At Davies Wealth Management, we’ve observed that high net worth individuals often employ distinct investment strategies to grow and preserve their wealth. These strategies can offer valuable insights for investors at all levels.

In this post, we’ll explore the investment approaches favored by high net worth individuals and how you can apply them to your own financial planning. We’ll also examine the key investment vehicles they use and provide practical tips for implementing these strategies effectively.

What Do High Net Worth Investors Do Differently?

Broad Asset Allocation

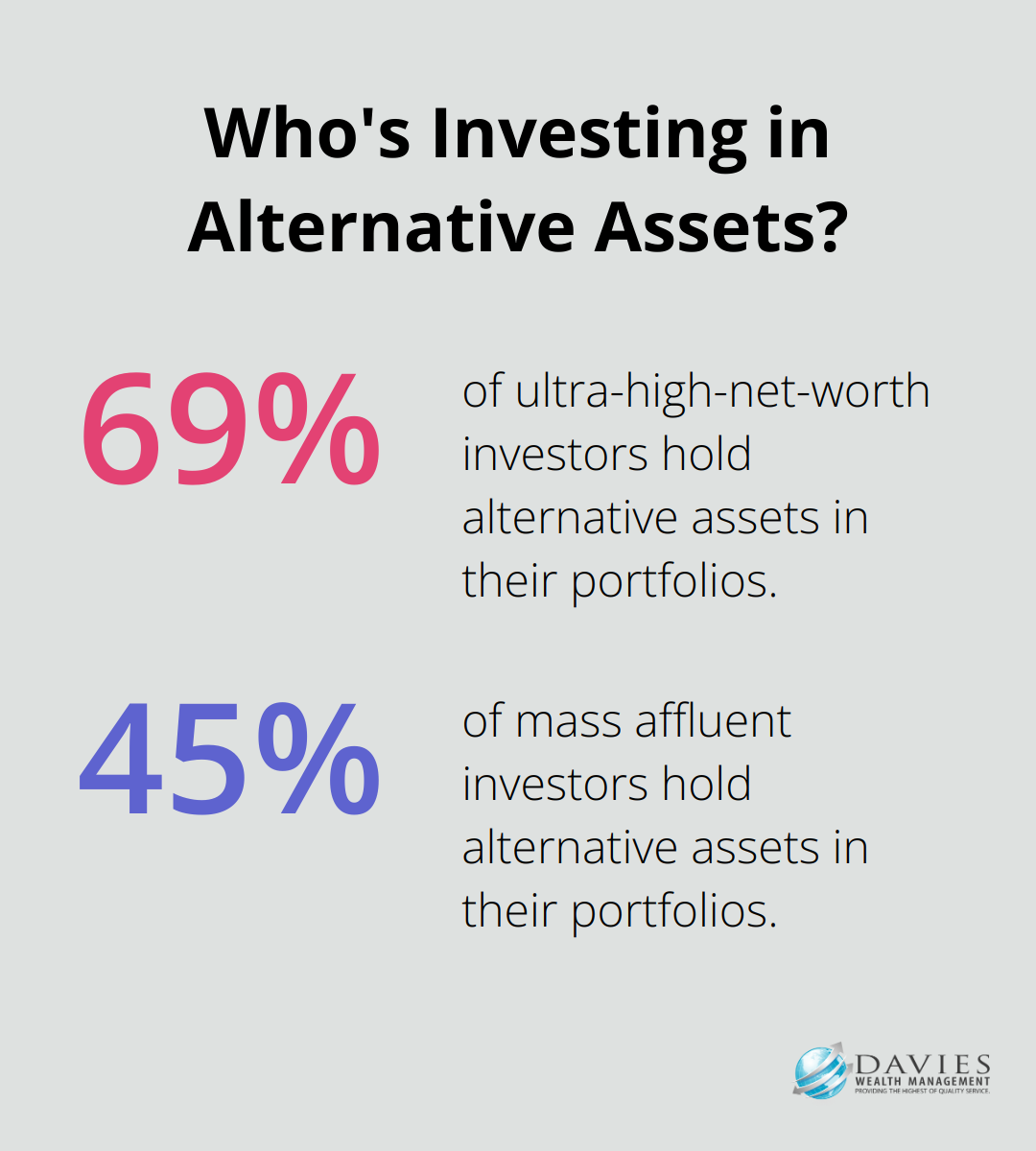

High net worth individuals (HNWIs) spread their investments across a wide range of asset classes. This strategy extends beyond the traditional mix of stocks and bonds. A 2023 survey by EY reveals that 69% of ultra-high-net-worth investors hold alternative assets in their portfolios, compared to only 45% of mass affluent investors. This broader diversification helps to reduce risk and capture opportunities across various market sectors.

