At Davies Wealth Management, we understand the challenges families face when managing generational wealth across different age groups. The gap in financial values, risk tolerance, and investment preferences can create significant hurdles in preserving and growing family assets.

Our team has developed effective strategies to bridge this divide and ensure smooth intergenerational wealth transfer. In this post, we’ll explore practical approaches to align family members’ financial goals and leverage technology for collaborative wealth management.

Why Generations Clash Over Wealth Management

The Millennial Money Mindset

Millennials (born between 1981 and 1996) prioritize experiences over material possessions. They show a strong interest in sustainable investing. Younger investors place a higher value on sustainability than previous generations, making sustainable investing a vital strategy for investors. This approach contrasts sharply with older generations’ focus on traditional investment vehicles.

Baby Boomers and Financial Security

Baby Boomers (born between 1946 and 1964) adopt a more conservative approach to wealth management. Their experiences through multiple economic cycles lead them to prioritize financial security. Baby Boomers’ retirement income at age 67 is likely to change compared with current retirees, according to a Social Security Administration study.

Gen X: The Sandwich Generation

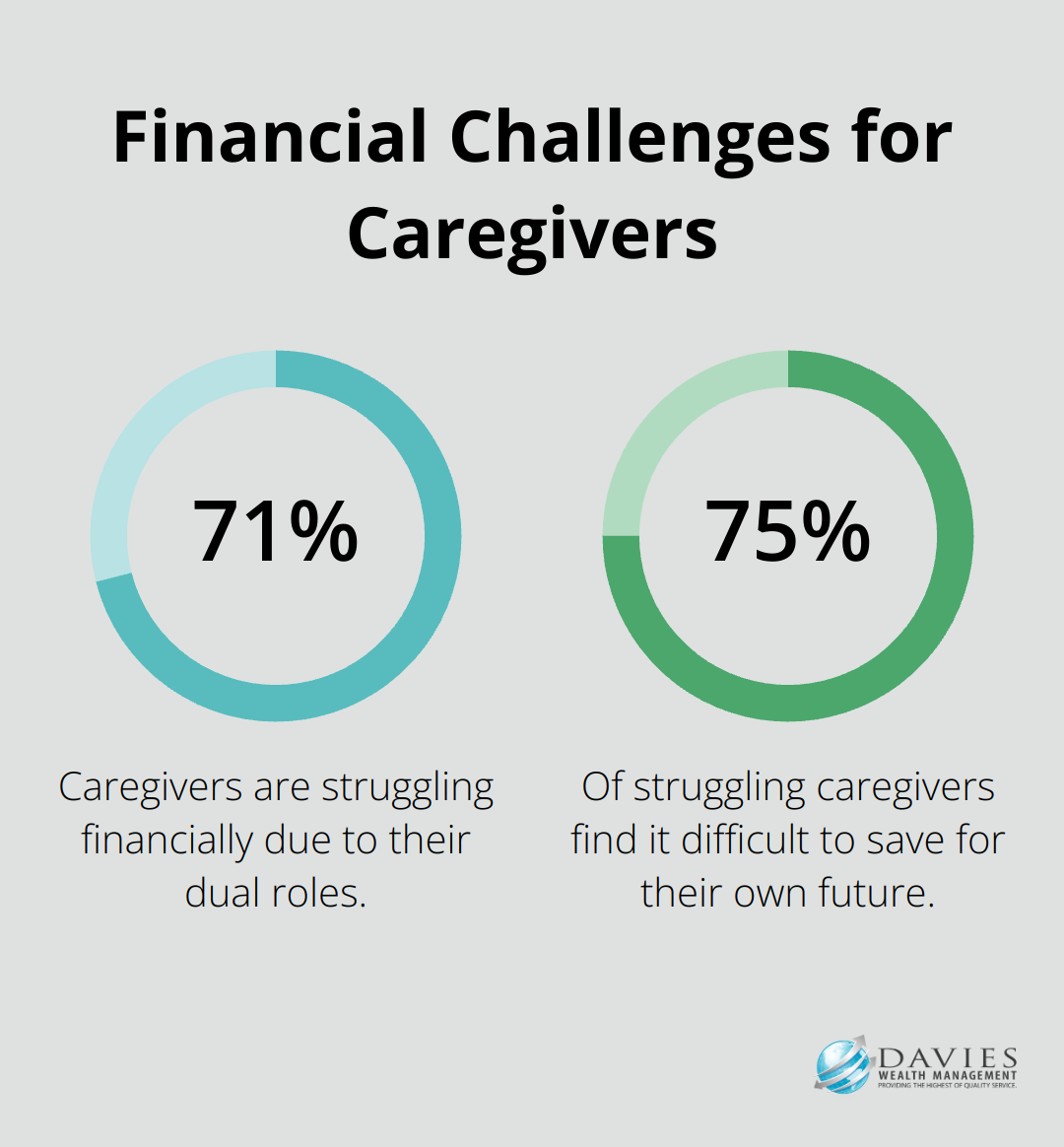

Generation X (born between 1965 and 1980) often finds itself in a unique position, caring for aging parents while supporting their children. This situation creates distinct financial priorities. A recent study highlights that 71 percent of caregivers are struggling financially as a result of their dual roles. Of these, 75 percent find it difficult to save for their own future.

Communication Challenges Across Generations

These generational differences create significant challenges in family wealth management. Communication breakdowns occur frequently, with each generation struggling to understand the others’ perspectives. Decision-making processes can become contentious, potentially leading to family conflicts and suboptimal financial outcomes.

Bridging the Generational Gap

Financial advisors (like those at Davies Wealth Management) develop strategies to bridge these gaps. They focus on creating open dialogues between generations, helping each group understand the others’ viewpoints. By facilitating these conversations, advisors can help families develop a unified approach to wealth management that respects each generation’s values while working towards common goals.

The next chapter will explore specific strategies for effective intergenerational wealth transfer, including the development of comprehensive family wealth plans and the implementation of family governance structures.

