Stuart’s unique economic landscape presents both opportunities and challenges for local investors. Market fluctuations and regional factors can significantly impact your financial future.

We at Davies Wealth Management believe investment diversification forms the foundation of any resilient portfolio. Smart asset allocation and risk management strategies help protect your wealth against unexpected market downturns.

Why Stuart’s Market Demands Different Investment Strategies

Stuart’s economy relies heavily on tourism, marine industries, and real estate development, which creates distinct investment patterns that differ from national trends. The Treasure Coast region experiences seasonal income fluctuations tied to winter visitor patterns, while hurricane risks and coastal development restrictions add unique variables to local market performance. Florida’s lack of state income tax provides significant advantages for high-income earners, but property insurance costs have surged nearly 60% between 2019 and 2023.

Regional Economic Drivers Shape Investment Outcomes

Martin County’s median household income of $96,829 exceeds the national average, yet property values have surged 28% over the past three years due to migration from higher-cost states. Local employment concentrates in healthcare, hospitality, and marine services-sectors that show different volatility patterns than technology or manufacturing hubs. Smart investors recognize these regional patterns and adjust their portfolios accordingly, which means they avoid overexposure to tourism-dependent stocks while they capitalize on infrastructure and healthcare growth opportunities.

Market Volatility Requires Active Management

Historical data shows the S&P 500 experiences double-digit pullbacks in more than half of calendar years despite the fact that it finishes positive 79% of the time, which makes regular portfolio monitoring essential rather than optional. We recommend quarterly rebalancing sessions, particularly after hurricane seasons when insurance and real estate sectors may need adjustment. Geographic diversification beyond Florida reduces concentration risk, with international equity allocations of 15-25% that provide protection against regional economic downturns while they maintain growth potential through global market exposure.

Tax Advantages Create Strategic Opportunities

Florida’s zero state income tax policy transforms how investors approach asset allocation and withdrawal strategies compared to residents of high-tax states. This advantage becomes particularly valuable for retirees who can maximize their after-tax income through strategic portfolio positioning. However, investors must balance these tax benefits against higher property insurance costs and potential hurricane-related losses that can impact real estate investments and local economic stability in ways that affect broader portfolio performance.

How Should Florida Investors Structure Their Portfolios

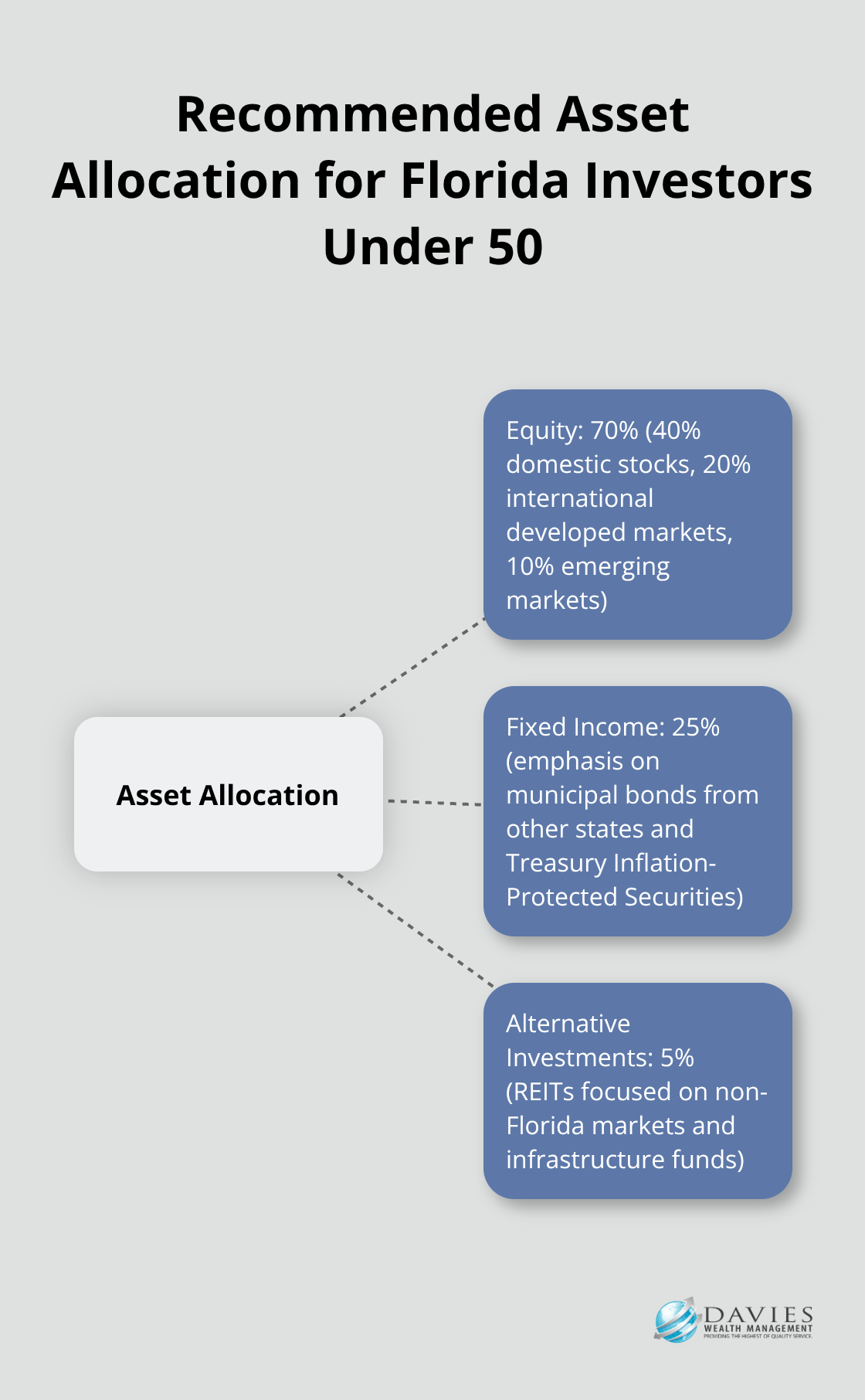

Florida investors need specific asset allocation approaches that account for zero state income tax benefits and regional economic patterns. We recommend a 70% equity allocation for investors under 50, with 40% in domestic stocks, 20% in international developed markets, and 10% in emerging markets to capture global growth while reducing Florida-specific concentration risk. Fixed income should comprise 25% of portfolios, with emphasis on municipal bonds from other states and Treasury Inflation-Protected Securities to hedge against rising insurance costs. The remaining 5% belongs in alternative investments like REITs focused on non-Florida markets and infrastructure funds that benefit from climate adaptation spending.

Tax-Efficient Portfolio Construction for Zero-Tax States

Florida residents can maximize their tax advantage through strategic asset location rather than traditional tax-loss harvesting strategies that benefit high-tax state residents. Place high-yield dividend stocks and taxable bond funds in regular brokerage accounts since you avoid state income tax, while growth stocks with minimal dividends work better in tax-deferred accounts. This approach reverses conventional wisdom and can enhance after-tax returns through tax-efficient portfolios. Rebalance portfolios in January when tourist season peaks affect local real estate and hospitality stocks, then again after hurricane season ends in November when insurance sector adjustments become necessary.

Income Strategy Beyond Traditional Dividends

Stuart investors should target 4-6% portfolio yield through diversified income sources rather than chase high-dividend Florida utilities or regional banks that create geographic concentration. Combine dividend growth stocks that yield 2-3% with covered call strategies on large-cap positions to generate additional 2-4% annual income while you maintain upside potential. International dividend stocks from countries with favorable tax treaties provide currency diversification and higher yields than domestic alternatives. European utilities and Canadian energy companies offer strong yields with better growth prospects than Florida-focused investments (particularly when compared to hurricane-exposed regional utilities).

Alternative Asset Integration

Alternative investments deserve special attention in Florida portfolios due to their inflation protection and geographic diversification benefits. Infrastructure funds that focus on climate adaptation projects provide both income and growth potential while they hedge against rising sea levels and extreme weather events. Real estate investment trusts from other regions reduce concentration risk while they maintain exposure to property appreciation trends. Commodity-focused investments help offset inflation pressures that particularly affect coastal insurance markets and construction costs throughout the state.

These strategic allocation principles set the foundation for effective risk management, which requires additional protection layers beyond basic diversification.

What Protection Strategies Work Best for Stuart Investors

Stuart residents need larger emergency funds than national averages due to hurricane risks and seasonal income fluctuations that affect tourism-dependent businesses. We recommend 8-12 months of expenses in cash reserves rather than the traditional 3-6 months, with funds split between high-yield savings accounts and short-term Treasury bills that maintain liquidity while they earn 4-5% returns. Florida’s zero state income tax advantage disappears quickly when emergency withdrawals trigger early retirement account penalties or force asset sales during market downturns. Property insurance costs average $6,000-$8,000 annually for coastal homes and demand additional cash buffers (particularly since hurricane deductibles often reach 2-5% of home values).

Emergency Fund Requirements for Coastal Living

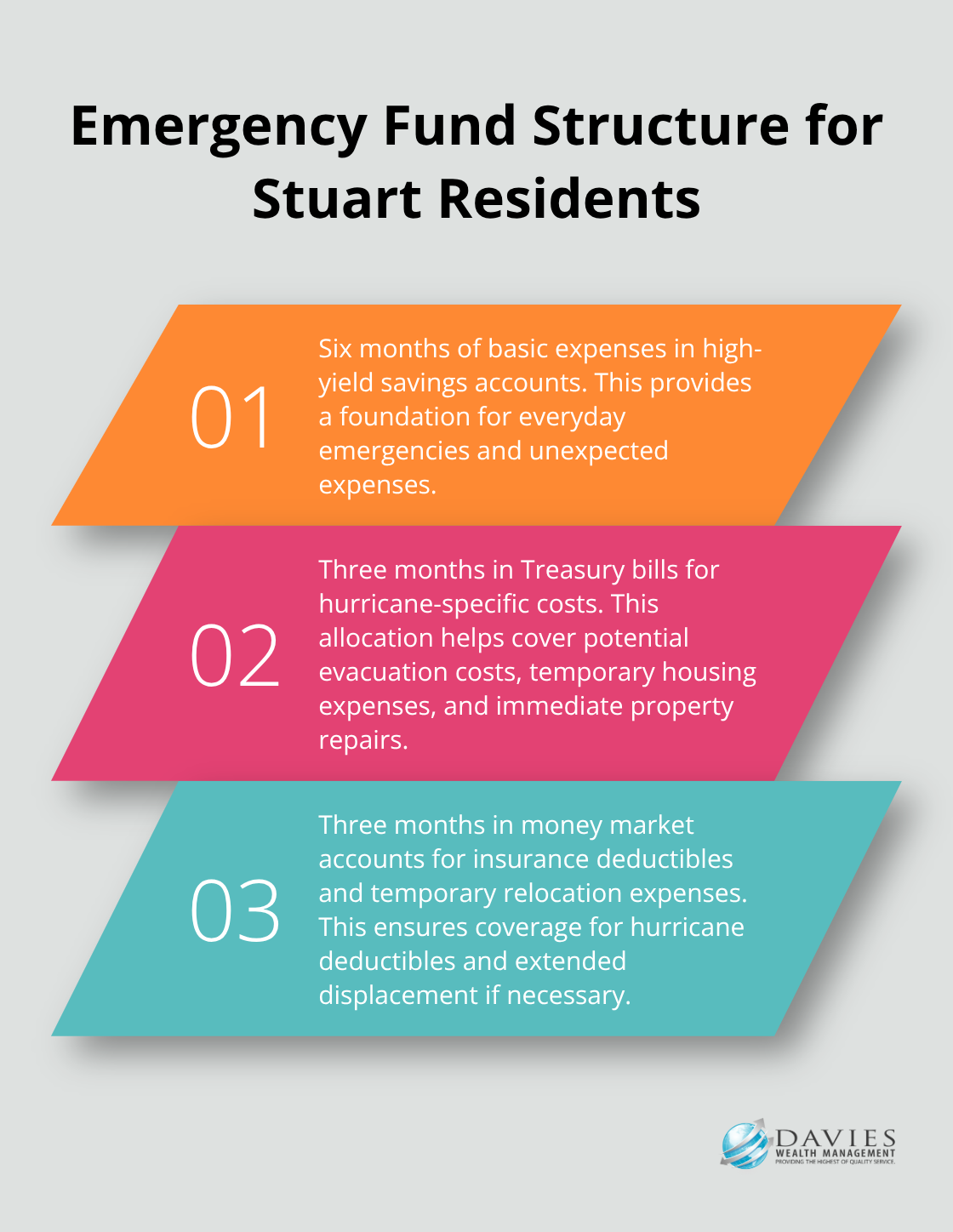

Hurricane season creates unique cash flow challenges that standard emergency fund advice fails to address. Stuart homeowners face potential evacuation costs, temporary housing expenses, and property repairs that insurance may not cover immediately. We recommend three separate cash reserves: six months of basic expenses in high-yield savings, three months in Treasury bills for hurricane-specific costs, and an additional three months in money market accounts for insurance deductibles and temporary relocation expenses. This 12-month total provides adequate protection when tourist-dependent income drops during storm seasons or economic downturns affect local employment.

Insurance Coverage Beyond Standard Policies

Standard homeowner policies exclude flood damage, yet Stuart’s location between the St. Lucie River and Atlantic Ocean creates significant flood risks that require separate National Flood Insurance Program coverage. Umbrella liability policies become essential when net worth exceeds $500,000 and provide $1-2 million additional coverage for approximately $300-500 annually. Life insurance needs increase for Stuart residents due to higher property values and potential hurricane-related income disruptions that affect surviving spouses. Estate planning requires Florida-specific strategies since the state eliminated inheritance taxes and allows larger wealth transfers to beneficiaries through proper trust structures.

Portfolio Monitoring During Hurricane Season

Quarterly rebalancing sessions should align with hurricane seasons and tourist patterns that affect local investment performance. Review portfolios in March before hurricane season begins, June during peak tourist season, September after hurricane season peaks, and December when seasonal residents return. Insurance sector positions require monthly monitoring during June through November when hurricane activity peaks and stock prices fluctuate based on storm forecasts and damage reports. Real estate investment trusts with Florida exposure need immediate review after named storms approach the Treasure Coast, while utility stocks require assessment when power outages exceed 48 hours.

Estate Planning in a Zero-Tax State

Florida’s elimination of inheritance taxes creates opportunities for wealth transfer strategies that high-tax states cannot match. Revocable living trusts help bypass probate costs that average 3-8% of estate values while they maintain control during your lifetime. Beneficiary designations on retirement accounts and life insurance policies transfer assets directly without court involvement or public records. Annual gift tax exclusions of $19,000 per recipient allow systematic wealth transfers that reduce estate size while they provide immediate benefits to heirs or charitable organizations.

Final Thoughts

Stuart investors need specific portfolio strategies that address Florida’s coastal risks and seasonal economic patterns. Investment diversification across multiple regions and asset classes forms the foundation for wealth protection against both market volatility and hurricane-related disruptions. Emergency reserves of 8-12 months provide essential protection when tourist-dependent income drops or natural disasters affect local employment.

Florida’s zero state income tax advantage creates significant opportunities for strategic asset allocation over decades. Quarterly portfolio reviews align with hurricane seasons and tourist patterns to optimize performance during regional economic shifts. Proper insurance coverage and geographic diversification protect against concentration risks that affect many coastal investors.

Stuart residents who implement comprehensive risk management strategies position themselves for sustained financial success regardless of market conditions. We at Davies Wealth Management help local investors navigate these complex decisions through personalized investment strategies that address your specific goals and risk tolerance. Start your resilient portfolio today with a comprehensive financial review that establishes proper emergency reserves and implements diversification strategies.

Leave a Reply