Tax-efficient investing is a powerful strategy to maximize your investment returns. By minimizing your tax burden, you can keep more of your hard-earned money working for you in the market.

At Davies Wealth Management, we understand the significant impact taxes can have on your overall investment performance. In this post, we’ll explore practical strategies and investment vehicles to help you optimize your portfolio for tax efficiency and potentially boost your long-term returns.

What Is Tax-Efficient Investing?

The Essence of Tax-Efficient Investing

Tax-efficient investing is a strategic approach to manage your investment portfolio. It aims to minimize your tax liability while maximizing your after-tax returns. This method involves placing investments appropriately in tax-deferred or taxable accounts to minimize taxes.

The Impact of Tax Minimization

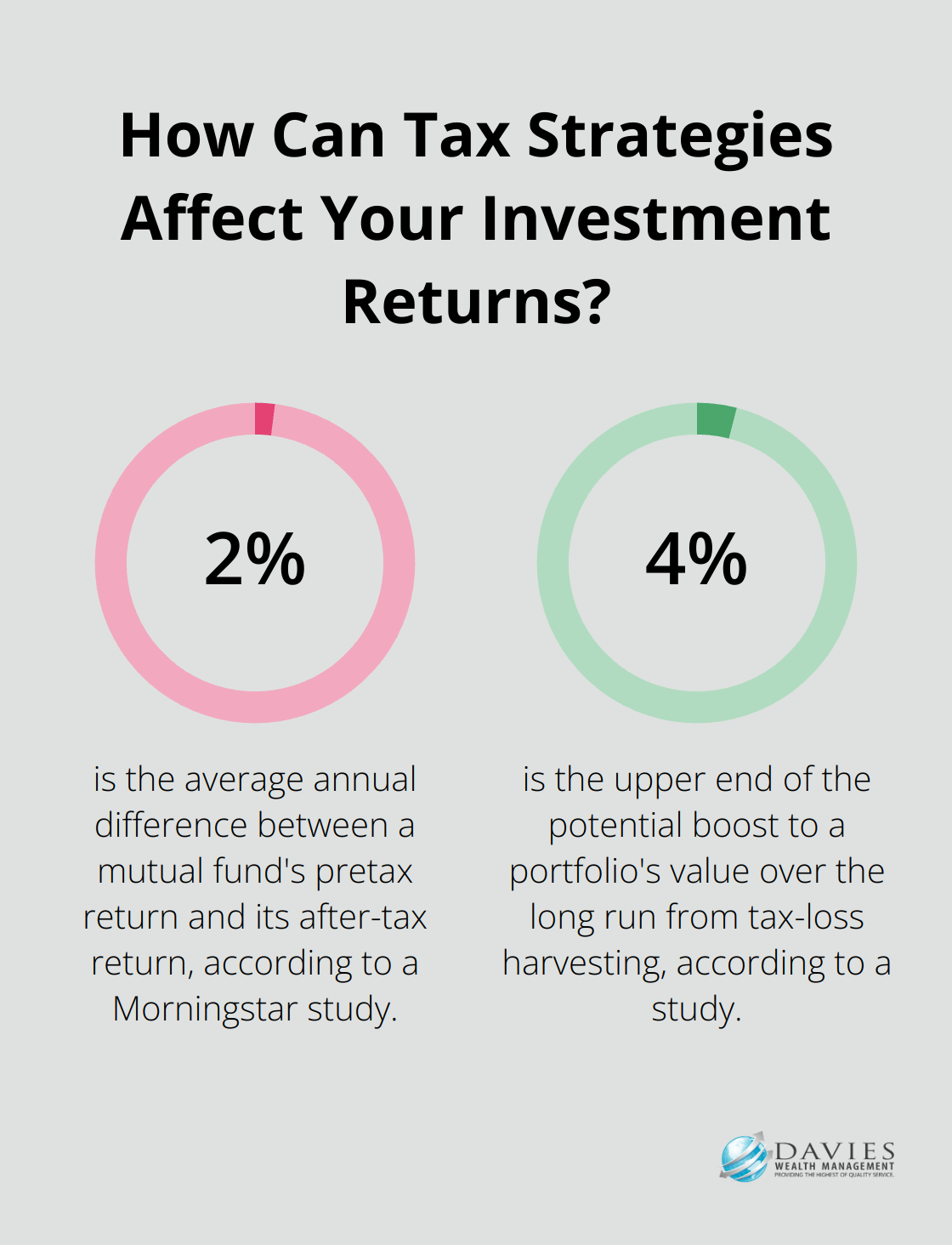

Reducing your tax burden on investments plays a vital role in long-term wealth accumulation. Each dollar you save in taxes becomes an extra dollar that can compound over time. This compounding effect potentially leads to significantly higher returns. A Morningstar study found that the average mutual fund’s annual after-tax return is about 2% lower than its pretax return. Over decades, this difference can amount to hundreds of thousands of dollars in lost wealth.

