Planning for retirement is a critical step in securing your financial future. At Davies Wealth Management, we understand the importance of planning for retirement and its impact on your long-term financial well-being.

With increasing life expectancies and evolving economic landscapes, it’s more important than ever to start preparing early. This blog post will guide you through the key components of a solid retirement plan and help you overcome common challenges along the way.

Why Start Planning for Retirement Now?

The Power of Compound Interest

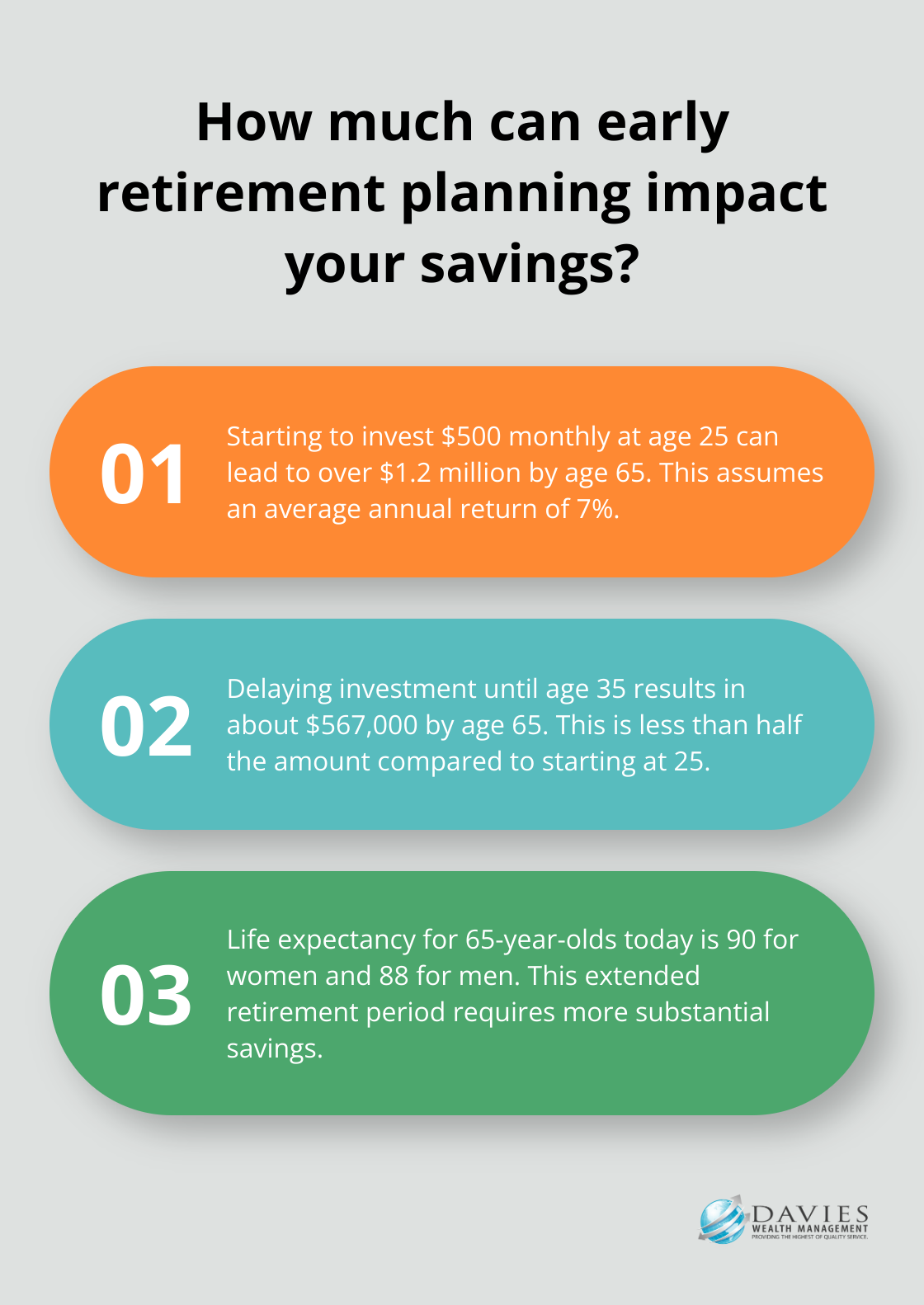

Starting your retirement planning early is one of the smartest financial decisions you can make. Time becomes your greatest ally when it comes to building wealth for retirement. The earlier you start saving and investing, the more time your money has to grow through compound interest. For example, if you start investing $500 monthly at age 25 (assuming an average annual return of 7%), you could have over $1.2 million by age 65. However, if you wait until age 35 to start, you’d have less than half that amount – about $567,000 – at 65. This stark difference illustrates why early planning is so important.

