduct 14 cents per mile driven for charitable purposes).

Stay Informed About Tax Law Changes

Tax laws change frequently. What was deductible last year might not be this year. Stay informed about current tax laws or consult with a tax professional to ensure you take advantage of all available deductions.

Leverage Professional Expertise

While self-education about tax deductions is valuable, the complexities of the tax code often require professional guidance. A qualified tax advisor can help you navigate the intricacies of tax law, identify deductions you might have missed, and develop a comprehensive strategy to minimize your tax liability.

As we move forward, it’s important to consider not just deductions, but also how to leverage tax-advantaged accounts to further reduce your taxable income. Let’s explore some powerful options in the next section.

How Tax-Advantaged Accounts Boost Your Savings

Tax-advantaged accounts offer powerful strategies to reduce taxable income and enhance long-term savings. These accounts provide unique benefits that can significantly impact your financial future.

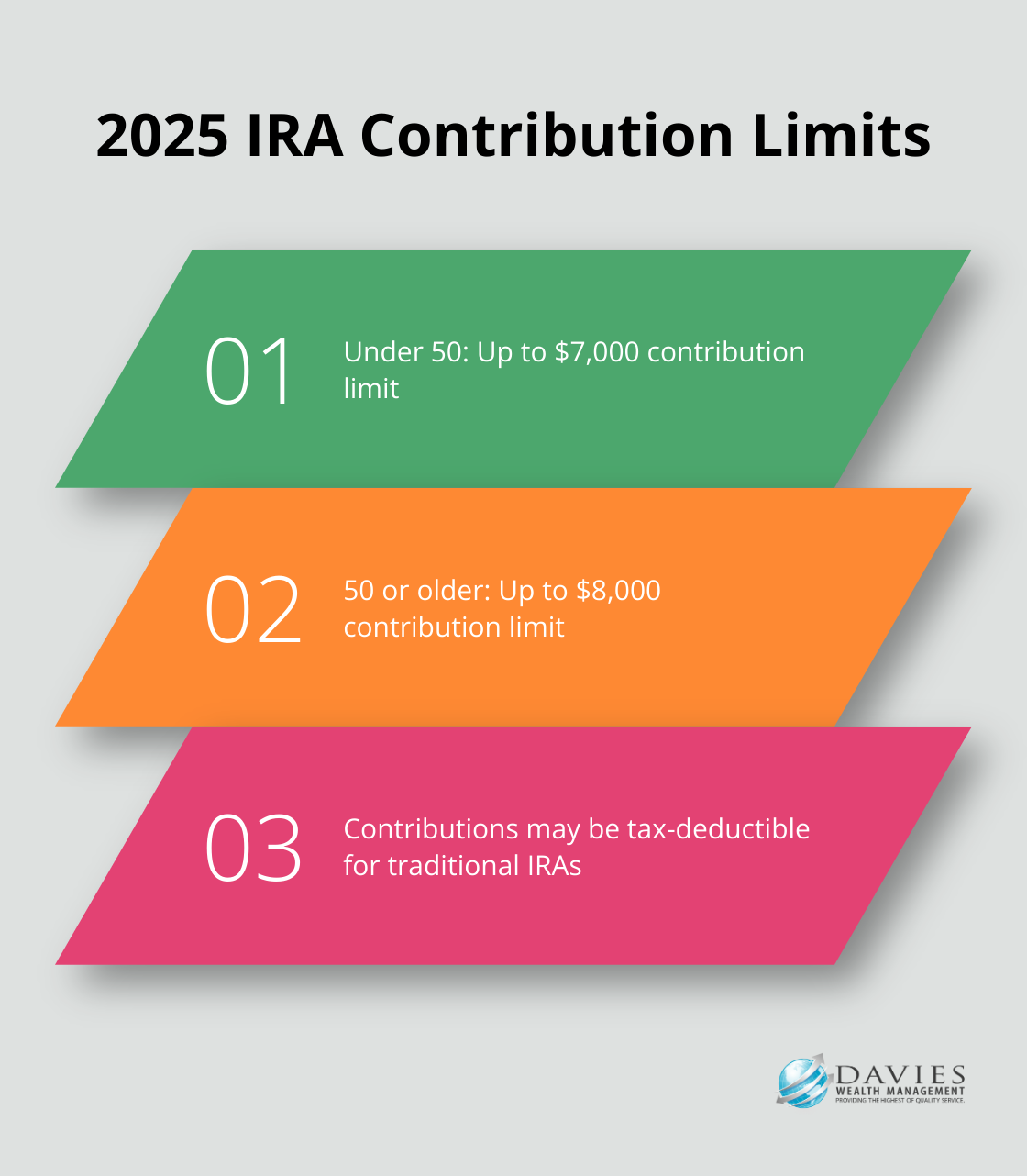

Maximize IRA Contributions

Individual Retirement Accounts (IRAs) serve as excellent vehicles for tax-efficient saving. Tax-deductible contributions to traditional IRAs can reduce your current taxable income. For 2025, you can contribute up to $7,000 to an IRA if you’re under 50, and $8,000 if you’re 50 or older.

