At Davies Wealth Management, we understand that high-net-worth individuals face unique tax challenges. Effective tax strategies for the wealthy are essential for preserving and growing wealth.

In this blog post, we’ll explore key tax planning techniques that can help minimize tax liabilities and maximize wealth preservation. From retirement account contributions to advanced trust structures, we’ll cover a range of strategies tailored for high-net-worth individuals.

Why Tax Planning Matters for High-Net-Worth Individuals

The Complex Tax Landscape for the Wealthy

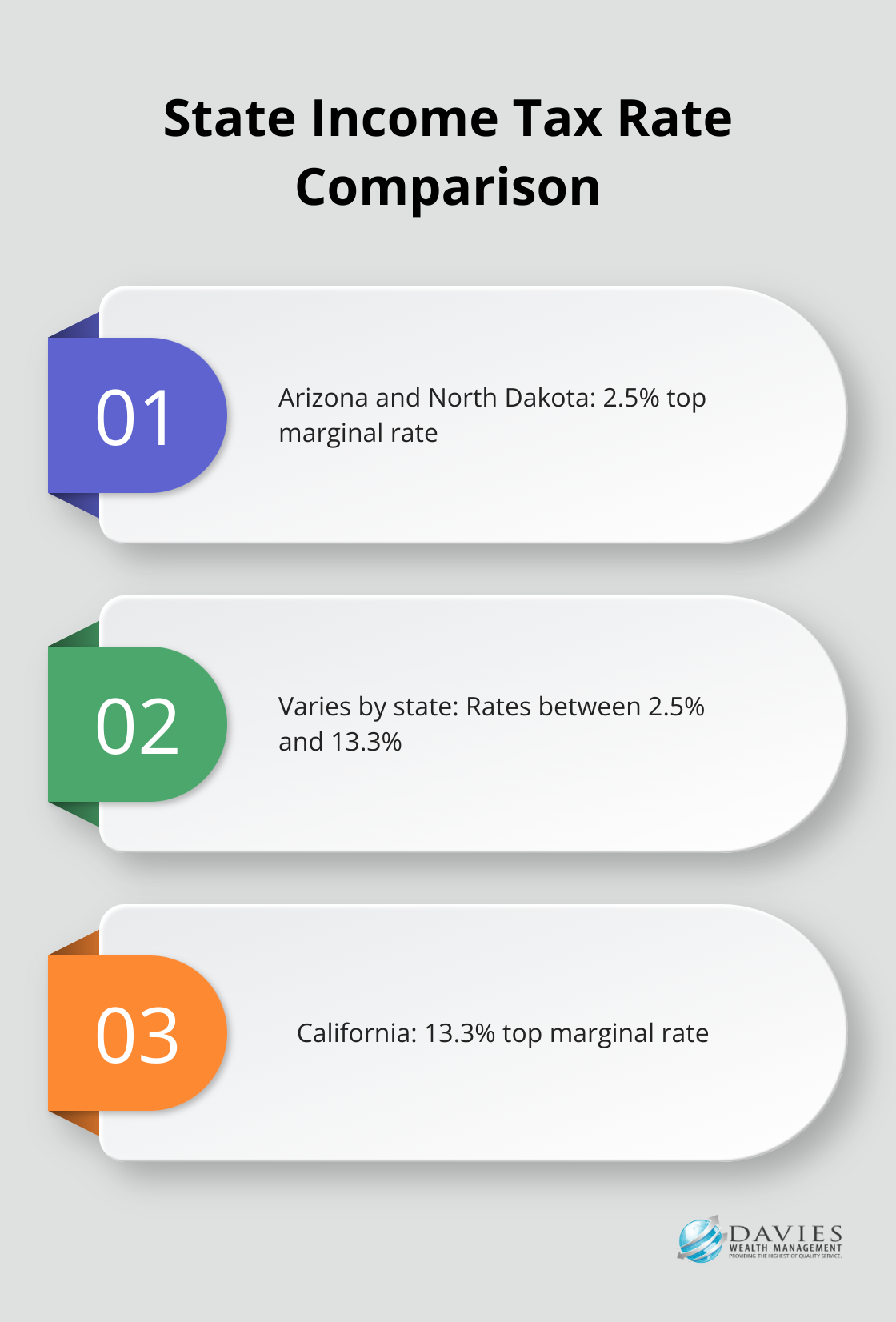

High-net-worth individuals face a unique set of tax challenges that require careful planning and strategic decision-making. Many wealthy clients underestimate the impact of taxes on their overall financial picture. High-income earners often find themselves in the highest tax brackets, potentially facing federal income tax rates of up to 37% as of 2025. Add state and local taxes, and the total tax burden can be substantial. For instance, top marginal rates span from 2.5 percent in Arizona and North Dakota to 13.3 percent in California.

Moreover, high-net-worth individuals typically have diverse income sources, including salaries, investment income, business profits, and rental income. Each of these income streams may be taxed differently, which adds layers of complexity to tax planning.

The Power of Proactive Tax Planning

Proactive tax planning isn’t about evading taxes; it focuses on legally minimizing tax liabilities and maximizing after-tax wealth. By leveraging tax-efficient investments, deductions, and credits, high-income individuals can significantly reduce their tax burden and protect their wealth.