How Taxes Affect Your Returns

Taxes can substantially erode your investment gains. For instance, if you’re in the highest tax bracket, short-term capital gains face tax rates as high as 37%. This means for every $1,000 in short-term gains, you could owe $370 in taxes, leaving you with only $630 to reinvest. Long-term capital gains rates are more favorable but still significant, ranging from 0% to 20% depending on your income level.

Effective Tax-Efficient Investing Strategies

Several strategies can enhance tax efficiency in your investment portfolio. One effective method is asset location, which involves placing investments in accounts where they’ll incur the least tax burden. For example, you can hold high-yield bonds in tax-advantaged accounts (like IRAs) to shield their income from immediate taxation.

Another powerful technique is tax-loss harvesting. This strategy involves selling investments at a loss to offset capital gains, potentially reducing your tax bill. A study found that tax-loss harvesting can potentially boost a portfolio’s value by anywhere from around 0.5% to around 4% over the long run.

The Role of Professional Guidance

Tax-efficient investing isn’t about avoiding taxes entirely, but rather about smart management to keep more of your money working for you. Implementing these strategies effectively often requires professional expertise. At Davies Wealth Management, we specialize in creating tailored tax-efficient investment plans that align with your unique financial goals and circumstances.

As we move forward, let’s explore specific strategies for tax-efficient investing that can help you optimize your portfolio and potentially boost your long-term returns.