Roth IRAs, while not offering immediate tax benefits, provide tax-free growth and withdrawals in retirement. This option can be particularly advantageous if you expect to be in a higher tax bracket in the future.

Harness the Power of 401(k)s

Employer-sponsored 401(k) plans rank among the most effective tools for reducing taxable income. In 2025, you can contribute up to $23,500 to a 401(k), with an additional $11,250 catch-up contribution if you’re 50 or older. These contributions use pre-tax dollars, effectively lowering your taxable income for the year.

Many employers offer matching contributions (essentially free money). Try to contribute at least enough to capture the full employer match. For example, if your employer matches 50% of your contributions up to 6% of your salary, contributing 6% would result in an additional 3% from your employer.

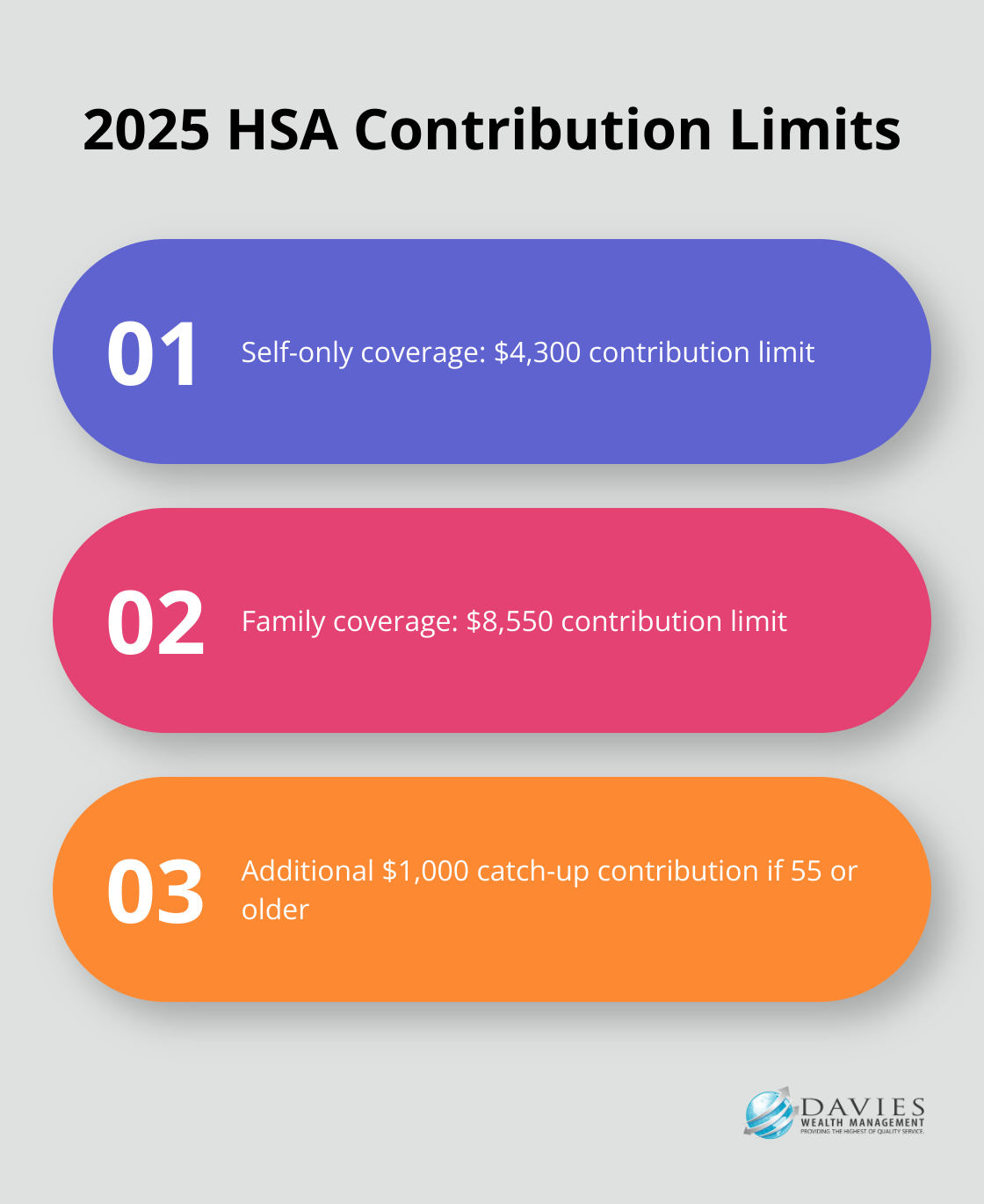

Unlock the Triple Tax Advantage of HSAs

Health Savings Accounts (HSAs) offer a unique triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2025, you can contribute up to $4,300 if you are covered by a high-deductible health plan just for yourself, or $8,550 if you have coverage for your family. If you’re 55 or older, you can add an extra $1,000 as a catch-up contribution.

HSAs are not “use it or lose it” accounts. Unused funds roll over year to year, potentially growing tax-free for decades. This feature makes HSAs an excellent option for long-term health care savings and even retirement planning.

Optimize Your Strategy

The optimal strategy for utilizing tax-advantaged accounts depends on your individual circumstances. Whether you’re a professional athlete managing variable income or a business owner planning for retirement, a tailored approach can help you navigate these options and create a tax-efficient savings plan.

As we move forward, it’s important to consider not only tax-advantaged accounts but also strategic timing of income and expenses. The next section will explore how careful planning of when you receive income and incur expenses can further reduce your taxable income.

When to Time Income and Expenses

Defer Income Strategically

Pushing income into the next tax year can lower your current year’s taxable income. This strategy works well if you expect to be in a lower tax bracket next year. Self-employed individuals might delay billing for December work until January. Employees could ask their employer to defer a year-end bonus to January.

The IRS has rules against constructive receipt, which means you can’t defer income you have the right to receive. Always consult with a tax professional before implementing income deferral strategies.

It’s worth noting that qualified wildfire relief payments are not taxable. If you received such payments, they may be nontaxable.

Accelerate Deductions

While deferring income pushes money into the future, accelerating deductions brings tax benefits forward. This approach is particularly useful if you expect to be in a higher tax bracket this year compared to the next.