Long-Term Vision

Wealthy investors often adopt a patient, long-term approach. They resist the urge to react to short-term market fluctuations. This strategy aligns with historical data showing that the S&P 500 has returned an average of 10% annually over the long term. By maintaining this perspective, HNWIs can weather market volatility and benefit from compounding returns.

Wealth Preservation Techniques

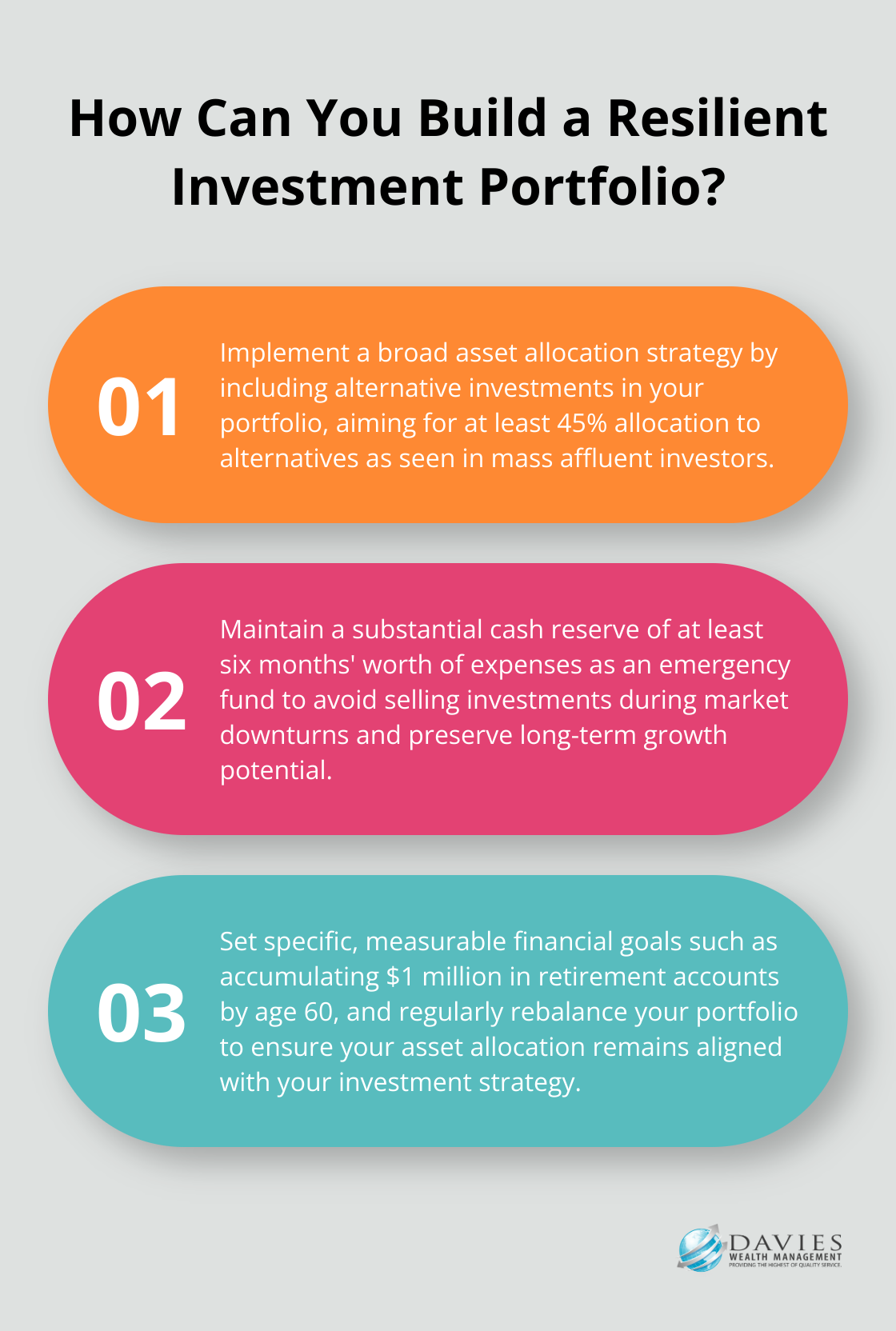

HNWIs place as much importance on preserving wealth as they do on growing it. They often employ strategies like maintaining substantial cash reserves. Financial advisors typically recommend keeping an emergency fund of at least six months’ worth of expenses. This buffer allows wealthy individuals to avoid selling investments during market downturns, thus preserving their long-term growth potential.

