At Davies Wealth Management, we understand the unique challenges faced by high-income earners when it comes to investing wisely.

Managing substantial earnings while navigating complex tax implications and balancing current lifestyle needs with long-term financial goals requires a strategic approach.

This guide offers investment advice for high-income earners, focusing on effective strategies to maximize wealth and minimize risks.

We’ll explore diversification, tax optimization, and wealth preservation techniques tailored specifically for those in higher income brackets.

Navigating High Income Challenges

High income earners face a unique set of financial hurdles that require careful navigation. Three primary challenges consistently emerge for those in higher income brackets: complex tax situations, lifestyle inflation pressures, and intricate compensation structures.

Tackling Tax Complexities

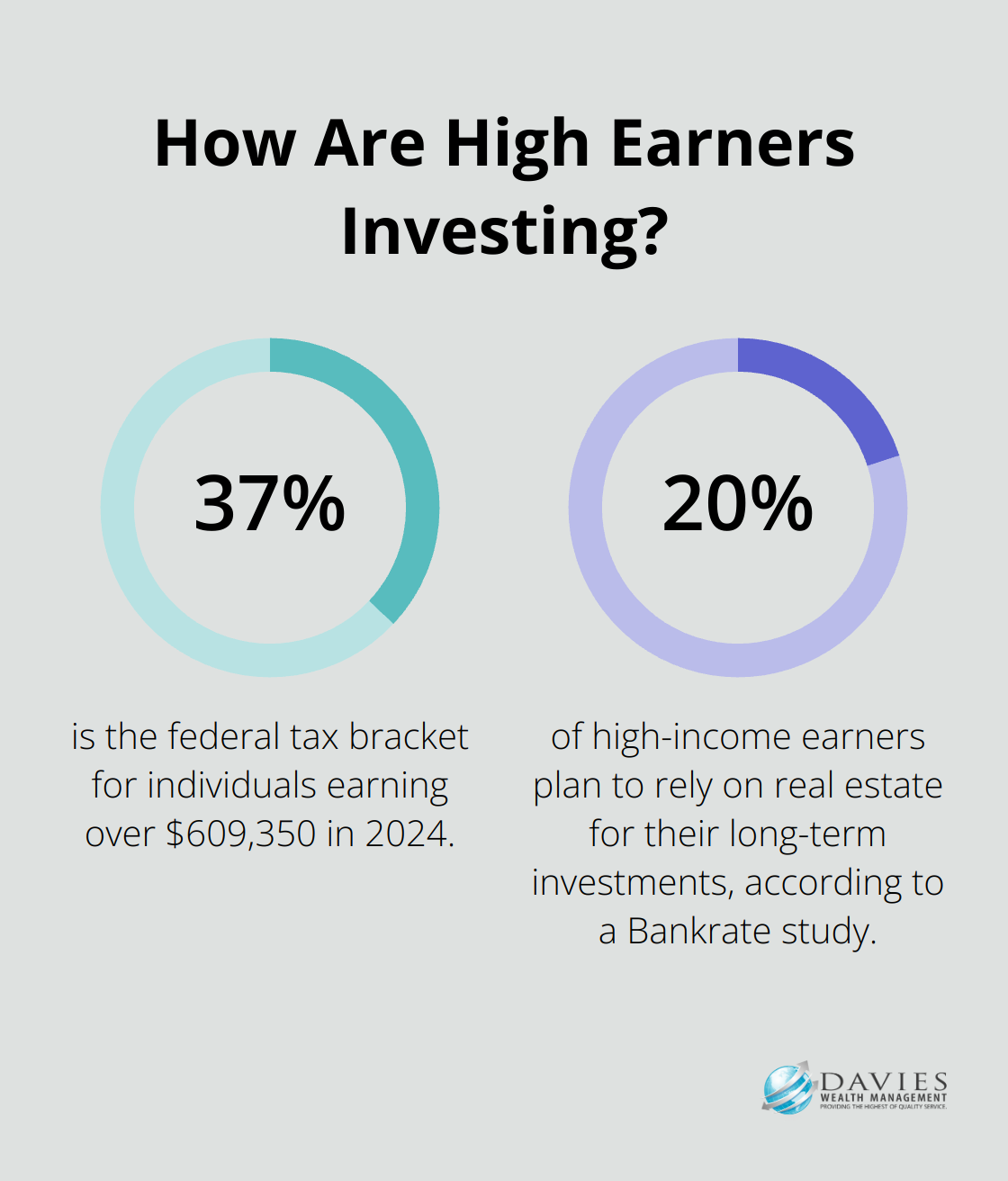

High earners often find themselves in the highest tax brackets, making tax optimization a priority. For instance, in 2024, individuals earning over $609,350 (or $731,200 for married couples filing jointly) fall into the 37% federal tax bracket. This doesn’t account for state taxes, which can push the total rate even higher in states like California or New York.

To mitigate this tax burden, consider these strategies:

