Tax planning can be a complex and daunting task for individuals. At Davies Wealth Management, we understand the importance of optimizing your tax strategy to keep more money in your pocket.

This guide will explore effective individual tax planning strategies, from understanding your current tax situation to implementing tax-efficient investment techniques. By following these practical tips, you’ll be better equipped to minimize your tax burden and maximize your financial well-being.

Assess Your Tax Situation

Understanding your current tax situation forms the foundation of effective tax planning. A comprehensive review of your financial landscape will help you identify opportunities for tax optimization.

Analyze Your Income Sources

Start by listing all your income sources. This includes wages, self-employment income, investment returns, rental income, and any other forms of earnings. Knowing where you stand relative to national averages provides context for your tax planning strategy.

Evaluate Deductions and Credits

Scrutinize your potential deductions and credits. The standard deduction for 2024 is set at $14,600 for single filers and married individuals filing separately, an increase of $750 from 2023. If your itemized deductions exceed these amounts, you may benefit from itemizing. Common deductions include mortgage interest, property taxes, and charitable contributions. Don’t overlook credits like the Child Tax Credit or the American Opportunity Credit for education expenses (which can directly reduce your tax bill).

Determine Your Tax Bracket

Determine your tax bracket and effective tax rate. For 2024, federal tax rates range from 10% to 37%. Your marginal tax rate (the rate on your last dollar of income) differs from your effective tax rate (the average rate you pay on all your income). Understanding this distinction is essential for making informed financial decisions.

For example, if you’re a single filer with a taxable income of $100,000 in 2024, you’d fall into the 24% marginal tax bracket. However, your effective tax rate would be lower due to the progressive nature of the U.S. tax system.

Consider Professional Guidance

Navigating the complexities of tax planning can be challenging. A professional tax advisor or wealth management firm (like Davies Wealth Management) can help you develop a clear picture of your tax situation. This understanding serves as the cornerstone for developing a tailored, tax-efficient financial strategy that aligns with your unique goals and circumstances.

As you gain a comprehensive understanding of your tax situation, you’ll be better equipped to explore strategies for maximizing tax-advantaged accounts. These accounts offer powerful tools for reducing your tax burden while building wealth for the future.

How to Maximize Tax-Advantaged Accounts

Tax-advantaged accounts are designed to help people save for important goals in life like college, a mortgage, and especially for retirement. These accounts form the cornerstone of a solid financial plan and offer significant benefits for savvy investors.