Crafting a Family Wealth Blueprint

Building a Unified Wealth Strategy

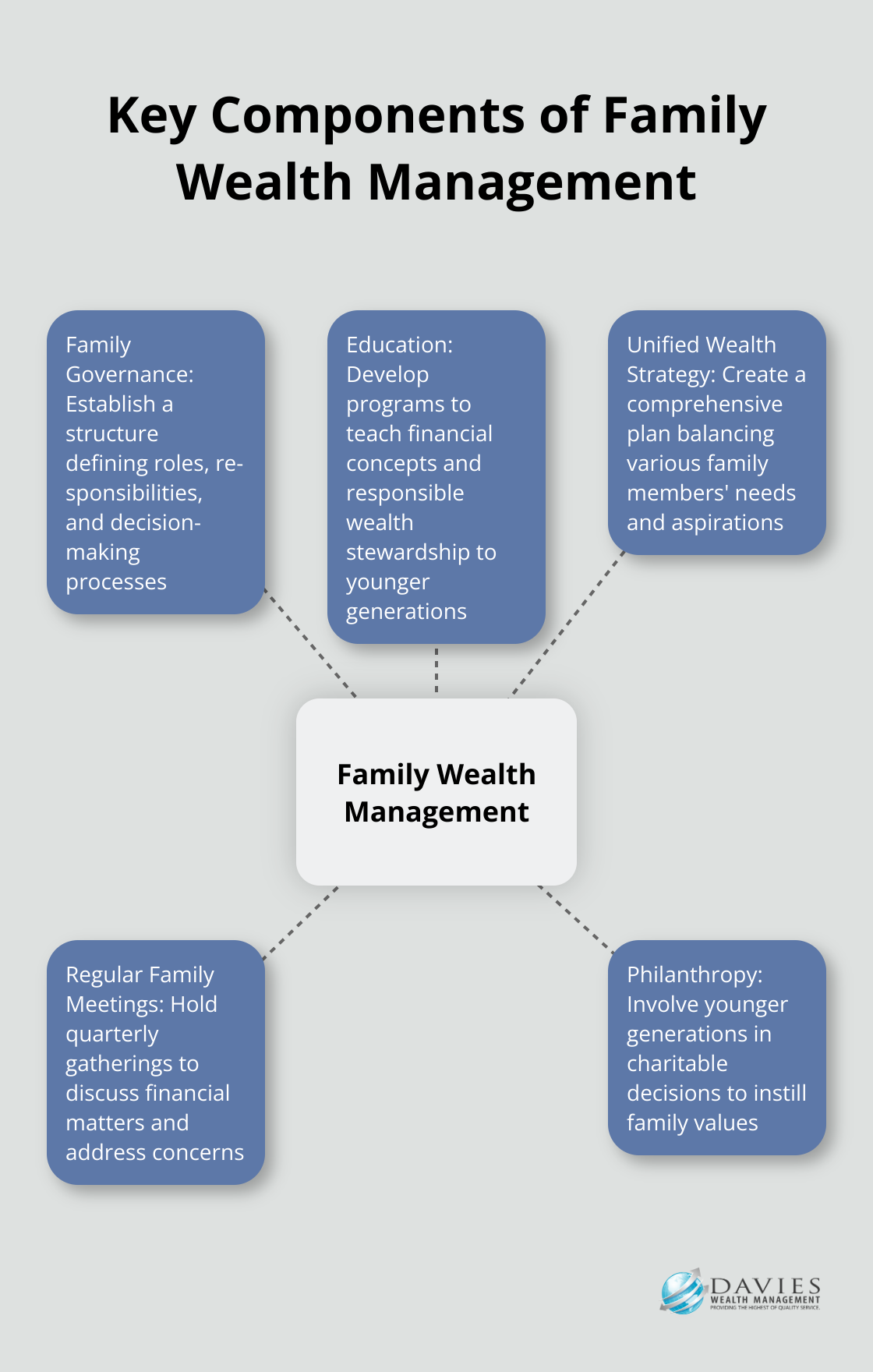

The cornerstone of effective wealth transfer is a comprehensive family wealth plan. This isn’t just a document; it’s a living strategy that evolves with your family. Organize a family wealth summit. The family office is increasingly a preferred vehicle for centralizing the stewardship of family assets across multiple generations. Invite all adult family members and create an open forum to discuss financial goals, values, and concerns.

During these summits, use a professional facilitator to ensure all voices are heard. Address topics like legacy wishes, risk tolerance, and investment preferences. Prepare for differing viewpoints – this diversity can actually strengthen your overall strategy.

Once you’ve gathered input, work with your financial advisor to craft a plan that balances various family members’ needs and aspirations. This plan should outline clear objectives, asset allocation strategies, and timelines for wealth transfer. Flexibility is key. Review and adjust your plan annually to account for changing family dynamics and economic conditions.

Establishing Family Governance

Implement a family governance structure. Strong family governance borrows from corporate governance best practices – aligning strategies with goals, defining roles and responsibilities. Think of it as creating a ‘family board of directors’. This structure should define roles, responsibilities, and decision-making processes for wealth management.

Draft a family constitution. This document should outline your family’s values, mission, and guidelines for wealth management. Include provisions for conflict resolution and decision-making processes. For example, you might establish a voting system for major financial decisions or create a rotation for family members to serve on an investment committee.

Set up regular family council meetings. These gatherings provide a forum to discuss financial matters, review investment performance, and address any concerns. Families who meet at least quarterly tend to have smoother wealth transitions and fewer conflicts.

Empowering the Next Generation

Education bridges generations in wealth management. Develop a structured program to teach younger family members about financial concepts, investment strategies, and responsible wealth stewardship. Successful training goes beyond altruism, incorporating financial literacy and experiential learning while emphasizing mentorship and wealth stewardship.