One key aspect of proactive planning is timing. Strategic realization of capital gains or losses can help manage your tax bracket and potentially reduce your overall tax burden. Similarly, planning charitable contributions or business expenses can provide valuable deductions when timed correctly.

Debunking Tax Strategy Misconceptions

Myth 1: Tax Planning is Only Necessary During Tax Season

In reality, effective tax management is a year-round process. Waiting until the end of the year often limits your options and potential tax-saving opportunities.

Myth 2: Aggressive Tax Strategies are Always Best

While minimizing taxes is important, it’s essential to balance tax efficiency with overall financial goals and risk tolerance. Overly aggressive strategies can lead to scrutiny from tax authorities and potential penalties.

Myth 3: Tax Strategies Don’t Need Regular Review

Tax laws change frequently, and personal circumstances evolve. Regular reviews and adjustments are essential to ensure your tax strategy remains optimal.

Integrating Tax Planning with Wealth Management

Effective tax planning for high-net-worth individuals requires expertise and a thorough understanding of complex tax laws. Integrating tax planning with overall wealth management helps build and preserve wealth more effectively. This approach considers taxes in every financial decision, from investment choices to retirement planning.

As we move forward, we’ll explore specific tax strategies that can help high-net-worth individuals preserve and grow their wealth. These techniques range from maximizing retirement account contributions to implementing advanced trust structures, providing a comprehensive toolkit for effective tax management.