Adapting to Economic Changes

The economic landscape constantly evolves, and retirement planning needs to adapt accordingly. With inflation rates fluctuating and market volatility becoming more common, a longer time horizon allows you to weather these changes more effectively. It gives you the flexibility to adjust your strategy as needed without drastically impacting your retirement goals.

Preparing for Longer Retirements

Life expectancies increase, which means your retirement savings need to last longer. The projected life expectancy for someone who is 65 years old today with no chronic conditions is age 90 for women and age 88 for men. This extended retirement period requires more substantial savings, making early planning even more critical.

Reducing Reliance on Social Security

While Social Security benefits are an important part of retirement income for many Americans, they were never intended to be the sole source of retirement funding. Social Security benefits for more than 72.5 million Americans will increase 2.5 percent in 2025. Early retirement planning allows you to build a robust nest egg that complements Social Security benefits, ensuring a more comfortable retirement.

Personalized Strategies for Success

Each individual’s situation is unique, which is why personalized strategies are essential for achieving retirement goals. Professional financial advisors can help create comprehensive retirement plans that account for these factors and more. They can offer tailored advice to help you navigate the complexities of retirement planning, regardless of when you start.

As we move forward, let’s explore the key components that make up a solid retirement plan and how you can implement them effectively in your financial strategy.

Building Your Retirement Blueprint

Define Your Retirement Vision

The first step in building your retirement blueprint requires you to clearly define what retirement means to you. Do you envision traveling the world, starting a new business, or simply enjoying more time with family? Your retirement goals will directly impact how much you need to save and invest. We recommend you write down your goals and assign a rough cost estimate to each. This exercise helps create a tangible target for your retirement savings.

Diversify Your Investment Portfolio

Diversify Your Investment Portfolio by holding a mix of stock, bond, and cash investments that can generate growth, provide income, and preserve your capital. A personalized asset allocation strategy based on your risk tolerance, time horizon, and financial goals will help you navigate market fluctuations more effectively.