Start early. Introduce basic financial concepts to children as young as 10 or 11. As they grow, gradually increase the complexity of topics. By their late teens, involve them in real financial decisions, perhaps by giving them a small portfolio to manage under guidance.

For adult children, sponsor their attendance at financial seminars or workshops. Many clients (including those at Davies Wealth Management) have found success in pairing younger family members with mentors – either senior family members or trusted advisors.

Hands-on experience is invaluable. Involve younger generations in philanthropic decisions. This not only teaches financial management but also instills family values. Set up a family foundation or donor-advised fund where younger members can participate in grant-making decisions.

As we move forward, we’ll explore how technology can further bridge the generational gap in family wealth management, offering new tools and platforms to enhance collaboration and engagement across all age groups.

How Technology Enhances Family Wealth Management

Technology transforms the way families approach wealth management, bridging generational gaps and fostering collaboration. At Davies Wealth Management, we recognize the power of innovative tools to revolutionize financial planning across generations.

Digital Platforms for Collaborative Planning

Advanced digital platforms now enable active participation in financial planning for all family members, regardless of location. Hundreds of relevant tools help wealth managers understand what is available and easily engage with what’s out there. These tools offer comprehensive views of family assets, allowing real-time tracking and analysis of investments across multiple generations.

Many platforms feature intuitive dashboards that appeal to tech-savvy younger generations while remaining accessible to older family members. They include features such as goal tracking, scenario planning, and document sharing (promoting transparency and engagement across all age groups).

Sustainable Investing Through Technology

The increased interest in sustainable and socially responsible investing, particularly among younger generations, has spurred the development of sophisticated ESG (Environmental, Social, and Governance) screening tools. These technologies allow families to align their values with their wealth through sustainability-based approaches to wealth management, such as impact investing.

Some robo-advisors now offer automated ESG portfolios, simplifying the process for younger family members to start investing in line with their principles. This approach bridges the gap between traditional investment strategies and modern, value-driven financial planning.

Fintech Solutions for Diverse Preferences

The fintech revolution introduces a wide array of tools catering to diverse investment preferences. For risk-averse older generations, AI-powered risk assessment tools provide detailed analysis and recommendations. Younger family members often prefer micro-investing apps, which make investing more accessible and engaging.

Cryptocurrency and blockchain technologies also gain traction, especially among millennials and Gen Z. While these investments carry higher risk, they represent a new frontier in wealth management that demands attention. Many platforms now offer educational resources alongside trading capabilities, helping to bridge the knowledge gap between generations.

Integrating Technology in Wealth Management Services

Professional wealth management firms (like Davies Wealth Management) integrate many of these technologies into their service offerings. Experienced advisors guide families in selecting and implementing the right mix of digital tools to enhance their wealth management strategy.

The effective use of technology creates a more inclusive, transparent, and efficient approach to managing wealth across generations. It allows families to stay connected, make informed decisions, and adapt their financial strategies to changing market conditions and personal circumstances.

Final Thoughts

Bridging the generational gap in family wealth management requires a comprehensive approach. Families must develop a robust wealth plan that incorporates input from all generations and establishes strong governance structures. Education empowers younger family members to become responsible stewards of generational wealth, ensuring effective asset management across time.

Technology integration offers exciting opportunities to enhance collaboration in wealth management. Digital platforms, sustainable investing tools, and fintech solutions cater to diverse preferences and promote transparency in financial planning. Open communication and mutual understanding form the foundation for successful generational wealth management, creating an environment where all family members feel heard and valued.

Davies Wealth Management specializes in helping families navigate the complexities of intergenerational wealth transfer. Our team provides personalized strategies to address unique challenges faced by each family (ensuring smooth transition of assets and values across generations). We take a unified approach to family wealth management, preserving legacies and maximizing financial potential for future generations.

Leave a Reply