Real estate tax strategies can significantly impact your investment returns. At Davies Wealth Management, we’ve seen how optimizing these strategies can lead to substantial savings and increased profitability for our clients.

This blog post will guide you through essential deductions, 1031 exchanges, and advanced tax optimization techniques in real estate investing. We’ll provide practical insights to help you navigate the complex world of real estate taxation and maximize your financial outcomes.

Real Estate Tax Deductions Explained

Real estate tax deductions can significantly boost your investment returns. Understanding and leveraging these deductions often leads to substantial savings for property owners and investors.

Mortgage Interest Deductions

Mortgage interest represents one of the largest deductible expenses for property owners. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. This applies to both primary residences and second homes. For investment properties, all mortgage interest is typically deductible against rental income.

Property Tax Deductions

Property taxes offer another significant deduction opportunity. The Tax Cuts and Jobs Act of 2017 capped state and local tax deductions (including property taxes) at $10,000 for both single filers and married couples filing jointly. However, for rental properties, property taxes remain fully deductible as a business expense.

Depreciation Benefits

Depreciation serves as a powerful tool for real estate investors. The IRS allows deductions for the cost of income-producing property over its useful life – 27.5 years for residential properties and 39 years for commercial properties. This non-cash expense can significantly reduce taxable income.

Home Office Deductions

If you use part of your home exclusively for managing real estate investments, you may qualify for home office deductions. This can include a portion of mortgage interest, property taxes, utilities, and maintenance costs. The IRS offers a simplified option, allowing a deduction of $5 per square foot of home office space (up to 300 square feet).

Record-Keeping and Professional Guidance

Maximizing these deductions requires meticulous record-keeping and a deep understanding of tax laws. While online resources provide general guidance, working with a qualified tax professional often proves the best way to ensure full advantage of all available deductions. Tax experts can help optimize real estate tax strategies and maximize investment returns.

As we move forward, let’s explore another powerful tax strategy in real estate investing: 1031 exchanges. This method allows investors to defer capital gains taxes and potentially increase their real estate portfolio’s value over time.

Unlocking 1031 Exchanges

What Are 1031 Exchanges?