Leverage Tax-Advantaged Accounts

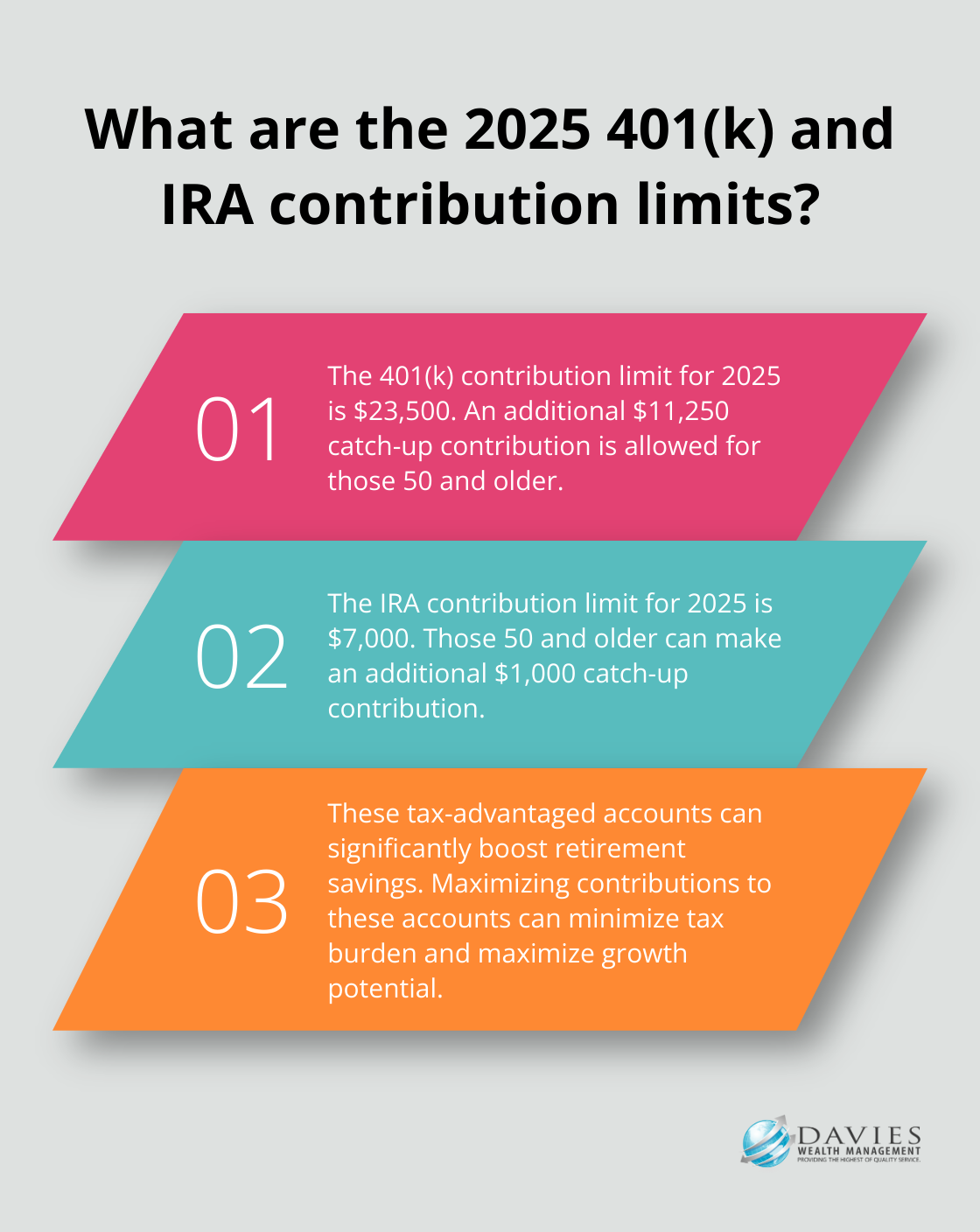

Maximizing contributions to tax-advantaged retirement accounts can significantly boost your savings. For 2025, the contribution limit for 401(k) plans is $23,500, with an additional $11,250 catch-up contribution allowed for those 50 and older. IRAs offer another avenue for tax-advantaged savings, with a contribution limit of $7,000 for 2025 (plus a $1,000 catch-up contribution for those 50 and older). Prioritizing these accounts will minimize your tax burden and maximize growth potential.

Develop a Sustainable Withdrawal Strategy

Planning how you’ll withdraw your retirement savings is just as important as saving itself. The traditional 4% rule suggests you withdraw 4% of your portfolio in the first year of retirement and adjust for inflation each subsequent year. However, this rule may not suit everyone. A personalized withdrawal strategy should consider factors such as life expectancy, market conditions, and changing expenses throughout retirement.

Regular Review and Adjustment

Retirement planning is an ongoing process that requires regular review and adjustment. Market conditions, personal circumstances, and financial goals can change over time. Try to review your retirement plan annually or whenever significant life events occur. This proactive approach ensures your retirement strategy remains aligned with your goals and adapts to changing circumstances.

As you implement these key components of your retirement blueprint, you’ll create a solid foundation for your financial future. However, navigating the complexities of retirement planning can be challenging. The next chapter will address common obstacles you might encounter and provide strategies to overcome them.