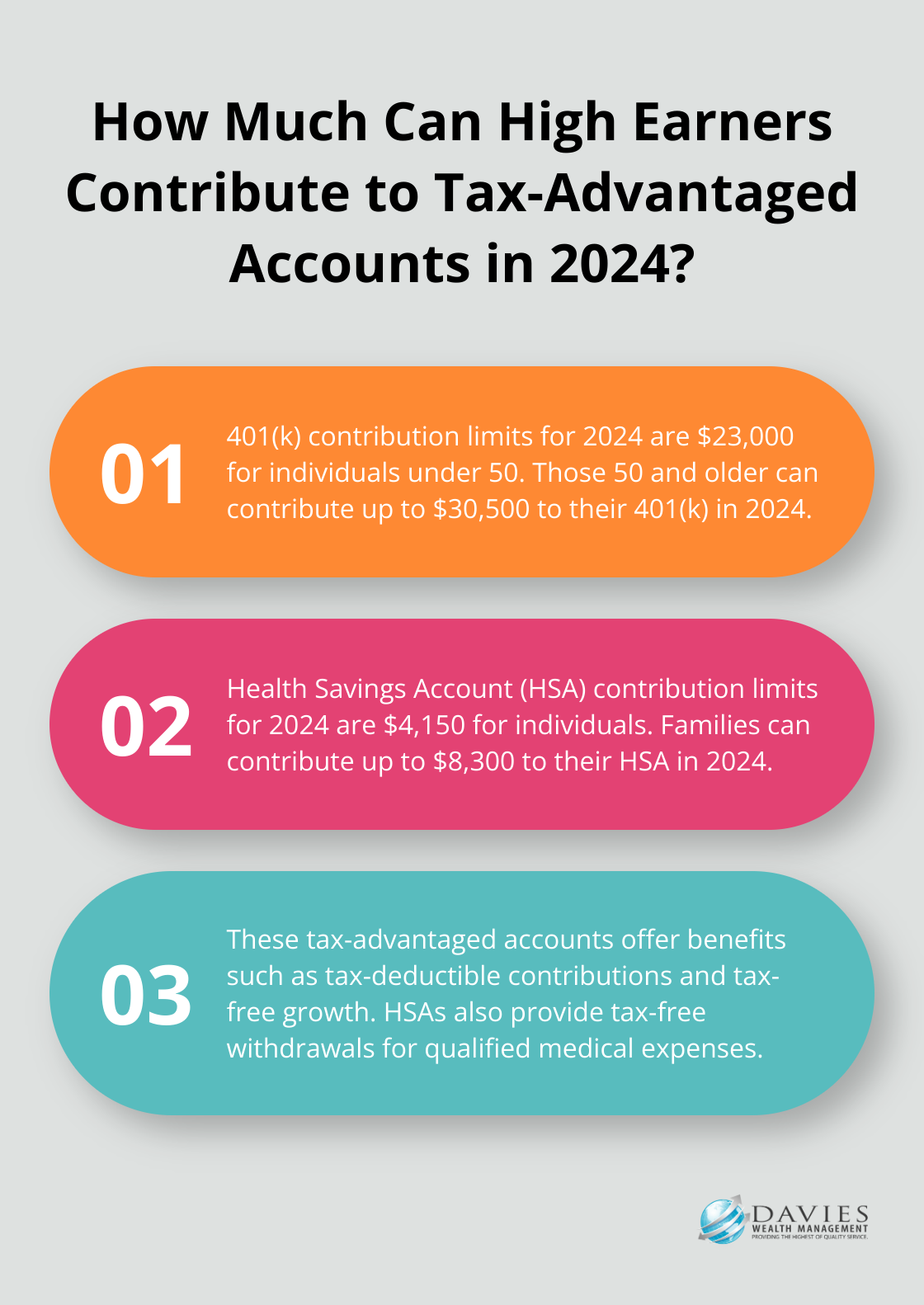

- Maximize contributions to tax-advantaged accounts like 401(k)s and Health Savings Accounts (HSAs). In 2024, you can contribute up to $23,000 to a 401(k), or $30,500 if you’re 50 or older.

- Explore a Backdoor Roth IRA conversion. This legal strategy allows high-income earners to bypass income limits on Roth IRA contributions.

- Implement tax-loss harvesting in your investment portfolio. This involves selling underperforming investments to offset capital gains taxes on your winners.

Balancing Lifestyle and Long-term Goals

As income increases, so does the temptation to upgrade your lifestyle. However, unchecked spending can derail long-term financial objectives. A study by Bankrate found that nearly 20% of high-income earners plan to rely on real estate for their long-term investments, indicating a trend towards more strategic wealth building.

Try these approaches to maintain balance:

- Follow an adjusted 40/30/20/10 rule, allocating 40% of income to necessities, 30% to discretionary spending, 20% to savings, and 10% to investments or debt repayment.

- Set up automatic transfers to investment accounts immediately after receiving your paycheck. This ensures consistent wealth accumulation before spending occurs.

- Invest in assets that appreciate over time (such as real estate or a diversified stock portfolio), rather than depreciating luxury items.

Decoding Complex Compensation Packages

Many high earners receive compensation packages that include base salary, bonuses, stock options, and other equity-based incentives. Understanding and optimizing these components is essential for maximizing returns.

Consider these strategies:

- Develop a comprehensive plan for exercising stock options. This might involve a staged approach to minimize tax implications and diversify risk.

- Evaluate deferred compensation plans if offered by your employer. These can provide tax benefits and help manage cash flow.