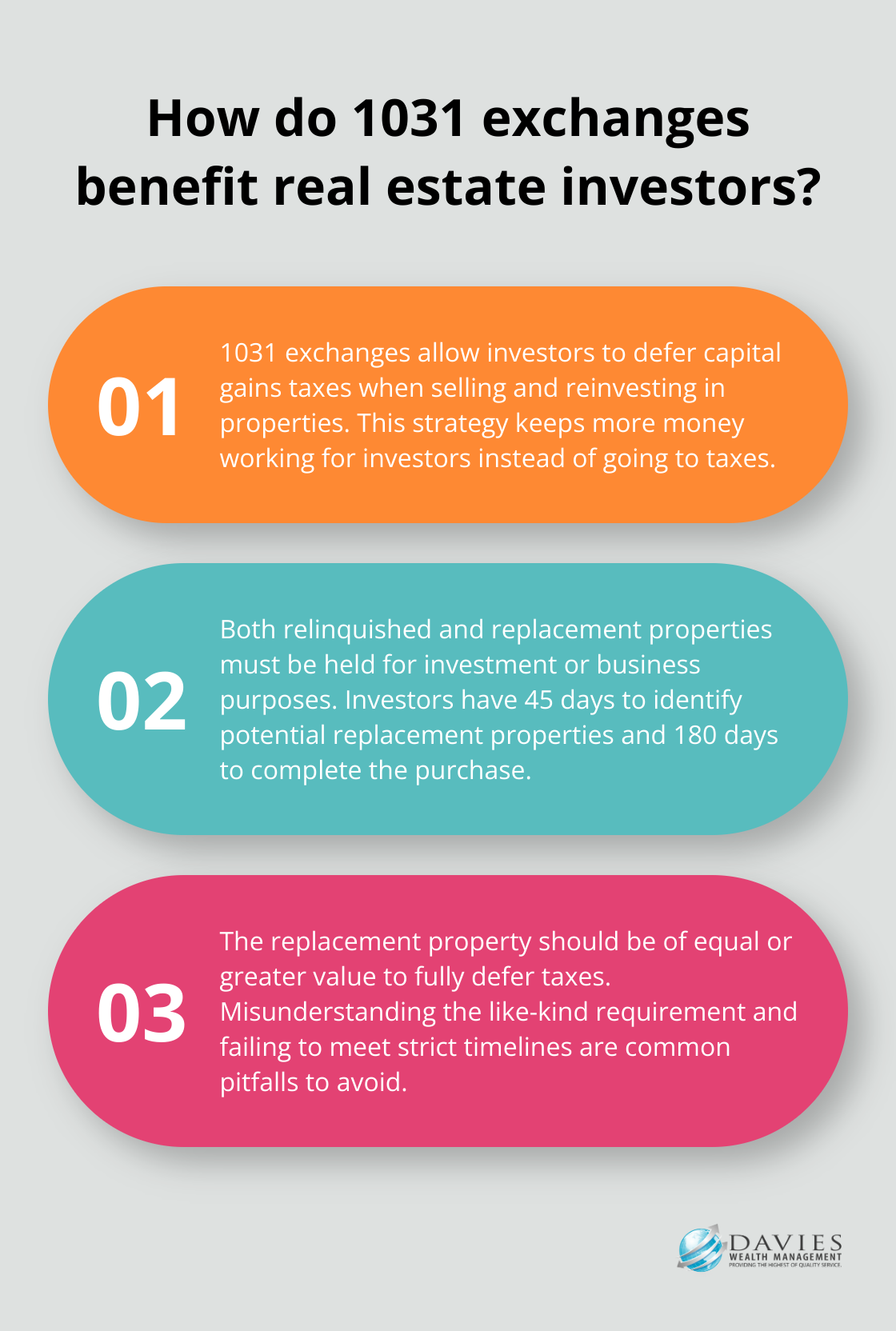

1031 exchanges represent powerful tools for real estate investors who want to defer capital gains taxes and grow their portfolios. These exchanges, named after Section 1031 of the Internal Revenue Code, allow investors to sell a property and reinvest the proceeds into a new property while deferring capital gains taxes. This strategy can significantly boost real estate investment returns by keeping more money working for investors instead of going to taxes.

Key Rules for Successful Exchanges

To qualify for a 1031 exchange, both the relinquished and replacement properties must be held for investment or business purposes. Investors must identify potential replacement properties within 45 days of selling their original property and complete the purchase within 180 days. The replacement property should be of equal or greater value to fully defer taxes (this is a critical point to remember).

Avoiding Common Pitfalls

One frequent mistake involves misunderstanding the like-kind requirement. While this term is broadly interpreted in real estate, it’s important to ensure your exchange adheres to IRS guidelines. Another pitfall is failing to meet strict timelines. We recommend starting your property search before initiating the exchange to maximize your chances of success.

Real-World Success Stories

Many investors have leveraged 1031 exchanges to great effect. For instance, one investor sold a small apartment building and used a 1031 exchange to acquire a larger, more profitable commercial property. This move not only deferred a substantial tax bill but also potentially increased their cash flow.

Navigating Complex Transactions

1031 exchanges can be complex, but with proper planning and guidance, they offer significant benefits for real estate investors. Professional wealth management firms (such as Davies Wealth Management) specialize in helping clients navigate these transactions to optimize their real estate portfolios and achieve their long-term financial goals.

As we move forward, let’s explore advanced real estate tax strategies that can further enhance your investment returns and minimize your tax burden.

Advanced Tax Strategies for Real Estate Investors

Real estate investors who want to maximize their returns must go beyond basic deductions and 1031 exchanges. Advanced tax strategies can significantly boost real estate investment performance. Let’s explore some cutting-edge approaches that savvy investors use to optimize their tax positions.