Navigating Retirement Planning Hurdles

Market Volatility Management

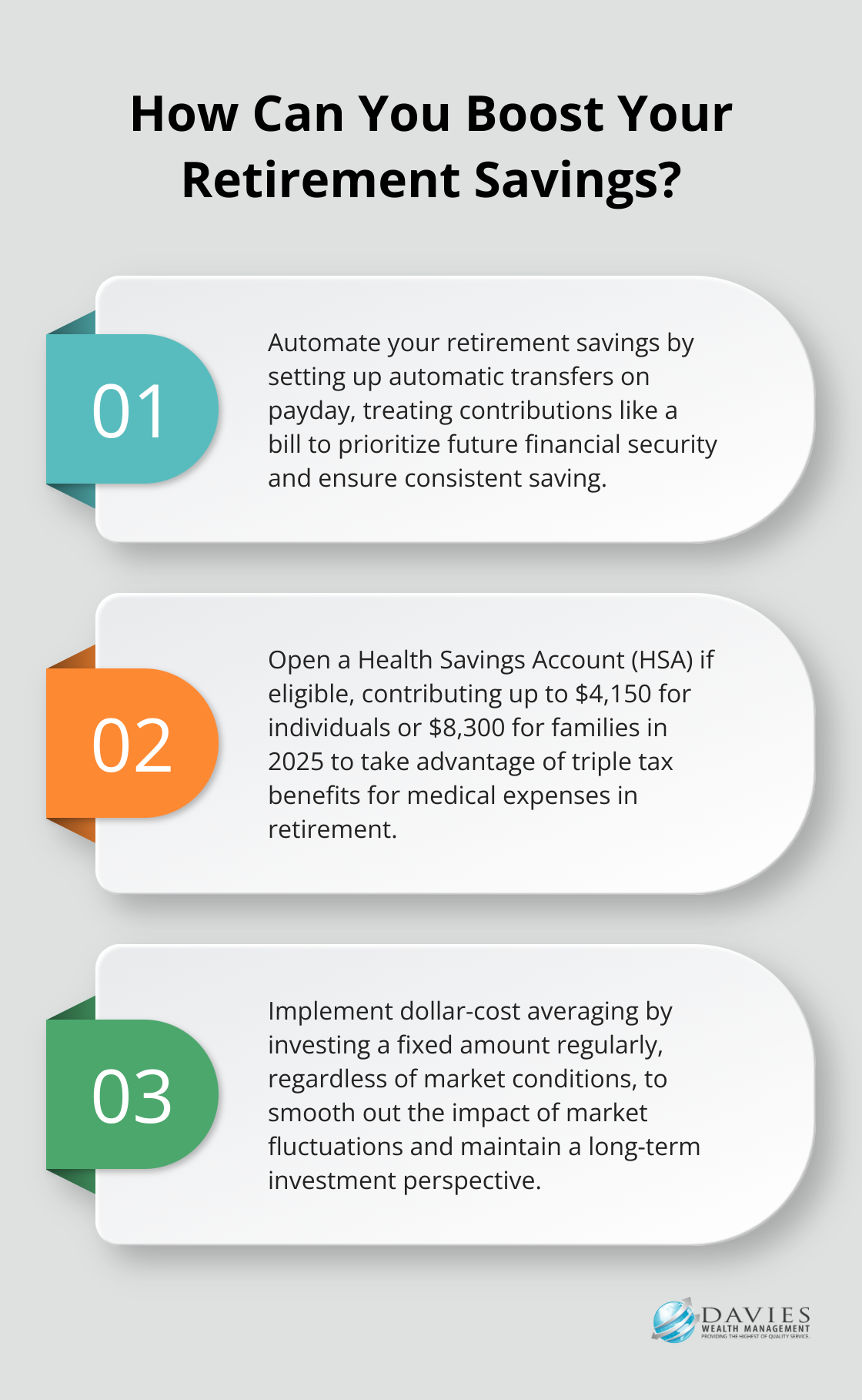

Market volatility is an inevitable part of investing. Don’t panic during downturns. Maintain a long-term perspective and adhere to your diversified investment strategy. Consider dollar-cost averaging, where you invest a fixed amount regularly, regardless of market conditions. This approach can help smooth out the impact of market fluctuations over time.

During periods of economic uncertainty, it’s wise to maintain an emergency fund. Try to save 3-6 months of living expenses in easily accessible savings. This buffer can prevent you from tapping into your retirement accounts during market downturns, allowing your investments time to recover.

Balancing Present and Future Financial Needs

Juggling current expenses while saving for retirement is a common challenge. Create a detailed budget that categorizes your spending. Look for areas where you can cut back without significantly impacting your quality of life. For example, reducing dining out by just one meal per week could free up hundreds of dollars annually for your retirement savings.

Automate your savings to ensure you consistently contribute to your retirement accounts. Set up automatic transfers on payday, treating your retirement contribution like any other bill. This “pay yourself first” approach can help prioritize your future financial security.

Adapting to Unexpected Life Events

Life is unpredictable, and unexpected events can derail even the best-laid retirement plans. Job loss, health issues, or family emergencies can all impact your financial situation. It’s important to build flexibility into your retirement strategy.

Consider disability insurance to protect your income if you’re unable to work due to illness or injury. Review your life insurance coverage regularly to ensure it adequately protects your family’s financial future. Don’t forget to update your estate plan (including your will and beneficiary designations) as your life circumstances change.

Managing Rising Healthcare Costs

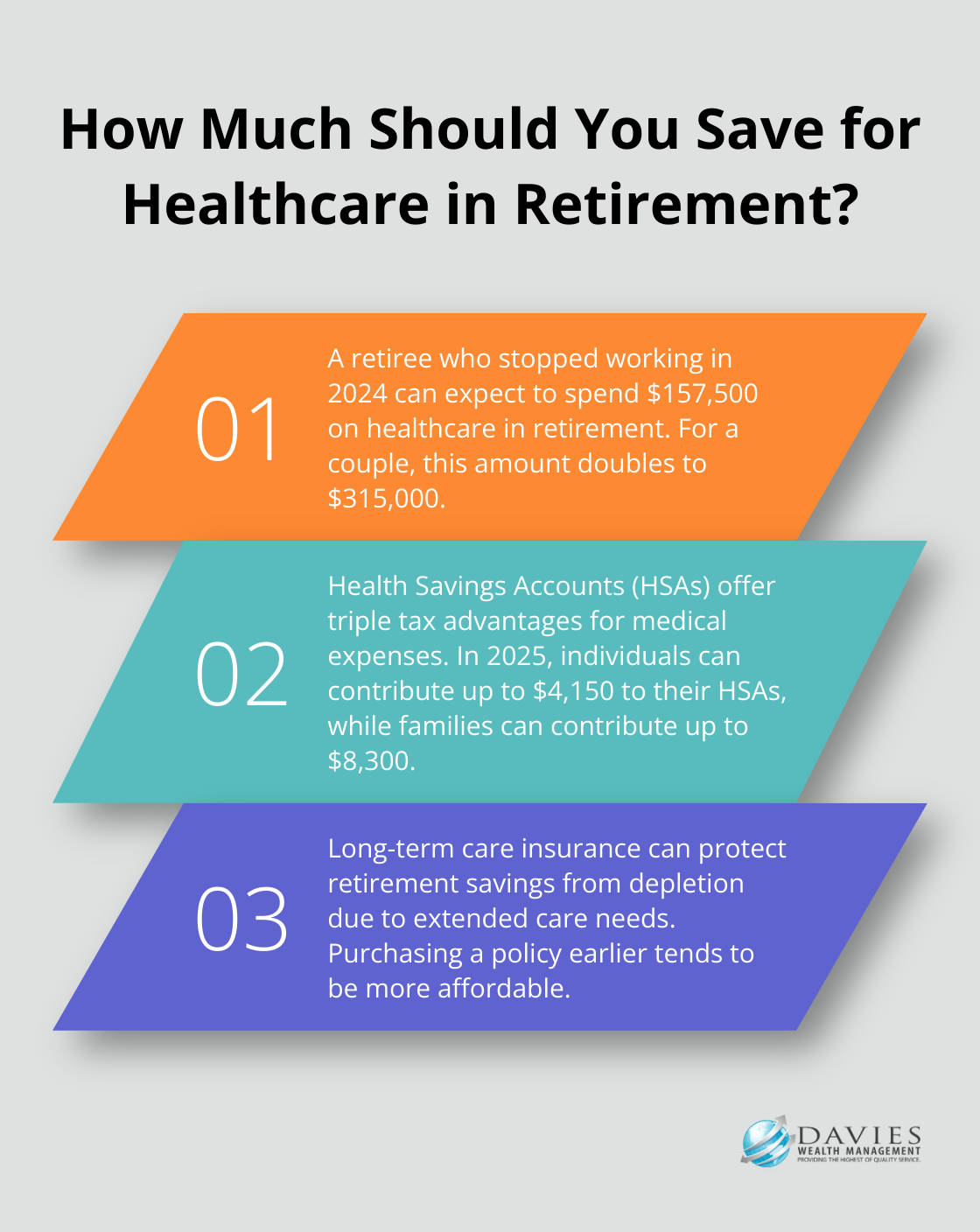

Healthcare expenses can significantly drain retirement savings. According to Investors.com, a retiree who stopped working last year can expect to spend $157,500 in health care and medical expenses in retirement ($315,000 for a couple).

To mitigate this risk, open a Health Savings Account (HSA) if you’re eligible. HSAs offer triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2025, individuals can contribute up to $4,150, and families can contribute up to $8,300 to their HSAs.

Long-term care insurance is another tool to consider. While it can be expensive, it can protect your retirement savings from depletion by extended care needs. The earlier you purchase a policy, the more affordable it tends to be.

Final Thoughts

Planning for retirement stands as a financial necessity and a vital step towards future well-being. The importance of planning for retirement cannot be overstated, as it provides the foundation for a comfortable life after your working years. Effective retirement planning requires a personalized approach tailored to your unique circumstances, goals, and risk tolerance.

Professional guidance can prove invaluable in creating comprehensive retirement strategies that address your specific needs and aspirations. Our team of experts at Davies Wealth Management can help you navigate the complexities of retirement planning, ensuring you stay on track to achieve your financial goals. We offer personalized strategies and expert guidance to help you work towards your retirement dreams.

You should not wait to secure your financial future. Start planning for your retirement today, regardless of your career stage. Regular reviews and adjustments will keep pace with changing life circumstances and economic conditions (a key aspect of successful retirement planning). Take proactive steps and seek professional advice when needed to build a solid foundation for a secure and enjoyable retirement.

Leave a Reply