- Analyze the tax implications of various forms of compensation. For example, Incentive Stock Options (ISOs) may offer different tax treatment compared to Non-Qualified Stock Options (NQSOs) in certain scenarios.

As we move forward, it’s important to recognize that these challenges require ongoing attention and expert guidance. The next section will explore effective investment strategies tailored specifically for high income earners, building on the foundation of understanding these unique financial hurdles.

Smart Investing Strategies for High Earners

At Davies Wealth Management, we have developed effective investment strategies tailored for high-income earners. Our approach focuses on maximizing returns while minimizing risks and tax liabilities.

Strategic Diversification

Diversification remains a cornerstone of smart investing. For high earners, this means expanding beyond traditional stocks and bonds. We recommend asset allocation across various classes, including real estate, private equity, and international markets. In a diversified portfolio, gains from some investments may help offset losses from others. However, diversification does not ensure a profit or guarantee against loss.

Maximizing Tax-Advantaged Accounts

High-income earners should prioritize contributions to tax-advantaged accounts. In 2024, you can contribute up to $23,000 to a 401(k) (or $30,500 if you’re 50 or older). Additionally, consider maxing out Health Savings Accounts (HSAs) with contribution limits of $4,150 for individuals and $8,300 for families in 2024. These accounts offer triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Alternative Investment Exploration

Alternative investments can provide additional diversification and potentially higher returns. Private equity, for example, has delivered higher net returns than public markets over the last 20 years. This outperformance tends to be particularly pronounced during periods of public market stress.