Maximizing Returns Through Tax-Efficient Strategies

Leveraging Tax-Advantaged Accounts

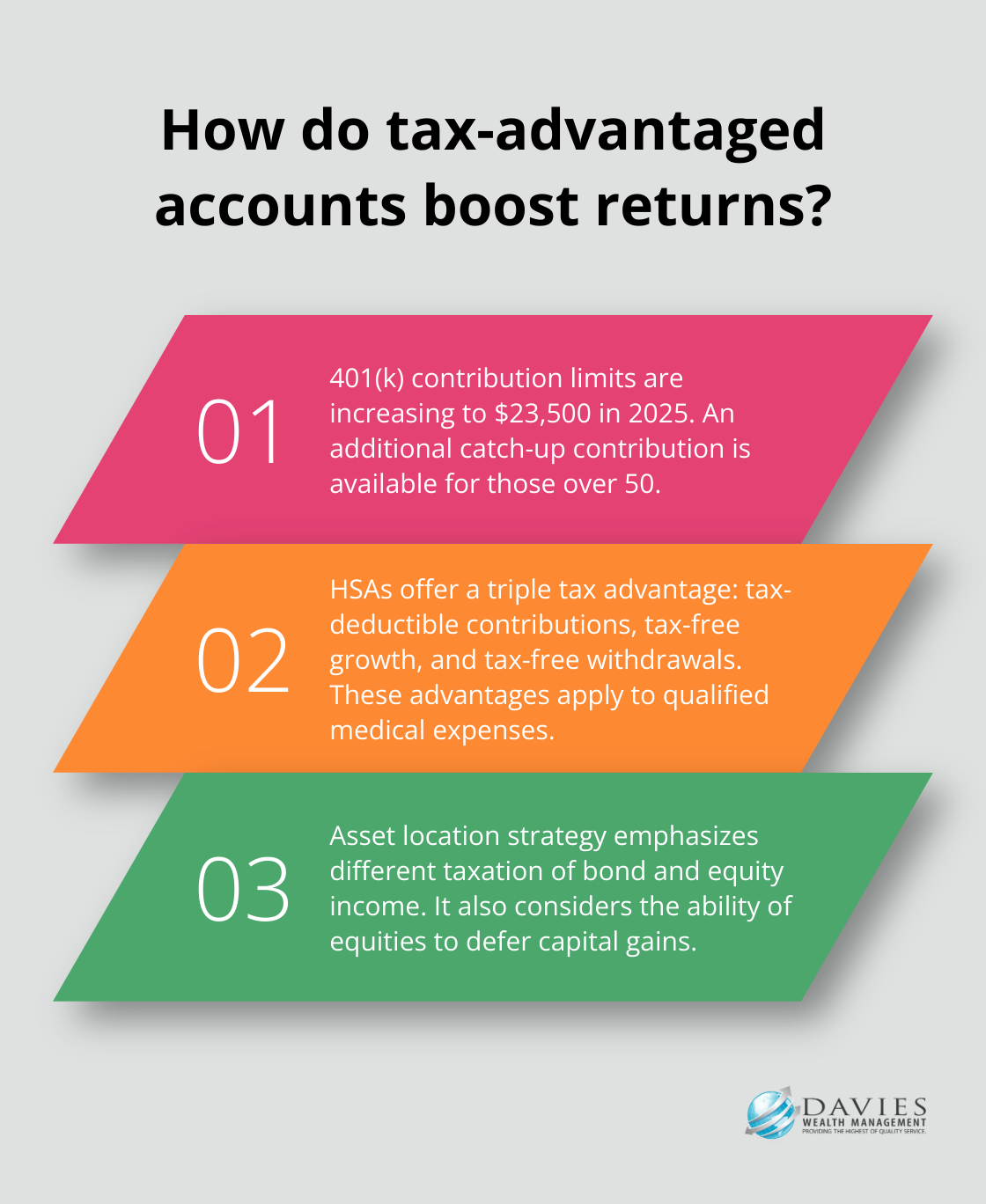

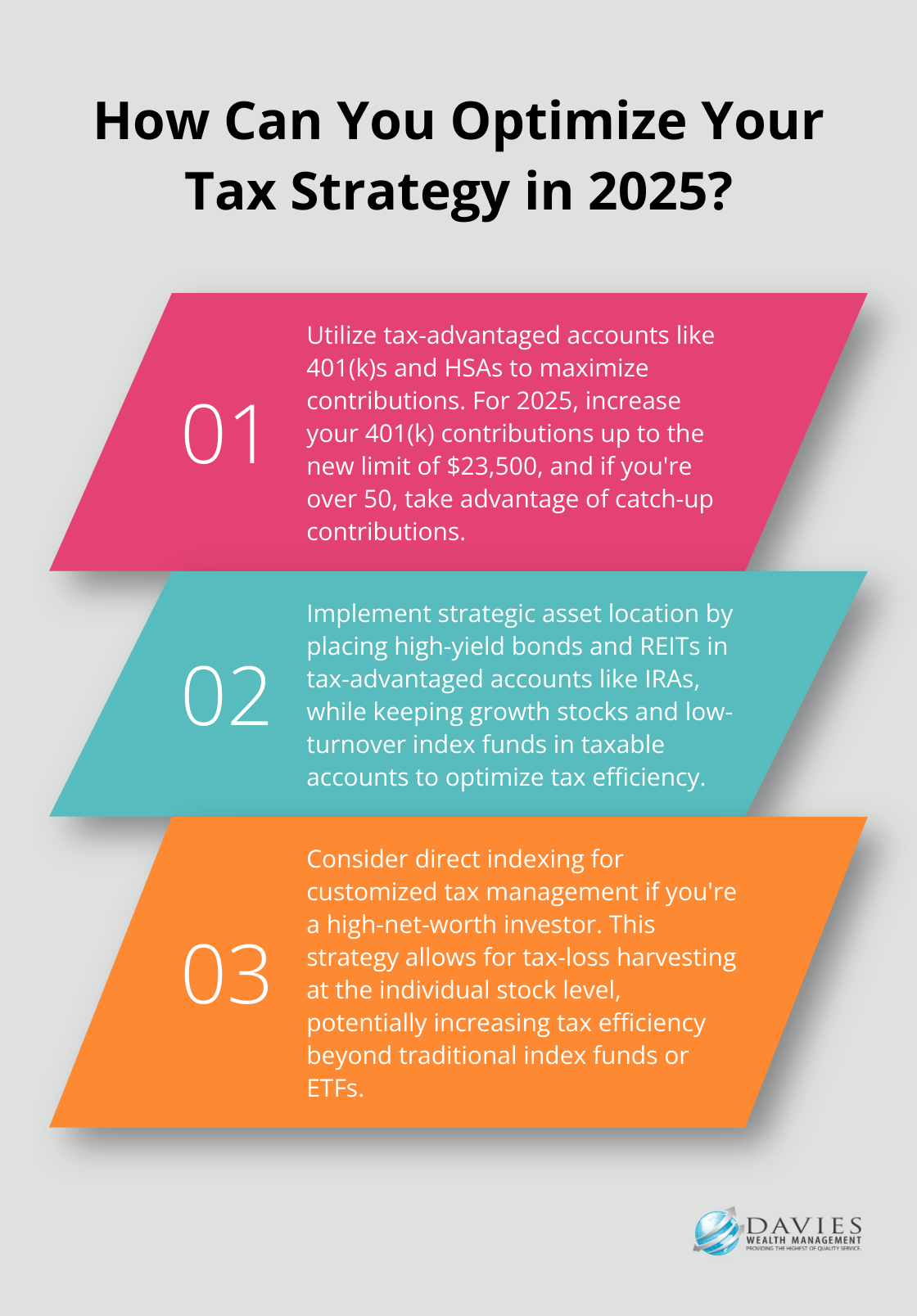

Tax-efficient investing focuses on maximizing after-tax returns. One of the most effective tools in this approach is the strategic use of tax-advantaged accounts. These include 401(k)s, Individual Retirement Accounts (IRAs), and Health Savings Accounts (HSAs).