Retirement Accounts: Your Tax-Saving Powerhouses

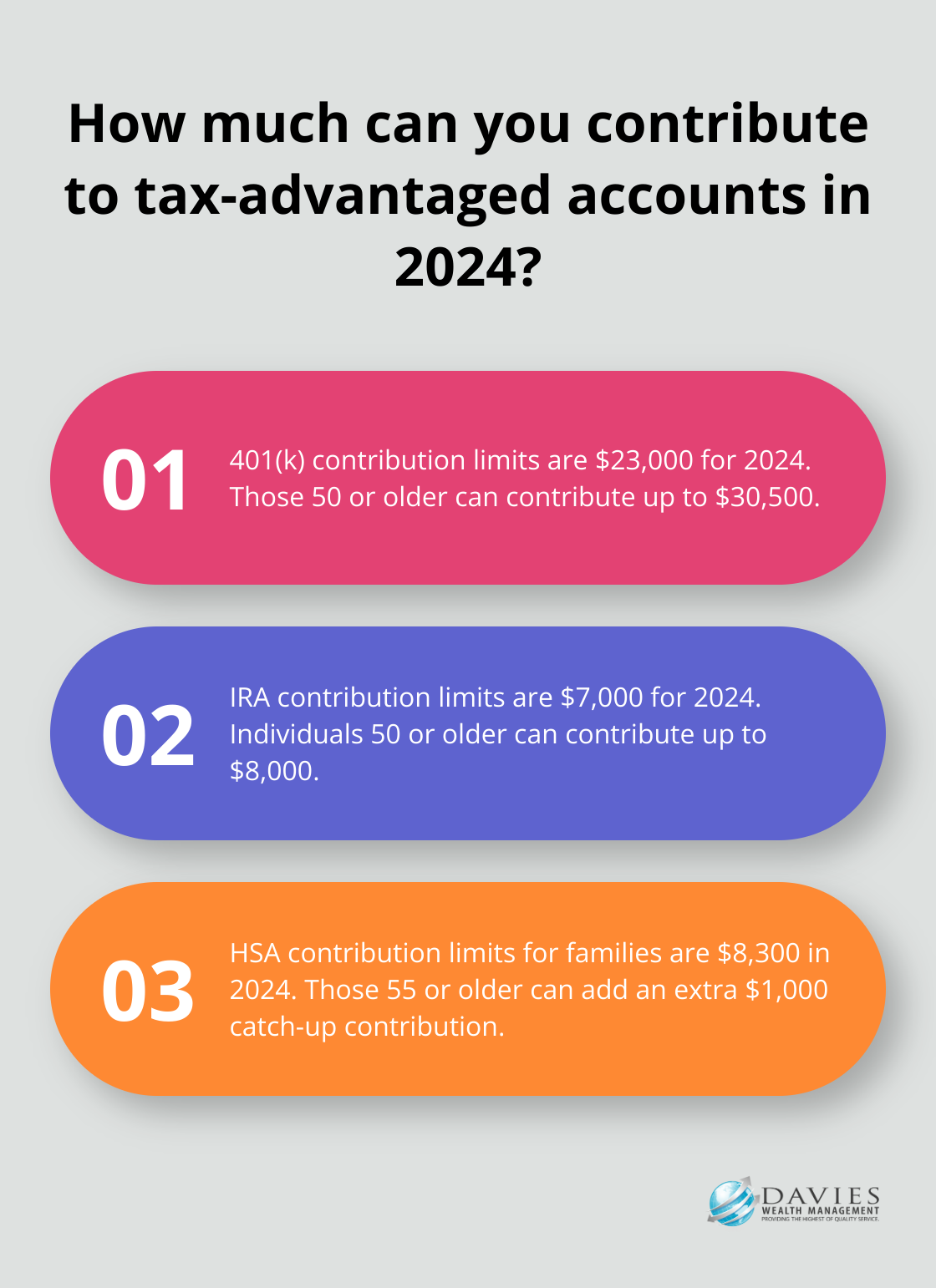

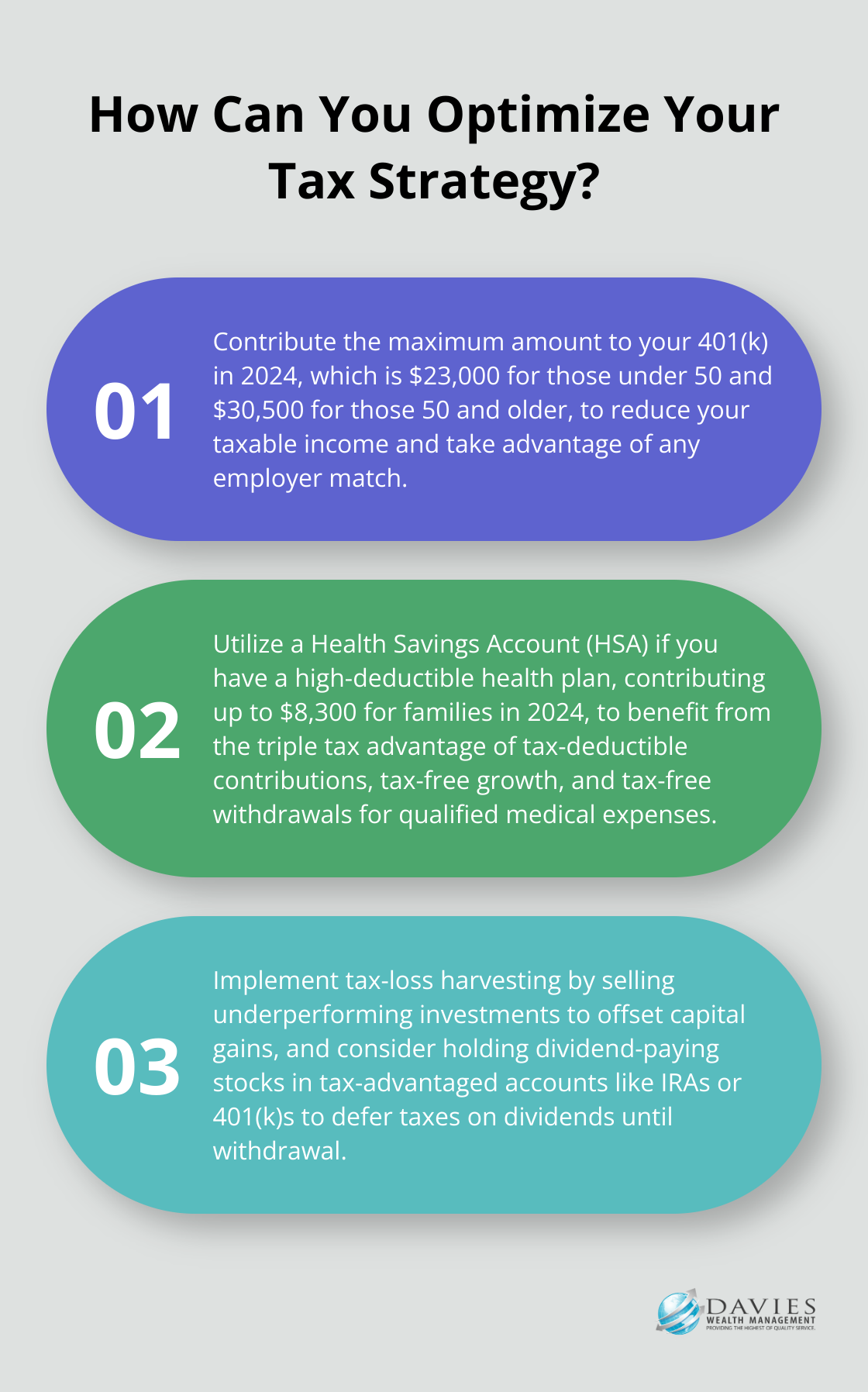

401(k)s and IRAs provide substantial tax advantages. In 2024, you can contribute up to $23,000 to a 401(k), or $30,500 if you’re 50 or older. These contributions use pre-tax dollars, which reduces your taxable income for the year. If your employer offers a match, you receive free money while lowering your tax bill.

IRAs offer additional tax-advantaged options. Traditional IRAs allow tax-deductible contributions (subject to income limits), while Roth IRAs provide tax-free withdrawals in retirement. For 2024, you can contribute up to $7,000 to an IRA (or $8,000 if you’re 50 or older).

Health Savings Accounts: Triple Tax Advantage

HSAs offer a unique triple tax advantage for those with high-deductible health plans. Contributions are tax-deductible, growth occurs tax-free, and withdrawals for qualified medical expenses incur no taxes. In 2024, families can contribute up to $8,300 if they had family HDHP coverage on the first day of the last month of their tax year. Those 55 or older can add an extra $1,000 catch-up contribution.

529 Plans: Tax-Smart Education Savings

529 plans excel as vehicles for education savings. While contributions don’t qualify for federal tax deductions, many states offer tax benefits for contributions. Money invested in 529 plans grows tax-free, and investors do not pay capital gains taxes if they spend that money on qualified education expenses. Some states (like New York) even offer tax deductions of up to $10,000 per year for married couples filing jointly.

Strategic Utilization of Tax-Advantaged Accounts

To maximize the benefits of these accounts, you should:

- Prioritize contributions to accounts with employer matches

- Consider your current and future tax brackets when choosing between traditional and Roth options

- Use HSAs as long-term investment vehicles if possible

- Evaluate state-specific benefits for 529 plans

Understanding the specific rules and limitations of each account type proves essential for optimal utilization. Professional guidance can help navigate these complexities and create a personalized strategy that aligns with your overall financial planning journey.

As you optimize your use of tax-advantaged accounts, you’ll want to complement this strategy with tax-efficient investment techniques. The next section explores how to structure your investment portfolio to minimize tax liabilities and maximize after-tax returns.

Mastering Tax-Efficient Investing

Tax-efficient investment strategies form a cornerstone of effective tax planning. Smart investment choices can significantly reduce tax liabilities and boost after-tax returns for investors.

The Power of Tax-Loss Harvesting

Tax-loss harvesting minimizes tax burdens by selling investments that have experienced losses to offset capital gains. For instance, an investor who realizes $10,000 in capital gains could sell underperforming investments at a $10,000 loss to neutralize the tax impact.

A study by Vanguard indicates that the value of tax-loss harvesting can be amplified or dampened by market returns over the investment horizon. This strategy can potentially add value to after-tax returns, but the exact impact depends on various factors.

Municipal Bonds for Tax-Free Income

Municipal bonds offer a unique opportunity for tax-free income, particularly for high-income earners. Interest paid on these bonds is often tax-free, making them an attractive investment option for individuals in high tax brackets. General obligation (GO) bonds are one type of municipal bond that investors might consider.

However, investors should compare the after-tax yield of municipal bonds with taxable alternatives. Sometimes, the tax benefit doesn’t outweigh lower pre-tax yields. Professional guidance can help navigate these complex calculations to ensure the most tax-efficient choice.

Strategic Placement of Dividend Stocks

Dividend-paying stocks present both opportunities and challenges from a tax perspective. While they provide steady income, dividends typically face taxation as ordinary income (up to 37% for high earners). However, qualified dividends receive more favorable long-term capital gains tax treatment (maxing out at 20% for most investors).

To optimize tax situations, investors should consider holding dividend-paying stocks in tax-advantaged accounts like IRAs or 401(k)s. This strategy allows for tax deferral on dividends until withdrawal (potentially during a lower tax bracket period). For taxable accounts, focus on stocks with qualified dividends or those with lower yields but higher growth potential.

Asset Location for Tax Efficiency

Asset location (a powerful yet often overlooked strategy) involves strategically placing investments in different account types to minimize taxes. High-yield bonds or REITs (which generate significant taxable income) often suit tax-advantaged accounts better. In contrast, broad-market stock index funds (inherently tax-efficient due to low turnover) can reside in taxable accounts.

Proper execution of an asset location strategy can help clients achieve lower currently taxable investment income and potentially benefit their heirs. This approach plays a pivotal role in a portfolio’s success.

Implementing these tax-efficient investment strategies requires careful planning and ongoing management. While the concepts may seem straightforward, execution can prove complex, especially when balancing tax efficiency with overall investment goals and risk tolerance. The expertise of a wealth management firm (such as Davies Wealth Management) becomes invaluable in these situations.

Final Thoughts

Individual tax planning strategies require continuous attention and adaptation. Tax laws change, and personal financial situations evolve, necessitating regular reviews and adjustments to your approach. Professional guidance can prove invaluable in navigating the complexities of tax planning and creating personalized, tax-efficient financial plans. At Davies Wealth Management, we specialize in helping clients optimize their tax situations and achieve their unique financial goals.

Our team of experienced advisors can develop comprehensive strategies tailored to your specific circumstances. We offer expertise for various client profiles, from professionals with complex income structures to individuals seeking to enhance their tax efficiency. Davies Wealth Management provides the personalized service and knowledge needed to help you reach your financial objectives while minimizing tax liabilities.

Take control of your financial future by implementing effective tax planning strategies. Professional guidance can ensure your efforts remain both effective and compliant with current regulations. Partner with an advisor to maximize your wealth and work towards a more secure financial future.

Leave a Reply