Dollar-Cost Averaging Implementation

Dollar-cost averaging is a powerful strategy for high-income earners. This approach involves consistent investment of a fixed amount at regular intervals, regardless of market conditions. This method can potentially reduce the impact of market volatility on your portfolio. Vanguard research suggests that dollar-cost averaging can lead to lower average costs per share over time, especially in volatile markets.

Personalized Investment Approach

High-income earners often benefit from a personalized investment approach. This involves tailoring strategies to individual financial situations, risk tolerances, and long-term goals. Wealth management for athletes and entertainers involves tailored financial strategies to grow, protect, and transfer wealth. It addresses unique income streams and challenges specific to these professions.

As we move forward, it’s important to consider how these investment strategies intersect with risk management and wealth preservation techniques. The next section will explore these critical aspects of financial planning for high-income earners.

Safeguarding Your Wealth

At Davies Wealth Management, we understand that building wealth is only half the battle. Protecting and preserving your hard-earned assets is equally important. This chapter explores essential strategies for high-income earners to safeguard their wealth against various risks and ensure its longevity.

Comprehensive Insurance Coverage

A robust insurance strategy is essential for high-income earners. Beyond standard policies, consider specialized coverage such as umbrella liability insurance. This type of policy provides coverage beyond the liability limits on your existing policies. According to NerdWallet, as of January 2, 2025, umbrella insurance offers protection beyond your existing policy limits and can be a valuable addition to your insurance portfolio.

For high-income professionals, disability insurance is also vital. It replaces a portion of your income if you’re unable to work due to illness or injury. Try to obtain a policy that covers 60-70% of your income. Some policies even offer riders for partial disability, allowing you to receive benefits if you can only work part-time.

Strategic Estate Planning

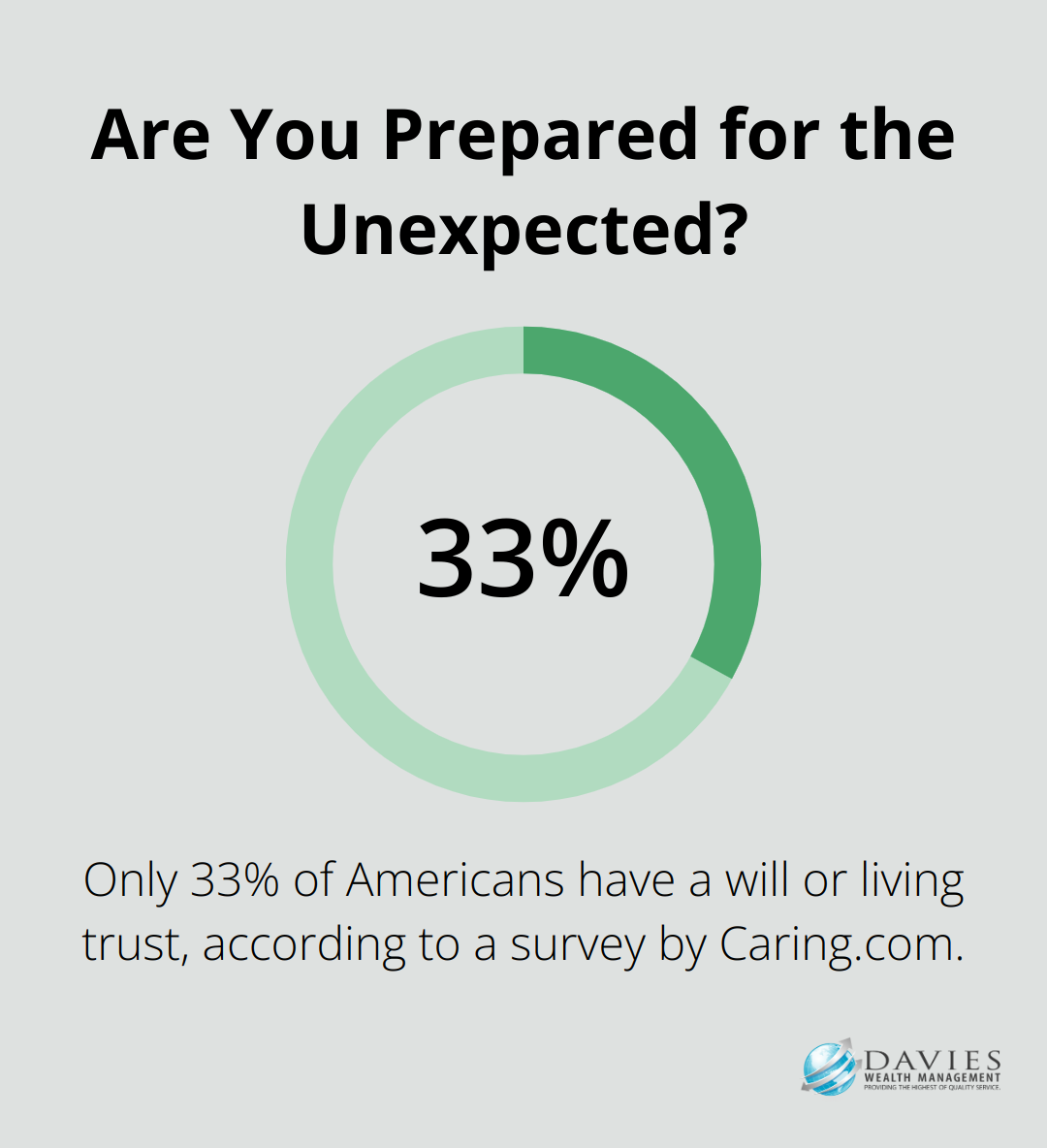

Estate planning is not just for the ultra-wealthy. For high-income earners, it’s a critical tool for ensuring your assets are distributed according to your wishes and minimizing estate taxes. Consider establishing a revocable living trust, which allows your estate to bypass probate, potentially saving your heirs time and money. A survey by Caring.com found that only 33% of Americans have a will or living trust, highlighting a significant gap in estate planning.

Another key strategy is gifting. In 2024, you can gift up to $18,000 per person annually without incurring gift taxes. This can effectively transfer wealth to your heirs over time while reducing your taxable estate.

Asset Protection Tactics

Protecting your assets from potential creditors or lawsuits is important for high-income earners. One effective strategy uses Limited Liability Companies (LLCs) or Family Limited Partnerships (FLPs) to hold investments or business interests. These structures can provide a layer of protection between your personal assets and business liabilities.

For medical professionals or others in high-risk professions, consider establishing a Domestic Asset Protection Trust (DAPT). As of February 10, 2025, only a handful of states have domestic asset protection laws that are worth mentioning, according to Dominion.

Dynamic Portfolio Management

Regular portfolio rebalancing maintains your desired risk level and asset allocation. According to Morningstar, as of July 16, 2024, if two assets have identical long-term total returns, rebalancing always leads to higher profits. Set up automatic rebalancing with your investment accounts, or schedule quarterly reviews with your financial advisor to ensure your portfolio stays aligned with your goals.

Final Thoughts

High-income earners face unique challenges and opportunities in investing and wealth management. Strategic diversification, tax-advantaged accounts, and alternative investments form the foundation of a robust investment portfolio. Professional guidance proves invaluable for navigating complex financial situations and optimizing investment strategies for high-income earners.

Protecting wealth through comprehensive insurance, estate planning, and asset protection tactics is equally important as building it. Regular portfolio rebalancing (at least annually) ensures investments align with long-term objectives and risk tolerance. A proactive approach to wealth management, combined with expert advice, supports long-term financial success and secures your financial future.

Davies Wealth Management specializes in personalized financial strategies for individuals with complex financial situations. Our team understands the nuances of high-income wealth management and can help you navigate the intricate landscape of taxes, investments, and wealth preservation. For tailored investment advice for high-income earners, contact Davies Wealth Management today.

Leave a Reply