Alternative Investment Focus

Alternative investments play a significant role in HNWI portfolios. According to Preqin, the global alternatives industry is poised to exceed US$30 trillion in assets under management. These investments, which can include private equity, real estate, and hedge funds, offer potential for higher returns and portfolio diversification.

Professional Guidance

HNWIs often work with experienced financial advisors to implement their investment strategies. These professionals help craft personalized investment plans that incorporate high-net-worth strategies, tailored to individual financial goals and risk tolerances. For professional athletes (who face unique financial challenges), specialized wealth management firms offer customized solutions to address their specific needs.

The investment strategies of HNWIs offer valuable insights for investors at all levels. In the next section, we’ll explore the key investment vehicles that high net worth individuals use to grow and preserve their wealth.

Investment Vehicles Favored by the Wealthy

Private Equity and Venture Capital

High net worth individuals (HNWIs) often use private equity and venture capital investments to grow their wealth. These investments allow wealthy individuals to take ownership stakes in private companies, which can yield higher returns than public markets. A study focused on ultra-high net worth (UHNW) investors with a net wealth of at least $100 million, highlighting the significant role these investments play in wealth creation strategies.

Real Estate as a Wealth Builder

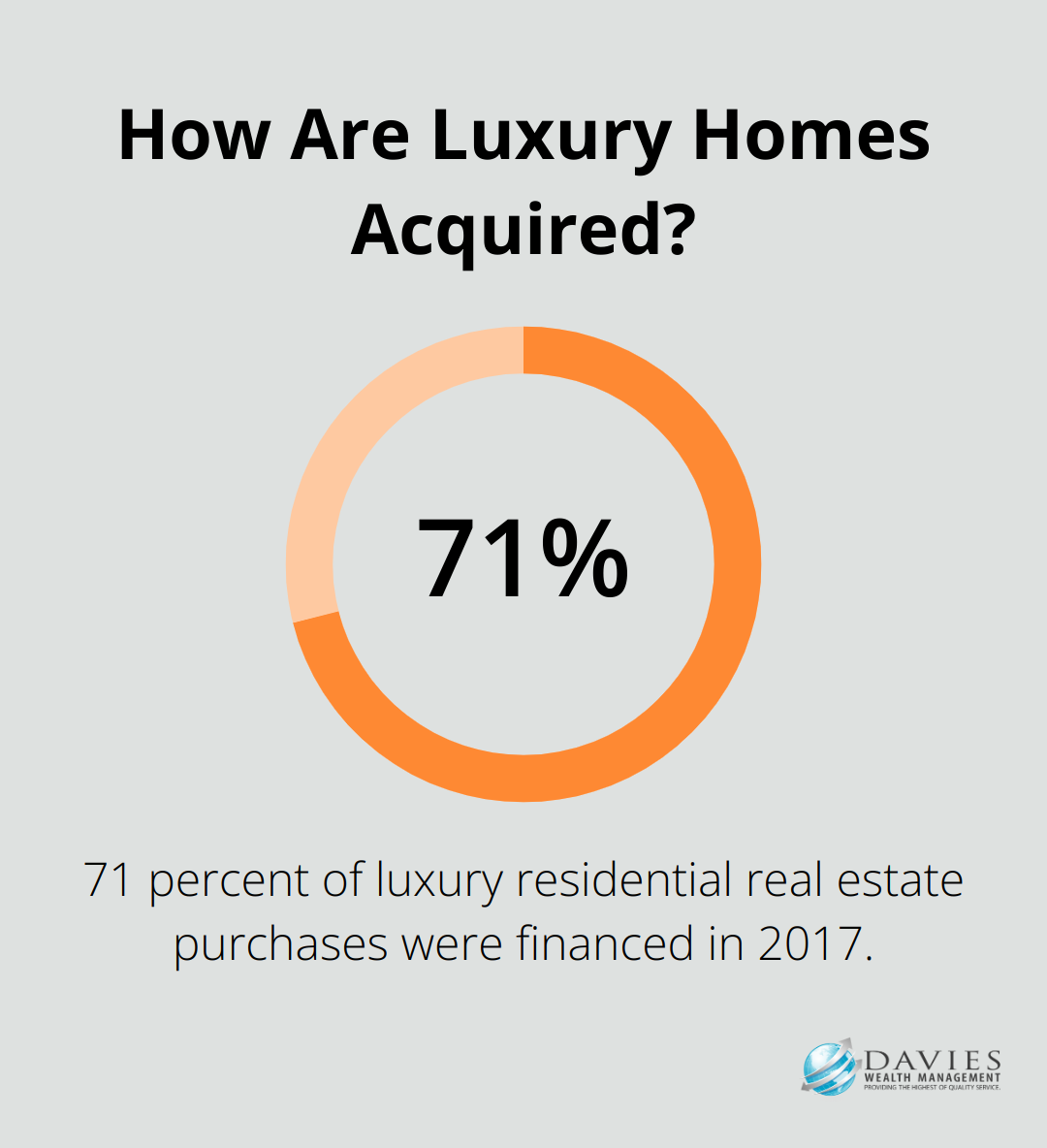

Real estate remains a cornerstone of many HNWI portfolios. This asset class offers potential for both income generation and capital appreciation. Recent data shows that in 2017, 71 percent of luxury residential real estate purchases were financed, indicating a shift in how wealthy individuals approach property investments.

Alternative Investments for Diversification

Alternative investments, including hedge funds, commodities, and private debt, play a significant role in HNWI portfolios. These assets can provide uncorrelated returns and protect against market volatility. Recent projections estimate that the alternative investment funds (AIFs) market will reach $25.8 trillion by 2032, growing at a CAGR of 7.9%. This growth underscores the increasing importance of alternatives in wealth management strategies.