Opportunity Zone Investments

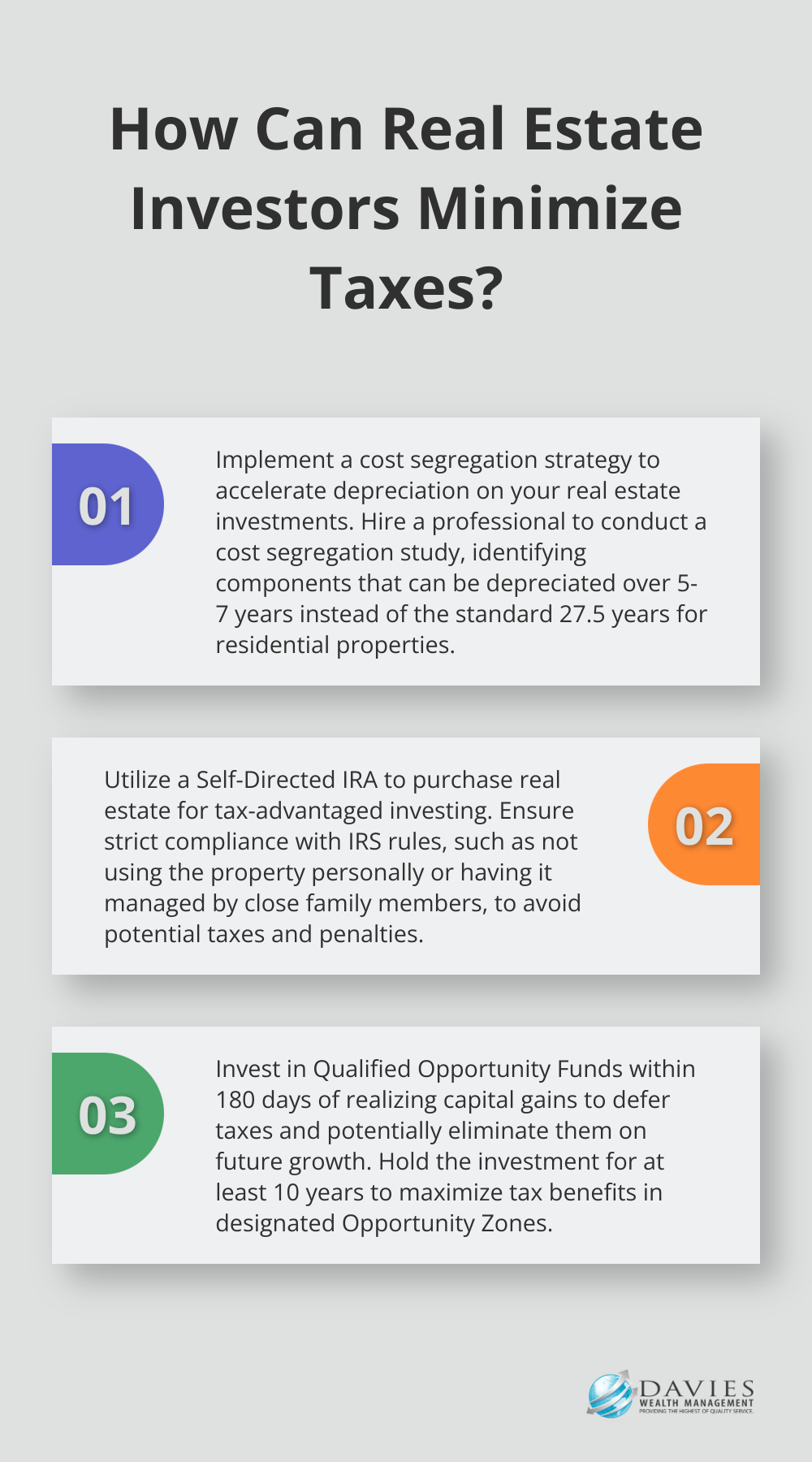

Opportunity Zones are tax incentives to encourage those with capital gains to invest in low-income and undercapitalized communities. Created by the Tax Cuts and Jobs Act of 2017, these designated areas allow investors to defer capital gains taxes by reinvesting their gains into Qualified Opportunity Funds (QOFs). If held for at least 10 years, the appreciation on the QOF investment becomes tax-free.

An investor who sells a property and realizes a $1 million capital gain can defer taxes on that gain by investing in a QOF within 180 days. If they hold the QOF investment for a decade, any appreciation on that $1 million is completely tax-free when sold. This strategy not only defers taxes but can eliminate them on future growth.