Powerful Tax Strategies for Wealth Preservation

Maximizing Retirement Contributions

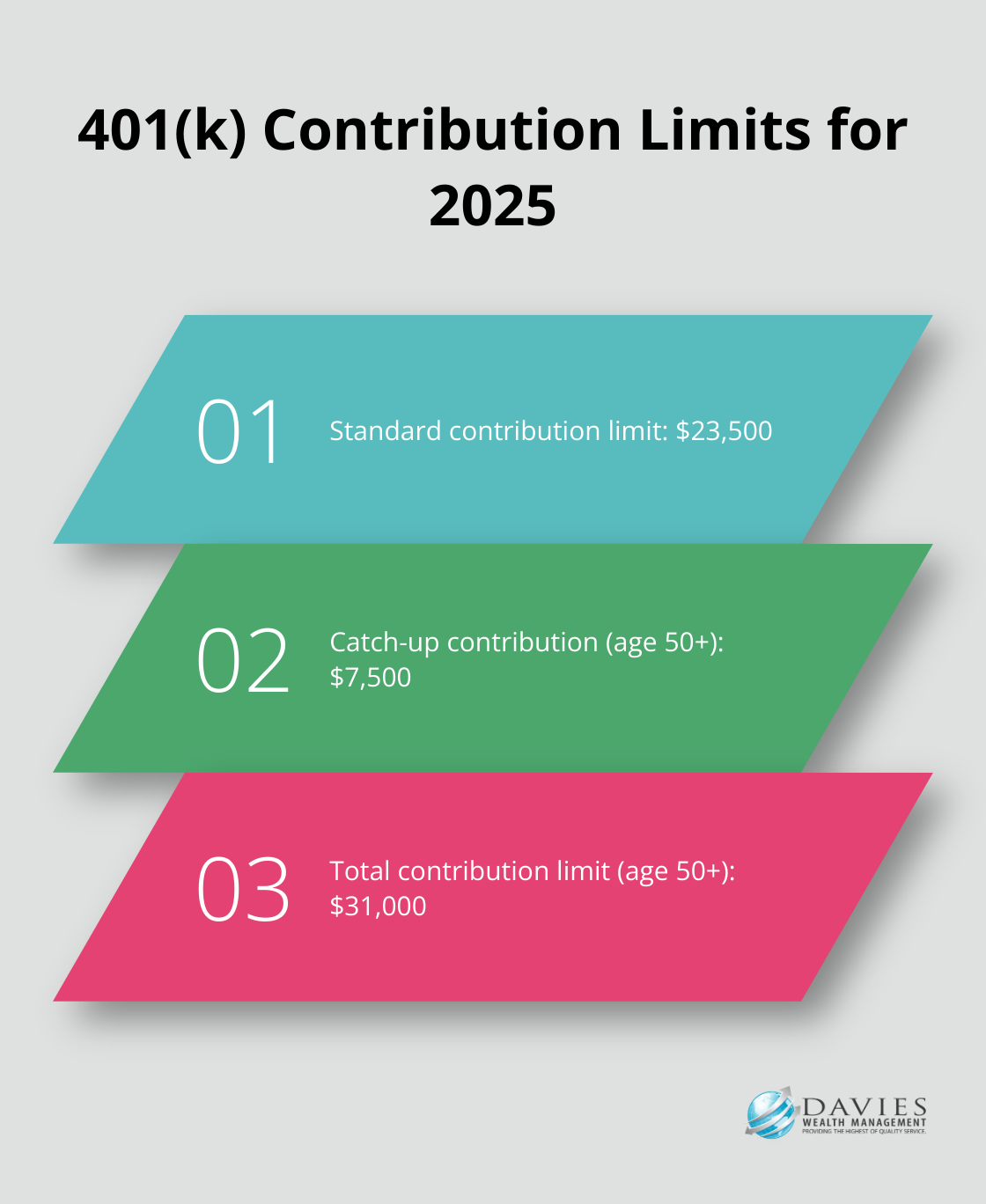

One of the most effective strategies for high-net-worth individuals is to maximize contributions to tax-advantaged retirement accounts. For 2025, the contribution limit for 401(k) plans stands at $23,500, with an additional $7,500 catch-up contribution for those 50 and older.

High-income earners should consider maxing out these accounts. They can also explore options like backdoor Roth IRA conversions if their income exceeds the limits for direct Roth contributions.

The Power of Tax-Loss Harvesting

Tax-loss harvesting proves to be a powerful tool for managing capital gains taxes. This strategy involves selling investments that have experienced losses to offset capital gains in other parts of your portfolio. Tax-loss harvesting is a widely used strategy in the field of personal wealth management, often lauded for its potential to improve an investor’s after-tax returns. While the potential benefits may vary, it can lead to significant wealth preservation over time.

Strategic Charitable Giving

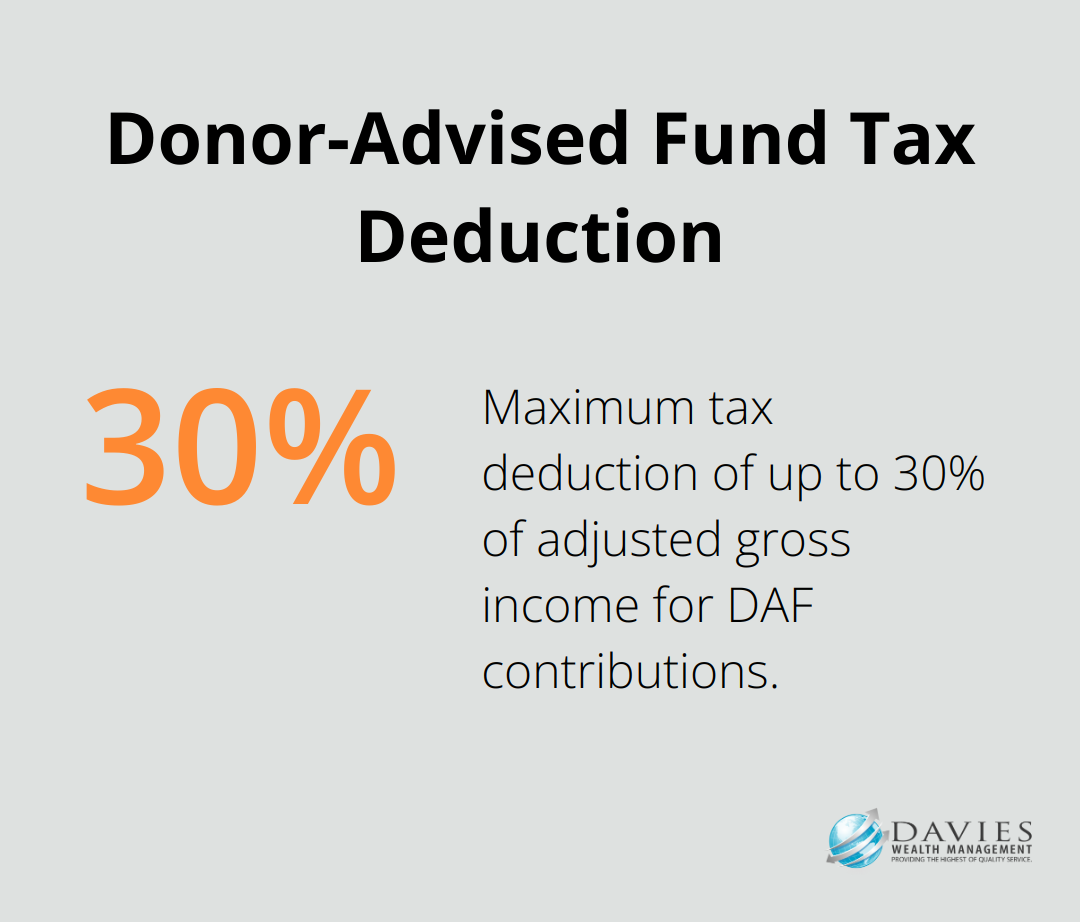

Charitable giving not only supports causes you care about but also provides substantial tax benefits. Donor-advised funds (DAFs) allow you to make a large charitable contribution in a single year, potentially pushing you over the standard deduction threshold. Donors receive an immediate tax deduction of up to 30% of adjusted gross income (AGI) for gifts of appreciated securities, mutual funds, real estate and other assets.

Another strategy involves donating appreciated securities directly to charities, which avoids capital gains taxes while still providing a deduction for the full market value.

Tax-Efficient Investment Vehicles

Selecting tax-efficient investment vehicles is essential for wealth preservation. Exchange-traded funds (ETFs) often have lower turnover and distribute fewer capital gains than actively managed mutual funds. For fixed income, municipal bonds provide tax-free interest at the federal level (and potentially at the state level as well). The Tax Policy Center notes that the top marginal tax-equivalent yield for high-income investors in the highest tax bracket can make municipal bonds significantly more attractive than taxable bonds of similar quality and maturity.

Advanced Estate Planning Techniques

Estate planning plays a critical role in wealth preservation, especially with the current estate tax exemption set to potentially decrease in 2026. Techniques such as grantor retained annuity trusts (GRATs) can pass assets you expect to appreciate in value to beneficiaries with minimal gift tax consequences. These strategies require careful planning and execution, so working with experienced professionals is vital.

As we move forward, we will explore even more sophisticated tax planning techniques that can further enhance wealth preservation for high-net-worth individuals. These advanced strategies build upon the foundation laid by the methods discussed in this section, providing a comprehensive approach to tax management and wealth protection.

Advanced Tax Strategies for High-Net-Worth Individuals

Leveraging Trusts for Tax Efficiency

Trusts offer powerful tools for high-net-worth individuals to reduce tax burdens while maintaining control over asset distribution. Grantor Retained Annuity Trusts (GRATs) are trusts created so that individuals and families can move wealth to heirs while using little, if any, of their lifetime federal gift and estate-tax exemption.

Intentionally Defective Grantor Trusts (IDGTs) present another effective strategy. These trusts allow grantors to pay income taxes on trust assets, enabling tax-free growth within the trust while reducing the grantor’s taxable estate.

Exploring Private Placement Life Insurance

Private Placement Life Insurance (PPLI) provides a tax-efficient investment wrapper for high-net-worth individuals. Earnings within the policy grow tax-deferred like an IRA, allowing for tax-free compounding of even the most tax-inefficient assets.

However, navigating the complex rules surrounding PPLI policies requires experienced professionals.

Capitalizing on Opportunity Zone Investments

Opportunity Zone investments offer significant tax benefits for individuals with substantial capital gains. In addition to the tax reduction for 2024, estimated tax payments for 2025 may be significantly reduced since most taxpayers can avoid the 7% surcharge on capital gains.

This strategy not only provides tax benefits but also supports economic development in designated low-income communities.

Implementing Family Limited Partnerships

Family Limited Partnerships (FLPs) serve as effective vehicles for transferring wealth while maintaining control and reducing estate taxes. In an FLP, parents typically act as general partners, retaining control over assets, while children or other family members become limited partners.

FLPs can provide significant valuation discounts for gift and estate tax purposes due to lack of marketability and minority interest considerations. These discounts can potentially result in substantial tax savings for high-net-worth families.

Utilizing Charitable Remainder Trusts

Charitable Remainder Trusts (CRTs) offer a win-win solution for philanthropically-minded high-net-worth individuals. These trusts provide income to the donor or designated beneficiaries for a specified term, with the remainder going to a chosen charity.

CRTs offer immediate income tax deductions based on the present value of the future charitable gift. They also allow for the sale of appreciated assets within the trust without triggering immediate capital gains taxes. This strategy can significantly reduce current tax liabilities while supporting charitable causes and providing ongoing income.

Final Thoughts

Effective tax strategies for the wealthy demand a comprehensive approach tailored to individual circumstances. High-net-worth individuals can utilize various techniques to preserve and grow their wealth, from maximizing retirement contributions to exploring advanced options like trusts and opportunity zone investments. The complexity of these strategies highlights the need for experienced professionals who can navigate the intricate tax landscape while aligning financial decisions with long-term goals.

Proactive and ongoing tax planning yields optimal results in the face of frequent tax law changes and evolving personal circumstances. Regular reviews and adjustments to tax strategies ensure the most beneficial opportunities are always leveraged. Effective tax planning focuses on making informed decisions that maximize after-tax wealth, not avoiding taxes altogether.

We at Davies Wealth Management specialize in creating personalized tax and wealth management plans for high-net-worth individuals (including professional athletes facing unique financial challenges). Our team’s expertise can help you build a robust strategy that supports your wealth preservation and growth objectives. For personalized guidance on implementing tax strategies for the wealthy, we invite you to explore our services at Davies Wealth Management.

Leave a Reply