HNWIs also explore unique alternative investments like art and collectibles. These non-traditional assets can offer potential for significant value appreciation over time.

Specialized Wealth Management for Athletes

At Davies Wealth Management, we recognize the value of these investment vehicles for our clients, including professional athletes who require specialized wealth management strategies. We work closely with our clients to determine the most appropriate mix of investments based on their individual goals, risk tolerance, and time horizon.

It’s important to note that while these investment vehicles offer significant potential, they often come with higher risks and require substantial capital. As such, it’s essential to work with experienced financial advisors who can provide guidance on incorporating these strategies into your overall wealth management plan.

The next chapter will explore how you can implement these high net worth investment strategies in your own financial planning, regardless of your current wealth level.

How to Implement High Net Worth Investment Strategies

Set Specific, Measurable Financial Goals

The first step to implement high net worth investment strategies is to define clear, quantifiable financial objectives. Instead of vague goals like “save for retirement,” set specific targets such as “accumulate $1 million in retirement accounts by age 60.” This precision allows for better tracking and adjustment of your investment strategy over time.

Seek Professional Guidance

While DIY investing has its merits, working with a financial advisor can significantly enhance your investment strategy. Good financial advice can be beneficial in the short run and exponentially more profitable for investors over longer periods of time. Professional advisors (like those at Davies Wealth Management) specialize in creating tailored investment plans that incorporate high-net-worth strategies, adapting them to suit individual financial situations and goals.

Regularly Rebalance Your Portfolio

High net worth individuals often maintain a disciplined approach to portfolio management. This includes regular rebalancing to ensure their asset allocation remains aligned with their investment strategy. Research using Canadian data for the period 1957-2018 provides evidence in support of portfolio rebalancing by professional portfolio managers.