For 2025, 401(k) contribution limits are increasing to $23,500, with an additional catch-up contribution for those over 50.

HSAs offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Strategic Asset Location

Asset location plays a critical role in tax-efficient investing. This strategy involves placing investments in the most tax-efficient accounts based on their tax characteristics. For example, high-yield bonds and REITs (which generate significant taxable income) often perform best in tax-advantaged accounts like IRAs. Growth stocks or index funds with low turnover typically suit taxable accounts due to their tax-efficient nature.

A study by Vanguard found that asset location strategy has frequently emphasized the different taxation of bond and equity income and the ability of equities to defer capital gains.

Harvesting Tax Losses

Tax-loss harvesting involves selling investments at a loss to offset capital gains. This technique proves particularly effective in volatile markets. For instance, 2020 was a boon for tax loss harvesting, and it’s a year-round strategy.

The IRS wash-sale rule prohibits claiming a loss on a security if you buy the same or a “substantially identical” security within 30 days before or after the sale. Therefore, careful planning and execution become essential.

Professional Guidance

While these strategies can significantly enhance after-tax returns, they require careful implementation and ongoing management. Professional guidance from experienced advisors can help ensure you maximize the benefits of tax-efficient investing while avoiding potential pitfalls.

As we move forward, let’s explore specific tax-efficient investment vehicles that can further optimize your portfolio and potentially boost your long-term returns.

Choosing Tax-Efficient Investment Vehicles

Index Funds and ETFs: Low-Turnover Champions

Index funds and Exchange-Traded Funds (ETFs) stand out as excellent choices for tax-efficient investing. ETFs can be more tax efficient compared to traditional mutual funds. Generally, holding an ETF in a taxable account will generate less tax liabilities.

The Vanguard Total Stock Market Index Fund (VTSAX) exemplifies this efficiency. While it’s known for its tax efficiency, it’s important to note that it has an expense ratio of 0.04% according to Vanguard’s website.

ETFs offer an additional tax advantage due to their unique creation/redemption process. This mechanism allows ETFs to avoid selling underlying securities when investors redeem shares, which further reduces taxable events.

Tax-Managed Mutual Funds: Active Management with Tax Focus

Investors who prefer active management but still prioritize tax efficiency should consider tax-managed mutual funds. These funds employ various strategies to minimize tax liabilities, such as loss harvesting, gain deferral, and dividend distribution management.