Charitable contributions and the prepayment and grouping together of certain expenses are effective ways to achieve deduction acceleration. Try to prepay deductible expenses like property taxes or make an extra mortgage payment in December to claim additional interest deduction. Charitable contributions made by December 31st count for the current tax year (even if you use a credit card and pay the bill in January).

Implement Tax-Loss Harvesting

Tax-loss harvesting is a powerful strategy for investors. It involves selling securities at a loss to offset the amount of capital gains tax owed from selling profitable assets. The IRS allows you to deduct up to $3,000 of net capital losses against ordinary income each year, with any excess carried forward to future years.

For example, if you have $10,000 in capital gains and sell underperforming stocks for a $13,000 loss, you can offset your gains entirely and deduct an additional $3,000 against your ordinary income. The remaining $7,000 loss carries forward to future years.

The wash-sale rule prohibits claiming a loss on a security if you buy the same or a substantially identical security within 30 days before or after the sale.

Consider Professional Guidance

Implementing these timing strategies effectively requires a deep understanding of tax laws and your personal financial situation. While these tactics can yield significant savings, they should be part of a broader financial plan.

A qualified tax professional or financial advisor can help you navigate these complex strategies. They can create a comprehensive plan that aligns with your financial objectives while maximizing tax efficiency.

Tailor Strategies to Your Situation

Your optimal approach to timing income and expenses depends on your individual circumstances. Whether you’re a professional athlete managing variable income or a business owner planning for retirement, a tailored approach can help you navigate these options and create a tax-efficient plan.

Final Thoughts

Effective tax strategies to reduce taxable income form a vital part of financial planning. These methods can significantly impact your financial well-being, from maximizing deductions to leveraging tax-advantaged accounts. However, tax planning is not a universal approach; your individual circumstances dictate the most effective strategies for you.

Personalized tax planning becomes invaluable in navigating the complexities of the tax code. Professional guidance can help you maximize savings and ensure compliance with changing tax laws. Davies Wealth Management specializes in providing comprehensive financial planning services, including tax-efficient strategies tailored to your unique needs.

Tax planning requires continuous adaptation as your financial situation evolves and tax laws change. Our team of experts can help you navigate the intricacies of tax planning, whether you’re managing variable income or securing your financial future. We will work with you to optimize your tax situation and help you achieve your long-term financial goals with confidence.

Leave a Reply