Monitor Market Trends

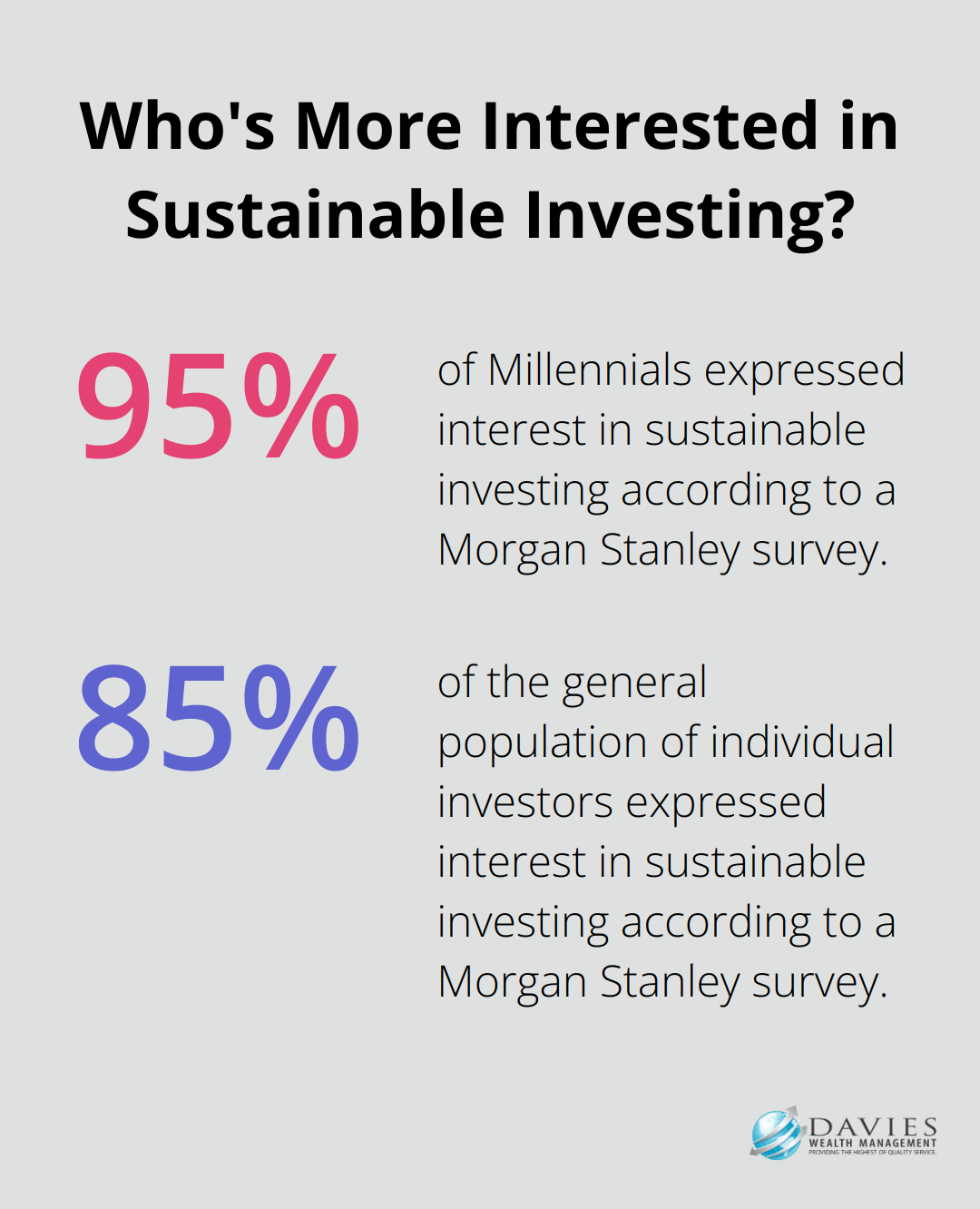

Successful investors stay informed about market trends and economic indicators. This doesn’t mean making knee-jerk reactions to every market movement, but rather understanding broader economic shifts that might impact your long-term strategy. For instance, the rise of ESG investing has led many high net worth individuals to incorporate sustainable investments into their portfolios. A Morgan Stanley survey found that 85% of the general population of individual investors and 95% of Millennials expressed interest in sustainable investing.

Use Technology for Investment Management

Technology has democratized many high net worth investment strategies. Robo-advisors and investment apps now offer access to sophisticated portfolio management techniques (once reserved for the wealthy). However, it’s important to understand that while these tools can be helpful, they may not provide the comprehensive, personalized approach that a dedicated wealth management firm can offer.

Implementing these strategies requires patience and discipline. The goal is to adopt a long-term perspective and avoid reactive decision-making based on short-term market fluctuations. You can work towards building and preserving wealth more effectively, regardless of your current financial status, by incorporating these high net worth investment strategies into your financial plan.

Final Thoughts

High net worth individuals’ investment strategies provide valuable insights for investors at all levels. These strategies encompass broad asset allocation, long-term vision, wealth preservation techniques, and alternative investment focus. The key to success lies in personalizing these approaches to fit your unique financial situation and goals (what works for one investor may not suit another).

Professional guidance often proves beneficial when implementing these complex wealth management strategies. At Davies Wealth Management, we create customized financial plans that incorporate high net worth investment strategies, adapting them to individual needs and goals. Our expertise extends to serving professional athletes, addressing their unique financial challenges with tailored solutions.

The most important aspect of these strategies is maintaining a long-term perspective in investing. High net worth individuals often achieve financial success through patience, discipline, and a focus on long-term growth rather than short-term gains. You can work towards building and preserving wealth more effectively by adopting this mindset and implementing these strategies. To learn more about how we can help you achieve your financial goals, visit us at Davies Wealth Management.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply