Corporate tax planning strategies are essential for businesses looking to optimize their financial performance and minimize tax liabilities. At Davies Wealth Management, we understand the complexities of navigating the ever-changing tax landscape.

Effective tax planning can lead to significant savings, improved cash flow, and enhanced competitiveness in the marketplace. This blog post will explore key strategies and considerations for implementing a robust corporate tax planning approach.

What Is Corporate Tax Planning?

Corporate tax planning is a strategic approach to manage a company’s financial affairs to minimize tax liabilities while ensuring compliance with tax laws. At Davies Wealth Management, we consider tax planning an integral part of overall financial management, not just a year-end exercise.

The Importance of Proactive Tax Planning

Proactive tax planning is essential for businesses of all sizes. It allows companies to anticipate tax obligations, identify potential savings opportunities, and make informed financial decisions. Effectively managing taxable income and strategically using tax credits are vital components of a valuable tax planning strategy. Companies can benefit from these practices to optimize their financial performance.

Key Elements of Effective Tax Strategies

Effective tax strategies encompass several key elements:

- Thorough understanding of current tax laws and regulations

- Accurate financial forecasting

- Strategic timing of income recognition and expense deductions

A comprehensive knowledge of tax codes is critical as they frequently change. For example, the Tax Cuts and Jobs Act of 2017 introduced significant changes to corporate tax rates and deductions, affecting businesses across the United States. This new provision, also known as Section 199A, allows a deduction of up to 20% of qualified business income for owners of some businesses.

Successful tax planning requires precise financial forecasting. This involves the projection of future income, expenses, and potential tax liabilities. Tools like cash flow modeling and scenario analysis help businesses make more accurate predictions and plan accordingly.

The timing of income recognition and expense deductions can significantly impact a company’s tax liability. Strategic timing can help manage taxable income effectively (e.g., accelerating deductions into the current tax year or deferring income to the next).

Benefits of Strategic Tax Planning

Strategic tax planning offers benefits beyond mere tax savings. A well-executed tax plan can improve a company’s cash flow, allowing for reinvestment in growth initiatives or increased shareholder returns.

Moreover, effective tax planning can enhance a company’s competitive position. Optimizing tax efficiency potentially allows businesses to offer more competitive pricing or invest in research and development, gaining an edge in the market.

Industry-Specific Considerations

Different industries face unique tax challenges and opportunities. For instance, professional athletes often encounter complex tax situations due to high incomes and multi-state earnings. A tailored approach ensures that each client’s tax strategy aligns with their overall financial goals and industry-specific considerations.

As we move forward to explore essential corporate tax planning strategies, it’s important to note that these principles form the foundation for more advanced techniques. The next section will detail specific strategies that businesses can implement to maximize their tax efficiency and overall financial performance.

Implementing Effective Corporate Tax Strategies

At Davies Wealth Management, we’ve observed how effective corporate tax strategies can significantly impact a company’s bottom line. This chapter explores practical approaches businesses can adopt to optimize their tax positions and enhance overall financial performance.

Leverage Tax Credits and Deductions

One of the most direct ways to reduce tax liability is to maximize available tax credits and deductions. The Research and Development (R&D) tax credit can provide substantial benefits for companies investing in innovation. Companies can choose between two methods to calculate their credit: 10% of the increase in Delaware qualified R&D expenses over their base amount or 50% of certain expenses. This credit isn’t limited to large corporations or tech companies; many businesses across various industries can qualify if they improve products or processes.

Another often-overlooked opportunity is the Work Opportunity Tax Credit (WOTC). This federal tax credit incentivizes employers to hire individuals from certain target groups who have consistently faced significant barriers to employment. The WOTC can provide up to $9,600 per eligible employee, depending on the target group and the qualified wages paid to the employee.

Optimize Business Structure for Tax Efficiency

The choice of business entity can profoundly impact a company’s tax obligations. While C-corporations face a flat 21% federal tax rate, pass-through entities like S-corporations and LLCs offer potential tax advantages for many businesses. The Tax Cuts and Jobs Act introduced a 20% deduction on qualified business income for pass-through entities, which allows pass-through business owners to deduct up to 20% of qualified business income (QBI) in determining their individual income tax liability.

However, the optimal structure depends on various factors, including the nature of the business, growth plans, and exit strategies. A thorough analysis of these factors can help recommend the most tax-efficient structure for unique situations.

Use Transfer Pricing Strategically

For businesses with multiple entities or international operations, transfer pricing can serve as a powerful tool for tax optimization. Companies can allocate profits to jurisdictions with more favorable tax rates by carefully structuring transactions between related entities. However, it’s essential to ensure that these arrangements comply with both domestic and international regulations.

The OECD’s Base Erosion and Profit Shifting (BEPS) project has led to increased scrutiny of transfer pricing practices. The OECD Transfer Pricing Guidelines provide guidance on the application of the “arm’s length principle”, which is the international consensus on the valuation of cross-border transactions between associated enterprises. Companies must maintain robust documentation to support their transfer pricing policies. This includes conducting regular economic analyses to demonstrate that intercompany transactions are priced at arm’s length.

Explore Tax-Advantaged Investment Opportunities

Businesses can also reduce their tax burden by strategically investing in tax-advantaged opportunities. For example, investing in Qualified Opportunity Zones can provide significant tax benefits, including deferral and potential elimination of capital gains taxes. As of 2021, there were over 8,700 designated Opportunity Zones across the United States, offering a wide range of investment possibilities.

Another option is to invest in renewable energy projects, which can qualify for the Investment Tax Credit (ITC). The ITC can offset up to 30% of the cost of qualifying solar, wind, and other renewable energy systems. This not only reduces tax liability but also aligns with growing environmental, social, and governance (ESG) considerations.

The implementation of these strategies requires careful planning and expertise. Professional guidance can help navigate the complex tax landscape while maximizing financial potential. As we move forward, it’s important to consider the challenges and considerations that come with corporate tax planning, which we’ll explore in the next chapter.