REITs for Tax Efficiency

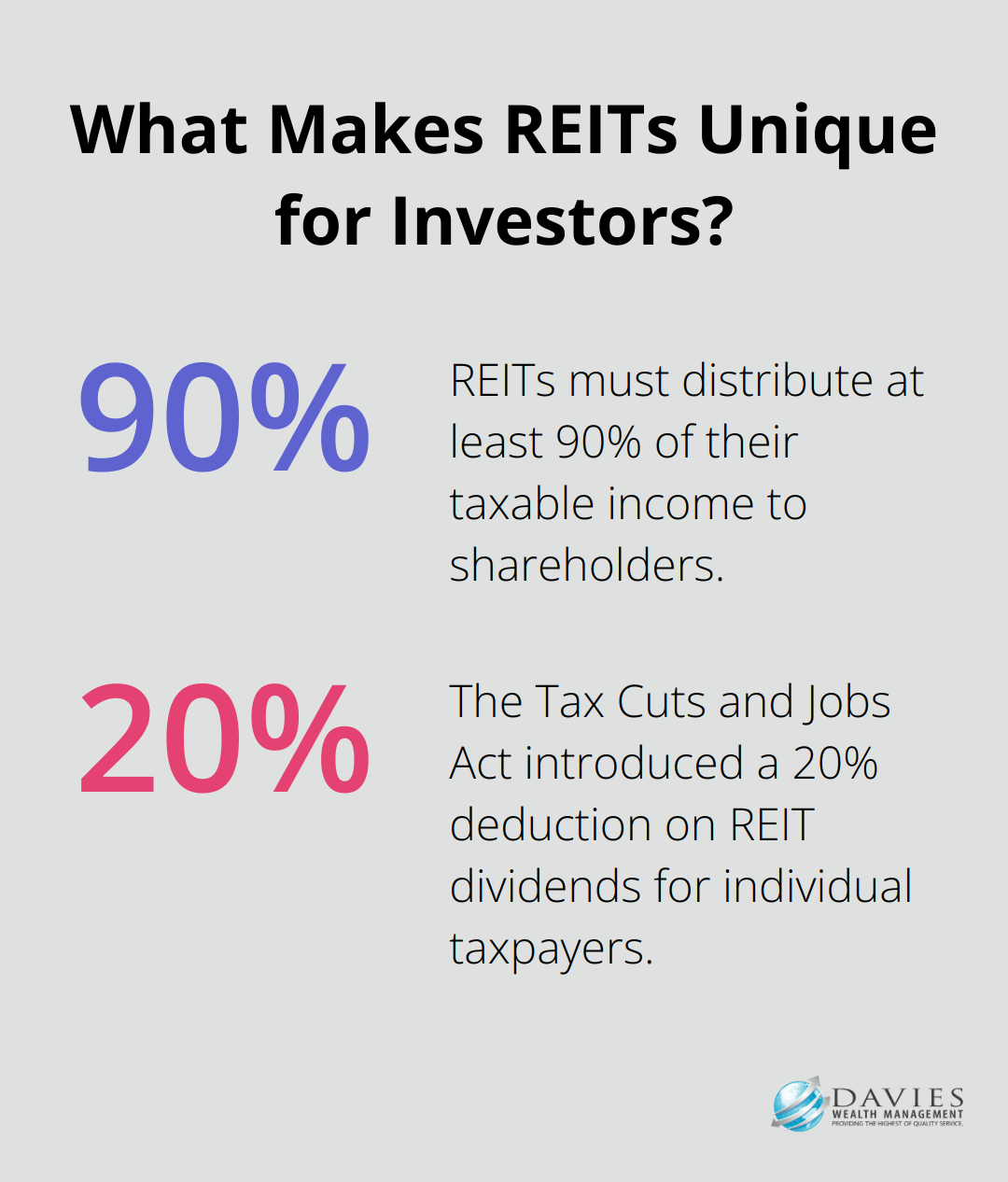

Real Estate Investment Trusts (REITs) offer another tax-advantaged way to invest in real estate. REITs must distribute at least 90% of their taxable income to shareholders, and they don’t pay corporate taxes on that distributed income. This structure can result in higher yields for investors.

The Tax Cuts and Jobs Act introduced a 20% deduction on REIT dividends for individual taxpayers. This means if you receive $10,000 in qualified REIT dividends, you may only be taxed on $8,000 (a straightforward way to reduce your tax burden while maintaining exposure to real estate markets).

Self-Directed IRAs for Real Estate

Self-directed IRAs allow investors to use retirement funds to purchase real estate, offering unique tax advantages. These accounts have the potential for higher returns than traditional investment options and can protect retirement savings from economic fluctuations and volatility.

It’s important to navigate the strict IRS rules surrounding these accounts. You can’t use the property personally or have it managed by a disqualified person (like a close family member). Violating these rules can result in the entire IRA being considered distributed, potentially triggering significant taxes and penalties.

Accelerating Depreciation with Cost Segregation

Cost segregation is a way for real estate investors to quickly deduct the depreciation of a property – anything from a single-family home to an office building. This strategy involves breaking down a property’s components and reclassifying certain elements for faster depreciation schedules.

While a residential rental property typically depreciates over 27.5 years, items like carpeting or appliances can be depreciated over 5-7 years. A professional cost segregation study can identify these opportunities, potentially resulting in significant tax savings in the early years of property ownership.

Implementing these advanced strategies requires careful planning and expert guidance. The potential tax benefits are substantial, but the rules are complex and the consequences of missteps can be severe. Professional wealth management firms specialize in helping clients navigate these strategies to optimize their real estate portfolios and achieve their long-term financial goals.

Final Thoughts

Real estate tax strategies significantly impact investment returns. Mastering these techniques proves essential for long-term success in property investing. From basic deductions to advanced methods like 1031 exchanges and opportunity zone investments, investors can optimize their tax positions and maximize profits.

The complex world of real estate taxation requires more than surface-level understanding. Rules and regulations surrounding these strategies change frequently, making professional guidance essential. Experienced financial advisors and tax professionals help avoid costly mistakes and ensure full utilization of available tax benefits.

Davies Wealth Management specializes in helping clients navigate real estate tax strategies. Our expert team provides personalized advice tailored to unique financial situations and investment goals. We develop comprehensive tax strategies that align with long-term objectives and maximize investment returns (for both seasoned and new real estate investors).

Leave a Reply