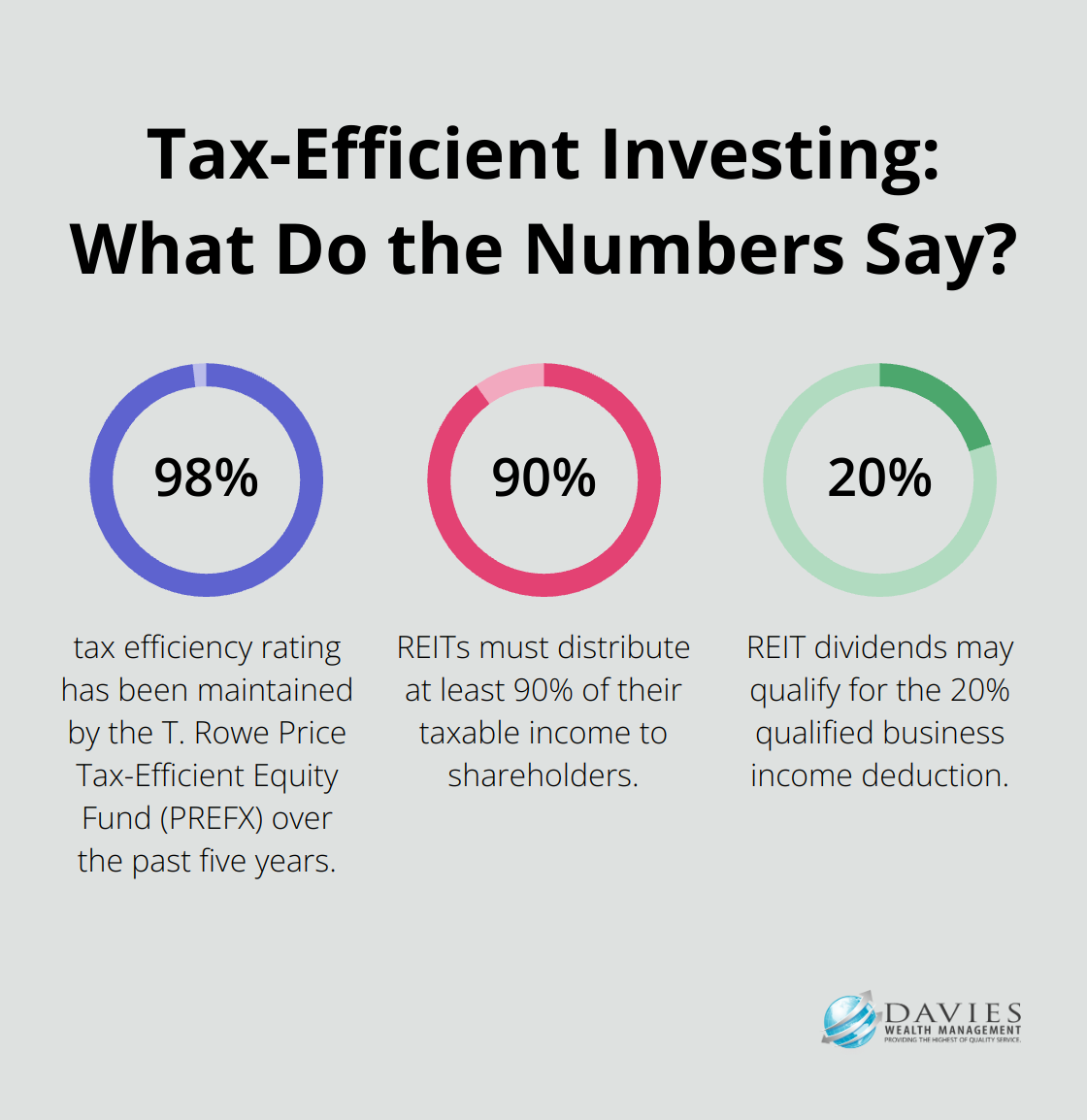

The T. Rowe Price Tax-Efficient Equity Fund (PREFX) serves as a prime example. It has maintained a remarkable 98% tax efficiency rating over the past five years, which significantly outperforms typical U.S. large-cap growth funds in this aspect.

Direct Indexing: Customized Tax Management

Direct indexing represents an advanced strategy that gains popularity among high-net-worth investors. This approach involves direct ownership of the individual stocks that make up an index, rather than investment in a fund that tracks the index.

The primary advantage of direct indexing lies in its ability to harvest tax losses at the individual stock level. Active tax management is the top direct indexing customization that advisors implement.

Direct indexing requires a significant initial investment and ongoing management, but it can serve as a powerful tool for tax-efficient investing, especially for high-income individuals or those with substantial capital gains from other investments.

REITs: Tax-Advantaged Income Potential

Real Estate Investment Trusts (REITs) offer unique tax advantages, which makes them an attractive option for income-focused investors. REITs must distribute at least 90% of their taxable income to shareholders, which results in high dividend yields.

While REIT dividends face taxation as ordinary income, they may qualify for the 20% qualified business income deduction (introduced by the Tax Cuts and Jobs Act of 2017). This can effectively lower the tax rate on REIT dividends for many investors.

Moreover, a portion of REIT distributions often classifies as return of capital, which does not incur immediate taxation but instead reduces your cost basis. This tax deferral can prove particularly beneficial in taxable accounts.

Final Thoughts

Tax-efficient investing forms a cornerstone strategy for maximizing investment returns over the long term. The strategies we discussed can help you keep more of your hard-earned money working in the market. Your unique financial situation, goals, and risk tolerance should guide your approach to tax-efficient investing.

At Davies Wealth Management, we create personalized, tax-efficient investment plans aligned with your specific needs and circumstances. Our team understands the complexities of tax laws and investment strategies, and we commit to helping you optimize your after-tax returns. We invite you to reach out to Davies Wealth Management to explore how we can assist you in implementing these strategies.

Tax-efficient investing requires a proactive approach and professional guidance. You can position yourself for potentially greater long-term wealth accumulation and financial success. Don’t let taxes unnecessarily erode your investment returns – take action today to optimize your portfolio for tax efficiency.

Leave a Reply