Navigating Corporate Tax Planning Hurdles

Keeping Pace with Regulatory Changes

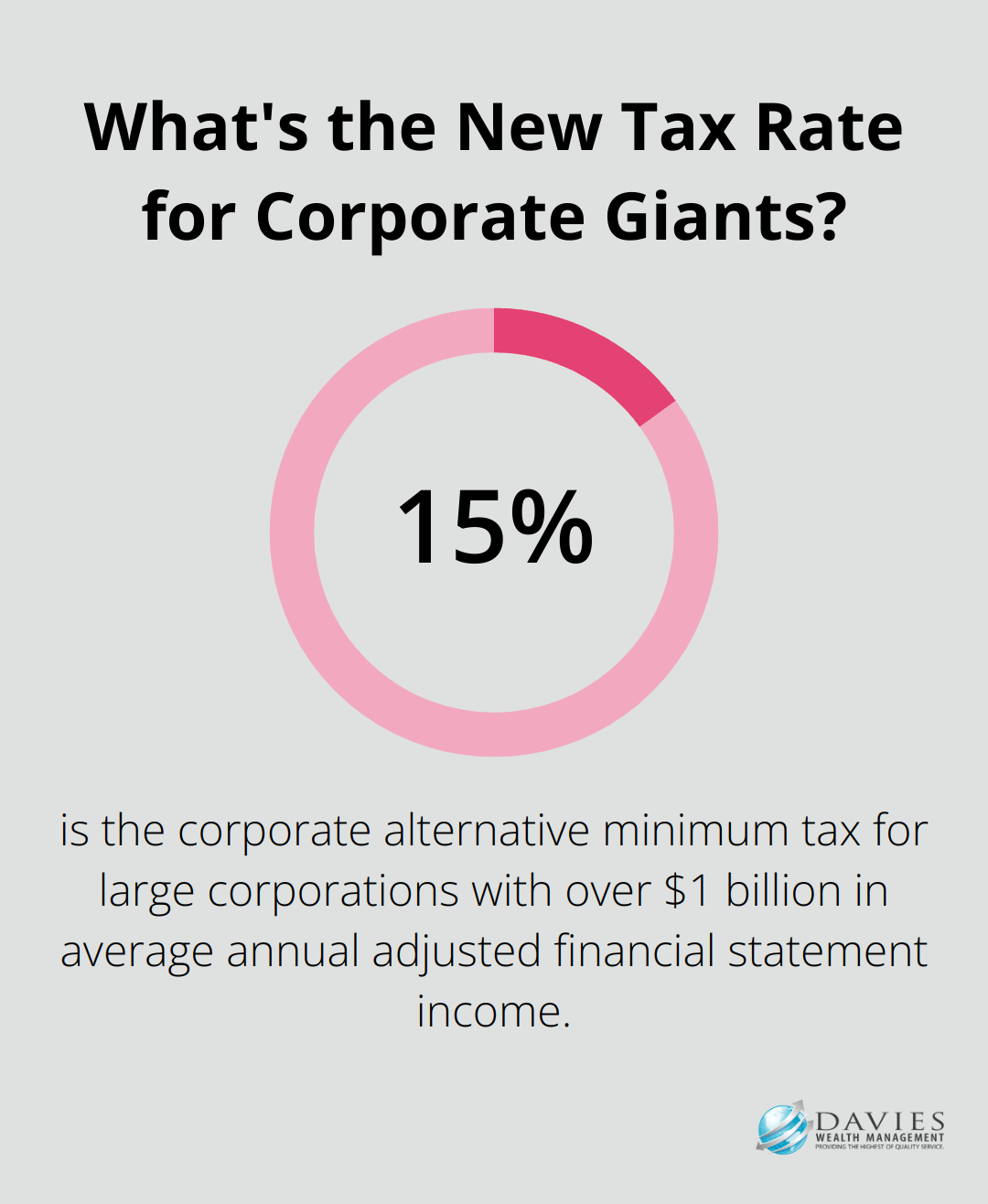

The tax landscape changes constantly, with new laws and regulations emerging frequently. The Tax Cuts and Jobs Act of 2017 brought sweeping changes to the U.S. tax code, affecting corporate tax rates and deductions for meals and entertainment expenses. The Inflation Reduction Act of 2022 introduced new provisions, including a 15% corporate alternative minimum tax for large corporations (with over $1 billion in average annual adjusted financial statement income).

Companies must invest in ongoing education and training for their finance and tax teams to stay ahead of these changes. Tax update services, industry conferences, and relationships with tax professionals can help companies anticipate and prepare for upcoming changes. The American Institute of CPAs (AICPA) offers regular updates and webinars on tax law changes that serve as invaluable resources for staying informed.

Aligning Tax Strategy with Business Goals

Tax efficiency should not come at the expense of broader business objectives. A tax strategy that looks good on paper but hinders growth or operational efficiency is ultimately counterproductive. For example, a company might defer income to reduce current-year taxes, but this could impact cash flow needed for expansion or investment in new technologies.

Companies should integrate tax planning into their overall business strategy. This integration might involve regular meetings between tax professionals and business unit leaders to discuss how tax considerations align with growth plans, capital expenditures, and market expansion strategies. These discussions allow companies to make informed decisions that optimize both tax positions and business performance.

Mitigating Audit Risks

The possibility of a tax audit concerns many businesses, and with good reason. The IRS plans to increase audit rates, particularly for high-income individuals and large corporations. In fiscal year 2022, the IRS conducted over 3.8 million audits, with a particular focus on returns claiming the Earned Income Tax Credit.

To reduce audit risks, businesses should maintain meticulous documentation for all tax positions and transactions. This documentation includes detailed records of expenses, transfer pricing documentation, and accurate and timely tax filings. A robust internal control system can help catch errors before they become issues during an audit.

Companies should consider conducting regular internal audits or “mock audits” to identify potential red flags before the IRS does. This proactive approach can address issues early and demonstrate a commitment to compliance if an actual audit occurs.

Ethical Considerations in Tax Planning

While minimizing tax liabilities is a legitimate goal, businesses must balance this with ethical considerations. Aggressive tax avoidance strategies can damage a company’s reputation and lead to legal consequences. Companies should strive for transparency in their tax practices and consider the broader societal impact of their tax strategies.

The concept of “tax morality” has gained traction in recent years, with stakeholders (including customers and investors) expecting companies to pay their “fair share” of taxes. Businesses should consider adopting a responsible tax policy that aligns with their corporate values and social responsibility goals.

Final Thoughts

Corporate tax planning strategies require a deep understanding of complex and ever-changing tax laws. Businesses must stay informed about regulatory changes, align their tax strategies with overall business objectives, and consider ethical implications in their tax planning efforts. Professional guidance often proves necessary for developing and executing a comprehensive tax strategy that maximizes efficiency while ensuring compliance.

Effective tax planning offers long-term benefits that extend beyond immediate tax savings. It can significantly improve cash flow, allowing for reinvestment in growth initiatives or increased shareholder returns. A well-executed tax strategy can also enhance a company’s competitive position, potentially enabling more competitive pricing or increased investment in research and development.

At Davies Wealth Management, we provide tailored financial solutions, including corporate tax planning strategies. Our team of experts can help navigate the complexities of tax laws, ensuring that your business remains compliant while optimizing tax efficiency. We invite you to explore our services for personalized advice on corporate tax planning and comprehensive wealth management solutions.

Leave a Reply